Author: Web3Mario

Abstract: On August 23, 2024, Federal Reserve Chairman Powell officially announced at the Jackson Hole Global Central Bank Annual Meeting that "Now is the time for policy adjustment. The direction of progress is clear, and the timing and pace of interest rate cuts will depend on the upcoming data, the changing outlook, and the balance of risks." This also means that the Fed's tightening cycle, which has lasted for nearly three years, has ushered in a turning point. If the macro data is not unexpected, the first interest rate cut will be ushered in at the interest rate meeting on September 19. However, entering the early stage of the interest rate cut cycle does not mean that the surge is coming immediately. There are still some risks that deserve everyone's vigilance. Therefore, the author summarizes some of the most important issues that need to be paid attention to at present, hoping to help everyone avoid some risks. In general, in the early stage of interest rate cuts, we also need to pay attention to six core issues, including the risk of recession in the United States, the rhythm of interest rate cuts, the Fed's QT (quantitative tightening) plan, the risk of renewed inflation, the efficiency of global central bank linkage, and the political risks in the United States.

Rate cuts do not necessarily mean an immediate rise in risk markets, on the contrary, they are mostly falling

The Fed's monetary policy adjustments have a profound impact on global financial markets. Especially in the early stages of rate cuts, although rate cuts are often seen as measures to stimulate economic growth, they are also accompanied by a series of potential risks, which means that rate cuts do not necessarily mean an immediate rise in risk markets, on the contrary, they are mostly falling. The reasons for this situation can usually be classified as follows:

1. Increased volatility in financial markets

Rate cuts are often seen as a signal of support for the economy and the market, but in the early stages of rate cuts, the market may experience uncertainty and increased volatility. Investors tend to interpret the Fed's actions differently, and some may believe that rate cuts reflect concerns about an economic slowdown. This uncertainty can lead to large fluctuations in the stock and bond markets. For example, during the financial crises of 2001 and 2007-2008, the stock market experienced significant declines despite the Fed's interest rate cut cycles. This was because investors were concerned that the severity of the economic slowdown outweighed the positive effects of the rate cuts. 2. Inflation Risks Rate cuts mean lower borrowing costs, encouraging consumption and investment. However, if rate cuts are excessive or last too long, they can lead to rising inflationary pressures. When ample liquidity in the economy chases limited goods and services, price levels can rise quickly, especially when supply chains are constrained or the economy is close to full employment. Historically, such as in the late 1970s, the Fed's rate cuts led to the risk of soaring inflation, which necessitated more aggressive rate hikes to control inflation, triggering a recession.

3. Capital outflow and currency depreciation

Federal Reserve rate cuts usually reduce the interest rate advantage of the US dollar, causing capital to flow from the US market to higher-yielding assets in other countries. This capital outflow will put pressure on the US dollar exchange rate, causing it to depreciate. Although the depreciation of the US dollar can stimulate exports to a certain extent, it may also bring the risk of imported inflation, especially when raw materials and energy prices are high. In addition, capital outflows may also lead to financial instability in emerging market countries, especially those that rely on US dollar financing.

4. Financial system instability

Rate cuts are often used to relieve economic pressure and support the financial system, but it may also encourage excessive risk-taking. When borrowing costs are low, financial institutions and investors may seek higher-risk investments to obtain higher returns, leading to the formation of asset price bubbles. For example, after the bursting of the tech bubble in 2001, the Fed slashed interest rates to support economic recovery, but this policy to some extent fueled the subsequent bubble in the real estate market, which eventually led to the outbreak of the 2008 financial crisis.

5. The effectiveness of policy tools is limited

In the early stages of rate cuts, if the economy is already close to zero interest rates or in a low interest rate environment, the Fed's policy tools may be limited. Over-reliance on rate cuts may not effectively stimulate economic growth, especially when interest rates are close to zero, which requires more unconventional monetary policy tools, such as quantitative easing (QE). In 2008 and 2020, the Fed had to use other policy tools to respond to economic downturns after cutting interest rates close to zero, which shows that in extreme cases, the effect of rate cuts is limited.

Let's look at historical data. With the end of the US-Soviet Cold War in the 1990s, the world entered a globalized political landscape dominated by the United States. Until now, the Fed's monetary policy has reflected a certain degree of lag. At present, China and the United States are in the midst of a fierce confrontation, and the shattering of the old order has undoubtedly exacerbated the risk of policy uncertainty.

Inventory of the main risk points in the current market

Next, let's take stock of the main risk points in the current market, focusing on the risk of recession in the United States, the pace of interest rate cuts, the Fed's QT (quantitative tightening) plan, the risk of renewed inflation, and the efficiency of global central bank linkage.

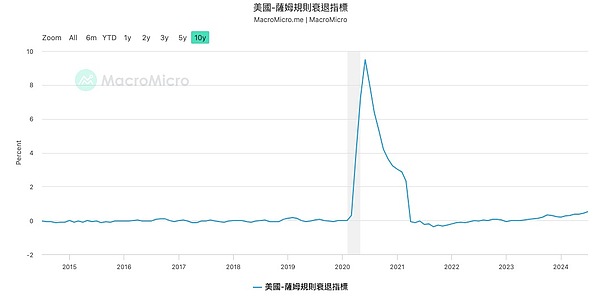

Risk 1: Risk of US economic recession

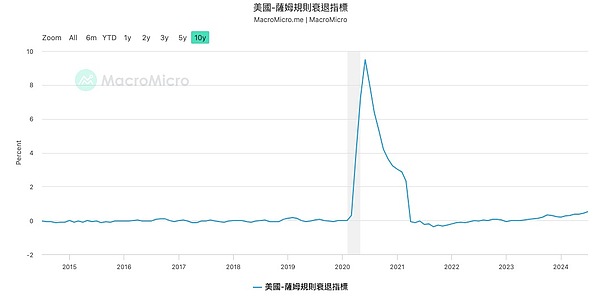

Many people regard the potential interest rate cut in September as a "defensive interest rate cut" by the Fed. The so-called defensive interest rate cut refers to the decision to cut interest rates to reduce the risk of potential economic recession when there is no obvious deterioration in economic data. In my previous article, I have analyzed that the US unemployment rate has officially set off the "Sam Rule" warning line for recession. Therefore, it is extremely important to observe whether the interest rate cut in September can curb the gradually rising unemployment rate and thus stabilize the economy and resist recession.

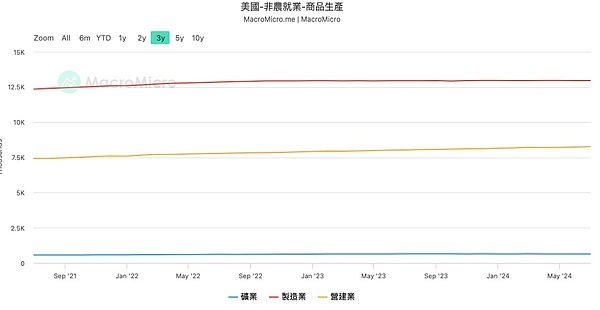

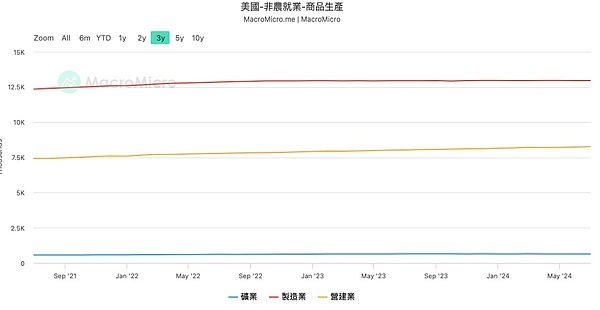

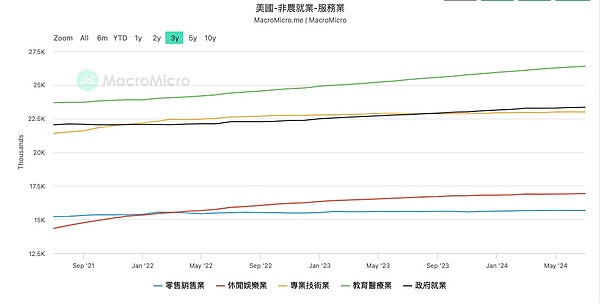

Let's take a look at what happened in the details of the non-agricultural employment data. We can see that in the commodity production category, the number of people employed in the manufacturing industry has experienced a long period of low volatility, and the construction industry contributes more to the data. For the US economy, high-end manufacturing, as well as its matching technology and financial services, are the main driving forces. That is to say, when the income of this part of the high-income elite class rises, the wealth effect will increase consumption, which will in turn benefit other low-end and medium-end service industries. Therefore, the employment situation of this group of people can be used as a leading indicator of the overall employment situation in the United States. The weakness of manufacturing employment may show certain fuse risks. In addition, if we look at the US ISM Manufacturing Index (PMI), we can see that the PMI is in a rapid downward trend, which further proves the weakness of the US manufacturing industry.

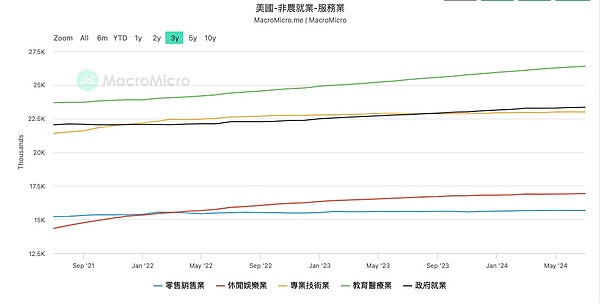

Next, let's look at the service industry. Both the professional and technical industry and the retail industry have shown the same freezing situation. The main positive contributions to the indicators are education, medical care, leisure and entertainment. I think there are two main reasons. One is that the new crown has recurred recently, and due to the impact of the hurricane, there has been a certain degree of shortage of related medical rescue personnel. Secondly, since most Americans are on vacation in July, the tourism and other leisure and entertainment industries have grown. When the vacation is over, this field is bound to receive a certain blow.

Therefore, in general, the current recession risk in the United States still exists, so friends need to further observe the relevant risks through macro data, mainly including non-agricultural employment, initial unemployment claims, PMI, consumer confidence index CCI, house price index, etc.

Risk 2: Rate Cut Pace

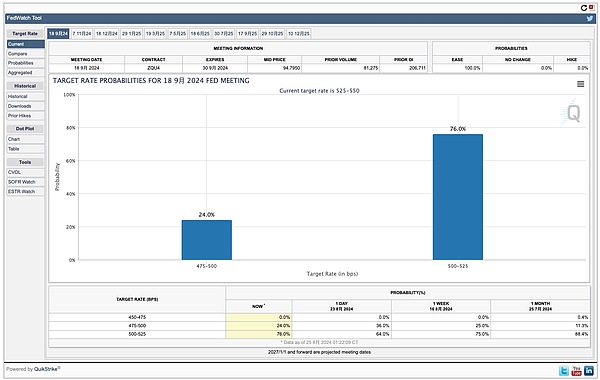

The second issue that needs to be paid attention to is the rate cut rhythm. Although it has been confirmed that the rate cut has begun, the speed of the rate cut will affect the performance of the risk asset market. Historically, the Fed's emergency rate cuts are relatively rare, so the economic fluctuations between interest rate meetings require the market's own interpretation to influence price trends. When certain economic data indicate that the Fed is raising interest rates too slowly, the market will be the first to react. Therefore, it is crucial to determine a suitable rate cut rhythm and guide the market to operate in accordance with the Fed's goals through interest rate guidance.

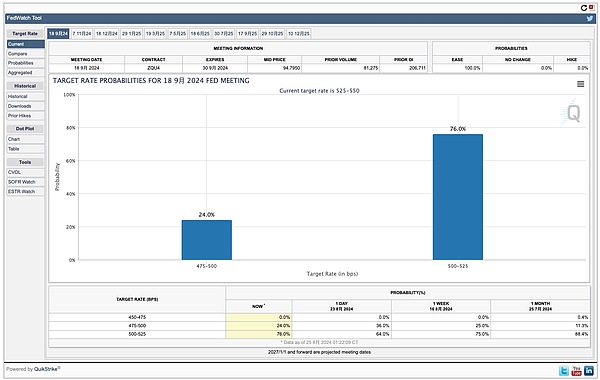

The current market estimate for the September interest rate decision is that there is a probability of a 25-50BP reduction of nearly 75%, and a probability of a 50-75BP reduction of 25%. If you pay close attention to the market's judgment, you can also clearly judge the market sentiment.

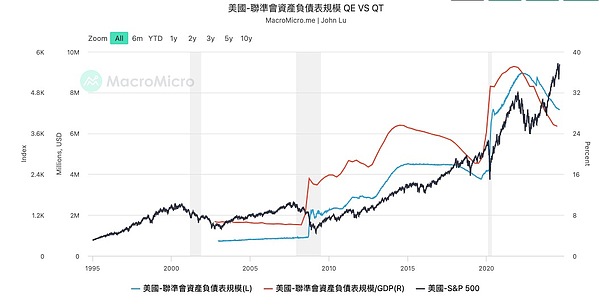

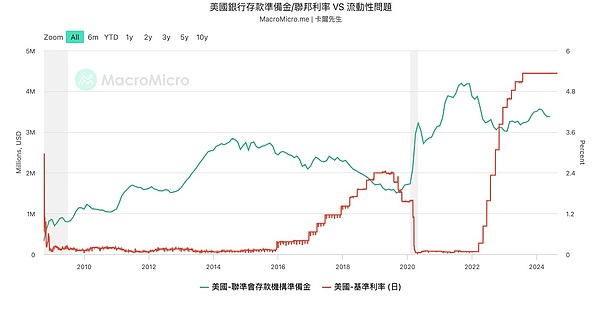

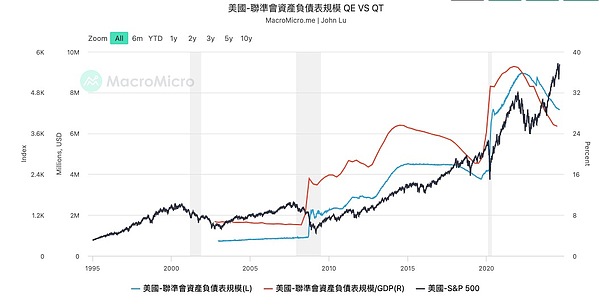

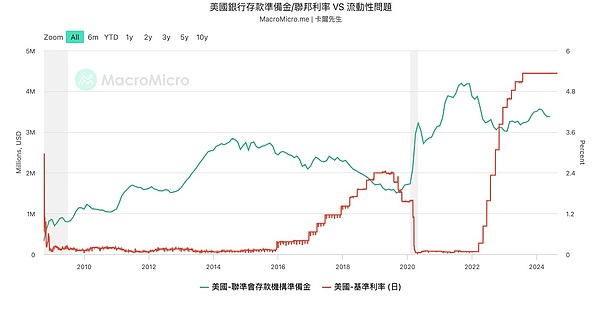

Risk 3: QT Plan

Since the financial crisis in 2008, the Federal Reserve has quickly lowered interest rates to 0, but it still has not been able to make the economy recover. At that time, monetary policy had failed because it could not continue to cut interest rates. In order to further inject liquidity into the market, the Federal Reserve created the quantitative easing QE tool, which injected liquidity into the market by expanding the Federal Reserve's balance sheet and increasing the size of the bank system's reserves. This method actually transfers market risks to the Federal Reserve. Therefore, in order to reduce systemic risks, the Federal Reserve needs to control the size of its balance sheet through quantitative tightening QT. Avoid disorderly easing that leads to excessive risks.

Powell's speech did not involve the judgment of the current QT plan and subsequent planning, so we still need to pay attention to the progress of QT and the changes in bank reserves caused by it.

Risk 4: Rekindled inflation risk

Powell remained optimistic about inflation risks at the meeting on Friday. Although it did not reach the expected 2%, he was already confident in controlling inflation. Indeed, this judgment can be reflected in the data, and many economists have begun to spread the word, that is, after experiencing the baptism of the epidemic, whether the target inflation rate is still set at 2% is too low.

But there are still some risks here:

First, from a macro perspective, the re-industrialization of the United States is affected by various factors and is not smooth. Moreover, it coincides with the anti-globalization policy of the United States in the context of Sino-US confrontation. The supply-side problems have not been solved in essence. Any geopolitical risk will exacerbate the resurgence of inflation.

Secondly, considering that the US economy has not entered a substantial recession cycle during this round of interest rate hikes, as interest rate cuts proceed, the risk asset market will recover. When the wealth effect reappears, with the expansion of the demand side, service industry inflation will also reignite.

Finally, there is the problem of data statistics. We know that in order to avoid seasonal factors from interfering with the data, CPI and PCE data usually use annual growth rates, that is, year-on-year data to reflect the real situation. By May this year, the high base factors in 2023 will be exhausted. Risk 5: Global central bank linkage efficiency I think most of my friends still remember the risk of Japan-US interest rate carry trade in early August. Although the Bank of Japan immediately came out to appease the market, we can still see its hawkish attitude from the congressional hearing of Kazuo Ueda two days ago. Moreover, during his speech, the yen also showed a significant rise and recovered after the officials' reassurance after the hearing. Of course, in fact, the performance of macroeconomic data in Japan does require an interest rate hike, which has been analyzed in detail in my previous article, but as the core source of global leverage funds for a long time, any interest rate hike by the Bank of Japan will bring great uncertainty to the risk market. Therefore, it is necessary to pay close attention to its policies.

Risk 6: US Election Risk

The last thing that needs to be mentioned is the risk of the US election. In my previous article, I have also made a detailed analysis of Trump and Harris' economic policies. As the election approaches, there will be more and more confrontations and uncertain events, so it is also necessary to always pay attention to matters related to the election.

Weiliang

Weiliang