Author: Bitkoala; Source: Bitkoala Finance

This week, World Liberty Financial (WLFI) officially started its public sale, and this crypto project with the background of the Trump family finally surfaced.

However, contrary to initial market expectations, WLFI's sales performance does not seem to be satisfactory.

The Trump family encryption project's WIFI traffic was too large and it was offline midway. Bitcoin's "take-off" was supported by Trump.

BitkoalaKoala Finance learned that since the public sale started, the WLFI sales website has been interrupted many times after it went online. WLFI consultant and Scroll blockchain network co-founder Sandy Peng attributed the website interruption to excessive traffic and said: "The team did not expect such a level of attention. "It is reported that the World Liberty Financial website (World Liberty Financial) lang="EN-US">WLFI's official portal for token sales received 72 million unique visits in the first hour after it went online. The site was then offline due to excessive traffic, but later came back online intermittently, apparently switching to a new web hosting service.

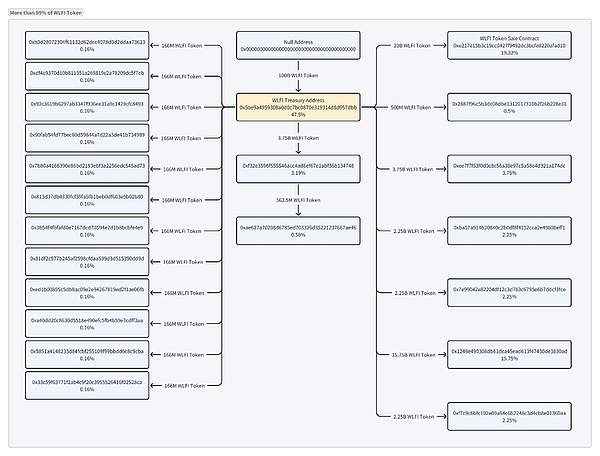

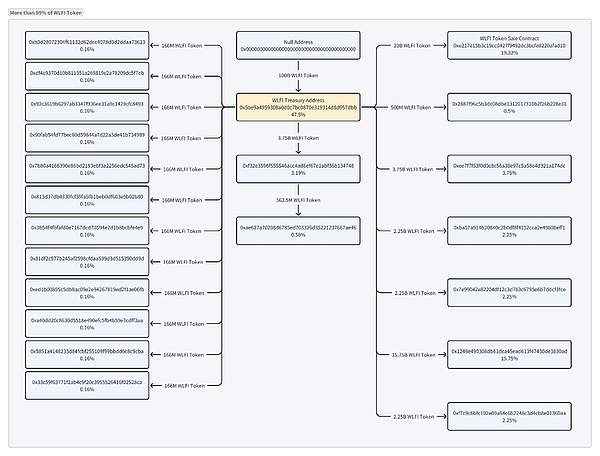

Against this backdrop, WLFI sales have encountered bottlenecks. According to monitoring by iChainfo, as of October 17, the Trump family project World

Liberty Financial's WLFI token sales reached $12.51 million. On-chain analysis results show that the total amount of tokens held by buyers is still less than 1%.

Not only that, the relevant documents also disclosed that the Trump family will receive 75% of WLFI's net income and will not bear any responsibility. It is reported that DT Marks DEFI

LLC, a Delaware company associated with Trump, will receive 75% of the net agreement income. The Trump family will receive 22.5 billion WLFI tokens, which are worth about $337.5 million based on the issue price of 1.5 cents this week. The document emphasizes that Trump and his family members are not directors, employees, managers or operators of WLF or its affiliates, and states that the project and tokens are "not related to any political activities."

The remaining 25% of the net agreed proceeds will accrue to Axiom Management Group (AMG), a Puerto Rican company wholly owned by co-founders of the project, Chase

Herro and Zachary Folkman. AMG has agreed to assign half of its proceeds to WC Digital Fi, a company affiliated with Steve Witkoff, a close friend and political donor, and some of his family members.

But strangely, just when the Trump family's encryption project was in trouble, Bitcoin rebounded and rose. Why?

Is Trump's blessing for Bitcoin's "takeoff"?

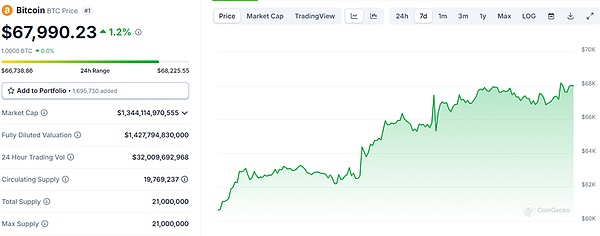

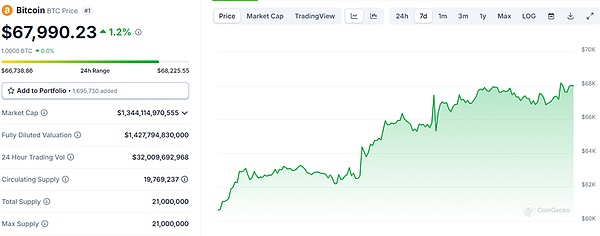

In fact, the market generally expects Trump to win the US presidential election, and his support for cryptocurrency has made investors confident in the future of Bitcoin, especially in the current global economic uncertainty and inflation concerns. Investors are looking for safe-haven assets. Bitcoin is regarded as a value-preserving asset due to its limited supply and decentralized characteristics. More and more mainstream financial institutions and large investors have begun to accept and invest in Bitcoin, which has further driven up the price of Bitcoin.

Data shows that in the past seven days, Bitcoin has risen all the way to the $68,000 range, and its market value has reached about $1.35 trillion, which is higher than the total market value of payment giants MasterCard and Visa.

The direct driving force behind Bitcoin's rise is still related to the continued inflow of funds, but it has slowed down slightly compared with the previous two weeks. The biggest crypto asset event this week was the attendance of Republican presidential candidate Trump at the US Bitcoin Conference on July 28. At this event attended by hundreds of thousands of people, Trump delivered a speech saying that if elected, he would include BTC in the US national reserves, promote the power supply of BTC mining in the United States, and establish the first presidential advisory committee on cryptocurrency in human history. There is no doubt that Trump is bringing BTC into wider global attention and linking national reserves with cryptocurrency for the first time. In response, Hong Kong lawmakers and representatives of related industries also called on the Hong Kong government to include BTC in its strategic reserves. Frankly speaking, when investors lose confidence in traditional financial markets or other cryptocurrencies, they may view Bitcoin as a safer safe-haven asset, driving up Bitcoin prices. The problems of World Liberty Financial may trigger investors' concerns about other crypto projects, causing them to sell their tokens, thereby indirectly driving up demand for Bitcoin. When Bitcoin prices rise, it may trigger the "fear of missing out," attracting more investors to enter the market and further driving up prices. At the macroeconomic level, monetary policy adjustments by central banks may affect investors' views on cryptocurrencies. For example, when traditional currencies depreciate, investors may turn to digital assets such as Bitcoin. Bitcoin is the first and most famous cryptocurrency, with a huge user base and brand awareness. In addition, Bitcoin is regarded as digital gold, with characteristics such as scarcity and decentralization, which give it a special status in the cryptocurrency market.

Summary

The cryptocurrency market is a highly volatile and complex market with many influencing factors. World Liberty

Financial's problems may be just one of the many reasons for the rise of Bitcoin. Investors should consider various factors comprehensively and conduct sufficient risk assessment when making investment decisions.

Miyuki

Miyuki