Author: Socra

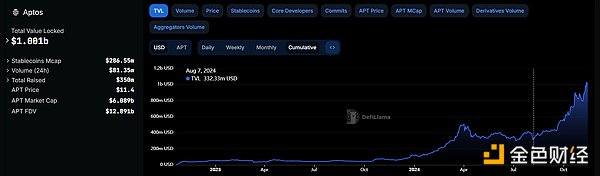

Recently, there have been several major news about Aptos, such as TVL exceeding 1 billion US dollars, BlackRock launching BUIDL fund on its chain, Bitwise will launch the world's first Aptos Staking ETP, etc. In particular, the MOVE public chain Sui has set new historical highs, which has made many investors turn their attention to Aptos.

The current crypto market has rebounded significantly, but the Aptos project token APT has performed generally. However, given the current attention of Aptos and its long-term ecological construction, it is still worth paying attention to the early popular projects on its chain.

The Quietly Growing Aptos

Aptos is a blockchain that adopts the Proof of Stake (PoS) mechanism and mainly uses the "Move" type of new smart contract programming language. The language is a Rust-based programming language developed by Diem blockchain engineers under Meta, formerly Facebook. The chain has a theoretical transaction throughput of more than 150,000 transactions per second through parallel execution.

In March 2022, Aptos raised $200 million in a seed round led by venture capital firm a16z. In July of that year, the company raised another $150 million in a Series A round led by Sam Bankman-Fried's FTX Ventures and Jump Crypto. Two months later, Binance Labs made another strategic investment in Aptos for an undisclosed amount, bringing its valuation to $4 billion in September.

On October 18, 2022, Aptos announced the launch of its mainnet.

Currently, the Aptos project token APT is $12.05, with a market value of approximately $6.41 billion. Judging from its price trend chart, the highest point of APT is only around $20, and it has hardly led the rise of other public chains.

However, its TVL has grown rapidly this year, with a year-to-date increase of about 1000%. When DeFiLlama data showed that the former Aptos TVL exceeded US$1 billion, setting a record high.

In addition, there have been a lot of big news about Aptos recently, and its project team is also actively building an ecosystem.

In November, BlackRock, the world's largest asset management company, launched its BUIDL fund on the Aptos blockchain, and Aptos will be the first non-EVM chain for BlackRock to launch the fund. Meanwhile, Bitwise Aptos Staking ETP is also scheduled to be listed on the Swiss Stock Exchange on November 19, and the product will become the world's first Aptos Staking ETP.

In October, Aptos became the network where investors can trade shares of Franklin Templeton OnChain U.S. Government Money Market Fund (FOBXX), which is currently the second largest tokenized fund on the market.

In the same month, the Aptos Foundation worked with AI companies to build Move programming language tools, which will make it easier to build ecological projects. USDT also went online on the Aptos mainnet.

Earlier, Aptos launched the Movementum Accelerator, and OKX Ventures, the investment arm of OKX, also launched a $10 million fund with the Aptos Foundation to support the development of the Aptos ecosystem and the adoption of Web3.

In addition, the Aptos Foundation has also cooperated with Alibaba Cloud and launched Alcove, Asia's first co-branded Move developer community.

Popular Ecosystem Projects

With the explosion of the MOVE public chain Sui, many community members have also begun to turn their attention to early projects on Aptos and MEME coins.

DeFi:

Amnis Finance

Liquidity Staking Protocol on Aptos. As a fundamental component of the Aptos ecosystem, Amnis Finance introduces a secure, user-friendly and innovative liquidity staking protocol that enables users to easily maximize the returns of their APT tokens while releasing their liquidity.

The current TVL of Amnis Finance is US$309 million.

Aries Markets

Aries Markets is a decentralized margin trading protocol on Aptos that allows users to borrow, lend, exchange and trade margin at lightning speed through an on-chain order book.

The current TVL is $282 million.

Thala

(THL)

Thala is a decentralized financial protocol powered by the Move language that supports seamless borrowing of decentralized, overcollateralized stablecoins in the Move Dollar and provides capital-efficient liquidity provision through a rebalancing AMM on the Aptos blockchain.

The current TVL is $250 million.

Merkle Trade

Merkle Trade is the first gamified perpetual trading decentralized exchange built on Aptos. The platform is committed to becoming the largest decentralized leverage trading center, emphasizing user-friendliness and accessibility.

Chain Games:

Aptos Arena

A shooting chain game on Aptos.

Formula Speed Thrills

An F1 Formula racing game launched by Kult Games studio.

Quest 4 Fuel

Quest 4 Fuel is a 2020 IDLE RPG game with semi-automatic 5v5 hero combat, AFK rewards, and PvP arenas set in a dark post-apocalyptic war world.

Stan

STAN is a community of esports fans that allows them to interact, play, and grow with their idols through a unique experience using digital collectibles/mutable NFTs.

Meme:

GUI

Gui Inu is the #1 community token on Aptos, built by the community. The current market cap is around $22.8 million.

doodoo

Similar to SHIBA, the current market cap is around $13.9 million.

CHEWY

Chewy Token is an Aptos-based memecoin with a green bear image, designed to celebrate the resilience of the crypto community and reward those who persevere in difficult times. The current market value is about $2.6 million.

DONK

Donk is a zebra-image memecoin on Aptos. Donk Studios is also building Donk AI, comics, NFTs, games, and DonkFi.

Summary

Before Sui fully broke out, few investors could judge that it could set new highs in a short period of time and drive on-chain projects to accelerate listing on exchanges. Similarly, although Aptos has not yet fully broken out, its TVL has increased nearly tenfold in the past year, and its tokens have been included in the list of investment products by many well-known institutions, which shows that it still has investment potential and value. Therefore, at this stage, it is worth paying attention to the earlier ecological projects on Aptos.

Aaron

Aaron

Aaron

Aaron Others

Others Coinlive

Coinlive  Coinlive

Coinlive  Others

Others Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph