Written by: Tia, Techub News

It has been a very different year for Ethereum. There have been many ups and downs, or perhaps it is "full of crises"...

This year has been an extraordinary year for Ethereum. There have been climaxes after the approval of the US spot ETF, as well as the crisis of facing competition from Solana and various "anti-Ethereum" remarks. In addition, there have been personnel changes. A researcher joined Eigenlayer as a consultant, and then resigned from the Eigenlayer position to better develop Ethereum. There was also the issue of Beam Chain and liquidity fragmentation raised at Devcon. All these things highlight this extraordinary year.

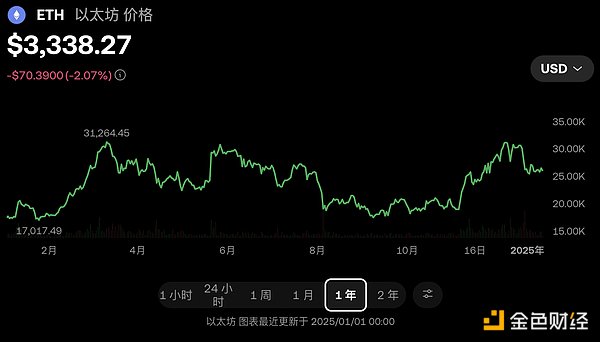

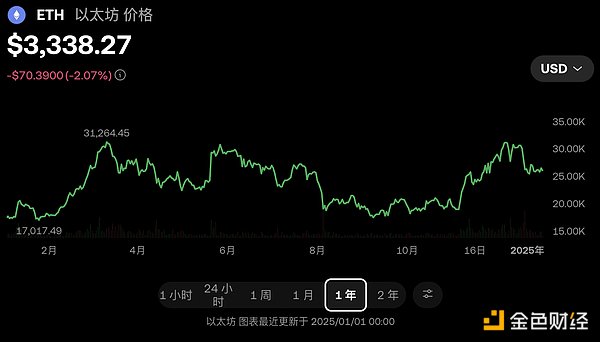

Ups and downs of price trends

From the Ethereum price chart, we can already understand how many ups and downs it has experienced. From more than two thousand dollars at the beginning of the year to more than four thousand dollars in March, back to the beginning of the two-word, and then rose to more than four thousand dollars again, it was full of drama and uncertainty.

On January 11, 2024, the U.S. Securities and Exchange Commission (SEC) document showed that the SEC approved 11 spot Bitcoin ETFs for listing. Riding on the east wind of ETFs and the expectation of Ethereum's approval of ETFs, Ethereum has soared all the way. In just over a month, the price has nearly doubled.

On July 23, the US spot Ethereum ETF was launched. Although the trading volume of the spot Ethereum ETF was hot after it was launched, the trading volume exceeded 200 million US dollars in just 45 minutes. However, since the price increase in the first half of the year has already included the expectation of issuing the Ethereum ETF, the US spot Ethereum ETF did not achieve excessive growth after it was launched.

Since there is no sustainable innovation in the industry to support high prices, after the Ethereum price has been running wildly, in August, the price began to fall wildly again. Starting from July 30, the price of Ethereum began to fall for 7 consecutive days. From a high of $3,366 to a low of $2,111. After that, it was a long sideways market.

Until President Trump won the election, he sang all the way again, pulling Ethereum from the beginning of the 2-digit to a high of $4,170.

The 7-day decline and 7-day rise, as well as the roller coaster-like multiples of ups and downs, reflect the extremely high volatility of the crypto market, and also show the emotions, expectations and external events of market participants. (Yes. This is crypto ?️)

Behind the ups and downs is a series of iron logic that must be acknowledged. For example, the sharp rise in the expectation of the listing of Ethereum ETF after the approval of Bitcoin ETF at the beginning of the year, such as the waterfall-like decline back to the starting point caused by the inability of ETFs to continue to drive industries that lack real innovation and lasting market demand; and the crazy rise due to Trump's optimistic outlook on crypto after taking office...

Looking back at the price trend of Ethereum, it is not difficult to find that its ups and downs are not only driven by external macro factors, but technological progress often plays an important role in it. From the launch of Ethereum 2.0, to the implementation of Layer2 scalability solutions, to the continuous optimization and update of the Ethereum network, every technological breakthrough has become the focus of the market. However, the gains brought about by these advances are not achieved overnight, but are often obscured by short-term market sentiment.

Beam Chain, Dencun Upgrade, Pectra Upgrade and Other EIPs

Beam Chain

Beam Chain was proposed by Ethereum researcher Justin Drake at Devcon in Thailand. Beam Chain is Justin's proposal to redesign the Ethereum consensus layer. The proposal is a further upgrade of Beacon Chain. The main goals are related to MEV, lowering the staking threshold, achieving fast finality single slot finality, and ZKing the entire consensus layer. Riding on the wave of SNARK technology breakthroughs, this proposal is equivalent to an upgrade of the old Beacon Chain design from 5 years ago.

Dencun Upgrade

The Ethereum Dencun upgrade was launched on March 13, 2024. The hard fork combines two core improvements: the Deneb consensus layer and the Cancun execution layer update. The highlight of the upgrade is EIP-4844 Proto-danksharding, which allows Rollup to send data such as transactions and proofs to Layer1 in the form of blobs. Since blobs are temporary storage and access to off-chain data, using blobs will make Rollup much cheaper than the original calldata. But this also caused a significant drop in Ethereum revenue.

EIP-4844 is a controversial EIP. In the short term, it is indeed the reason for the sharp decline in Ethereum's revenue and one of the main reasons why Ethereum is criticized; but some people also call this EIP "a small step for Sharding and a big step for Ethereum's expansion". In the long run, its specific impact is still unknown.

The Dencun upgrade also includes some EIPs that improve the efficiency of Ethereum, such as EIP-7516, EIP-6780, EIP-5656, EIP-1153, etc. The specific EIPs included in the Dencun upgrade are detailed in the table below.

Pectra Upgrade

The Pectra upgrade combines two independent upgrades: the Prague execution layer upgrade and the Electra consensus layer upgrade. The Pectra upgrade is an upgrade before the Fusaka upgrade (which is specifically designed to implement the Verkle transition). Since Ethereum developers agree that other substantive changes cannot be combined with Verkle, the Pectra upgrade is a series of other changes before the implementation of the Verkle transition. The Verkle transition represents the migration of all Ethereum state data from the Merkle Patricia tree structure to the Verkle structure. This will enable nodes to generate smaller proofs about state data, which can be more easily passed to other nodes, and is a prerequisite for the implementation of "stateless clients".

The Pectra upgrade is initially scheduled to be activated on the mainnet in early 2025. Among them, the more important one is the account abstraction EIP-7702, whose main function is to extend the smart account function to EOA.

EIP-7702 is an improvement of EIP-3074 and was proposed in May 2024. EIP-3074 is the first attempt by the community to explore extending smart account functionality to EOA. Unlike ERC-4337 (which introduces a smart contract called EntryPoint so that the smart contract can behave like a user's account), if ERC-4337 is a way to implement account abstraction without changing the execution layer or consensus layer, EIP-3074 requires an Ethereum hard fork to implement. It mainly extends the smart account function to EOA by introducing two opcodes, AUTH and AUTHCALL.

EIP-7702 is a step further than EIP-3074. Unlike EIP-3074, which implements the smart account model of EOA with its opcodes, with EIP-7702, EOA can now store an address called a "delegation indicator" that points to a smart contract. When a transaction is sent to EOA, it can execute the code at this specified address as if it were its own code, similar to how "delegated calls" work in smart contracts.

EIP-7702 brings smart account functionality to EOA while addressing many of the concerns raised by EIP-3074, providing full compatibility and a clear upgrade path with ERC-4337, and is planned to be included in the Pectra upgrade.

Since the focus of Pectra will shift to Verkle Tree after the upgrade, EIP-7702 may be the last EIP for account abstraction-related upgrades, as there may not be another 2-year window to include account abstraction-related upgrades after this.

So far, other code changes on Pectra have mainly involved improving the experience of users and smart contract developers. For a more detailed introduction to the Pectra upgrade, please refer to this article.

Other EIPs

Not all EIPs that have passed the review need to be used after the hard fork upgrade. Ethereum has also passed some major process/standard EIPs this year, such as the cross-chain intention standard ERC-7683 and the account abstraction standard ERC-4337 (ERC is a subset of EIP). Such changes rely more on the community's recognition of the EIP, that is, whether the community is willing to accept or actively implement it. Some EIPs that need to be used after the hard fork upgrade also need to wait for the acceptance of users, DApps, etc. before they can be widely adopted.

Interoperability: Cross-chain/Rollup Standards

With the Ethereum Rollup-centric roadmap and the growing number of Layer1s, on-chain liquidity is fragmented and composability, one of the biggest advantages of the chain, is gradually lost with the fragmentation.

Interoperability has two gradient problems to solve: one is how to achieve fast, low-cost and secure cross-chain of assets, and the second is how to achieve synchronous composability.

Currently, there are many protocols that can achieve the first gradient problem. Protocols like Across have greatly improved the cross-chain speed and have low transaction fees. Due to its intent-based architecture, the security issues of user cross-chain have also been completely transferred to solvers. At present, some proposals related to cross-chain/Rollup are mainly committed to solving some preliminary standard issues.

Synchronous composability will be subsequently transferred to Based Rollup for implementation. The specific proposals for cross-chain/Rollup are as follows:

ERC-7683

ERC-7683 is an intended cross-chain standard jointly proposed by Across and Uniswap. Through this standard, all intended interoperable orders can share the solver network.

ERC-7683 combined with ERC-3668 and ERC-3770 will bring initial interoperability experience to L2. ERC-7683 creates a unified framework for cross-chain intentions that can be accessed by all solvers; EIP-3370 adds identification tags to blockchain addresses, clearly indicating the specific blockchain network to which the address belongs, preventing users from sending money to the wrong network; ERC-3668 CCIP Read has done a good job of off-chain verification, providing a secure mechanism for obtaining off-chain data without additional trust assumptions, and will effectively and automatically support light clients compatible with L2 blockchains without any additional configuration of wallets.

RIP-7755 (L2 Call Standard)

RIP-7755 is the L2 call standard. The POC was launched by the Base research team on October 17, aiming to achieve seamless cross-chain interoperability between different Ethereum Layer2 networks, especially mainstream second-layer networks such as Optimism and Arbitrum. The proof of concept of RIP-7755 is applicable to blockchains that comply with the EIP-4788 standard, and it has been able to verify the status of the OP Stack chain and Arbitrum.

Summary

The above is an overall review of the major events that Ethereum has experienced in 2024. Of course, the journey of Ethereum 2024 is far more than this. It also includes the dispute with Solana, criticism of unclear positioning and centralization, large institutions starting to hold Ethereum spot ETFs (Michigan Pension Fund disclosed holding more than $10 million in Ethereum spot ETFs), large institutions launching tokenized products on Ethereum (UBS launched uMINT, a tokenized money market fund based on Ethereum in Singapore, and Wall Street giant Guggenheim tokenized $20 million in commercial paper on Ethereum), and V God published 6 articles on the Ethereum roadmap in a row after facing the crisis, and conducted AMA answers on Ethereum Research Reddit, etc.

And in the end, everything points to an unresolved question: where is the future?

Catherine

Catherine