On the first trading day after the National Day holiday, A-shares once again set off a daily limit surge, with a full-day turnover of nearly 3.5 trillion yuan, setting a new record. During the continuous surge of A-shares, the US, Japanese, Indian and crypto markets were all sucked blood to varying degrees. In order to ease the pressure of capital outflow, some markets have successively introduced boosting measures. First, the US Department of Labor released extremely stunning non-farm employment data for September, and significantly revised up the number of jobs in July and August, trying to suppress the rapidly rising recession expectations. Secondly, Japanese media hyped that "stock god" Buffett plans to issue yen bonds for the second time this year, and plans to use the funds raised to invest in Japanese financial and shipping stocks, intending to convey Buffett's confidence in Japan's economic recovery to the outside world. Only the crypto market is in a state of "no milk supply", so in the past week, due to the continuous outflow of funds, the discount rate of USDT once fell from -0.56% to -3%.

It is worth noting that although the USDT discount rate has continued to expand over the past week, the adjustment of the crypto market has been very mild, with Bitcoin's cumulative decline of only 2.5%. In addition, during the period when funds flowed out of USDT in large quantities, the Bitcoin perpetual contract funding rate on Binance and OKEX platforms remained at a positive premium for most of the time, which shows that the most sensitive funds in the market are completely insensitive to this type of negative impact. This also reflects that most of the funds flowing out of USDT do not belong to the active purchasing power of the market. According to some U merchants, there are two main reasons for the recent outflow of funds from USDT: First, affected by the sharp depreciation of the US dollar, foreign funds began to flow back, and some funds quickly completed the exchange of US dollars to RMB through USDT, avoiding the cumbersome settlement process and review. Second, under the influence of the continued fermentation of the A-share money-making effect, funds that used to be managed and arbitrage in the crypto market through USDT gradually turned to the A-share market. However, as the US dollar-RMB exchange rate stabilized and A-shares fell into volatility, the discount rate of USDT began to narrow, and the pressure of capital outflow was alleviated. As long as Tether's redemption is not a problem, USDT's large discount will not last too long.

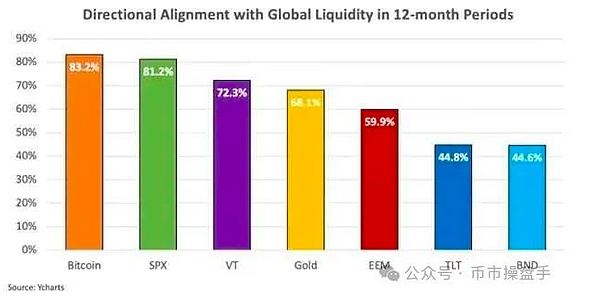

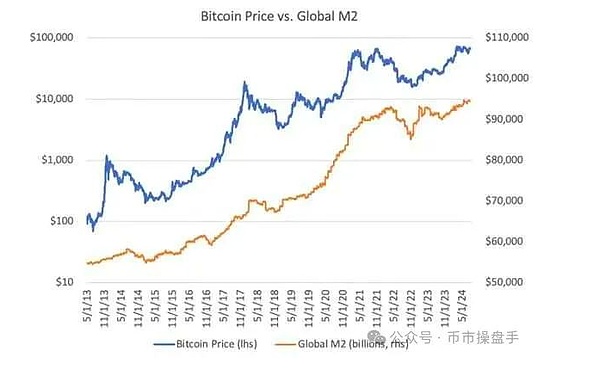

Although the crypto market has been regarded as a shadow market for U.S. stocks this year, Bitcoin is still the best performing asset class in U.S. stocks. Not only have ETFs linked to Bitcoin outperformed U.S. stocks, but U.S. listed companies with Bitcoin as the underlying asset have also performed well. For example, since September 6, MicroStrategy's stock price has risen by 68%, far exceeding Nasdaq's 8.3% and S&P's 7.1%. Bloomberg Industry Research data shows that the MicroStrategy 2X Leveraged ETF issued by REX Shares and Tuttle Capital Management attracted nearly $130 million in net inflows within two weeks of listing, becoming one of the best performing new ETFs in the market. This phenomenon shows that Bitcoin is still the hottest asset in U.S. stocks. If the upward trend of U.S. stocks remains unchanged, holding Bitcoin can still earn leveraged returns on U.S. stocks. By disassembling the structure of the US non-farm data that exceeded expectations in September, it can be found that the increase of 918,000 government employees and 121,000 part-time workers is the main reason for the employment data exceeding expectations, while the number of private employees, which better reflects the employment situation, has decreased by 458,000. However, this watery non-farm employment report still successfully reversed the market's expectations of economic recession. After the release of the non-farm data, the pricing of the current round of interest rate cuts by US Treasury bond interest rate futures fell from 245 basis points to 185 basis points, and the US 10-year Treasury bond rose from 3.80% to 4.02%, and the US dollar stabilized and rebounded. Although the expectation of interest rate cuts has shrunk, the decline in interest rates can still bring about the effect of credit expansion when the economy has not fallen into recession. This window period coincides with the upcoming launch of a new round of large-scale economic stimulus by the world's second largest economy, so the global M2 will inevitably enter a new upward cycle. According to research by financial institution Swan Bitcoin, Bitcoin is consistent with global liquidity trends 83% of the time in any 12 months, a higher proportion than any other major asset class. If historical data is valid, Bitcoin will start a new round of increases within 12 months after the September interest rate cut.

After the release of the U.S. non-farm data, Buffett continued to express his concerns about the economic outlook by selling, selling, and selling. However, with the coordinated efforts of the US government and the Federal Reserve to maintain stability, the US stock market will most likely continue to fluctuate upward before the election. After all, historically, Buffett's sell signals usually lag 8 to 13 months. Therefore, the author still believes that October and November are the best windows for the market to go long.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Brian

Brian Brian

Brian Hui Xin

Hui Xin Brian

Brian Hui Xin

Hui Xin Joy

Joy Joy

Joy Joy

Joy