Author: Edward Bolingbroke, Anya Andrianova, Bloomberg; Translator: Baishui, Golden Finance

The debate over the size of the Federal Reserve's expected interest rate cut in November is intensifying, with traders increasing bets on futures closely tied to the central bank's move as officials begin to weigh their next move.

Weaker-than-expected U.S. consumer confidence data on Tuesday left investors more inclined toward a second straight half-point rate cut at the Nov. 7 decision.As a result, it's essentially become a coin-tossing game in the swaps market, choosing between another outsize rate cut and a more standard quarter-point cut.

Swap traders are now pricing in a total of about three-quarters of a percentage point in the Fed’s two remaining rate cuts this year, the second of which is due on Dec. 18, meaning a half-point cut at one of those meetings.

“We are increasingly leaning toward a 50 basis point cut,” said Nathan Thooft, senior portfolio manager at Manulife Investment Management in Boston. “While we haven’t officially changed our stance, the cuts this year are two quarters of a percentage point — one in November and one in December.”

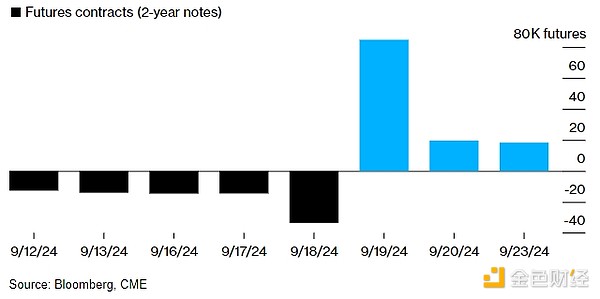

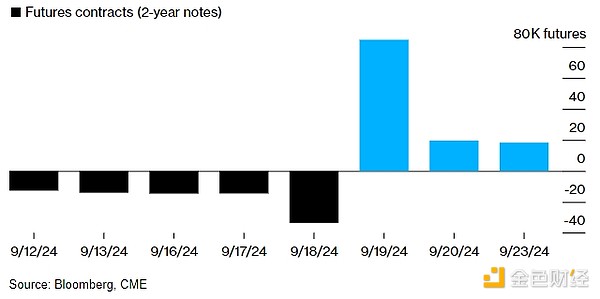

Positioning data show that interest rate markets have begun to prepare for Nov. 7 since the Fed’s decision last week. Open interest in two-year Treasury futures has surged. The number of positions held by traders for December 2024 Treasury maturities has climbed to about 4.4 million contracts, the highest level so far. Bets on December futures tied to the secured overnight financing rate (SRR) have also risen significantly.

However, traders are not currently making large bets in one direction due to mixed signals from policymakers for the November meeting. This is different from the situation before the Fed's half-percentage point rate cut on September 18, when futures bets favored such a large rate cut.

Change in open interest in U.S. two-year Treasury futures

Traders are closing positions ahead of the Fed meeting and then adding risk after it ends.

On Tuesday, Federal Reserve Governor Michelle Bowman said the central bank should cut rates at a "measured" pace after two officials downplayed the possibility of a half-point cut the day before. Meanwhile, Austan Goolsbee of the Chicago Federal Reserve said rates need to be lowered "substantially."

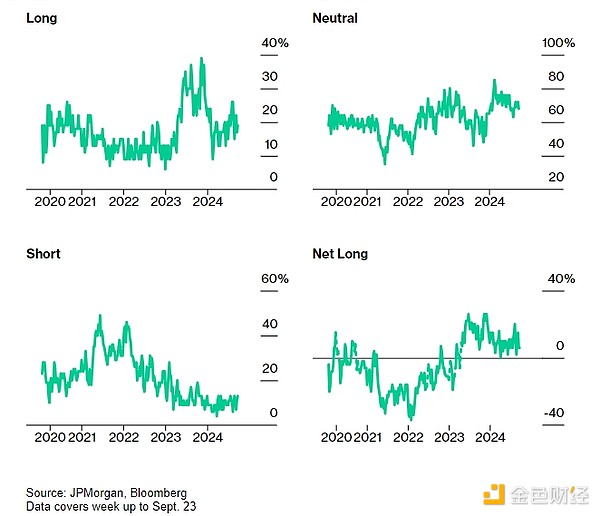

Meanwhile, On the cash Treasuries side, bullish momentum ahead of last week's Fed meeting remains intact, with JPMorgan Chase's Treasury clients keeping their net long position steady in the week to Sept. 23. The benchmark 10-year Treasury yield has risen about 12 basis points to about 3.73% during this period, as bond markets have sharply increased curve steepening trades following the Fed's rate cuts.

Here's an overview of the latest positioning indicators in interest rate markets:

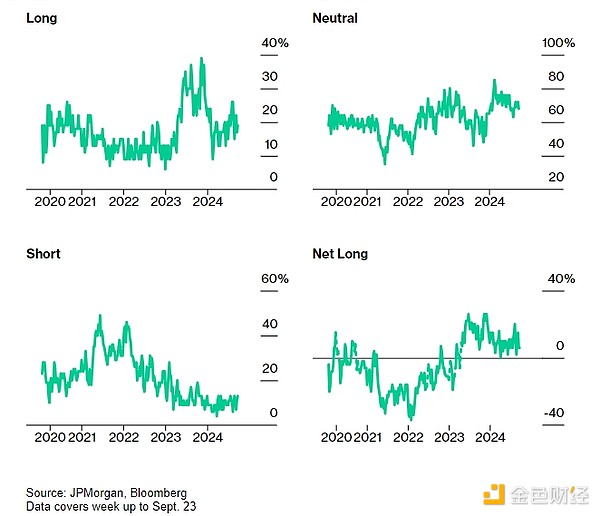

JPMorgan Survey

JPMorgan Treasury clients' outright long and outright short positions both increased by 2 percentage points in the most recent week, with net long positions remaining unchanged at 6 percentage points. All-client outright short positioning is now the highest in a month.

JPMorgan Treasury All-Client Positioning Survey

Client outright long positions rose to their highest level since December.

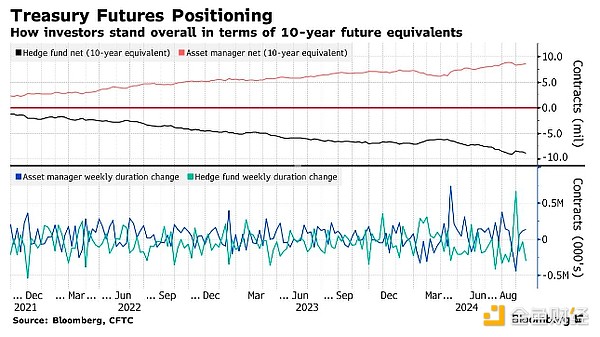

Asset management companies, hedge funds are long SOFR futures

Asset management companies and leveraged funds remain net long in SOFR futures, indicating that they are preparing for further rate cuts.

In the week ended Sept. 17, the day before the Fed cut rates, asset managers added about $2 million in risk for every basis point of risk in their net long positions, while hedge funds closed about $2.6 million in long SOFR futures for every basis point of risk, Commodity Futures Trading Commission data showed.

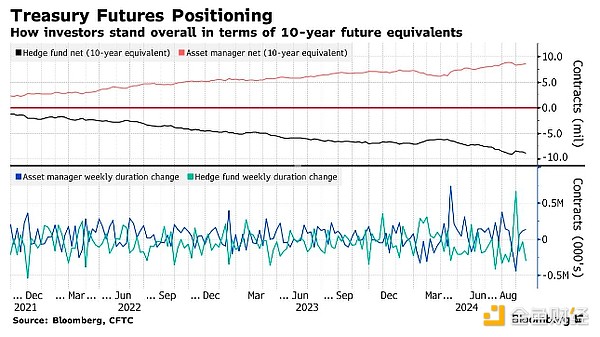

In Treasury futures, asset managers increased their net long position by about 135,000 10-year Treasury futures equivalents during the reporting week, while hedge funds increased their net short position by nearly 300,000 10-year Treasury futures equivalents.

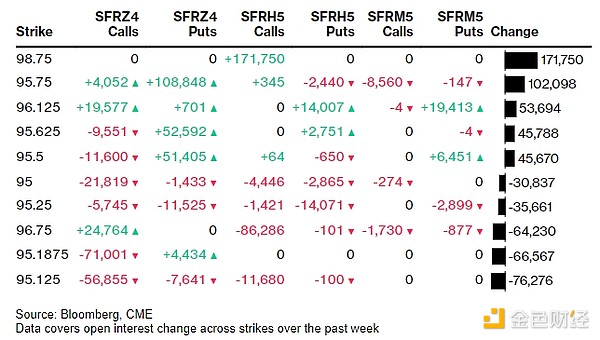

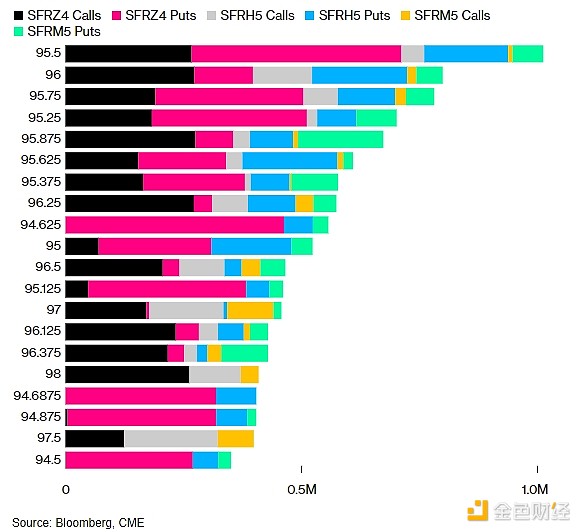

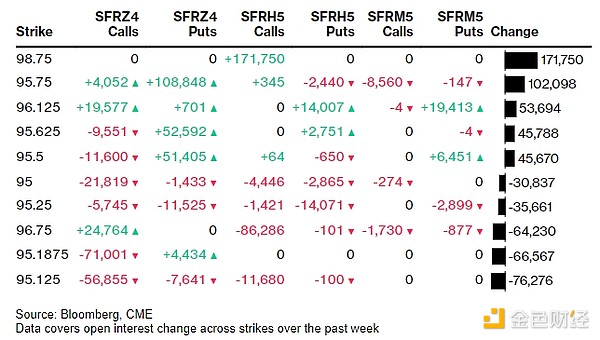

Most Active SOFR Options

The 98.75 SOFR option strike was one of the most active options over the past week. This is due to a large amount of dovish positioning in the Mar25 call options through the SFRH5 97.75/98.75 2x3 call spread, of which about 80,000 long positions have been formed. The Dec 24 puts have surged higher following recent inflows, including buyers of the SFRZ4 96.00/95.75 1x2 put spread, which saw additional positions added in the 95.75 strike.

Most Active SOFR Options Strike Prices

Weekly Net Change of Top 5 vs Bottom 5 SOFR Options Strike Prices

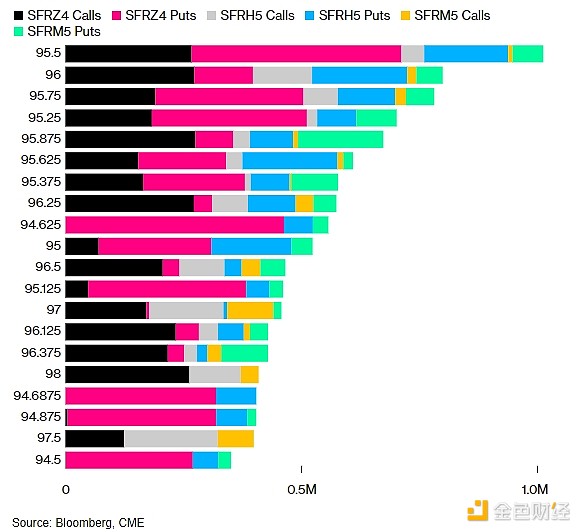

SOFR Options Heat Map

Among SOFR options with maturities ending in June 2025, the 95.50 strike price remains at the highest level, with a large number of December 24th calls and puts occupying this level. There have been some recent outright purchases of the Dec 24 95.50 put options that have added to open interest for that strike. There has also been some uptick in downside activity over the past week, including the SFRZ4 95.625/95.50 put spread and the SFRZ4 95.5625/95.4375 put spread bought at 1.

SOFR Options Open Interest

Top 20 open SOFR options positions for Dec 24, Mar 25, and Jun 25 terms.

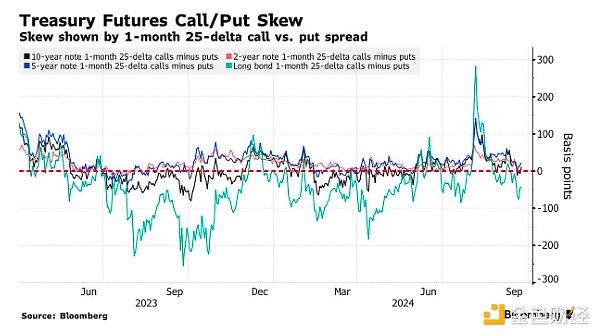

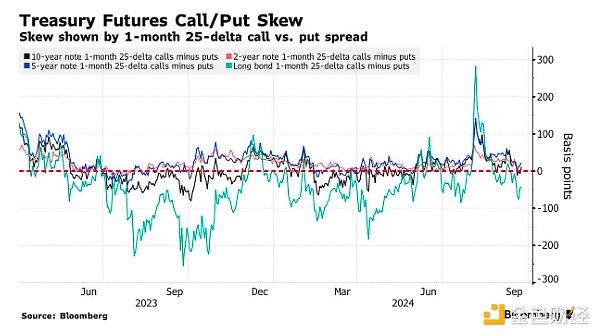

Option premiums remain close to neutral levels

The premium paid to hedge the market continued to hover around neutral levels in the range from the front end to intermediate bonds over the past week, while a few weeks ago, the premium surged to the call premium as traders expected the market to continue to rise. At the long end of the curve, premiums began to rise to hedge against selling, which is reflected in the negative skewness of the long-term bond call/put spread as traders expect the curve to steepen.

Catherine

Catherine