Source: Shenwan Hongyuan Macro

Summary

The 2024 US election is about to come to an end. How to judge the market impact and possible interpretation of the "Trump transaction"? For reference.

(I) How did the "election transaction" perform in history? The fourth quarter traded the "surprise" of the election, and the subsequent trading policy was promoted

Looking back at history, "election transactions" are usually carried out in three stages: In the first stage, when one party's winning advantage rapidly expands/narrows, "election transactions" will be opened in advance.The US election is divided into two steps: the party primary and the presidential election. The primary usually ends around the end of August. At that time, the candidates of the two parties and their policies gradually become clear, and the market gradually starts to trade the "policy gap".

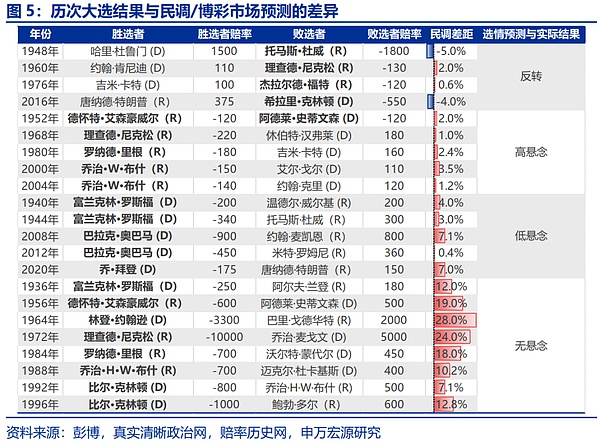

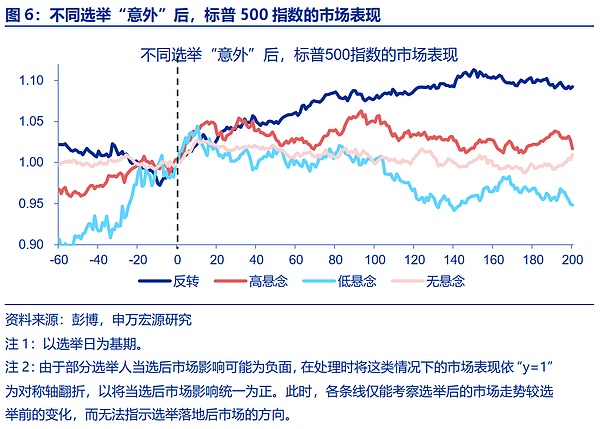

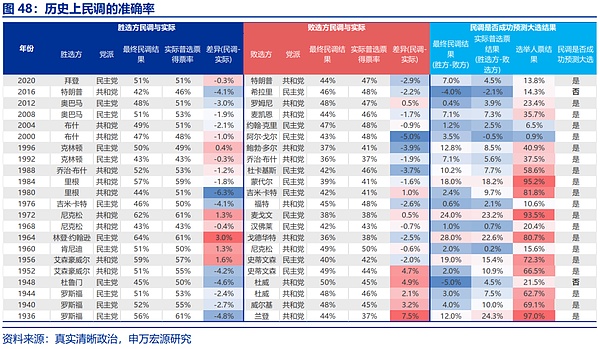

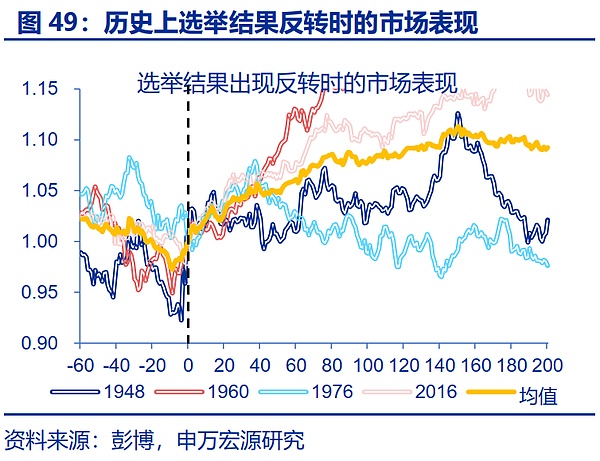

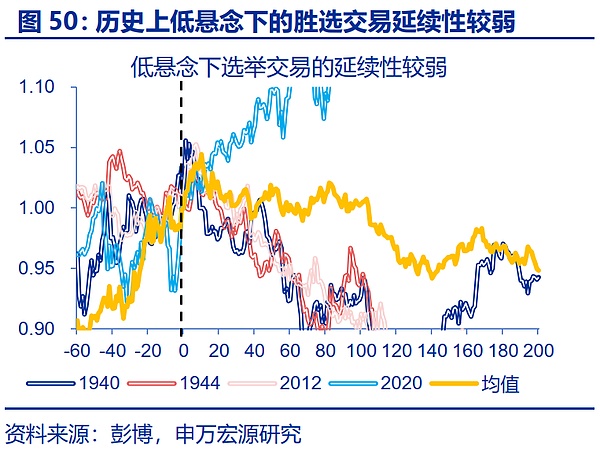

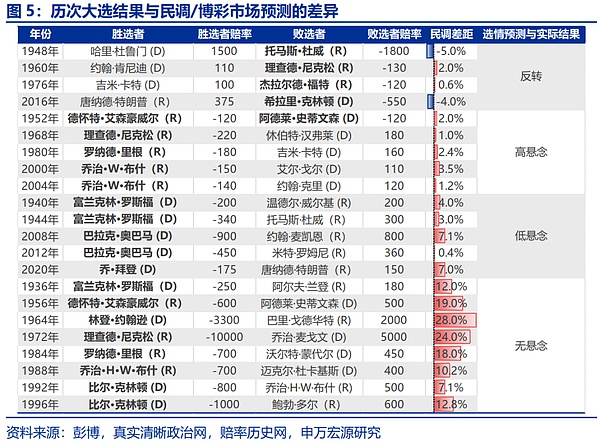

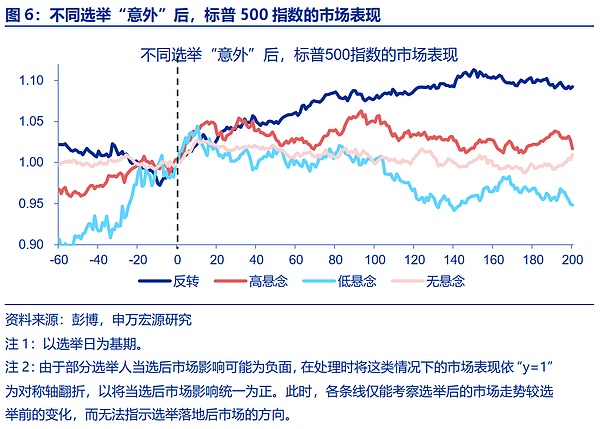

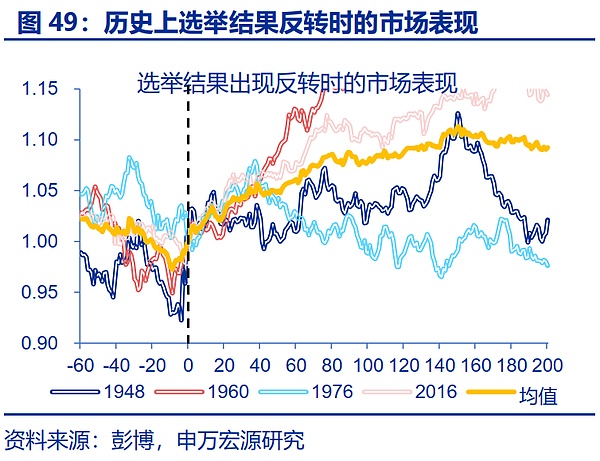

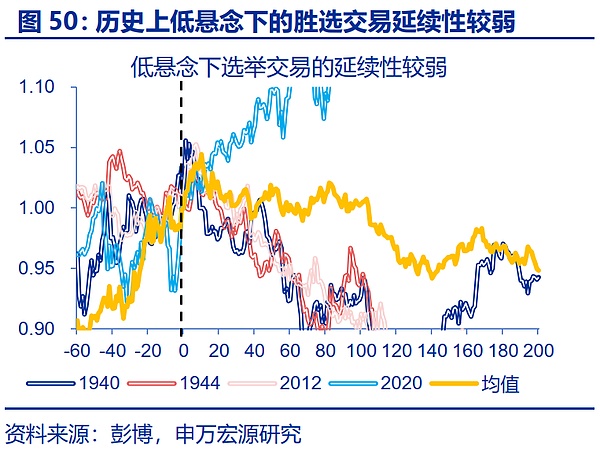

In the second stage, after the election, the market prices the "surprise" of the election. Elections since 1936 can be divided into four scenarios: 1) The outcome is reversed, and the market performance is significantly reversed compared with the previous three months, such as 2016; 2) Winning under high suspense, the market continues the previous trading direction for about one month, such as 2004; 3) Winning under low suspense, the market continues for about 10 trading days after the election, such as 2020; 4) Winning without suspense, the market reaction after the election is weak, such as 1996.

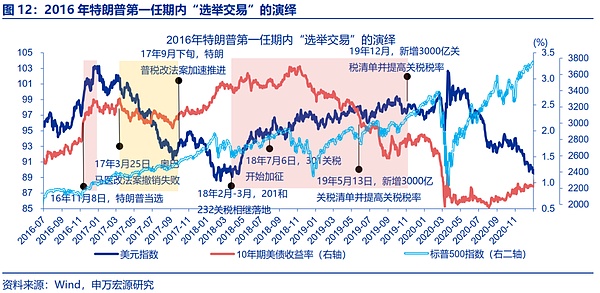

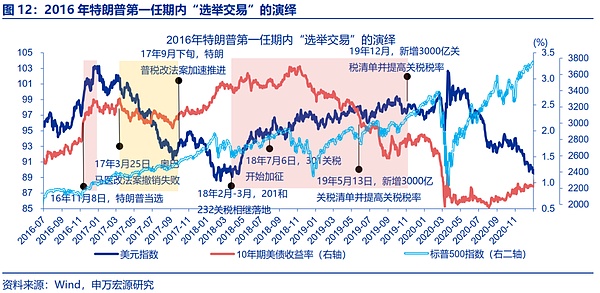

In the third stage, the implementation/failure of core policies will also lead to the restart/reversal of previous transactions. Take Trump's first term as an example. In March 2017, Trump's first policy, the new health care reform bill, failed, and Trump's trading began to "reverse". It was not until early November 2017 that the successful promotion of the tax reform bill revived the market's confidence in Trump's policies, and Trump's trading was subsequently restarted.

(II) How does the market conduct "Trump trading"? The US dollar is strong, US stocks and copper are bullish, and US bonds and gold are bearish.

From the perspective of market transactions themselves, Trump's transactions can be observed from three perspectives.1) Focus on the performance of major asset classes during the two debates. Trump had a clear advantage in the debate on June 27 and lost in the debate on September 10; 2) The correlation between Trump's victory advantage and the performance of various assets in the past 90 trading days. 3) The performance of major asset classes during Trump's transactions from November to December 2016.

On the whole, the "Trump transaction" has a high degree of certainty in the upward trend of US and Chinese bond yields, the strengthening of the US dollar, and the rise of Bitcoin. The transaction is bullish on US stocks and copper prices, bearish on gold prices, and has an uncertain impact on oil prices.From the results of previous market transactions, Trump's transactions are not "bad for copper and oil, bullish for gold", which may be somewhat different from the judgment based on policies.

Beyond the consensus: 1) For copper, Trump does not completely restrict the new energy industry. Tax cuts, re-industrialization and other economic stimulus will also boost demand for copper. 2) For gold, Trump's policy pushes up US bond interest rates, which is bearish for gold prices. At the same time, his geopolitical policy may ease geopolitical risks. 3) For oil, re-industrialization and other stimulus to demand may weaken the potential negative impact of supply to a certain extent.

(III) "Trump deal" in the equity market? The overall market growth is relatively positive, pay attention to finance, energy and manufacturing

As far as US stocks are concerned, the "Trump deal" may be structurally bullish for the overall market growth. From early June to mid-July and mid-September, the probability of Trump's victory has increased significantly. In these two stages, the overall market and growth of US stocks are relatively dominant. Logically, Trump's tax cuts, technology and other policies are good for growth sectors, while his policies have increased the upside risk of US bond yields, which may put small-cap stocks under relative pressure.

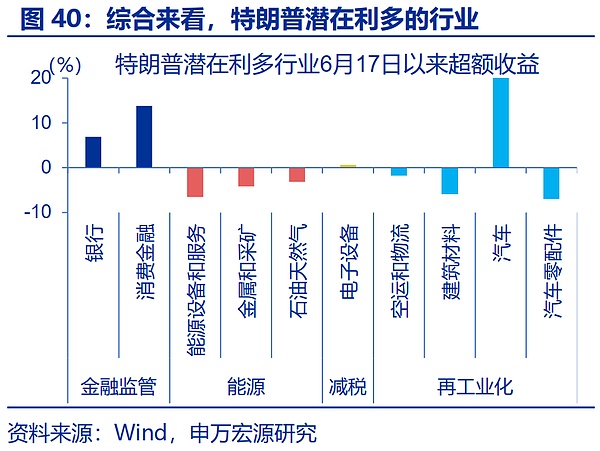

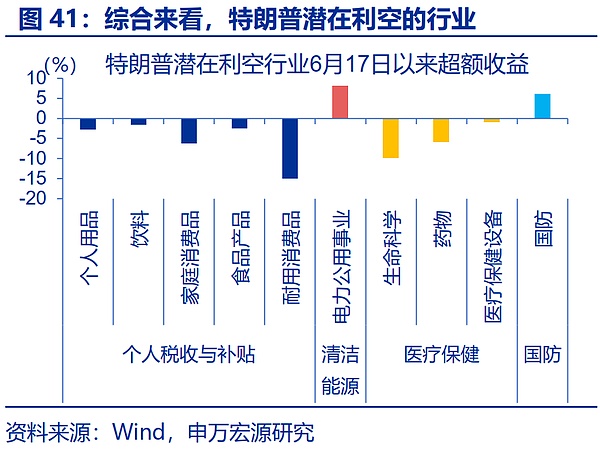

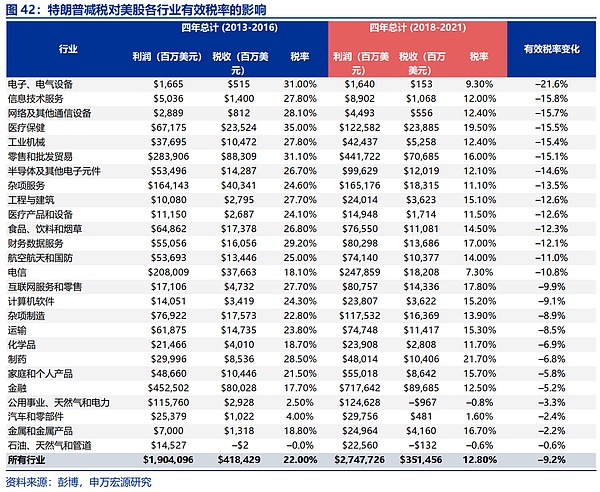

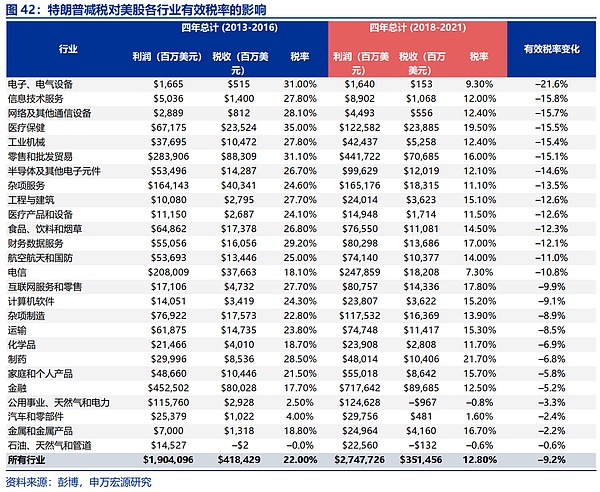

Taking into account the correlation between the excess returns on the debate day, the excess returns at each stage of the election, and the Trump winning rate in the past 90 trading days, we can judge the potential impact of Trump's transactions on the industry:1) Financial regulation relaxation, good for banks, etc.; 2) Traditional energy development, good for energy equipment, etc.; 3) Corporate tax reduction, good for electronic equipment, etc.; 4) Weak support for clean energy, bad for power utilities, etc.

In addition to the above industries, the following categories that are more worthy of attention or outside the consensus are:1) Trump's policies such as re-industrialization support air logistics, building materials, and automobiles. 2) Compared with Harris's tax cuts and subsidies for middle- and low-income groups, Trump's tax cuts benefit the rich more, which is bearish for essential consumption, health care, etc.; 3) Trump's geopolitical contractionary policies are bearish for the military industry.

(IV) Possible interpretation of "election trading"? In the short term, we will see unexpected results; in the medium term, we will see policy impulses; in the long term, we will see fundamentals

At present, the balance of trading has tilted towards Trump; if Trump is elected, the continuity of trading may be limited; if Harris wins, trading may reverse significantly.The continuation of mail-in ballots and the migration of urban and rural populations after the epidemic will still bring certain variables to the election. If Trump is elected, the market may be similar to 2020, with a slight continuation of trading; and if Harris wins, the market may be similar to 2016, with a significant reversal of trading.

In the medium term, whether the policy propositions are smoothly promoted may directly affect the reversal or continuation of the third stage of election trading.

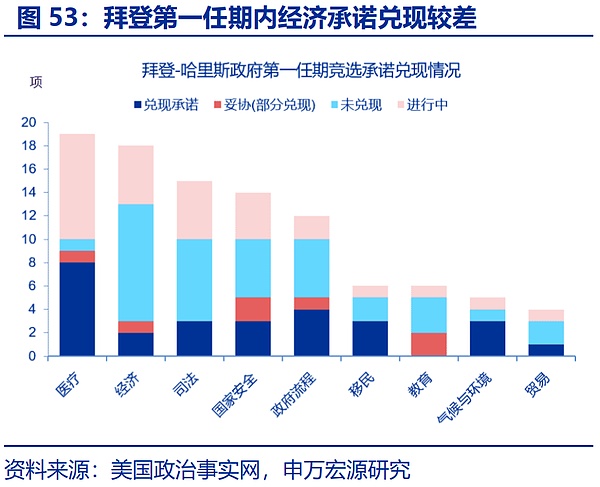

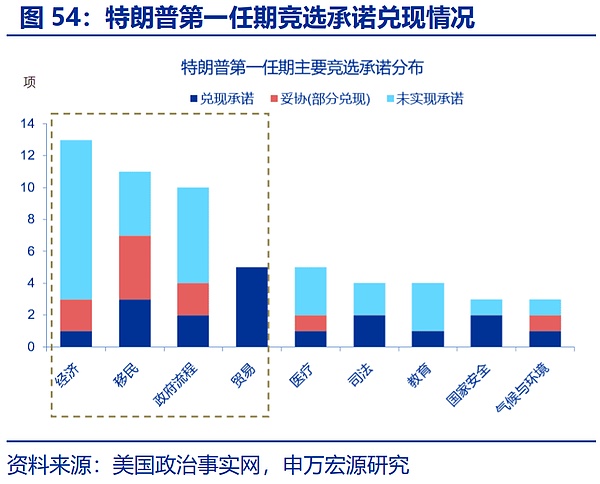

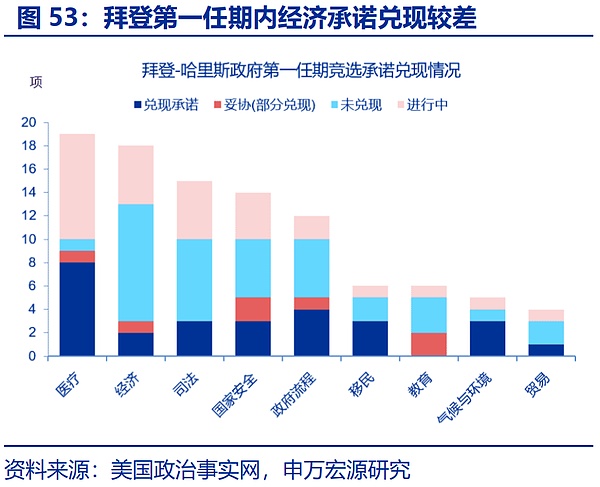

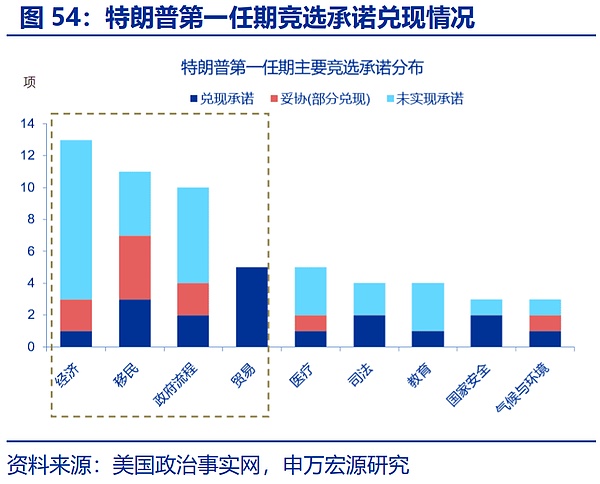

In terms of rhythm, in his first term, Trump quickly introduced policies in the fields of immigration, trade, and regulation through executive orders, but the tax policy was slow to be implemented.2) In terms of implementation possibility, the policy fulfillment rate during Trump's first term was only 23%, but the fulfillment rate in the field of trade was higher.

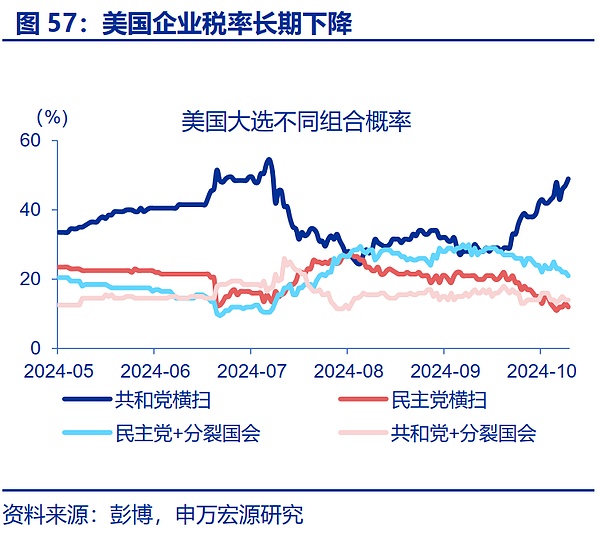

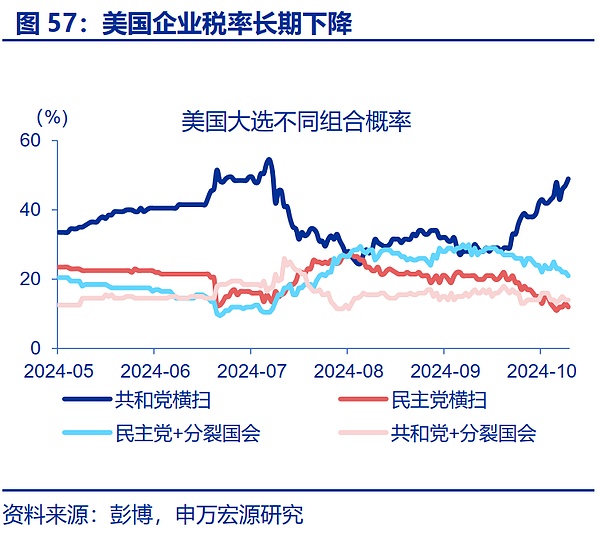

In the long run, the impact of the election on the market may be mainly achieved through the impact on fundamentals. The results of this year's election can be divided into four scenarios: ① Republican victory (49%), ② Trump + split Congress (14%), ③ Democratic victory (12%), ④ Harris + split Congress (21%). From the perspective of the positive impact on the economy: ③>①>④>②.

Risk Warning

Risk Warning: Geopolitical conflicts escalate; US economic slowdown exceeds expectations; Japanese yen continues to appreciate beyond expectations.

Report Text

The 2024 US election is about to come to an end, but the impact of the "Trump deal" on some assets is still controversial. What is the proper meaning of the "Trump deal" in asset price performance, and what is the possible market interpretation after the election? For reference.

1. How did the "election deal" perform in history? Trading in the fourth quarter election "surprises", subsequent trading policies promoted

Looking back at history, "election trading" is usually carried out in three stages: the rapid change of the winning advantage of one party before the election, the "surprises" of the trading results after the election, and whether the policy is implemented or not determines the continuity/reversal of the transaction.

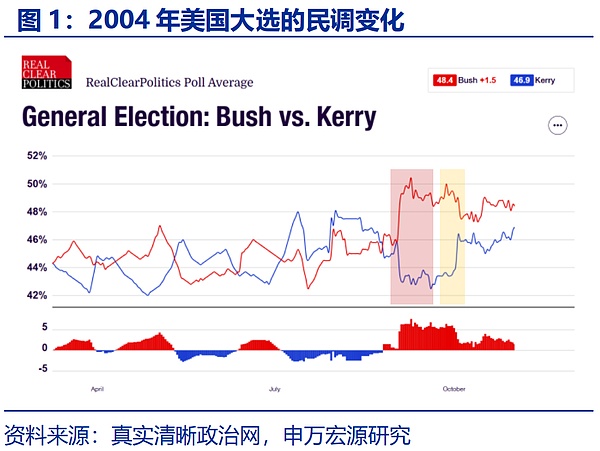

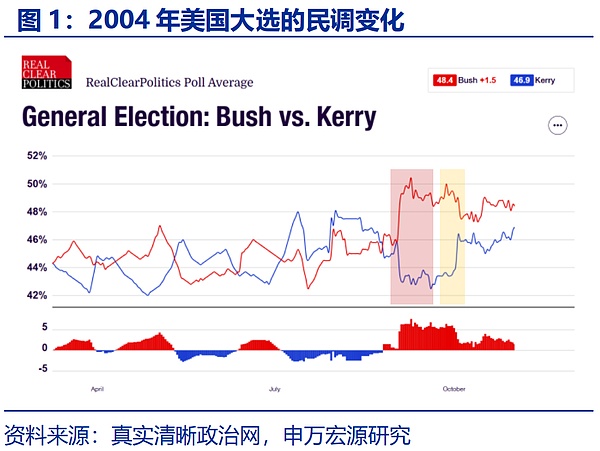

In the first stage, when the winning advantage of one party expands/narrows rapidly, "election trading" will start in advance. The US election is divided into two steps: the party primary and the presidential election. The primary usually ends around the end of August. At that time, the candidates of the two parties and their policies gradually become clear, and the market gradually starts trading on "policy differences". 1) Taking Bush VS Kerry in 2004 as an example, the attitude towards traditional energy and when the Iraq War will end are the main policy differences between the two. The shooting on September 2 greatly boosted Bush's chances of winning the election, and energy equipment and defense military industries also rose simultaneously; and after the failure of the debate on September 30, the excess returns of the two industries also reversed rapidly. 2) In 2008, Obama's chances of winning the election continued to increase after he was officially nominated, and the deal around Obamacare was also launched in mid-September.

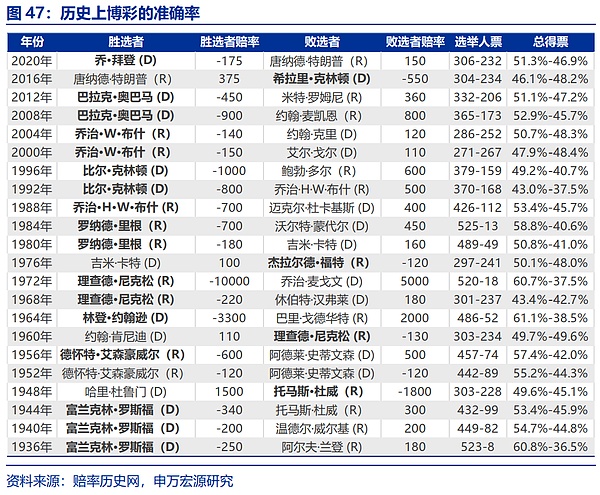

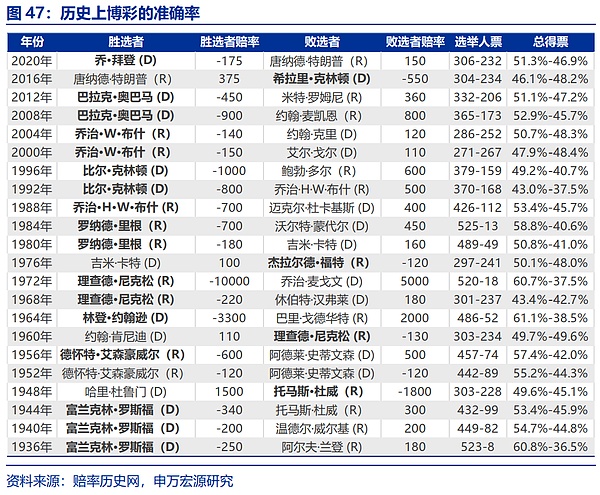

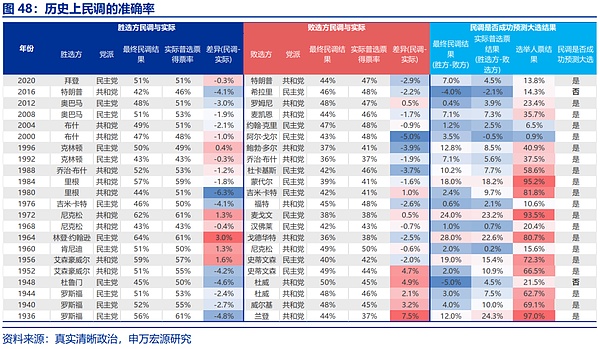

In the second stage, after the election, the market will price in the "surprises" of the election.Based on the gap between the predictions of the gambling market and the polls, the general elections since 1936 can be divided into four situations: "reversal of outcome", "winning under high suspense", "winning under low suspense", and "winning without suspense". 1) In the case of a reversal, the market performance has a significant reversal compared with the previous three months. The 2016 election is a typical case. 2) In the case of a win under high suspense, the market will continue the previous trading direction for more than a month. 3) In the case of a win under low suspense, the market's continuity after the election is weaker, only about 10 trading days. 4) In the case of a win without suspense, the market's early pricing has been relatively sufficient, and the reaction amplitude and continuity after the election are relatively weak. The 2020 election is a typical case.

In the third stage, the implementation/failure of core policies will also lead to the restart/reversal of previous transactions. Take 2017 as an example. At that time, under the campaign promises such as tax cuts and trade conflicts, the market's response to the "Trump deal" was "strong US stocks" and "strong US dollars". On March 25, 2017, the failure of the new medical reform bill caused the US stock market to fall rapidly and the US dollar to weaken significantly that day. The bill was the first key bill Trump tried to promote, but the party could not reach a consensus and it was withdrawn before the House of Representatives voted, which had a significant impact on market confidence and Trump's deal began to "reverse". It was not until early November that the successful promotion of the tax reform bill restored market confidence in Trump's policies, and Trump's deal was restarted in the promotion of the 2018 tariff bill.

Take the Trump deal from 2016 to 2019 as an example, in the second and third stages, "Trump deals" were staged. 1) The first stage, from early September to November 7, 2016, after the primary election and before the election day, polls and betting leaned towards Hillary, the S&P 500 weakened, the US dollar index fluctuated, and the Trump trade had not yet started. 2) The second stage, from November 8 to December 31, 2016, the "surprise" of the election was quickly priced in, the US dollar index soared, and the S&P 500 index rose sharply. 3) The third stage, after the new medical reform bill was withdrawn on March 15, 2017, the US dollar index continued to weaken, and the Trump trade was temporarily reversed; until February 2018, the imposition of 201 and 232 tariffs ignited the market's confidence in trade policies, the US dollar index continued to strengthen, and the Trump trade was restarted.

2. How is the market conducting the "Trump trade"? The certainty of a strong dollar is high, US stocks and copper are bullish, while US bonds and gold are bearish.

Currently, the market's interpretation of the "Trump deal" is mainly to look at the market from the perspective of policy, but the impact of a series of campaign proposals on assets may be differentiated; and starting from the market transaction itself, this difference may be eliminated to a certain extent.On the one hand, the different policy proposals of Trump or Harris may have opposite effects on a certain type of asset; taking the US dollar as an example, Trump's policies such as reducing corporate taxes, increasing tariffs, and supporting industrial production all have the characteristics of a strong dollar, but he also tried to promote the "weak dollar plan". The trend of the US dollar in Trump's transactions cannot be derived from the policy itself. On the other hand, the two have certain commonalities in some policies, such as both advocating the promotion of US industrial production, but the impact of "policy differences" on copper and cyclical stocks is also difficult to measure. The market provided answers to such questions in the first stage of the "Trump victory" transaction.

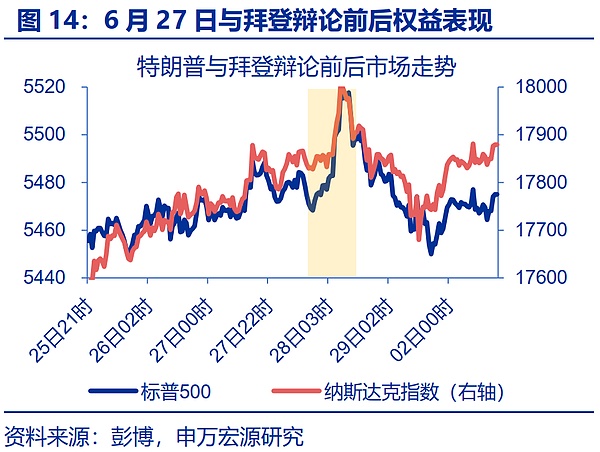

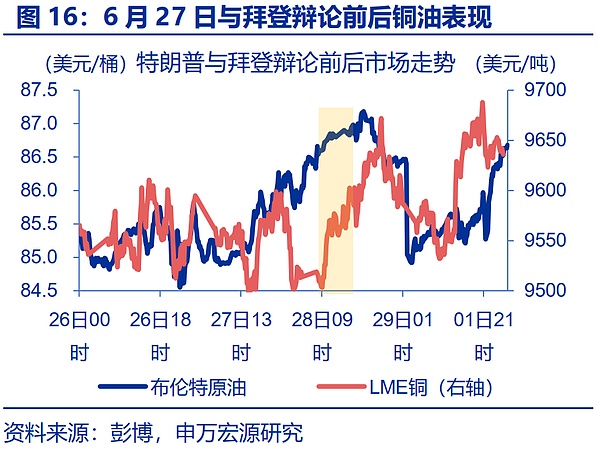

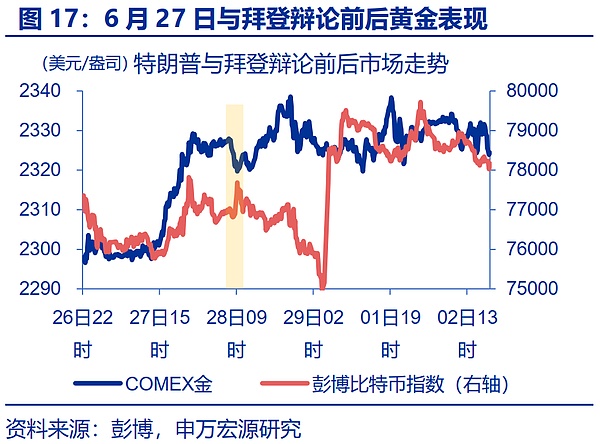

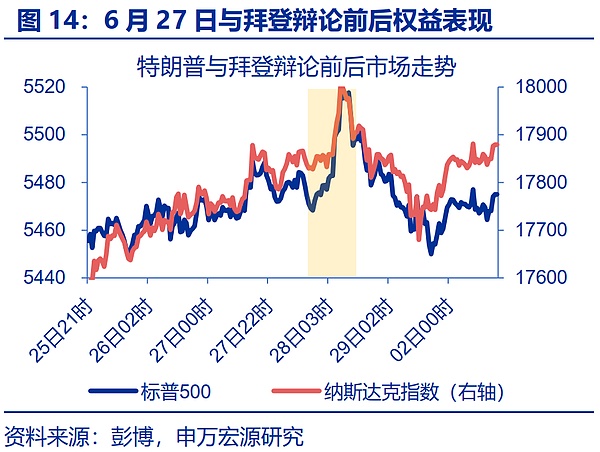

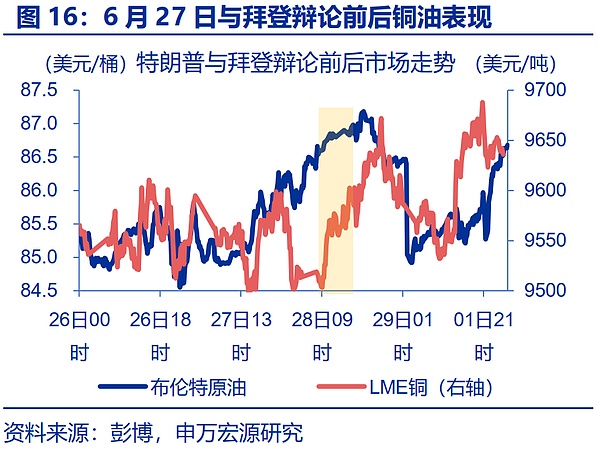

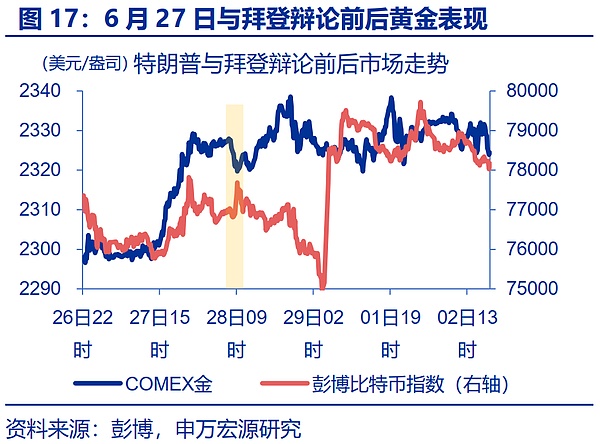

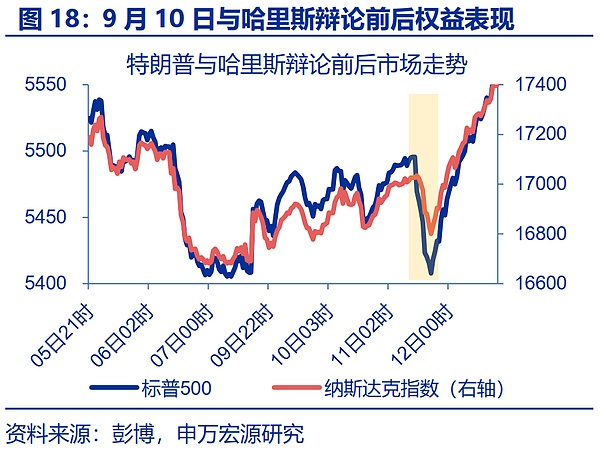

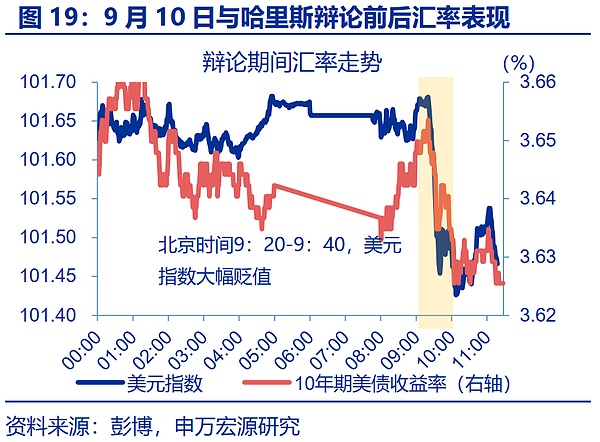

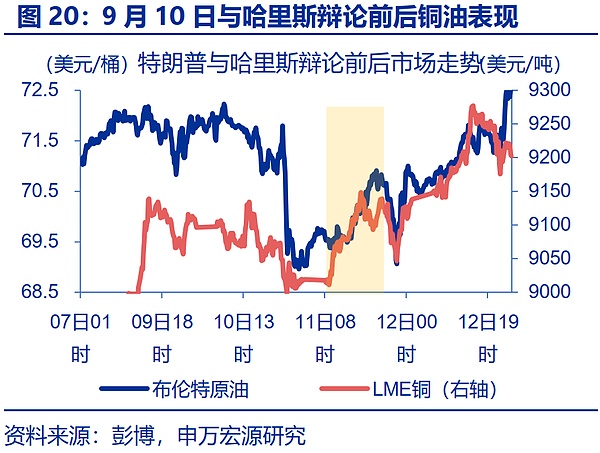

Perspective 1: Focus on the performance of major asset classes during the two debates. At 9:00 p.m. Eastern Time on June 27, Trump and Biden held their first presidential debate. Trump clearly dominated the debate and established a significant advantage over Biden. During the debate, the S&P 500 and Nasdaq indexes rose sharply, the U.S. dollar index strengthened, U.S. Treasury yields rose, LME copper rose rapidly, Bitcoin rose, Brent crude oil prices rose slightly, and COMEX gold was under obvious pressure. Judging from this performance, the "Trump deal" may have the characteristics of pushing up the U.S. dollar, pushing up U.S. Treasury bond interest rates, and being bullish on U.S. stocks, copper, and Bitcoin. It is bearish for gold prices and has a weak impact on crude oil prices.

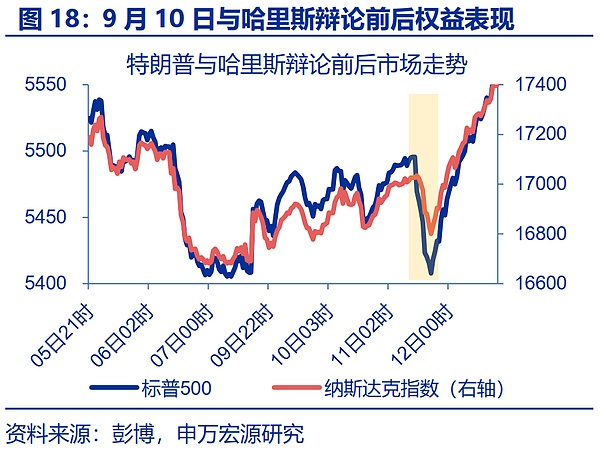

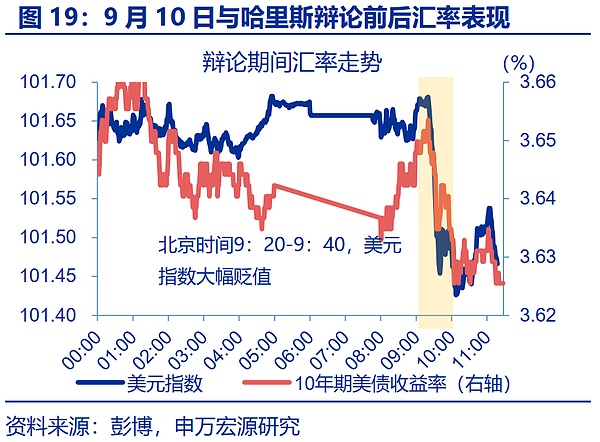

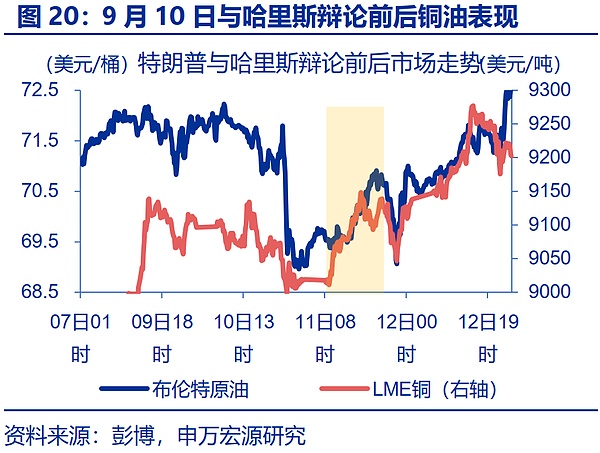

In the debate with Harris on September 10, Trump was at a disadvantage, and the market trend during this period may be the opposite of the "Trump deal". During the debate, under the "Harris deal", the S&P 500 and Nasdaq indexes weakened rapidly after opening, the US dollar index weakened, US bond yields fell, copper and oil prices rose in resonance, Bitcoin fell, and gold prices rose slightly. Judging from the market performance this time, the policy difference between Trump and Harris still has the characteristics of a strong dollar, pushing up U.S. bond interest rates, bullish for U.S. stocks and Bitcoin, and bearish for gold prices. The instructions on copper and oil prices that are more contradictory than the previous ones may be disturbed by OPEC's downward adjustment of global oil demand growth expectations for this year and next year on the evening of September 10.

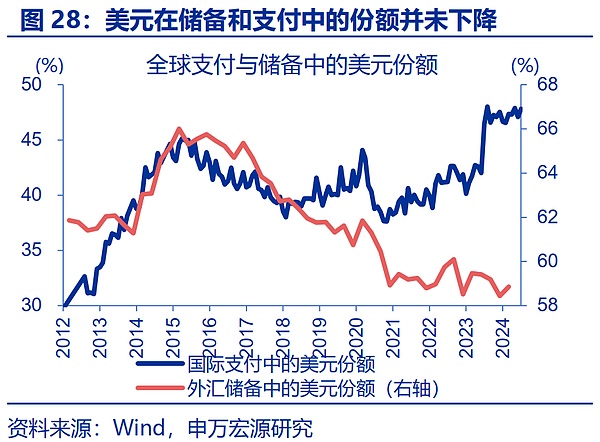

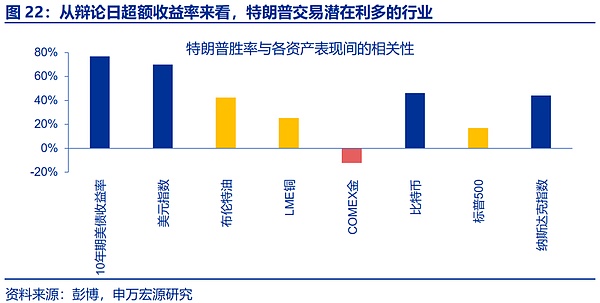

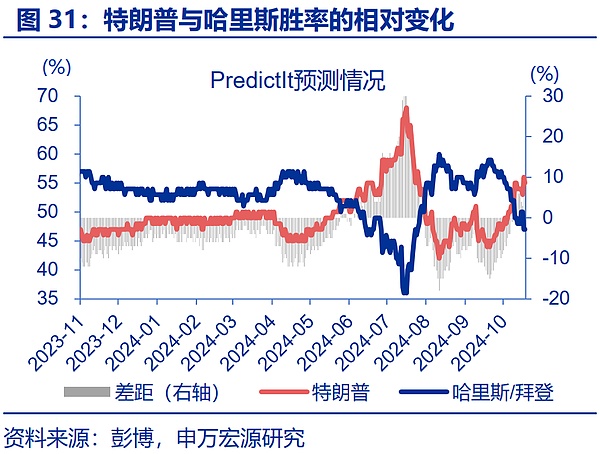

Perspective 2: The correlation between Trump's victory advantage and excess returns. In the past 90 trading days, with the start of the presidential debate, asset pricing began to consider the impact of "election trading". From June 17 to date, the correlation between various assets and Trump's winning rate in the gambling market is as follows: 1) The correlation between the 10-year US Treasury yield and the US dollar index and Trump's winning rate is as high as 0.77 and 0.70 respectively. Trump's trading has the most certain support for the rise of US Treasury yields and the strengthening of the US dollar; 2) The correlation between Bitcoin and Nasdaq and Trump's winning rate is 0.46 and 0.44 respectively, and they also obviously benefited from Trump's trading; 3) Brent crude oil, LME copper and S&P 500 are weakly positively correlated with Trump's winning rate, and the bullish copper and oil seem to have some differences with the interpretation at the policy level; 4) Gold prices are weakly negatively correlated with Trump's winning rate.

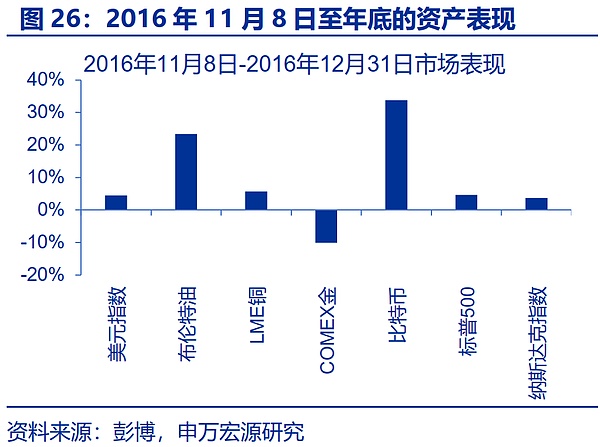

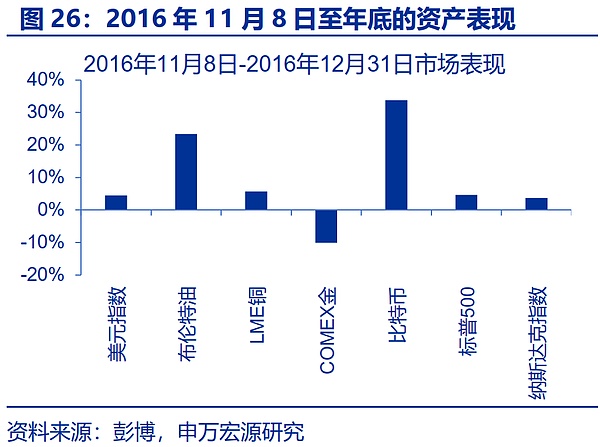

Perspective 3: Performance of major asset classes during Trump's transactions in 2016. After Trump's unexpected election on November 8, 2016, the performance of many major asset classes reversed significantly, and the market showed typical characteristics of the "Trump transaction". As of December 31, 2016, the US Treasury yield rose rapidly by 59bp, and the US dollar index rose by 4.4%; in the equity market, the S&P 500 index and the Nasdaq rose by 4.6% and 3.7% respectively; in the commodity market, Brent crude oil rose by 23.4%, LME copper rose by 5.7%, and COMEX gold fell by 10.0%; in other assets, Bitcoin rose by 33.8%.

On the whole, the "Trump deal" has a high degree of certainty in the upward trend of US Treasury yields, the strengthening of the US dollar index, and the rise of Bitcoin. The deal is bullish on US stocks and copper prices, bearish on gold prices, and there is uncertainty about the impact on oil prices. In terms of the direction of the impact of Trump's transactions, the categories that are somewhat different from the perception based on the policy are mainly copper, gold and oil. Of course, commodity prices will also be disturbed by multiple other factors, but judging from the previous trading results, Trump's transactions may not be "bad for copper and oil, good for gold".

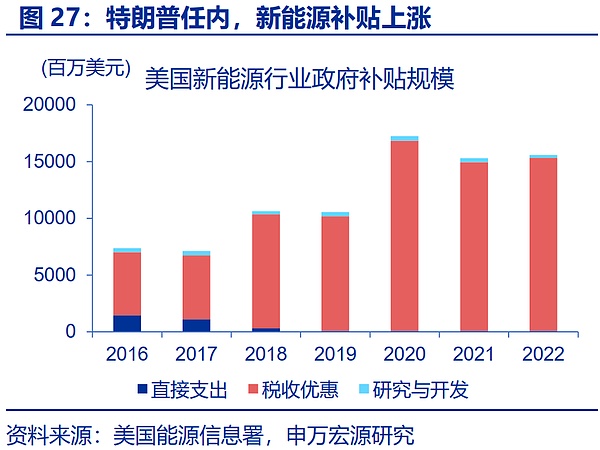

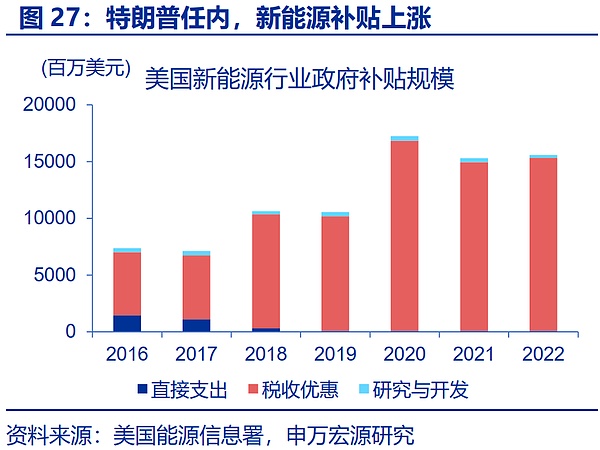

1) In terms of copper, Trump did not completely restrict the new energy industry. During his tenure, the production of natural gas and renewable energy in the United States hit a new high, and the subsidy amount for clean energy increased from US$7.1 billion in 2017 to US$17.3 billion in 2020. At the same time, tax cuts, re-industrialization and other economic stimulus will also boost demand for copper.

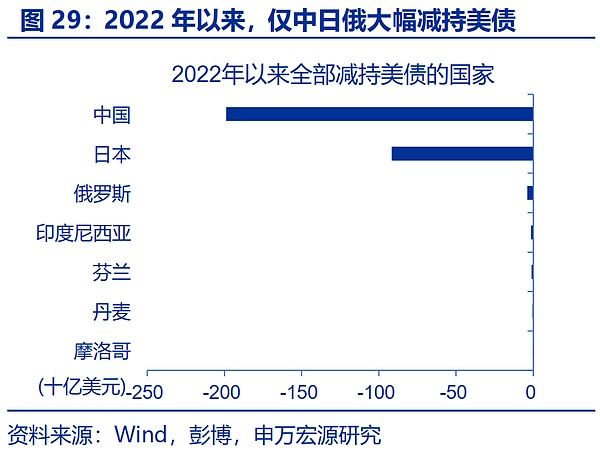

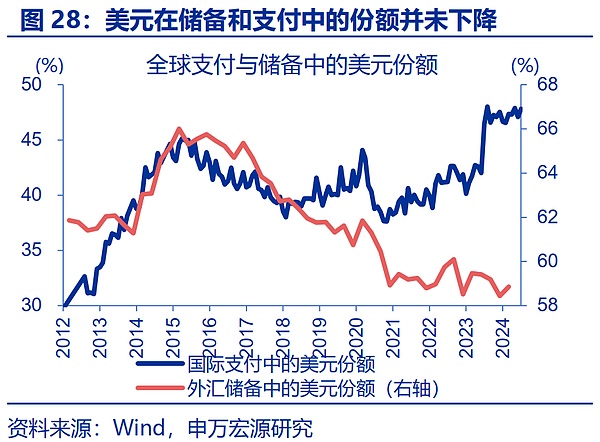

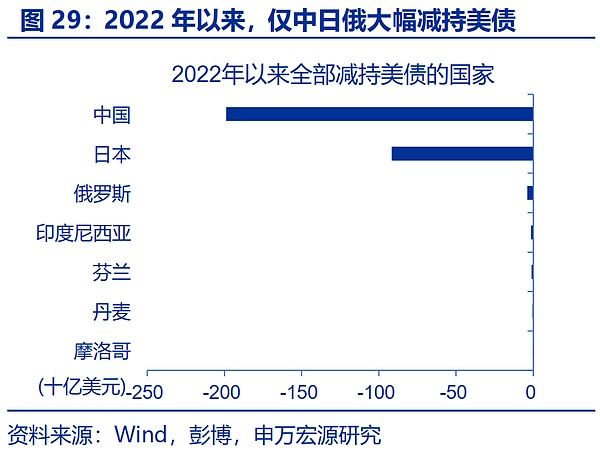

2) In terms of gold, Trump's victory will indeed interrupt policy continuity and amplify market uncertainty to a certain extent, but the high certainty of his policy on the rise of US Treasury yields is still bearish for gold. At the same time, Trump's attitude of shrinking the front on geopolitical issues is also conducive to reducing geopolitical risks. In addition, the expansion of the deficit ratio does not necessarily lead to a surge in the central bank's demand for gold purchases. The central bank's gold purchases may be dominated by some countries based on security considerations, and have little to do with the credit of US debt.

3) Oil, Trump holds an energy expansion policy, but on the one hand, the US shale oil production capacity is close to a high level, and there is still a long lag from the issuance of licenses to the increase in supply; on the other hand, the stimulation of demand by policies such as re-industrialization may weaken the negative impact of Trump's energy policy on oil prices to a certain extent.

III. "Trump Deal" in the Equity Market? The market is relatively positive for growth, with attention paid to finance, energy and manufacturing

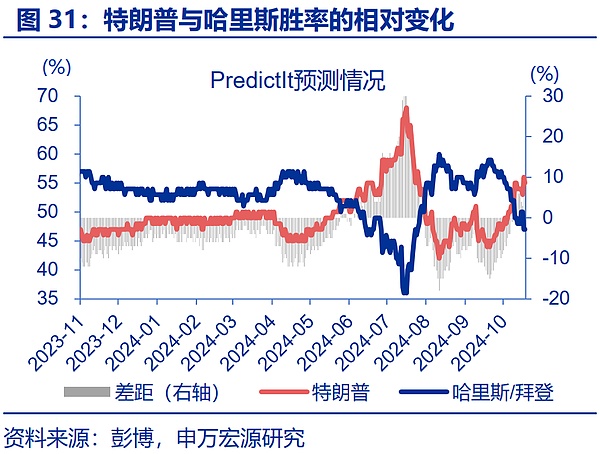

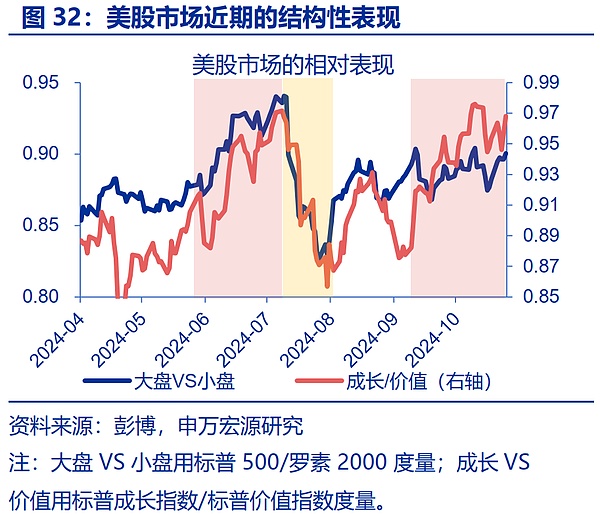

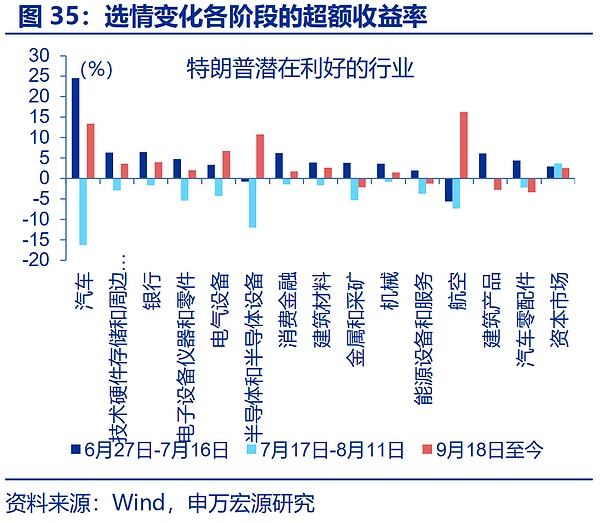

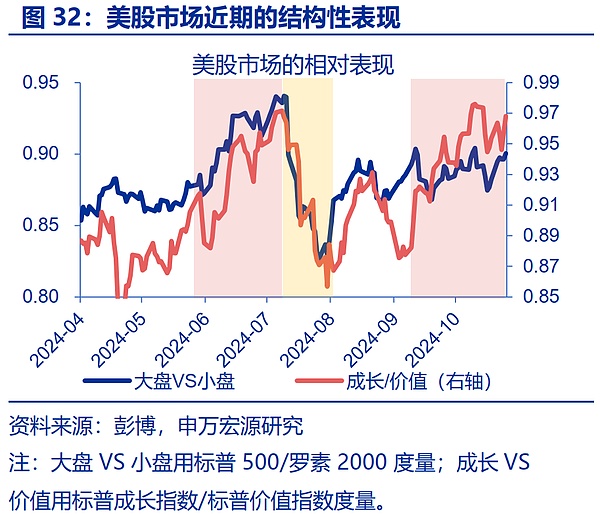

As far as U.S. stocks are concerned, structurally speaking, the "Trump Deal" may be relatively positive for market growth. According to the changes in PredictIt's odds, the "election trade" since June can be roughly divided into three stages: the first stage, from early June to mid-July, Trump's chances of winning the election increased significantly; the second stage, from mid-July to early August, Harris's sudden appearance brought a sharp decline in Trump's chances of winning; the third stage, since mid-September, Trump's trade has re-emerged due to Harris's poor performance in interviews and other reasons. From the perspective of relative market performance, in the first and third stages, the large-cap and growth sectors were clearly dominant; in the second stage, the large-cap and growth sectors weakened significantly. Logically, Trump's tax cuts, technology and other policies are all good for the growth sector, and the upward risks brought by his policies to US bond yields may put small-cap stocks under relative pressure.

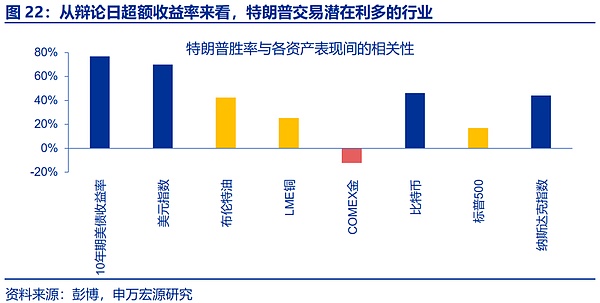

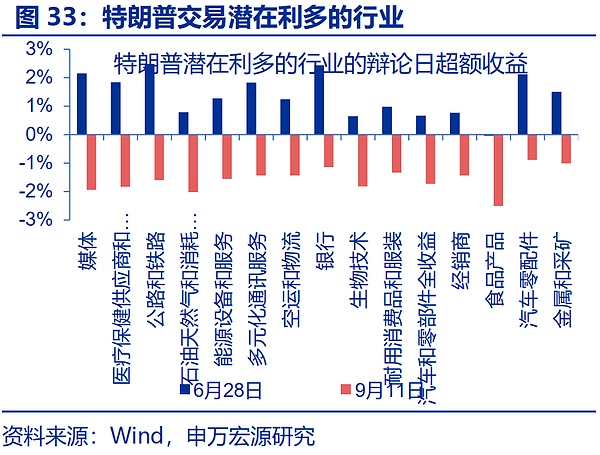

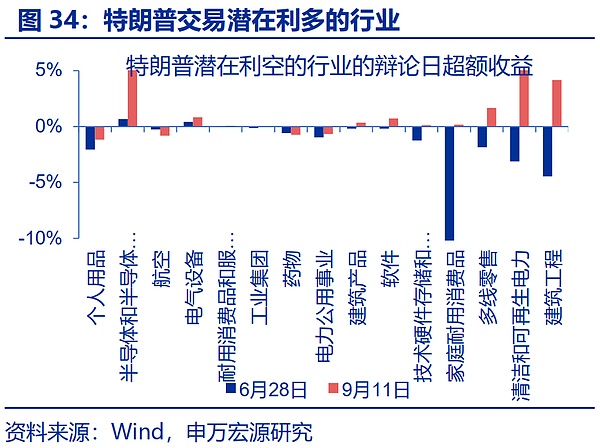

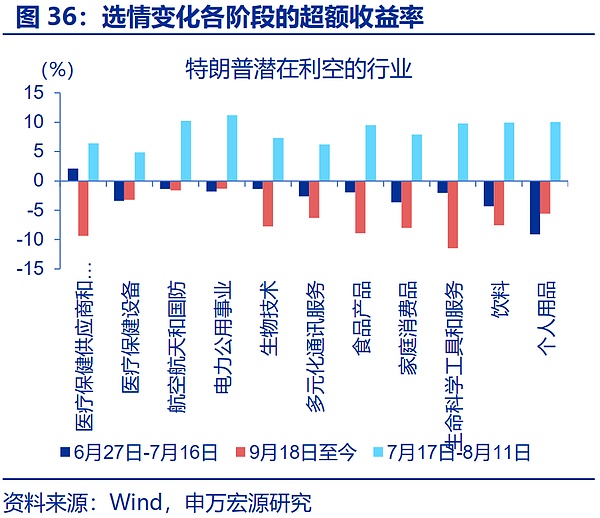

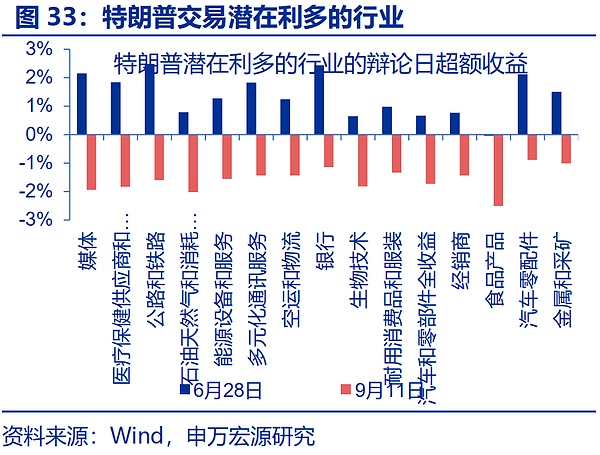

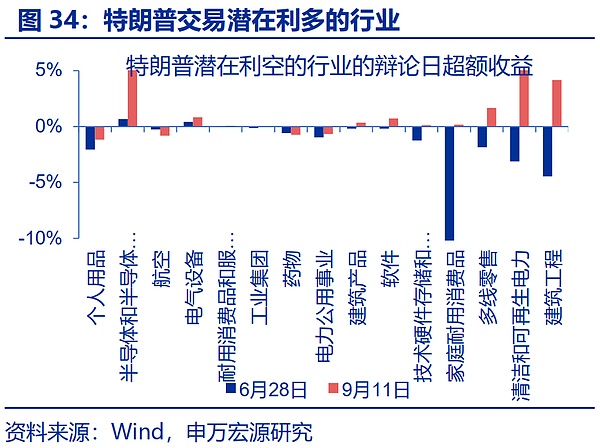

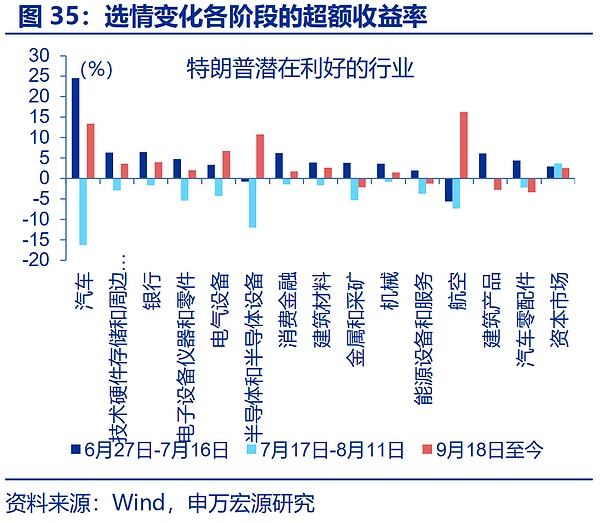

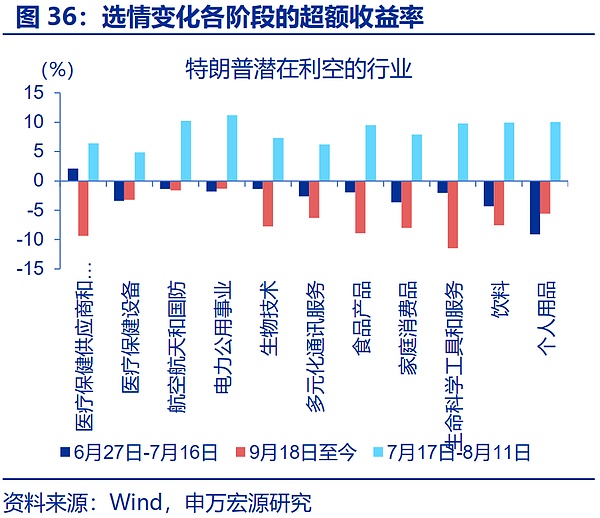

By industry, the potential bullish and bearish factors can also be evaluated from the excess returns during the "Trump Trade" period. 1) From the perspective of intraday returns on the debate day, after Trump dominated the debate on the evening of June 27, the industries that benefited from Trump's trade should have performed well the next day, while Trump performed poorly in the debate on the evening of September 10, and the industries that benefited from Trump's trade should have reversed the next day. 2) From the perspective of the various stages of Trump's election, June 27-July 16 and September 18 to date were both stages in which Trump's winning rate increased, which should benefit the "Trump Trade" targets; and from July 17 to August 11, when Harris' winning rate increased significantly, the weak industries may be more in line with the characteristics of the "Trump Trade".

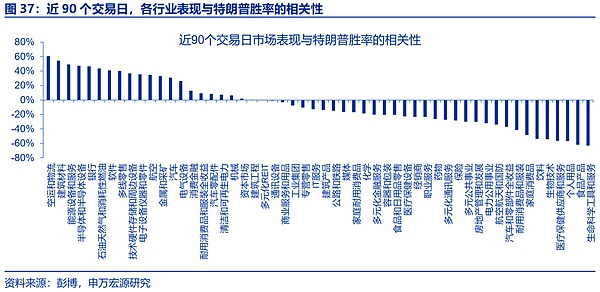

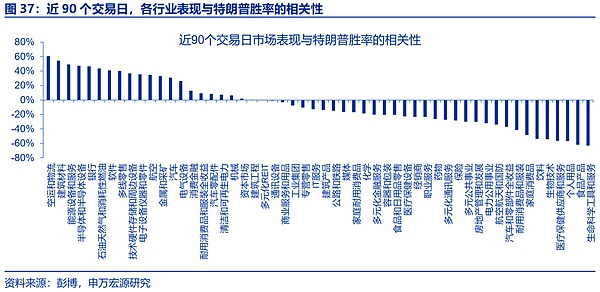

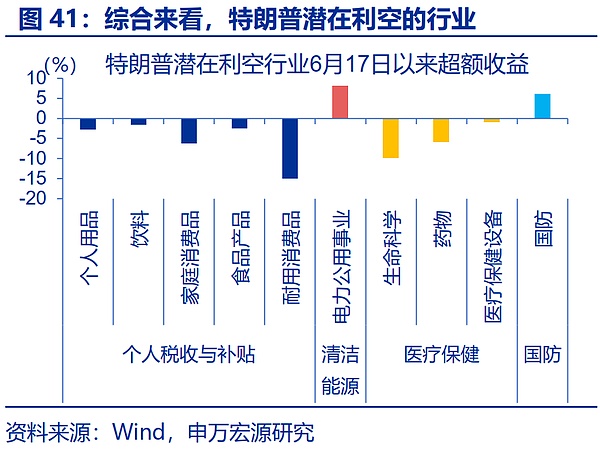

Furthermore, we can also examine the correlation between the market performance of various industry indexes and Trump’s winning rate. Since June 17, industries such as air transport and logistics, building materials, energy equipment and services, semiconductors, and banking have a high positive correlation with Trump's winning rate, which are 0.61, 0.55, 0.49, 0.47, and 0.47 respectively; industries such as life sciences, food, personal products, healthcare suppliers and services, and biotechnology have a high negative correlation with Trump's winning rate, which are -0.63, -0.62, -0.57, -0.56, and -0.54 respectively.

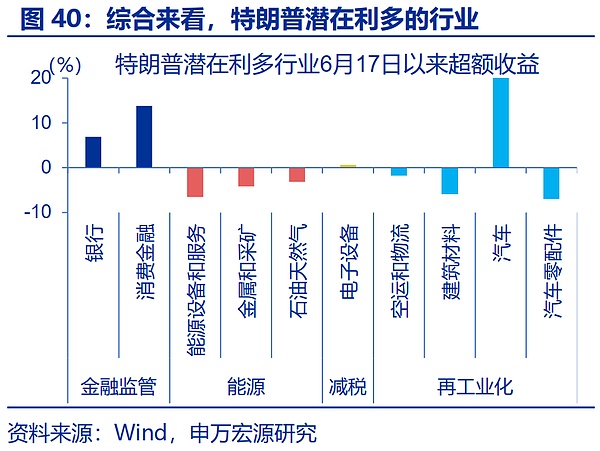

Taking into account the excess returns on the debate day, the excess returns at each stage of the election, and the correlation with Trump's winning rate in the past 90 trading days, the industries that are potentially beneficial to Trump can be roughly divided into four categories:1) Banks and consumer finance that benefit from financial regulatory relaxation; 2) Energy equipment and services, metals and mining, and oil and gas that benefit from supporting traditional energy development; 3) Electronic equipment that benefits from corporate tax cuts; 4) Air transport and logistics, building materials, automobiles, and auto parts, etc.

The potentially negative industries can also be divided into 4 categories:1) Consumer goods, such as personal products, beverages, household consumer goods, food, durable consumer goods, etc.; 2) Clean energy, such as electric utilities; 3) Healthcare, such as life sciences, drugs, and healthcare equipment; 4) Defense and military industries.

The market has a consensus that finance, traditional energy, tax cuts, etc. are positive, while clean energy and other negatives are negative. The following categories are more worthy of attention:

1) Air freight logistics, building materials, automobiles and other industries supported by Trump's re-industrialization policy logic.

2) Compared with Harris' tax cuts and subsidies for middle- and low-income groups, Trump's tax cuts benefit the rich more, and are negative for essential consumption, healthcare and other industries.

3) Trump's contractionary policy on geopolitics is negative for defense and military industries.

Fourth, the possible interpretation of "election trading"? In the short term, the unexpected results, in the medium term, the policy pulse, and in the long term, the fundamentals

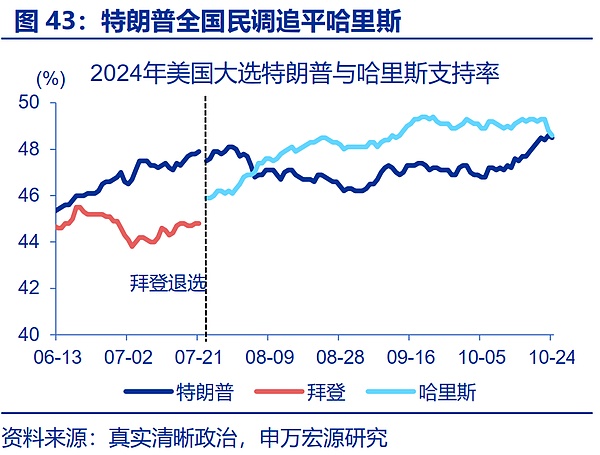

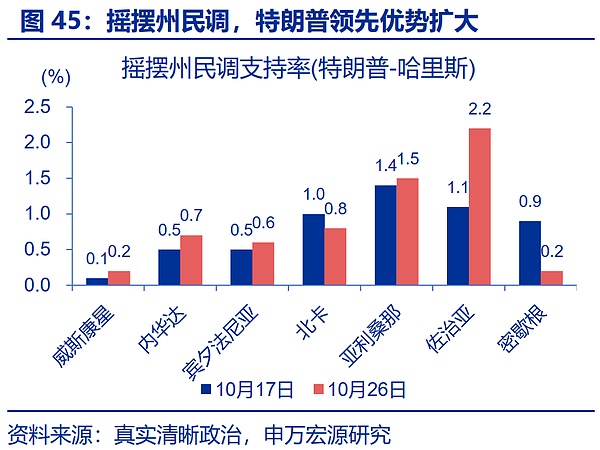

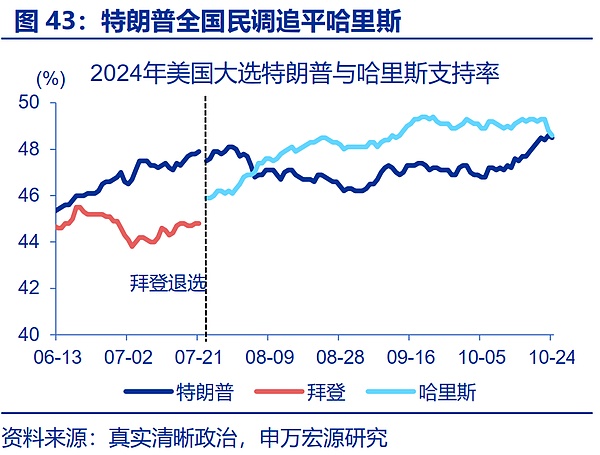

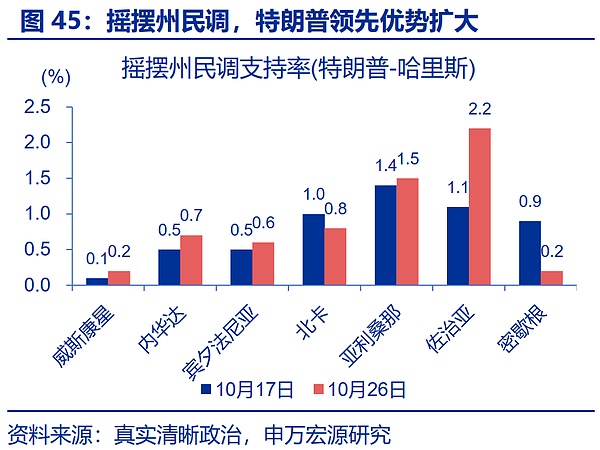

Recently, the probability of Trump's victory has increased significantly, and the market has once again priced in Trump's victory. As of October 24, the RCP aggregate poll showed that Trump's approval rating was 48.5% and Harris's was 48.6%; in September, Trump's polls were once 2 percentage points behind, and now he has caught up with Harris. Trump's approval rating is leading in all seven swing states; as of October 26, Trump's lead in Georgia, Arizona, Pennsylvania, Nevada, and Wisconsin has continued to expand compared to last week. From the perspective of the gambling market, Trump's chances of winning are as high as 61%. Since September 23, the Trump Organization has risen by as much as 268%, and Trump's trading has clearly been rekindled.

But the election is far from set in stone; in the short term, if Trump is elected, the continuity of previous transactions may be relatively limited, but if Harris wins, previous transactions may be reversed significantly. Looking back at history, the betting market's predictions of election results are not reliable. Five of the 22 elections since 1936 failed to make correct predictions; polls are also flawed. This year, the continuation of mail-in ballots, the migration of rural and urban populations after the epidemic, and the new biases in the polling model after the correction of Trump may all bring uncertainty to the results, but market transactions have clearly tilted towards Trump. This means that if Trump is successfully elected, the market trend may be similar to 2020 and 2012, with a slight continuation of previous transactions; but if Harris wins the election, the market may be similar to 2016, with a sharp reversal.

In the medium term, the focus of market interpretation is on the pace of election promotion and the possibility of implementation. 1) From the perspective of the pace of promotion, the US president can implement policy propositions through executive orders, legislation, etc.; the legislative process is slower to implement, while executive orders are easier to implement. With historical reference, in his first term, Trump quickly introduced policies in the fields of immigration, trade, and regulation through executive orders, but the implementation of tax policies was slow. 2) From the perspective of implementation, without the cooperation of Congress, Harris' tax policy and Trump's tax and energy policy may be hindered; at the same time, both sides have a poor record of fulfilling their campaign promises. During Trump's first term, the policy fulfillment rate was only 23%, but the fulfillment rate in the trade field was higher. Whether the policy propositions are smoothly promoted may directly affect the reversal or continuation of the third phase of the election deal.

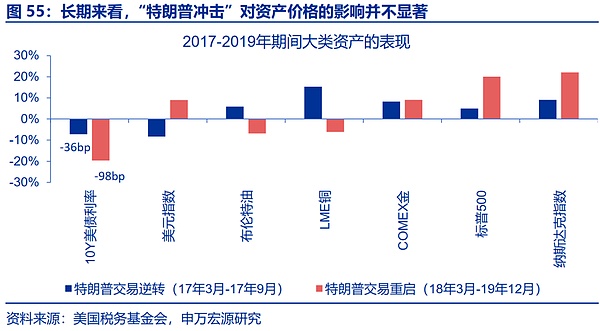

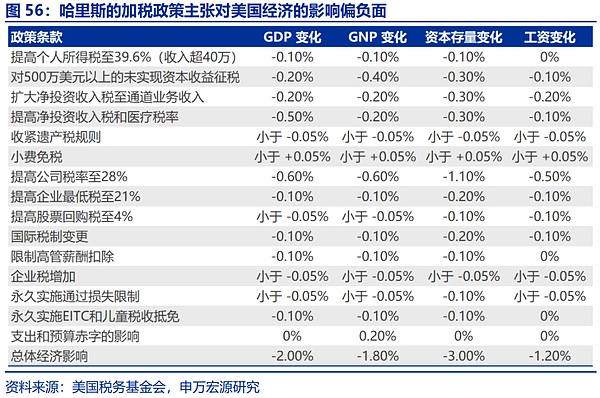

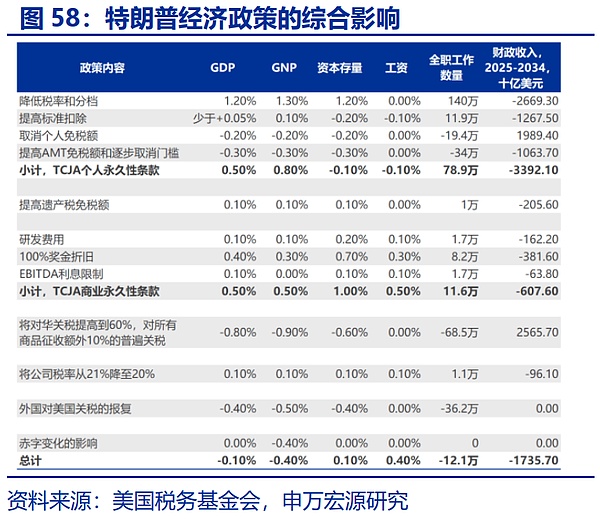

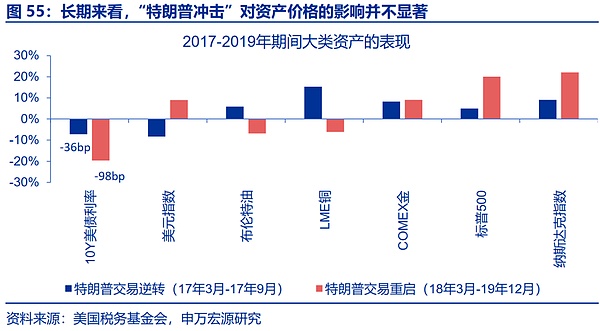

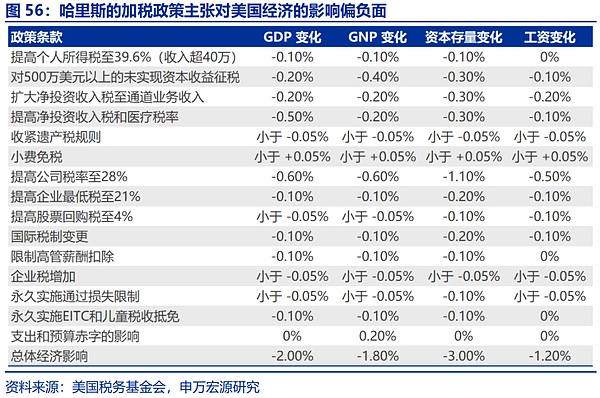

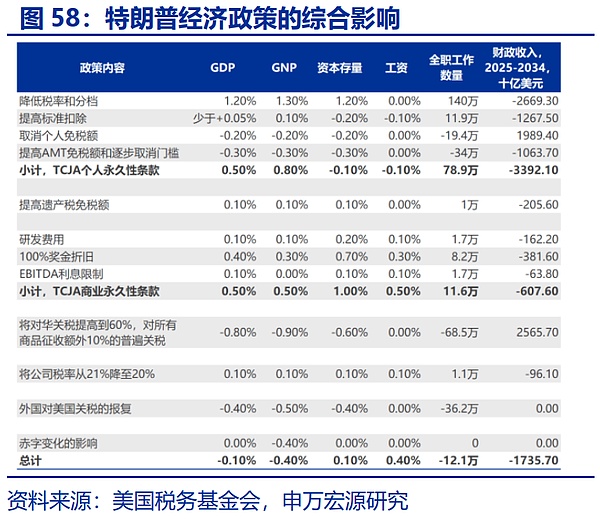

In the long run, the fundamentals themselves are still the more decisive factor in the pricing of most assets. The impact of the election on the market may be mainly realized through the impact on fundamentals. From the market trend during 2017-2019, during the period when the implementation of trade policies led to the restart of the "Trump deal", the US bond yields continued to fall, copper and oil fell in resonance, and gold prices rose sharply, which seemed to conflict with the proper meaning of the "Trump deal"; the reason behind this is that trade frictions and the downward economic cycle have led to a significant weakening of the US economy, which dominated the market during this period. Looking back, the "election deal" should still return to the fundamentals itself. At present, this year's election can be divided into four scenarios: a comprehensive victory of the Republican Party (probability: 49%), Trump + a divided Congress (probability: 14%), a comprehensive victory of the Democratic Party (probability: 12%), and Harris + a divided Congress (probability: 21%). According to the magnitude of the positive impact on the economy, they are ranked as follows: a comprehensive victory of the Democratic Party> a comprehensive victory of the Republican Party> Harris + a divided Congress> Trump + a divided Congress.

Risk Warning

1. Geopolitical conflict escalates. Russia-Ukraine conflict has not ended, and the Palestinian-Israeli conflict has revived. Geopolitical conflict may aggravate the volatility of crude oil prices and disrupt the global "de-inflation" process and "soft landing" expectations.

2. The US economic slowdown exceeded expectations. Since May, US economic data has fallen short of expectations, the labor market has slowed down, residents have faced increasing pressure to repay principal and interest, and the trend of slowing consumption continues.

3. The yen continues to appreciate beyond expectations. Against the backdrop of recession trades and the Fed's rate cuts, the yen has appreciated significantly. If the yen continues to appreciate significantly, it will hinder the recovery of Japan's domestic demand and the normalization process of the Bank of Japan.

Jasper

Jasper