Author: Climber, Golden Finance

On July 4, the total locked value (TVL) of the re-staking project Symbiotic officially exceeded $1 billion, and the project has been online for less than a month. Previously, Symbiotic's TVL reached $200 million in just two days after its launch, and has been rising since then, and its staking pool has reached the upper limit many times. When it announced the increase of multiple re-staking pool upper limits, the project's TVL soared 3 times that day.

Symbiotic is also a project favored by Paradigm and Lido, and raised $5.8 million in the seed round. As a new force in the re-staking track, many industry insiders regard it as a competitor of EigenLayer.

SymbioticIntroduction

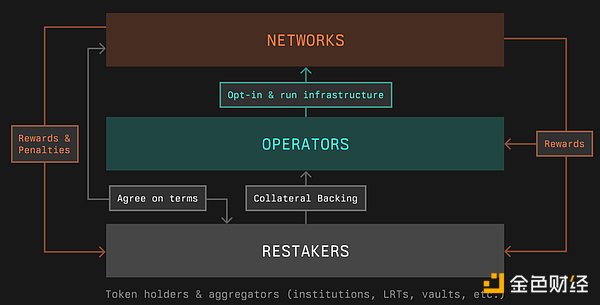

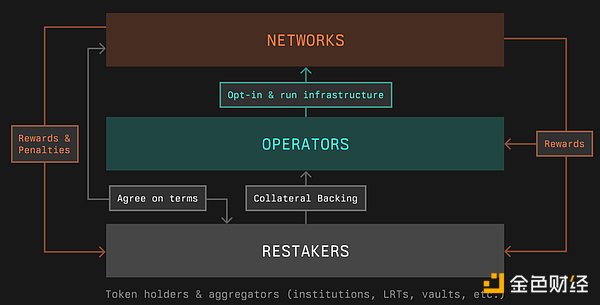

Symbiotic is a shared security system. It is designed to be an extremely flexible, permissionless and reliable lightweight coordination layer. It allows network developers to adjust and control their own (re)staking methods. Shared security refers to the fact that multiple networks can share the services and security guarantees of the same set of node operators, thereby improving capital efficiency and security.

Similar to EigenLayer, Symbiotic will provide decentralized applications with a scheme called Active Verification Service (AVS) to jointly ensure security. Users will be able to re-stake assets they have stored in other crypto protocols to help protect these AVSs in exchange for rewards.

But compared to EiegnLayer, Symbiotic allows users to "re-stake" using Lido's stETH and other popular assets that are not natively compatible with EigenLayer. It can be said that the range of tokens that users can stake is wider, including ERC20 tokens, Ethereum validator withdrawal vouchers, and liquidity provision proofs.

In addition, Symbiotic provides more flexible component customization options. While the core protocol is partially defined by an immutable core contract, other components, such as staked assets, reward mechanisms, and penalty criteria, can be configured by the network or other agents as needed.

Symbiotic was developed by the team that previously created the Stakemind staking service and aims to be "a permissionless re-staking protocol that provides a flexible mechanism for decentralized networks to coordinate node operators and economic security providers."

Symbiotic Protocol Features:

Multi-asset support: Symbiotic allows direct deposits of any ERC-20 token, including Lido's stETH, cbETH, etc. This makes Symbiotic more diversified and efficient than Eigenlayer, which mainly focuses on ETH and its derivatives.

Modular design, customizable parameters: Networks using Symbiotic can choose their collateral assets, node operators, reward and penalty mechanisms, and all participants can flexibly choose to join or exit the shared security arrangements coordinated by Symbiotic.

Immutable core contracts: Symbiotic's core contracts are non-upgradeable (similar to Uniswap), which reduces governance risks and potential failure points, reducing execution layer risks.

Permissionless design: By allowing any decentralized application to integrate without approval, Symbiotic provides a more open and decentralized ecosystem.

Core modules

The Symbiotic protocol consists of 5 interrelated components:

1. Collateral

Symbiotic's security layer. Collateral is an abstract concept used to represent underlying on-chain assets that are chain- and asset-agnostic. Collateral in Symbiotic can include ERC20 tokens, withdrawal vouchers from Ethereum validators, or other on-chain assets (such as LP positions), regardless of which blockchain the positions are held on.

2. Vaults (Vaults, also known as Operator Staking Pools)

Symbiotic's (re)staking layer. Delegating collateral to operators across networks is handled by vaults that can be managed in a custom way (e.g. by liquidity (re)staking providers like Lido or institutional holders) or by delegation to operator-specific vaults.

3. Operators (aka Validators, Sorters, Guardians, Caretakers…)

Operators in Symbiotic are defined as entities that run the infrastructure of a network. In Proof of Stake, successful staking providers have established a brand presence and operate across networks. The Symbiotic protocol creates a registry of operators and enables them to opt-in to the network and receive economic support from re-stakers through vaults.

4. Resolvers (aka Slashing Committees, Proofs, Dispute Resolution Frameworks…)

Resolvers are entities or contracts responsible for passing or vetoing penalties incurred by operators on the networks they provide services on. They are agreed upon by vaults representing economic security providers and the networks they provide security for.

Resolvers can be fully automated (in the case of objectively provable slashing violations) or can take the form of entities such as slashing committees and external dispute resolution frameworks. Resolvers enable networks and re-collateralizers to share collateral with each other by providing an (ideally neutral) third party to arbitrate penalties.

5. Networks (aka Appchains, Rollups, AVS, etc.)

A network in Symbiotic is defined as a protocol that requires a set of distributed node operators to provide trust-minimized services, such as decentralized ordering of transactions, reaching consensus on off-chain data and bringing it on-chain (oracles), automating specific protocol functions (guardians), etc.

Decentralized infrastructure networks can leverage Symbiotic to flexibly acquire security in the form of operators and economic support. In some cases, a protocol may consist of multiple sub-networks with different infrastructure roles. The modular design of the Symbiotic protocol allows developers of such protocols to define the rules of participation that participants need to opt-in to these sub-networks.

Symbiotic enables network builders to define, control, and adjust their methods for onboarding, incentivizing, and punishing operators and their principals (economic collateral providers).

Project Dynamics

Symbiotic launched on June 11, and the deposit pool for stETH reached its cap that day. Since then, Symbiotic has announced several times that the protocol's staking pool has reached its cap.

On June 12, Symbiotic tweeted that the protocol reached its staking cap of 41,290 wstETH in 5 hours. Despite this, users can still stake other assets, and as the protocol initially expands, the staking cap will gradually increase and more asset options will be added. Just one day later, Symbiotic stated here that all available re-staking assets for the project have reached their staking cap.

On June 27, Symbiotics announced that USDe reached the pledge limit and added USDe and ENA as new re-pledge assets. However, the USDe pool hit the hard cap of $50 million 15 minutes after opening.

On July 3, Symbiotic, a re-pledge agreement invested by Paradigm and Lido, has raised the deposit limit of multiple re-pledge pools. This also made its TVL take off directly, breaking through the $1 billion mark.

Currently, the Symbiotic ecosystem has nearly 20 partners, and the well-known projects are as follows:

On the day Symbiotic went online, Lido DAO announced a partnership with the re-staking yield platform Mellow Finance and the re-staking agreement Symbiotic to launch "Restaking Vaults".

Later, LayerZero Labs announced that Symbiotic would be launched on LayerZero. Through Ethena Labs, Symbiotic would be integrated into the LayerZero DVN framework, enabling users to stake ENA to ensure cross-chain transfers of Ethena assets. Another staking giant, ether.fi, also announced the launch of weETHs, a liquid re-staking token (LRT) based on Symbiotic.

In addition, Ethena Labs also announced that it would work with Symbiotic and LayerZero to pilot a universal re-staking module.

Summary

It was previously rumored that Symbiotic rose to prominence because Paradigm's investment in EigenLayer was rejected and it turned to its competitor in anger. At the same time, the market speculated that the staking leader Lido was cultivating new forces to deal with the dangers of EigenLayer. But in any case, a track with competition and mutual involution can produce more quality project teams.

JinseFinance

JinseFinance