Author: Zixi.eth; Source: X@Zixi41620514

Recent views on TON

The TON ecosystem is still in its early stages. Although it has great potential, projects in the TON ecosystem may not have enough opportunities for larger funds.

1. The ecosystem is taking shape

After TON began to build its ecosystem in the second half of last year, we saw the first outbreak of the TON ecosystem this year. Overall, the TON Foundation has very good execution and it took less than a year to take shape.

2. The balance between decentralization and centralization

The TON Foundation is very clear about which parts should be decentralized and which parts should be centralized. For example, the wallet and payment are decentralized, which was one of WeChat's core competitiveness back then, and TON is also very clear about it. Only after solving the problem of fund custody security (everyone trusts TG's technology, and the wallet will not be lost), simple fund payment (no need to use cumbersome bank card payment, all on-chain TON/U), and simple and easy to use (no need to jump 78 times like Metamask or OKX Wallet, or Taobao in the early years to buy things), can we truly achieve the Web3 version of WeChat payment. Other ecological projects adopt the idea of Crypto native, outsource everything, and encourage the community to do it.

3. Diversified profit model

The profit model of ecological projects no longer needs to be as simple as that of pure Web2/3 projects, and the profit model begins to diversify. The Web2 model can make profits by collecting advertising fees, selling users to exchanges, selling value-added services in games, charging subscription fees, or not issuing coins. The Web3 model can charge fees for financial protocols such as DeFi, sell NFTs, or issue coins.

4. Basic traffic and user value

TG is characterized by basic traffic, which solves the payment problem. These users have certain Crypto knowledge, but users are scattered in low-value areas, and the unit value of most users is not high. Does this mean that Web3 financial tools should not be used on TON, but Web2 traffic should be adopted?

5. HTML5-based Web2 company

The TON ecosystem is essentially a HTML5-based Web2 company, but with blockchain added to the payment/settlement level. So why do these projects have to use TON? In theory, it is entirely possible to use TG's traffic, and then use Polygon, Solana, or other L2. Returning to the essence, TG has traffic, and TON provides settlement. Other ecological projects do not have to start from scratch, just add TON (just like Travala booking air tickets and hotels, Oobit Crypto payment, TON is a good embellishment, not the core).

6. TVL growth and market value limit on the chain

TVL on the chain grows rapidly, but it is limited by the small market value of TON, so the ceiling will be relatively small. DeFi should still be done on BTC and Ethereum. But TON is different from BTC and Ethereum. TON's chips are relatively concentrated. Do the core interest holders of TON have financial needs? I am personally conservative about innovation on the asset side of non-BTC and Ethereum. This is no longer the era of DeFi and finance.

7. Unregulated environment

TG is a completely unregulated environment. This means that projects engaged in traffic and casino business can be free from legal supervision.

8. Business is greater than investment

At present, it seems that doing business on TON may be more reasonable than investing. A large number of projects have already achieved considerable income on TON, such as Catizen's income of more than 10 million US dollars and Hamster's daily income of one million US dollars. But as an investor, the profit and loss ratio is not high.

9. Projects with short life cycles

The life cycle of projects on TON may be shorter. For example, most users of Catizen and Hamster are coin-pullers. Once the coins are issued, the coin-pullers will dump the market, and the project will basically end by 50%. Will it evolve into an extreme ROI return business?

10. Projects suitable for crowdsourcing

Crowdsourcing projects may be naturally suitable for taking root on TG. It is precisely because TG has gathered a large number of non-high-value people (the user portrait may be similar to YGG), are crowdsourcing projects with positive cash flow suitable for TG? For example, data labeling, data collection for autonomous driving, and food delivery.

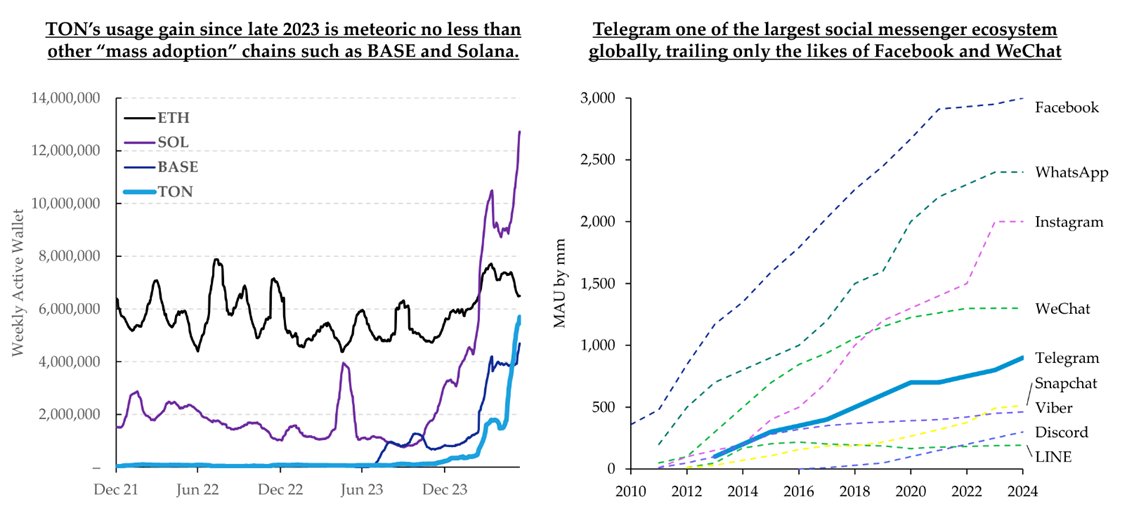

Others

TG is currently the fifth largest social platform, founded by the Durov brothers in 2013. TON was established in 2017, the main network was launched in the second half of 21, and it was not until 23 that it began to officially promote and operate. Ton is comparable to Solana and Base, because both Solana and Base are high-performance public chains with obvious 2C attributes. Solana previously relied on FTX, Base relied on Coinbase, and Ton relied on TG, all of which have certain traffic carriers. Judging from the current Weekly active wallet, Ton's growth has surpassed Base, and is currently close to half of Solana. At present, Ton's strategy is completely copied from WeChat applet, starting its own unique web3 journey.

(Image source: folius ventures)

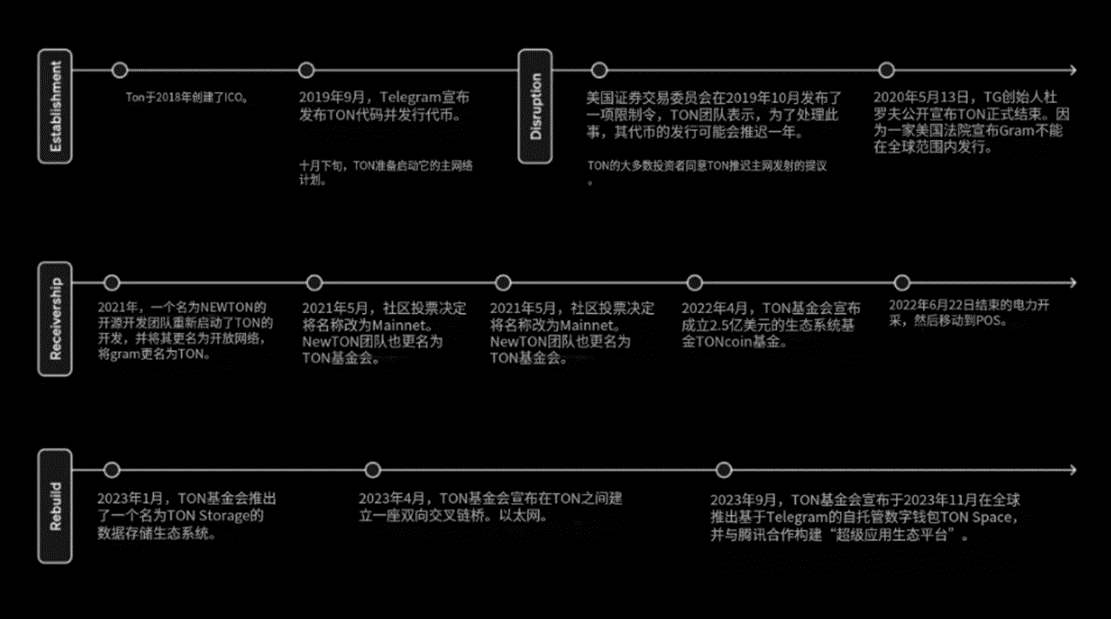

In 2013, the Durov brothers founded TG; in 2018, Pavel Durov launched TON and raised $1.7 billion in ICO; in 2020, under the entanglement of the SEC, TG gave up the leading development of TON; at the same time, the TON community established the TON Foundation to continue to lead the development of TON; in September 2021, the mainnet was launched and the coin was issued; from 2021 to the beginning of 2022, TON The foundation and miners have accumulated 80%+Ton chips; in September 2023, TG announced an exclusive cooperation with Ton, and the ecological strategy was fully copied and pasted on WeChat applet; in February 2024, Pantera heavily invested $300m in Ton; in April 2024, Tether began to deploy USDT on Ton, and users were able to start transferring through TG; in June 2024, Notcoin/Hamster/Catizen and others began to explode on TG.

The risk of highly concentrated chips needs to be considered.

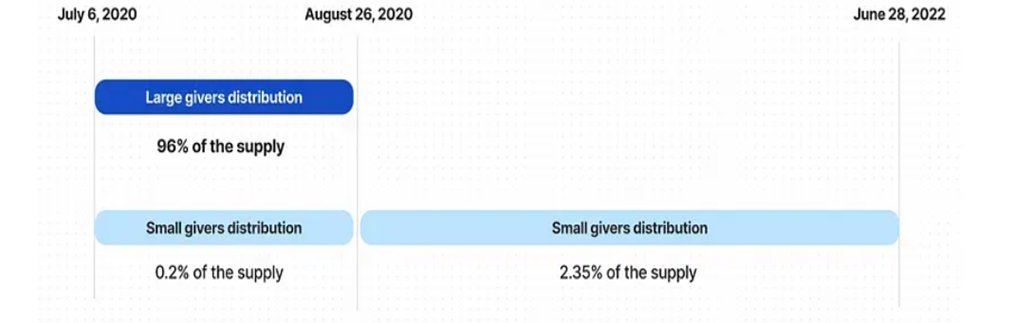

There are two types of contract addresses: Small Givers and Large Givers. The latter distributes more tokens each time (100,000 each time, instead of 100), but requires more computing power.

Telegram launched token mining on July 6, 2020, transferring tokens from system addresses to 20 contracts that distribute tokens.

Mining lasted from July 6, 2020 to June 28, 2022, but almost all tokens were distributed in the first 51 days:

From July 6, 2020 to August 26, 2020, Large Givers distributed 4.8 billion (96%) tokens, and Small Givers distributed 9.9 million tokens (0.2%);

From August 27, 2020 to June 28, 2022, Small Givers distributed 117.3 million tokens (2.35%).

It is worth noting that a total of 3,278 unique addresses participated in mining, but only 248 addresses participated in the distribution of Large Givers. So we know that 96% of TON supply is allocated to 248 addresses. Moreover, these 248 addresses are closely related: we found many groups of miner addresses that are associated with each other and have the same patterns, such as the start and end time of mining or the operation of mined tokens. We also found some retail activities, but most of the token supply is mined by a group of interconnected whales.

Source: Whiterabbit

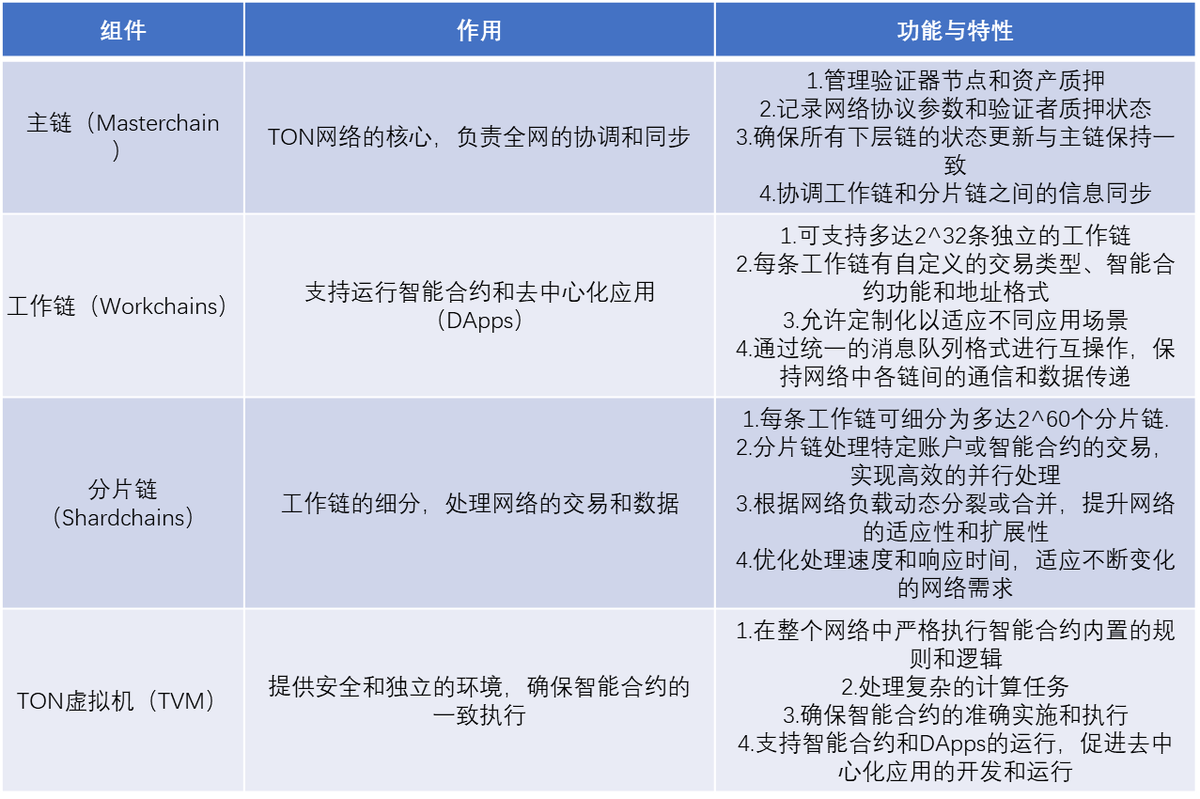

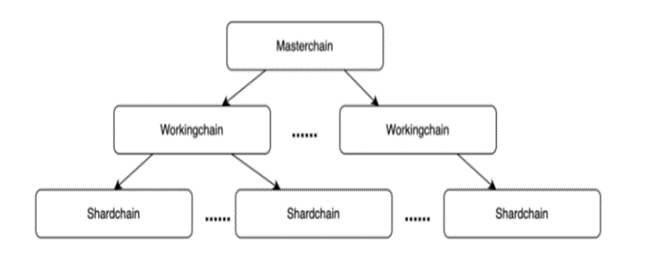

From the structure on the chain, it looks like a good technical route in 2021. Directly modularize the chain.

Ton's development language is different from the mainstream web2 and the solidity of Ethereum EVM. Ton has developed TVM (Ton virtual machine) and uses Fift, FunC and Tac for programming. These three languages are special development languages on Ton and are relatively new. The overall developer ecosystem is relatively early, mainly because the programming language is relatively early.

FunC is a high-level language designed specifically for smart contract programming on the TON blockchain. It is a domain-specific, C-like, statically typed language. FunC is used to write smart contracts, which are then compiled into Fift assembly code, and finally generate bytecode for the TON virtual machine (TVM). Fift is a low-level assembly language, and FunC programs are compiled into Fift assembly code. Fift is closer to the bottom layer and is usually not used directly to write smart contracts, but as an intermediate representation between FunC and TVM bytecode. Tac is designed to provide a higher level of abstraction than FunC while maintaining compatibility with the TON virtual machine.

FunC is a variant of C language, which is a bit similar to C/C++. Ton chose FunC because TG was written in C. Ton abandoned the crypto native idea of EVM solidity and defined its function as assisting TG in building an ecosystem. This means that Ton is not designed for Web3 Geeks. More scenarios are for ordinary web2 users. To put it bluntly, it is a blockchain for TG users. Therefore, some technical shadows, such as high concurrency and asynchronous structure, refer to the architecture of web2. So from the perspective of developer ecology, the play style is very web2+web3. This can be seen in the subsequent ecological development.

Why is TON Ecosystem attracting everyone's attention now?

True Web2+Web3

TG Dapp (Mini Program) has Web2 main business, and crypto is just a value add. For example, games can generate a lot of income through Web2 profit models such as advertising, and can avoid the original crypto model of spending money on marketing and data + listing + cutting a wave and running away. In addition, through crypto global payment, cross-border e-commerce/overseas business/airplane and hotel reservations can have new payment expansion channels.

Low development cost

Most mini-programs can be deployed through HTML5, and TON provides a series of technical development documents and templates, so that developers can complete the deployment without writing code from scratch. According to feedback, project parties with Web2 backgrounds can complete the deployment of a mini-program within two or three days.

Broadened the possibilities of Web3

For Web3, Ton Ecosystem has opened up new possibilities for project parties, no longer obsessed with crypto native tracks such as Infra/DeFi, and supports developers to build products based on social, games, e-commerce, cross-border business and other fields, thereby broadening the scope of choice for project parties. Finally, when developers develop in the TON ecosystem, they can complete the interaction and integration of multiple products on a single platform on Telegram. For users, the mini-program applications of the TON ecosystem have obvious advantages in terms of interaction. Users can complete one-stop interactive operations by clicking on the wallet mini-program without leaving the Telegram platform, without switching to external wallets such as MetaMask. In addition, the wallet on Telegram already supports users to deposit funds with legal currency OTC, that is, users can directly use credit cards to purchase crypto assets, realizing seamless interaction from capital injection to various applications on the chain.

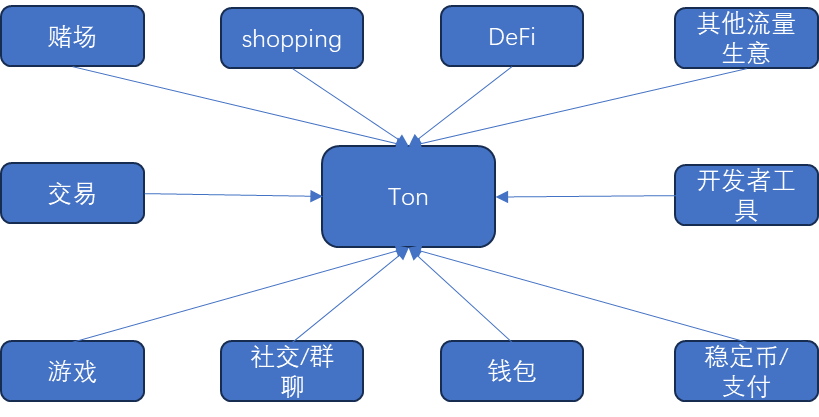

The following is the Ton ecosystem. At present, games and social networking are developing more hotly. The current game ecosystem is mostly tapgame, that is, tap-tap, three-in-a-row and other rustic games, which mostly use html interface + crypto native economy + advertising fees for profit, but there are a lot of users, which is the current hot product. In the Ton ecosystem, games are still in a state of red ocean competition, but cross-border e-commerce, encrypted payment and other web2-oriented scenarios are relatively blue ocean.

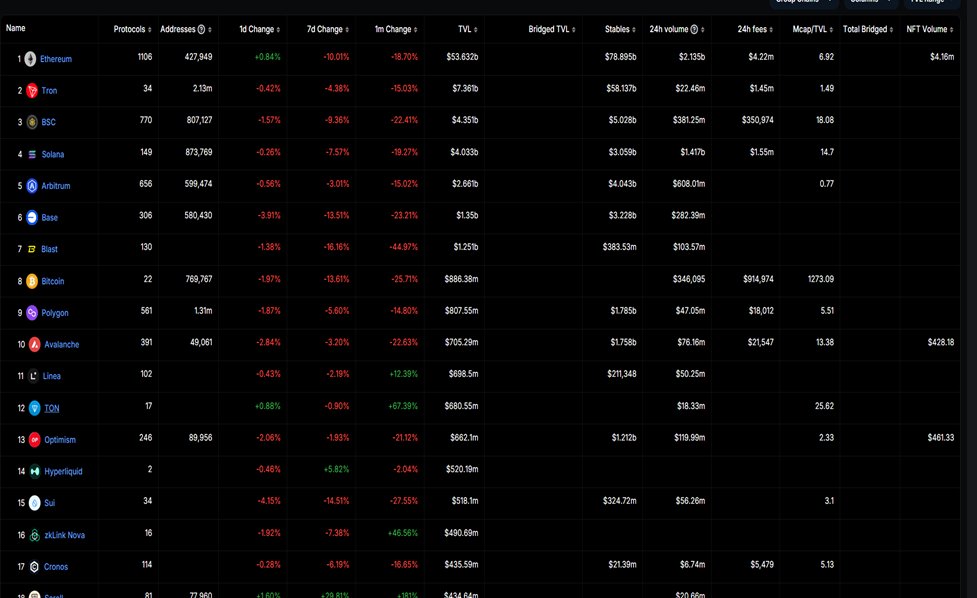

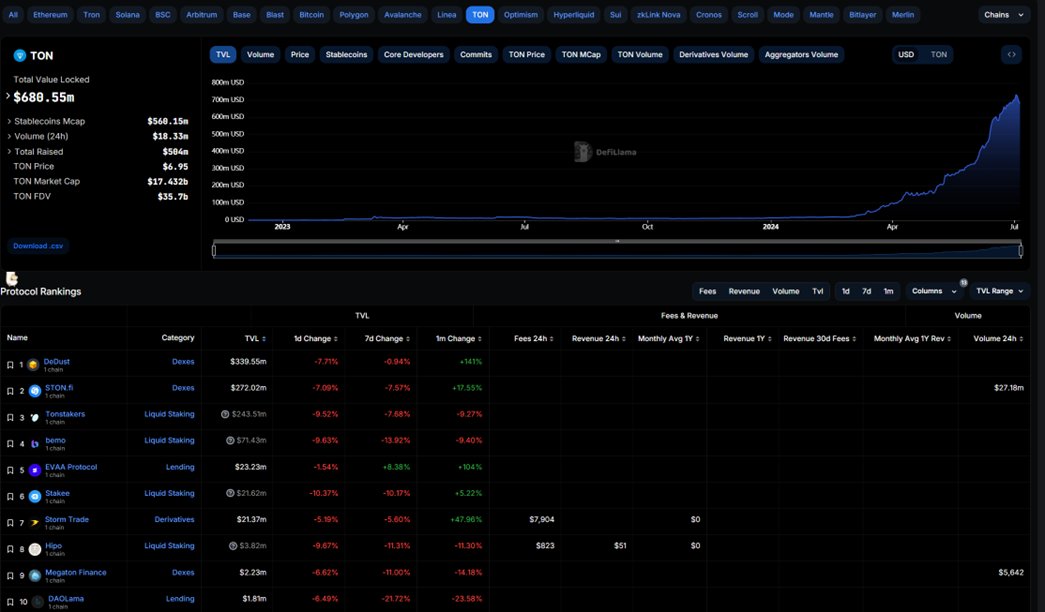

DeFi - TVL performance is not outstanding, after all, it is not a crypto native public chain

Ton's DeFi performance is relatively average, with an overall TVL of only 680 million, which is not even comparable to midstream L2 such as Linea and Blast, but it also makes sense. Ton has not advertised itself as a crypto native public chain since the first day of its development, so DeFi is not the focus of its ecological development.

00000

00000

Stablecoin/payment/wallet-priority strategy, payment ecosystem with web2 experience

Since 2017, Telegram has actually been exploring its own business model, whether it is payment services, advertising, or ICO financing that was paused by the US SEC, but the final result was not ideal. Last year, Pavel Durov revealed that the annual cost of maintaining the normal operation of Telegram is about US$630 million. According to the Wall Street Journal, by April 2021, Telegram had accumulated $700 million in debt. Therefore, since 2021, Telegram has publicly issued excess bonds worth hundreds of millions of dollars many times, and in March this year it also obtained $330 million in funds through the sale of bonds.

Telegram is often regarded as the Web3 version of WeChat. From the perspective of active users, Telegram and WeChat are not much different. WeChat has about 1.2 billion active users, and Telegram has 900 million and is still increasing, but the profit methods are far apart. Payment is the main commercialization path of WeChat. Compared with WeChat, Telegram will also choose payment. However, since Telegram is not regulated and cannot obtain mainstream financial regulatory licenses, it only has the path of Web3 payment, and its founder Pavel Durov entered the Crypto industry very early.

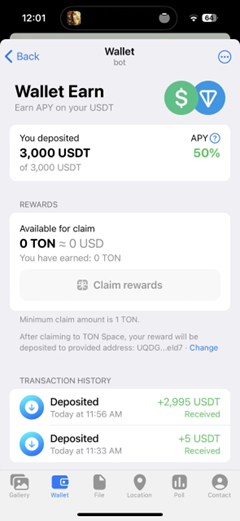

Since the beginning of this year, Ton has started to focus on the stablecoin strategy, introducing USDT to the Ton chain and providing subsidies. After KYC, users (including mainland Singapore, etc.) can stake USDT through TG's official wallet Ton space. Ton officials have given 50% APY, 3000U/two-month upper limit of rewards to attract deposits, and the interest is paid in Ton currency. After two months of development, the issuance of Ton USDT has rapidly increased from 100 million to 500 million.

Ton USDT can be transferred directly to friends through the wallet, just like WeChat transfers to friends. In addition, the money can be withdrawn, which is completely different from traditional on-chain payments.

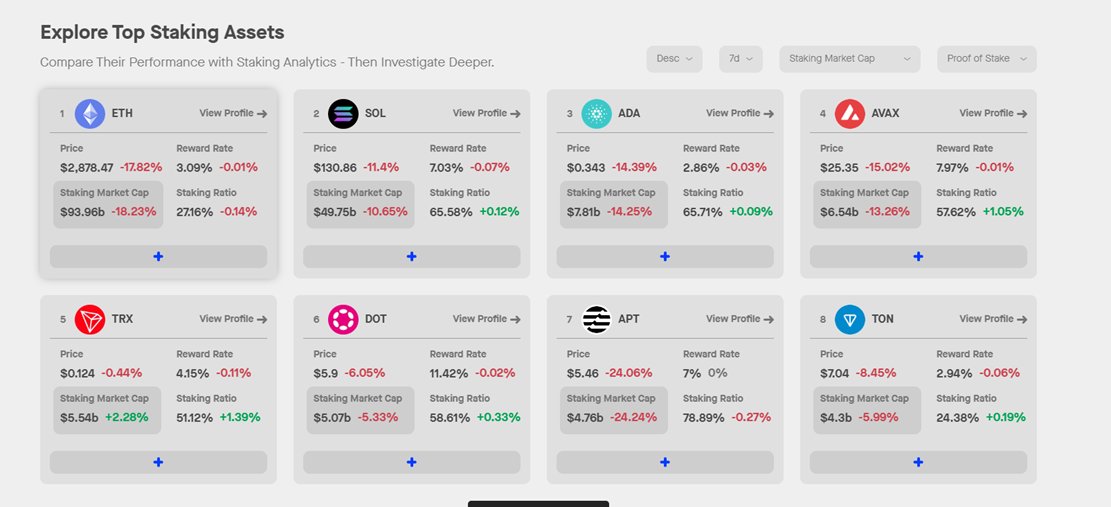

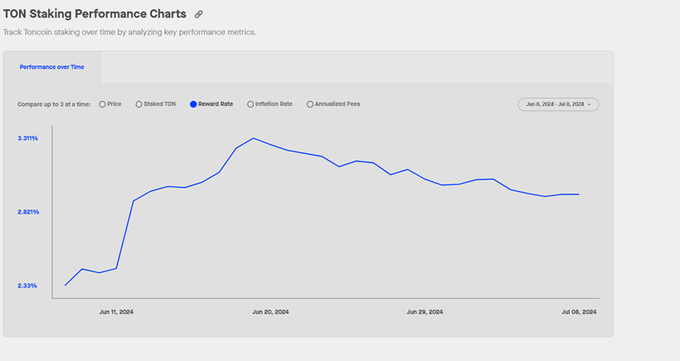

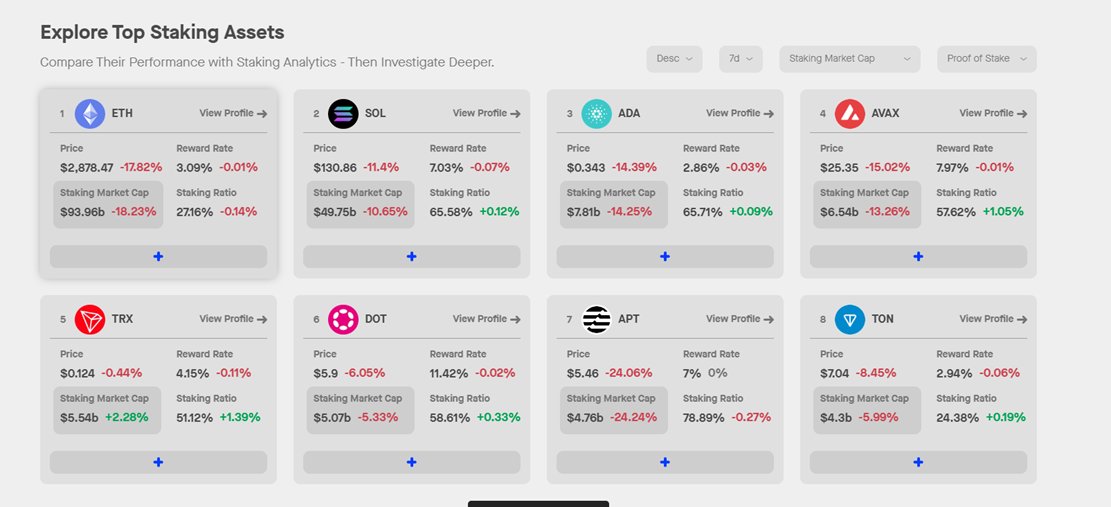

The staking ratio of normal non-Ethereum public chains usually reaches more than 50%, and there will be higher APY to attract miners. However, Ton's staking ratio and reward ratio are relatively low. It is speculated that the reasons are: 1. Most of the chips are still in the hands of the Ton foundation/early miners; 2. There are very few chips circulating in the market, and the few chips and the number of pledgers need to be screened; 3. Reward ratio = inflation + gas fee, Ton's gas fee is relatively low (0.005*7=0.035U), which can only mean that the network activity is actually lower than expected (this may be because most of the popular Ton ecological projects currently only have the expectation of issuing coins, and have not yet been fully launched on the chain). Ton's inflation is only 0.3%-0.6%, which means that most of the income from Ton staking comes from Ton gas fee, which is different from the measures taken by large public chains such as Solana.

Catizen is a project made by a very early web2 game team. Before that, in 21 years, they had done a project called tap fantasy, an idle H5 game on Facebook. Catizen is an idle synthesis game for raising kittens. Two low-level kittens are synthesized into high-level kittens. The higher the level of the cat, the higher the output. Users can use additional crypto tokens or U to buy additional functions to speed up the output of kittens. Catizen's in-game revenue has exceeded 10 million US dollars, which was achieved within about two months after the game was launched. In June, the total number of Catizen users exceeded 20 million, the DAU was about 2 million, the on-chain users exceeded 700,000, and the paying users were about 500,000. The on-chain user conversion rate remained at around 10%, and more than 50% of active users were paying users. Based on this, Catizen will gradually launch its own mini-game platform in the future and build itself into Telegram 4399/Steam.

Hamster Combat is the most popular tap game on TG. Players earn coins by hanging up/clicking the screen/completing tasks, and consume coins to form a better team to get more coins. The overall focus is on hanging up and cultivating. Hamster is very malignant - one tap earns one coin, 1000 energy, you need to click 1000 times, you need to wait for the automatic reply before you can click again, and there are 6 opportunities to instantly restore energy every day; fission is also done well; the passive income of hanging up is only valid within three hours of exiting the game, and you need to re-enter the game after the timeout. Hamster is very popular in the Middle East and Southeast Asia, which is very similar to the logic of the gold-making gamefi in the past. But it is worth noting that Hamster has not issued tokens at present, which means that users only get "points" instead of real tokens. They are more like the party of wool. Hamster's revenue comes from advertising and importing new customers to exchanges. It is said that the daily advertising revenue is millions of dollars, and the paying group is the exchange.

Other ecosystems are slightly smaller, so I won't go into details. Just look at the pictures. For the track that the official has personally participated in, third parties may not have much chance to participate in it.

Cointelegraph

Cointelegraph

Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph 链向资讯

链向资讯 Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph