Do you know Bitcoin?

Yes. It is the magical "virtual currency". It has no entity and is entirely virtual. It plays the leading role in various "get rich overnight" stories. But because it is too "trendy", it was once considered a lie.

Some time ago, its price was rising again. Especially this year, since Trump won the election, its price has soared, with an increase of nearly 40%. Until December 5, the price of a bitcoin exceeded $100,000 for the first time.

(Image from the Internet)

100,000 US dollars is not a small amount. Converted into RMB, it is about 700,000 yuan. Therefore, this matter has also attracted the attention of many people. Many friends in my circle of friends are also discussing it.

Some people say that it is nonsense. If I issue a set of "Lao Li Coins" myself tomorrow, can one coin be worth 100,000 yuan? This is a scam. Some people also say that whether it is true or false, it is now 100,000 US dollars per coin. Will it rise in the future? I also want to rush in.

I am not a professional financial practitioner and am not proficient in the logic of virtual currency investment.

However, I did own a Bitcoin.

Yes. I used to have it. So it seems that I lost 700,000. But, is it really so?

Also share this story with you.

It was about ten years ago, and I was working as a strategic consultant for a well-known investment institution.

This investment institution was called Morningside Capital at the time, and later changed its name to 5Y Capital. They were once an angel investor of Xiaomi, and after Xiaomi went all the way to the IPO, the return on investment reached 866 times. Later, they also invested in famous companies such as Kuaishou, and are one of the most successful investment institutions.

Every month, we spend about two days to look at some projects and confirm whether to invest. Because I have worked in technology companies such as Microsoft before, I will pay more attention to technology projects.

At that time, the Internet era was booming, and all kinds of innovative plans and ideas emerged one after another. I thought I knew more about the field of science and technology. But I soon found that I couldn't understand some of the entrepreneurs' plans.

Especially when I saw a virtual currency trading platform project.

That was my first time to come into contact with virtual currency trading. I found it interesting and curious, so while listening to the project initiator's introduction, I opened their trading website to see what it was all about.

As I watched, I found that they supported Bitcoin transactions. So I decided to try to buy one. After all, how can you raise valuable questions without actually experiencing it?

At that time, the price of Bitcoin was about 4,000 yuan per coin. I completed the transaction quickly. After that, I did some research and found that there were similar virtual currency trading platforms in the United States. For example, Coinbase. So I registered a Coinbase account and transferred the bitcoins I bought on the Chinese platform to the Coinbase account like sending an email.

Then, I found something that shocked me: This bitcoin purchased with RMB can be exchanged for US dollars immediately.

Under the restrictions of foreign exchange control, it is very troublesome to exchange RMB for US dollars. But now, I can complete this operation instantly.

It's incredible. I suddenly felt that this virtual digital currency might change an era.

However, I bought this bitcoin at that time just to get a better understanding of the project. And I didn't plan to invest in it. So, I didn't buy a lot of Bitcoin.

However, the surprise caused by Bitcoin has always remained in my heart. Therefore, I have been paying attention to policies related to Bitcoin.

In 2013, the People's Bank of China and five other ministries and commissions issued a notice on preventing Bitcoin risks, saying that Bitcoin is a virtual commodity and cannot and should not be circulated in the market as currency. But Bitcoin trading is an online commodity trading behavior, and ordinary people have the freedom to participate under the premise of assuming their own risks.

In 2017, CCTV reported that the central bank announced the official rectification of the Bitcoin platform. Because Bitcoin may be used as an intermediate link in the transfer of value and exceed the annual exchange quota per person.

Later, there were continuous notices and announcements. Prohibit illegal financing. Prohibit the issuance of tokens. Strengthen supervision. The intensity is getting stronger and stronger.

So, at first, many companies that announced support for Bitcoin payments suspended payments. Later, it became increasingly difficult to buy Bitcoin.

So, once the payment function is cancelled, will Bitcoin completely lose its use?

I didn't think too much about it. And my Bitcoin was not sold. It just lay quietly in the account. Until I almost forgot about it.

Until later, when I remembered it by chance, I found that the Bitcoin I bought for 4,000 yuan had risen to more than 50,000 yuan. It has increased more than ten times.

So I sold it. Because I thought that the price was already very high at the time. After all, there was once a hero who exchanged 10,000 Bitcoins for two large pizzas.

(Laszlo Hanyecz, the programmer who spent 10,000 bitcoins for pizza)

I said goodbye to this bitcoin.

However, over the years, whenever I discussed the transformation of Internet finance with clients from banks, insurance companies and fund companies, we almost always talked about Bitcoin. Because everyone was really surprised: Why can Bitcoin have such value today?

I think it’s probably because of: consensus.

This is the same as “Why is gold valuable?” Because everyone has reached a consensus that “it is valuable”.

Gold, a precious metal produced from the earth, very cleverly meets several attributes of a transaction intermediary.

First, it has limited reserves. There is only so much gold on the earth. You cannot produce it infinitely. Because if something can be produced infinitely, it is difficult to maintain its status as a currency;Second, it is easy to divide. Whether you want to get more or less, it can be weighed out. If it is a large piece every time, it will be difficult to transfer;Finally, it is not easy to deteriorate. It will not go bad if it is left alone.

Gold naturally has the properties of currency. Therefore, there is a saying that "gold and silver are not naturally currencies, but currencies are naturally gold and silver."

Understand why gold can become currency. You will understand why Bitcoin has the opportunity to become a currency.

First, its total amount is limited. According to the algorithm setting, its issuance will be halved every 4 years. In the end, the limit of Bitcoin in the world is about 21 million; secondly, it is also easy to divide. The smallest unit of Bitcoin is 10 to the negative 8th power; finally, as a digital asset, Bitcoin will certainly not be damaged.

Yes. The three properties are almost all consistent. When Satoshi Nakamoto designed Bitcoin, he used gold as a reference.

Moreover, compared with other currencies, Bitcoin has another advantage: higher credibility.

In 2008, Satoshi Nakamoto wrote a paper called "Bitcoin: A Peer-to-Peer Electronic Cash System".

Please note that there is a word that is very conspicuous: peer-to-peer. That is, P2P.

I know. When it comes to P2P, many people will definitely think of the sensational fraud activity back then. P2P lending was also in a mess because the platform ran away. However, the original intention of P2P was not like this.

The original intention of P2P is "decentralization". Decentralization means there is no central agency.

Bitcoin is a central bank-free, decentralized monetary system.

In the "centralized" monetary system, you deposit 5,000 yuan in the bank. This 5,000 yuan is actually a piece of data in the bank's ledger. All your operations on this 5,000 yuan need to go through the bank as an intermediary, and do identity authentication and modification before they can be completed. The bank is the center.

But what if there is a problem with the "center" itself?

Decentralization.

The ledger is no longer just placed in the center of the bank, but appears on all the recording nodes of the entire network. It is impossible that more than half of the computing nodes have problems at the same time? Maybe it is possible, but the possibility is not great.

This "decentralized accounting technology" has another name.

Blockchain.

Bitcoin is a specific application of blockchain technology.

Therefore, after the emergence of Bitcoin, even if a country wants to ban it, it cannot be achieved by rushing into a headquarters building or arresting a gang leader. Because it does not rely on a certain center.

This ensures that it is difficult for someone to manipulate it. It is more credible.

However, this still does not mean that it can become a currency.

Unless someone thinks it has value.

As one of the first cryptocurrencies to appear, some people think it has value. Later, when there was no official channel to recognize it, some people used it for payment. More and more people think it has value. Gradually, Bitcoin began to operate and grow. Some rich people began to leave Bitcoin as an inheritance to their children without paying inheritance tax. Later, some national governments and politicians also began to recognize the value of Bitcoin.

For example, Trump.

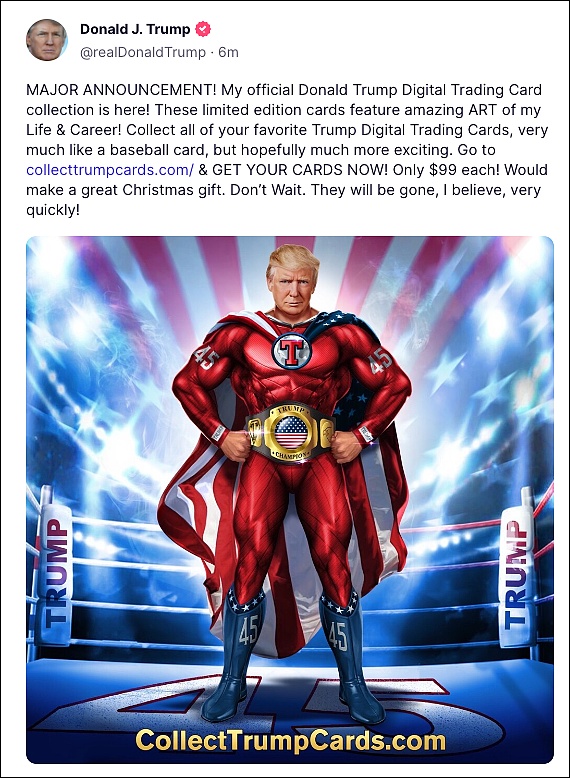

Recently, he has been promoting his idea: the government will reserve a large amount of Bitcoin, even instead of gold. He is not only a supporter of the crypto market, but also a direct beneficiary. Trump's digital trading card NFT, which is named after him, has earned his family $22 million.

(Trump announces the sale of digital trading cards)

Perhaps, as some people say, the purpose of the Trump administration's reserve of Bitcoin may be to push up the appreciation and then repay debts. There may be other reasons. But in any case, the price of Bitcoin has risen.

This is the power of consensus.

If there really comes a day when Satoshi Nakamoto's dream comes true and Bitcoin officially becomes a currency, then the total amount of currency in circulation in the world divided by 21 million is roughly its value.

How much will that be? $200,000, $500,000, or more? I can't count it, there are too many.

However, does this possibility exist? Will Bitcoin become a global transaction currency?

This is an open and complex question.

But I really find it hard to imagine that many countries will recognize its transaction currency status. Because, to some extent, it undermines the central bank's monetary system. When the macro-economy needs to be stimulated or braked, the central bank wants to influence the macro-economy by controlling the total amount of money as before, which will be much more difficult.

Okay. My story with Bitcoin is over.

However, the purpose of telling this story is not to regret that I bought too little and sold too early.

Because it is meaningless. If I didn't sell it at that time, I might feel lucky now. Similarly, if the price falls, I will regret selling it at that time.

Perhaps, the real focus is not on short-term judgment, but on whether you can hold on.

Especially, when an asset has risen more than ten times, even if you are still optimistic about its long-term value, can you hold on?

This is a small reflection. It can also be regarded as a small review and a small commemoration when Bitcoin breaks through the $100,000 mark.

The past ten years have been full of changes. Ten years ago, I bought a Bitcoin at a price of 4,000 yuan and sold it when it rose to 50,000 yuan. Today, it has risen to $100,000. From 4,000 yuan to 100,000 US dollars, this is not only a change in numbers, but also a microcosm of an era.

Perhaps, in this rapidly changing world, the most important thing is not to predict the future, but to keep an open mind.

Only in this way can we learn to grow in uncertainty.

What do you think?

Alex

Alex

Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Alex

Alex Joy

Joy Brian

Brian Alex

Alex Joy

Joy Edmund

Edmund