Highlights

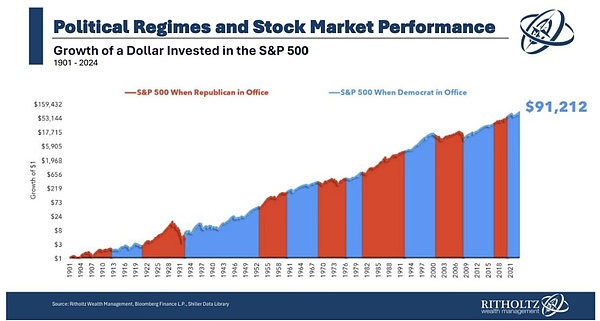

① The historical trend data of the S&P 500 index since 1901 shows that no matter which party is in power in the White House, the index will rise in the long run.

② The market generally believes that given Trump's current position, he supports policies such as cryptocurrency, traditional energy, infrastructure construction and tax cuts; if Harris comes to power, she will tend to favor welfare policies, health care, green energy, US export growth, housing support, etc.

③ The current US stock market is regaining the "Trump deal". Take Trump's social media company DJT as an example. The stock has doubled since October; Phunware has accumulated a total increase of more than 200% this month; in addition, cryptocurrency concept stocks publicly supported by Trump have rebounded collectively, and Bitcoin has risen by more than 10% from its low point in the month.

With the Federal Reserve previously announcing its first rate cut since 2020, the market is turning its attention to the next major event - the US election on November 5.

The following figure is a chart of the S&P 500 index since 1901. Red represents the period when the Republican Party was in power in the United States, and blue represents the period when the Democratic Party was in power. Historical data shows that no matter which party is in power in the White House, the index will rise in the long run.

However, due to the different policy tendencies held by candidates from different parties, the emergence of the new president will have an important impact on different sectors of the US stock market.

Recent polls show that Harris and Trump are evenly matched in the presidential election. Harris leads by 4 percentage points in the ABC/Ipsos poll, while Trump has a slight advantage in other polls. This shows that Harris's support has declined since the last New York Times poll in early October.

This is also the origin of Goldman Sachs, JPMorgan Chase, and Deutsche Bank speaking out collectively in recent weeks, and Wall Street's full bet on the "Trump deal". JPMorgan Chase reported on the 17th that hedge fund flows showed a strong preference for Republican themes, while renewable energy, an obvious representative of the Democratic Party's victory, was sold off heavily in the previous weeks.

The current market generally believes that given Trump's current position, he supports policies such as cryptocurrencies, traditional energy, infrastructure construction and tax cuts; if Harris comes to power, she will tend to favor welfare policies, health care, green energy, US export growth, housing support, etc.

RockFlow has sorted out the different positions of the two and their impact on related sectors in detail, and listed related concept companies and targets to help everyone discover more investment opportunities from this important event.

1. Trump deal

Recently, as Harris' lead in the polls over Trump narrowed, the latest odds in the gambling market also showed that Trump has surpassed Harris. The market is regaining the "Trump deal".

Take Trump's social media company DJT as an example. The stock has doubled since October. Phunware has risen by more than 200% this month. In addition, cryptocurrency concept stocks publicly supported by Trump have rebounded collectively, and Bitcoin has risen by more than 10% from its low point this month.

The Trump stock list previously launched by the RockFlow investment research team includes important targets related to the "Trump transaction", including DJT, a media platform founded by Trump, PHUN, which developed campaign application software for the Trump team in the 2020 presidential election, RUM, a video platform where Trump supporters gather, and related military stocks Lockheed Martin and Raytheon Technologies (expected to benefit from increased military spending after Trump takes office), CAT (expected to benefit from Trump's desired tax cuts and infrastructure policies), Tesla (Musk is his loyal supporter), etc.

In addition, given Trump's political stance and policy inclinations, more pharmaceutical stocks (such as Eli Lilly) and bank stocks (such as Goldman Sachs and JPMorgan Chase) are expected to benefit from his re-election.

Specifically, investors can focus on the following four sections:

1) Trump supports cryptocurrency, so it may be good for MSTR, COIN, MARA

Trump attended the Bitcoin 2024 conference and expressed his views on cryptocurrency. He declared that if he enters the White House again, he will strive to make the United States the world's "cryptocurrency center" and "Bitcoin power". He promised that under his governance, Bitcoin mining and popularization will be promoted to ensure the United States' leading position in the global encryption industry. Trump also announced that the federal government will retain all the Bitcoins it holds, about 210,000, accounting for 1% of the total Bitcoin, making the United States the first country in the world to include Bitcoin in its national strategic reserves, giving Bitcoin a strategic value similar to gold.

2) Trump supports traditional energy, so it may be good for BKR, XOM, CVX

This year, the Republican Party announced a new version of its policy platform: in terms of energy policy, its position has changed from "supporting the development of all tradable energy without subsidies" to "comprehensively increasing energy production, simplifying the approval process, removing improper restrictions on the oil, gas and coal markets, and achieving US energy self-sufficiency; opposing green policies and abolishing electric vehicle subsidies". The Republican Party led by Trump has higher requirements for energy independence, and its support for traditional energy and suppression of new energy are more obvious.

3) Trump supports the relaxation of financial regulation, which may be good for JPM, GS, BAC

Trump's regulatory attitude towards financial institutions, especially banks, is inclined to relax restrictions and reduce requirements for indicators such as capital and capital adequacy ratio. He believes that relaxing financial regulation can release the capital stock in the banking system, thereby promoting banks to increase loan issuance. In addition, the tax reform policy proposed by Trump will also help improve the profitability of financial companies.

4) Trump plans to strengthen infrastructure construction, which may benefit CAT

The infrastructure construction plan advocated by the Trump administration is also the focus of market attention. The goal of the plan is to comprehensively upgrade and transform the infrastructure of the United States through large-scale public and private investment. His advocacy of increased investment in the infrastructure sector is expected to benefit industries closely related to infrastructure construction, including companies in the fields of transportation, construction, communications and material supply.

2.Harris Deal

In contrast to Trump, Kamala Harris emphasizes inclusive economic growth, sustainability and addressing the problem of inequality. If Harris takes office, investors need to focus on the following beneficiary sectors:

1) Harris advocates promoting the growth of US exports, which may benefit WMT and AMZN

Harris's stance on tariffs is more moderate and friendly than Trump's. She believes that Trump's tariff policy will lead to increased consumer spending on gasoline and daily groceries, which will put pressure on the economic conditions of middle-class families. She advocates promoting the growth of US exports. This attitude may have a positive impact on global trade, especially for large US multinational companies with extensive operations and overseas income in the global market.

2) Harris calls for more housing support, which may benefit SWK

According to previous reports, Harris called for the construction of 3 million new homes in the next four years to cope with the high housing prices caused by insufficient supply, and planned to cancel the tax benefits for Wall Street financial institutions to buy houses in response to the rapid rise in housing prices. On the demand side, Harris plans to provide first-time homebuyers with higher down payment assistance and tax credits to stimulate the market. These measures have a positive impact on residential construction suppliers.

3) Harris supports clean energy, which may be good for FSLR, ENPH, CSIQ

With Harris' support, the Biden administration successfully signed the landmark Inflation Reduction Act. In addition, she proposed to inject $20 billion into the EPA's Greenhouse Gas Reduction Fund to promote the growth of clean energy. She emphasized strict supervision of oil companies and other polluting companies, and has filed lawsuits against several fossil fuel companies, including a lawsuit against a pipeline company over oil spills, and investigated ExxonMobil's possible misleading of the public on climate change. Harris may be more positive than Biden in promoting clean energy.

4) Harris supports the legalization of marijuana, which may be good for TLRY and CGC

The Democratic Party is working to legalize marijuana at the federal level, and Harris is also supportive of this. In the previous vice presidential debate, she said that the Biden-Harris administration promised to "legalize marijuana and clear the criminal records of those convicted of marijuana-related crimes." Harris has also been outspoken in criticizing the existing marijuana restriction policies as "unreasonable" and called on the US Drug Enforcement Administration (DEA) to reclassify marijuana. Therefore, if Harris wins the election, the marijuana industry may become one of the main beneficiaries.

3. Conclusion

The RockFlow investment research team believes that the upcoming US presidential election will bring new investment opportunities to the US stock market. If you are optimistic about Trump's election, you can pay attention to opportunities in industries such as cryptocurrency, traditional energy, and infrastructure construction; if you think Harris will win the election, you can invest in companies related to healthcare, green energy, and housing support.

The targets involved in the "Trump deal" and the "Harris deal" will continue to cause heated discussions in the next two weeks. Only by deeply understanding the impact of the two candidates' policy strategies and different preferences can investors effectively avoid investment risks and seize market opportunities.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Xu Lin

Xu Lin Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph