Author: joshuabaker.eth Source: mirror Translation: Shan Ouba, Golden Finance

Recently, Arbitrum’s DAO passed a vote to decide on a new sequence replacement feature, named: Timeboost™️. At the end of this article, I am tasked with imploring the Arbitrum DAO and team to reconsider their implementation of Timeboost™️, but I know it may be futile. I see some major problems, not only in the greedy and short-sighted reasons they have shown in pushing this feature, but also in the disastrous impact it may have on users in the Arbitrum ecosystem.

When talking to people in the CeFi (centralized finance) space, I often cite Arbitrum as the only beacon of hope in an increasingly deteriorating MEV (maximum extractable value) environment. Sadly, this is no longer possible. First come first served was a very special ordering structure that made Arbitrum a safe haven for users who didn’t want their transactions to be exploited in various ways, but this “upgrade” (if you can call it that) fundamentally undermines that.

Why did they build this monstrosity?

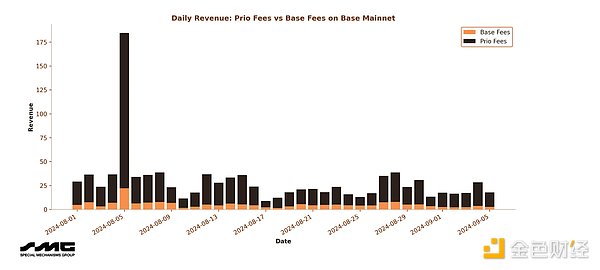

First, let’s look at some data on other L2 profit sources:

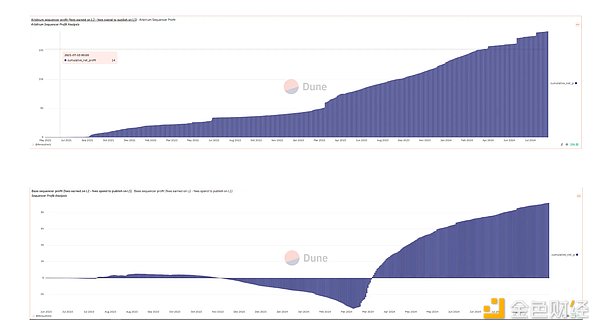

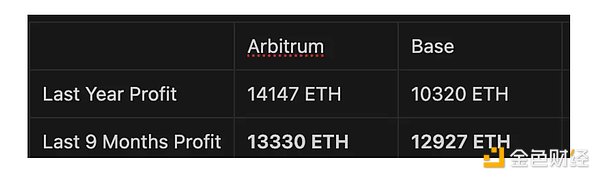

Also take a look at Arbitrum and Base’s revenue and profit data over the past year:

Let’s focus on two data points in particular, because this is a very interesting set of charts presented by our lovely friend 0xRenaud on his Dune dashboard.

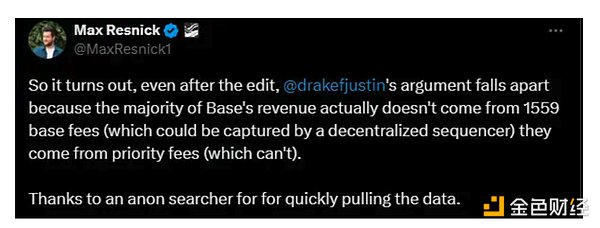

Look at this comeback! In my opinion, this is the most frightening data point for Arbitrum as a top player, because Base has surpassed them on the profit benchmarks for the past 9 months and 6 months. As you can clearly see in the SMG data posted above, most of Base's profits come from priority fees, which are the fees that searchers and market makers (MM) pay to get their arbitrage and MEV priority. To date, Arbitrum has no priority gas fee mechanism and still made a lot of money.

This is why the Foundation and DAO want to build a preferred gas fee mechanism, but I want to be clear: I have no problem with this! What I hate is this over-engineered mechanism that could overwhelm Arbitrum’s retail users and result in more MEV being extracted per dollar of transaction volume than any other chain in the Ethereum ecosystem. At the end of the post I’ll detail some alternatives that I recommend the Foundation and DAO explore, but first, let’s take a closer look at the design of this “mechanism”.

The mechanism itself

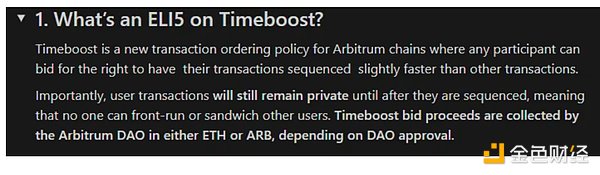

Here is a snippet from the FAQ in the official Arbitrum documentation:

These two data points caught my attention:

Timeboost™️ sells the right to put a transaction at the beginning of a block for a full minute. Given that this will increase Arbitrum block times by 200ms to 450ms (also mentioned in the documentation), this means that the auction winner will gain exclusive first-transaction control for about 133 blocks at a time on average. I brought this up on Twitter a few days ago, and now I want to dive into a few ways some serious seekers could completely blow up the system:

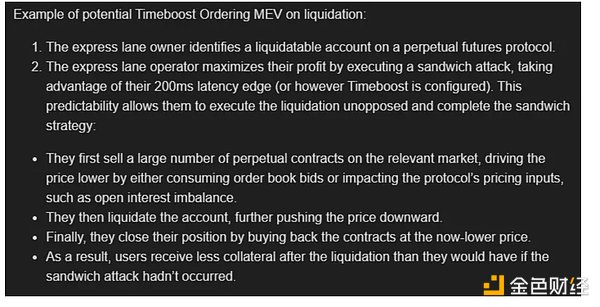

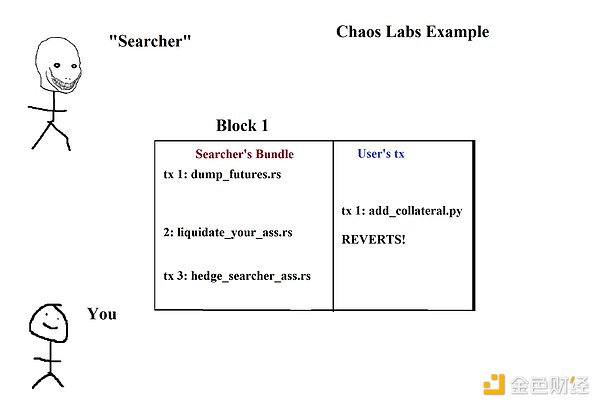

First, let’s look at an example that the Chaos Labs team detailed in their Timeboost™️ risk assessment, but I think they severely underestimate the following risk:

If you read the Arbitrum docs/FAQ about Timeboost™️, they actually advocate for this mechanism. They think that simple pre- and post-transaction operations within each block are a good thing, because in theory the auction will capture a large portion of the MEV (Maximum Extractable Value). But this is only true if the auction is only for one block. The current auction is actually for 133 blocks. This means that they are essentially selling the right to "pinch" for 132 consecutive blocks (the first block does not count because it is free). This fact will lead to massive multi-block MEV, possibly reaching an order of magnitude never seen before. I would also like to point out another potential vicious game theory scenario that I expect to happen at least once.

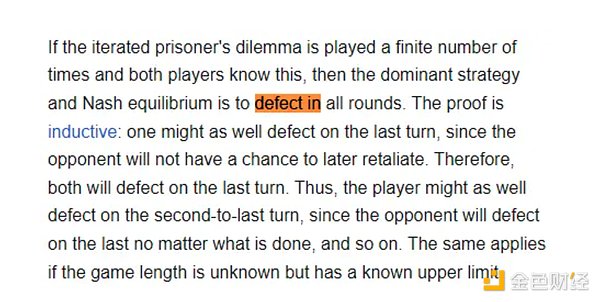

Here is a quote from Wikipedia on the Prisoner's Dilemma. Very basic stuff. In any infinite game, cooperation is the optimal strategy! But in any finite game, the endgame is that you screw your opponent. This is how events like Celsius or FTX happen, but it also explains why platforms like eBay have very low fraud rates. What does this mean for Arbitrum’s Timeboost™️ mechanism? Quite simply, if I am an anonymous auction bidder with the ability to generate 2^256 different public keys to bid on, then I can do whatever I want because I am not playing an infinite game, but an infinite number of finite games. In my mind, one potential attack vector is price manipulation similar to the Chaos Labs example, but across multiple blocks.

Assume that this searcher is savvy enough to have a model that can predict the price change of a token on a centralized exchange (CEX) with more than 50% probability based on market liquidity. In practice, this is the job of a market maker, collecting data, making predictions based on this data, and adjusting spreads and orders accordingly. Let’s assume that the Chaos Labs team is correct, and because of Timeboost, no one will try to do CEX-DEX (decentralized exchange) arbitrage during the 200ms delayed transaction period of each block:

If you’ve heard of the prisoner’s dilemma, you’ll know that the solution is always to be the last person to drop the soap… wait, that’s not right. Wait a minute…

It is also important to note that shorter block times reduce the MEV extractable by on-chain “LVR” (Lag Price Arbitrage) (backed by the paper):

In this case, the searcher knows exactly that all order flow in a block is from retail or low-sophisticated users. Therefore, they can effectively treat the entire 1-minute period as one giant block that runs for a full minute. That is, instead of performing arbitrage operations on every block, they can strategically postpone arbitrage operations, let prices fluctuate, and then perform large-scale arbitrage after T+n blocks. This scenario is impossible to model without Timeboost™️ running in real time, but beware that there may be seekers paying attention to this. This could become a form of value extraction that may only be tested sporadically on some blocks initially, and then gradually put into large-scale production. We may well see some kind of arms race between seekers who succeed in the bid and those who don't.

For example, the winning seeker "A" chooses not to arbitrage block n-2 in their first minute, and instead merges blocks n-2 and n-1 into one block, operating through the method I just described. They then put the post-transaction into the last block, thereby treating the first two blocks as a larger, more profitable block.

Suppose seeker "B" notices this. They realize that they can include a transaction during the delay period of block n-1 to arbitrage the block before "A" does. So in the next minute, "A" puts in a post-transaction in block n-2, and completes the arbitrage before "B", making "B" the victim of the first-transaction arbitrage in the next block.

I'm sorry if this is a bit confusing, but this all turns into a prisoner's dilemma. If "A" knows that "B" won't screw them in the next block, they will betray "A" before they have the chance. If "A" figures this out, they'll be smarter next time.

Conclusion

Please don't implement this mechanism. If you must, at least give me some popcorn to watch the fun. But seriously, I think there are some interesting ideas in the Timeboost mechanism that are worth exploring, but the opportunity for multi-block MEV is too serious to be ignored. Arbitrum has always been my favorite chain, and as I mentioned earlier, I tell every traditional finance practitioner that this is an excellent MEV ecosystem chain where users can get good pricing, liquidity, and are protected from front-end transaction exploitation.

However, this proposal will ruin all of that.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Zoey

Zoey TheBlock

TheBlock Coinlive

Coinlive  Catherine

Catherine Coinlive

Coinlive  Coinlive

Coinlive  Nell

Nell Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph