Author: Edgy Source: X, @thedefiedge Translation: Shan Ouba, Golden Finance

This has been the strangest cycle so far - no one knows what will happen next.

In times like this, it helps to see what others are doing. So I spent the weekend digging deep to see what the big VCs have been busy with lately.

I know some of you might be thinking: "They're just casting a wide net and praying that they can get in early and benefit."

Listen, I don't think they're the smartest people in the room, especially after the last cycle. But we should still pay attention to them: they have information advantages, are well-funded, and are closer to the builders than we are.

I want to know:

Are they doing some interesting moves?

Are they interested in some “shitcoins” like us?

Or do they still hold some “dinosaur coins” (old cryptocurrencies)?

So, my friend Edgy compiled hours of research into a quick five-minute read.

Let’s see what the “crypto maniacs” in suits are up to.

Instructions

Don’t copy what VCs do. They have better deals than we do, and they play a different game than we do. This is just to give us an idea of what other players in the space are like.

We can’t control all the wallets. We did our best to track via crowdsourced tags and on-chain analysis, but were unable to capture them all.

We picked a few funds and sorted them by size. We'll cover each fund's total balance, primary holdings, secondary holdings, and any recent interesting activity.

Top Crypto VCs and Their Holdings

1. a16z ($482.3M)

a16z is one of the largest UNI holders on the market. They have enough voting power to pass proposals, as 4% of UNI supply is enough to reach a quorum. They have been holding UNI for several years.

The latest change to a16z’s wallet is the unlocking of their OP tokens, which they continue to hold.

2. Galaxy Digital ($364.5M)

Major assets:

BTC: $194M

ETH: $115M

USDC: $40M

USDT: $5M

AVAX: $4M

USDC: $1.3M

AAVE: $1.14M

Small assets ($100k-$500k): MKR, OXT, UNI, TOKE

They generate a lot of volume, mostly in stablecoins and BTC. Most likely doing token distribution and arbitrage strategies.

They recently withdrew $3.3 million of AVAX from Binance.

3. Jump Trading ($286.4 million)

Main assets:

USDC: $78 million

USDT: $70.38 million

stETH: $70.38 million

ETH: $54.9 million

T: $2.15 million

WETH: $1.24 million

SHIB: $1.2 million

SNX: $1.16 million

Small holdings ($200,000 to $700,000): MKR, LDO, GRT, DAI, UNI, KNC, HMT, BNB, CVX, COMP, INJ, MNT

Jump has a pretty typical VC portfolio, mostly ETH and stablecoins. Notably they hold Threshold Network, SHIB, and SNX.

Despite claims that Jump has exited crypto, they are still active.

Jump has also started depositing ETH into LMAX, an institutional-grade crypto exchange.

4. Wintermute ($159.8 million)

Main assets:

USDC: $16.60 million

WBTC: $11.15 million

PEPECOIN: $10.52 million

ETH: $10.39 million

USDT: $9.11 million

TKO: $4.67 million

CBBTC: $4.63 million

MATIC: $4.41 million

BMC: $4.36 million

NEIRO: $3.48 million

Small assets (US$200,000 to $3 million): BASEDAI, TON, ZK, MOG, stETH, ARB, ENA, ARKM, APE, LDO, ONDO, etc.

Wintermute is a "heavyweight player" in the meme coin field. In addition to their largest holding PEPECOIN (note: this is not PEPE, it is another meme coin), they also hold a large number of meme coins such as MOG, NEIRO, COQ, APU, SHIB, BENJI, etc.

They are the market makers for meme coins.

Wintermute recently started accumulating CBBTC (Coinbase BTC) and BTC in its wallet.

They also sent over $6 million of SHIB to Binance.

5. Pantera Capital ($161.15 million)

Main assets:

ONDO: $152 million

ETHX: $4.4 million

SD: $1.11 million

ECOX: $941,600

LDO: $388,000

PERC: $375,000

NOTE: $274,000

Pantera recently transferred nearly $3 million of MATIC to Coinbase.

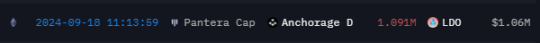

They also moved $1 million of LDO to Anchorage, a platform that provides crypto staking for institutions.

Interestingly, most of their ETH was moved to centralized exchanges. In addition, we also noticed that the value of their investment in ONDO dropped by 56%. It is worth noting that Pantera was one of the early private investors in ONDO.

6. Blockchain Capital ($67.1 million)

Major assets:

AAVE: $32.8 million

UNI: $18.35 million

ETH: $4.16 million

UMA: $2.12 million

SAFE: $1.89 million

1INCH: $1.88 million

COW: $1.62 million

FORT: $1.31 million

USDC: $1 million

Small assets ($100,000-$600,000): SUSHI, BAL, PSP, USDC, PERP

The largest holding AAVE is worth watching. They have been holding AAVE for years. Due to its recent price increase, it may be worth a closer look.

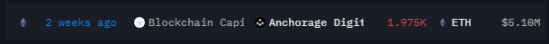

They also moved over $5 million of ETH to Anchorage, just like Pantera.

7. Spartan Group ($35.38 million)

Main assets:

PENDLE: $16.93 million

GAL: $2.65 million

MNT: $2.49 million

OP: $1.40 million

IMX: $1.18 million

WILD: $1.09 million

GRT: $1.04 million

AEVO: $982k

USDC: $841k

PTU: $800k

RBN: $778k

1INCH: $700k

Small assets ($100k-$500k): MAV, CHESS, MPL, G, DYDX, ALI, BETA, PSTAKE, ETH

Spartan Group is heavily invested in Pendle. Other than that, their trading is rare. They are mainly using USDC for arbitrage strategies.

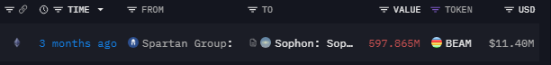

Interestingly, they are depositing all BEAM into Sophon, an upcoming chain that is already open for depositing assets to participate in the airdrop.

8. DeFiance Capital (US$33.6 million)

Main assets:

PYUSD: US$20 million

LDO: US$6.08 million

BEAM: US$3.94 million

USDC: US$1.1 million

TBILL: US$1.04 million

Small assets (US$50,000 to US$300,000): VIRTUAL, AVAX, BAL, MCB, USDT, INSUR

DeFiance is betting on gaming tokens. Their recent transactions involved multiple payments from Shrapnel, a Web3 shooter.

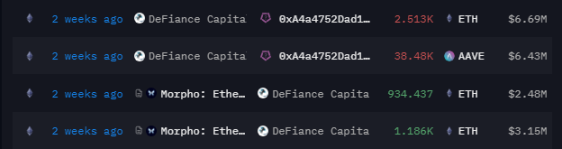

They also recently collected a large amount of ETH from Morpho.

Common Trends We See Among VCs

Common Holdings: a16z, Jump, Wintermute, and Blockchain Capital prefer top DeFi tokens (e.g., UNI, AAVE), ETH, and stablecoins. Probably due to the bear market, they are more focused on liquidity and DeFi protocols.

Long-term holding: a16z and Blockchain Capital have a "diamond hand" attitude towards certain assets - for example, they have held UNI and AAVE for several years.

Stablecoin arbitrage: They both engage in stablecoin arbitrage operations, which can be seen by their large stablecoin trading volume.

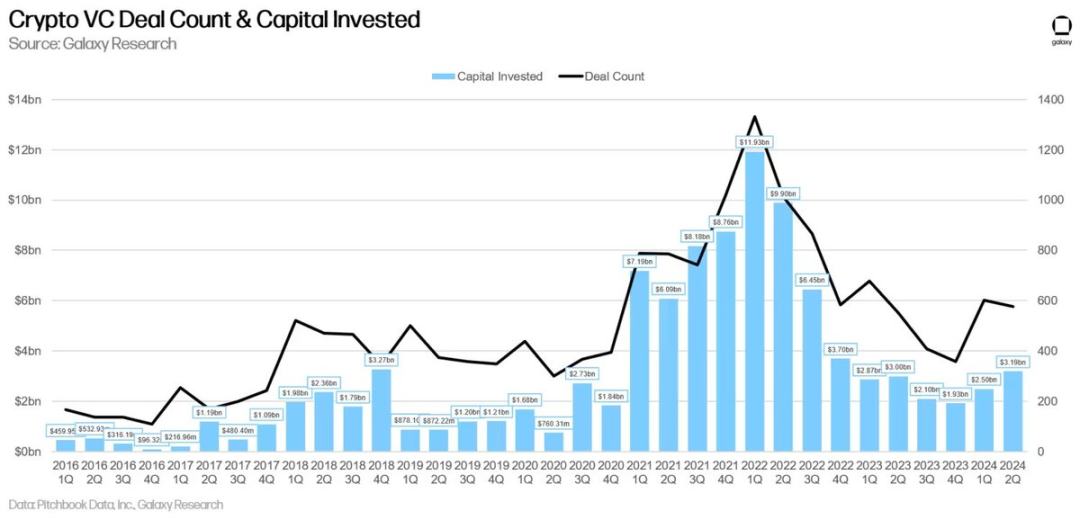

Bitcoin Layer 2 projects continue to attract a lot of investment. BTC L2 companies and projects raised a total of $94.6 million in this quarter, an increase of 174% month-on-month.

Early stage transactions still dominate the market. Nearly 80% of investment capital went to the early stage, and seed round transactions accounted for 13% of all transactions.

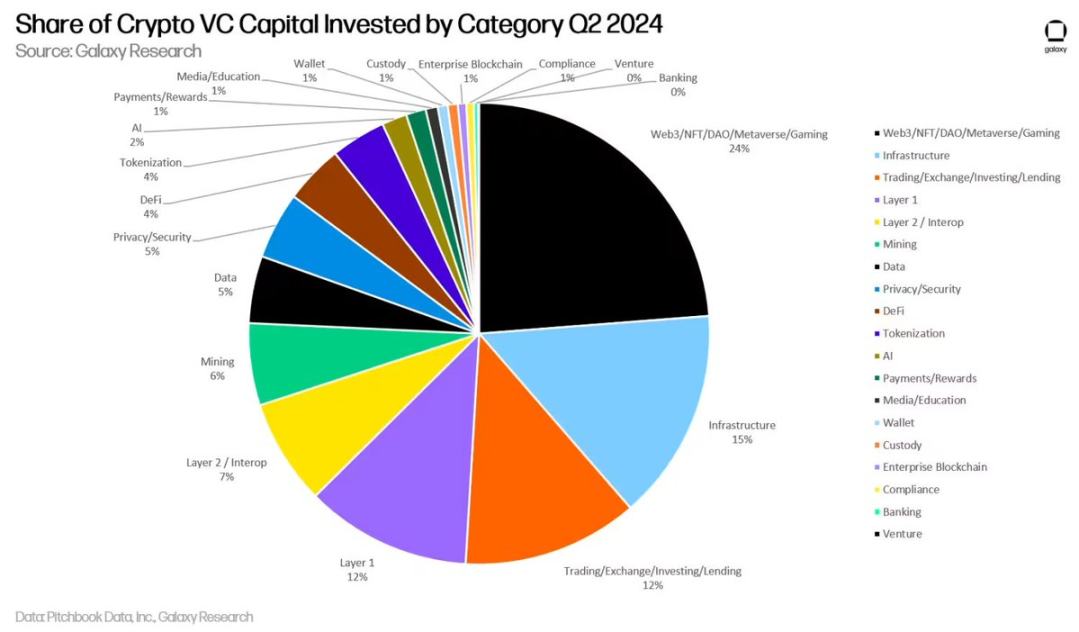

Investment Trends: Despite the huge craze about NFTs and GameFi in 2021, this space has cooled down in 2024.

VCs are now leaning more towards trends like AI, infrastructure, and even memes.

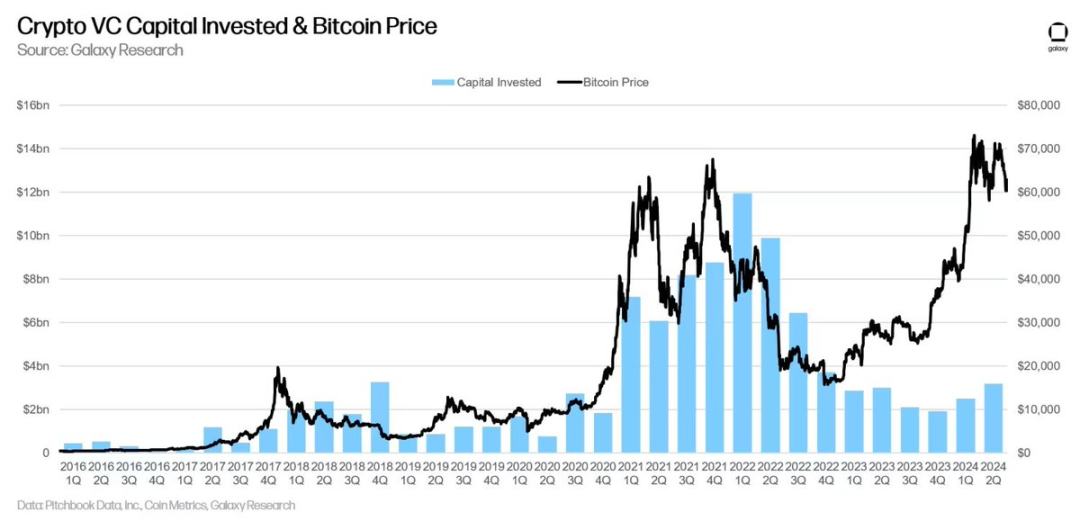

We recently read Galaxy’s report on VC trends in 2024. Here are some highlights:

It is worth noting that the scale of investment does not completely follow the price of Bitcoin.

This correlation was more accurate in the past, but now venture capital appears to be more exhausted.

Most investments are concentrated in the NFT/game/DAO fields, followed by infrastructure.

"In Q2 2024, companies and projects in the 'Web3/NFT/DAO/Metaverse/Games' category attracted the largest share of crypto VC funding, raising a total of $758 million in VC funding. The two largest deals in this category were Farcaster and Zentry, which raised $150 million and $140 million, respectively."

Hopefully this in-depth analysis will provide you with insights into how VCs operate in the crypto space.

The key is to observe their behavior, spot potential trends in advance, and understand how they operate. Don't copy VC's trading strategies outright, but use them as a tool to improve your research.

YouQuan

YouQuan

YouQuan

YouQuan Brian

Brian Hui Xin

Hui Xin Joy

Joy YouQuan

YouQuan Brian

Brian Hui Xin

Hui Xin Joy

Joy Brian

Brian Hui Xin

Hui Xin