On the evening of March 5, the crypto community was abuzz because after a long 28 months, Bitcoin once again set a new historical high, once touching 69080 USDT, breaking through the previous high. The previous high of 69040.1 USDT set in November 2021 can be said to be just a stone's throw away from US$70,000.

Unsurprisingly, many "Bitcoin surge" analyzes in the industry will focus on macro factors such as halving and interest rate cuts, but Koala Finance believes that this time The market rise may be related to a "micro" company, which is MicroStrategy. Let us conduct an in-depth analysis in this article.

The day before the surge, it was announced to raise US$600 million to increase its holdings of Bitcoin. Why does MicroStrategy always seize the opportunity accurately?

In fact, just before Bitcoin skyrocketed on the evening of March 5, MicroStrategy "suddenly" issued an announcement announcing its plans to adjust the stock price based on market conditions and other factors. , offering an aggregate principal amount of US$600 million in convertible senior notes due 2030 to qualified institutional buyers through a private placement. MicroStrategy also expects to grant to the initial purchasers of the notes an option to purchase up to an additional $90,000,000 in the aggregate principal amount of the notes for a period of 13 days beginning on and including the date when the notes are first issued.

MicroStrategy is an American business intelligence software company. Its CEO Michael Saylor is a strong supporter of Bitcoin. Since August 2020, MicroStrategy has The majority of the funds on its balance sheet were converted into Bitcoin, and it is now one of the largest Bitcoin holders in the world.

MicroStrategy can so accurately grasp the timing of the rise in Bitcoin prices for the following reasons:

MicroStrategy is optimistic about Bitcoin in the long term: Michael Saylor believes that Bitcoin is the best candidate for the future global reserve currency and regards it as a An investment tool to combat inflation. Therefore, MicroStrategy has been committed to holding Bitcoin for the long term and will not change its investment strategy due to short-term price fluctuations.

Keeping insight into market sentiment: MicroStrategy has been paying close attention to the Bitcoin market and can accurately judge changes in market sentiment. Prior to the announcement on March 4, 2024, Bitcoin prices had been rising for several weeks and market sentiment was at a high. MicroStrategy chose this time to announce its fundraising to increase its holdings of Bitcoin, which is undoubtedly the best time to seize market sentiment.

Strong financial strength: MicroStrategy is a highly profitable company with sufficient financial strength. This allows MicroStrategy to raise large amounts of funds in a short period of time and quickly convert them into Bitcoin.

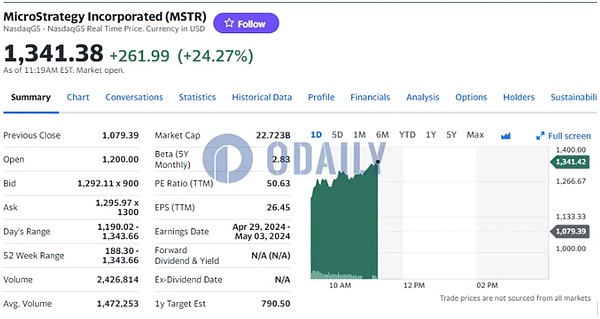

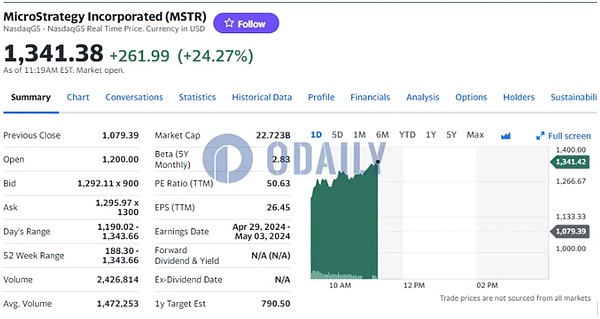

Not only that, as the price of Bitcoin rose, MicroStrategy's stock price also exceeded US$1,300 and is now trading at US$1,341.38, with an intraday increase of 24.27%, and the year-to-date increase has reached 105.25%. Market analysts believe that if this trend is followed, MicroStrategy is expected to hit its highest closing price since March 2000 (when its stock price reached $2,267.50). However, its current stock price is still lower than the historical closing high of $3,130.00 on March 10, 2000. There is a gap of nearly 60%.

Of course, MicroStrategy's investment strategy also involves certain risks. If the price of Bitcoin were to decline significantly, MicroStrategy would suffer significant losses in the value of its assets.

However, so far, MicroStrategy's investment strategy seems to be successful, and the value of MicroStrategy's Bitcoin holdings has grown since August 2020 Several times, it has brought huge returns to the company's shareholders. It is reported that Michael Saylor, chairman of MicroStrategy, has increased his personal wealth by about US$700 million after the price of his company's stock and Bitcoin continued to rise. Michael Saylor is MicroStrategy's largest investor and owns Approximately 12% of the company's shares. He also revealed that he personally owned 17,732 Bitcoins in 2020, so his holdings and positions climbed to $2.96 billion from $2.27 billion at the beginning of the week.

Can MicroStrategy drive crypto whales to invest in Bitcoin?

Koala Finance has learned that MicroStrategy currently holds a total of approximately 193,000 BTC, far exceeding the Bitcoin holdings of other listed companies. The average purchase price is 31,544 USDT per coin. Calculated based on US$69,000, the floating profit exceeds US$7 billion.

Market analysts believe that driven by MicroStrategy, it may "stimulate" more crypto whales to enter the market. For example, just after it announced that it will continue to purchase Shortly after investing in Bitcoin, HODL15Capital noticed the buying action of a mysterious whale. Since each increase in position is about 100 BTC, the mysterious address is also named Mr. 100. After recent frequent increase in positions, this address has held a total of approximately 51,064 BTC, worth approximately US$3.5 billion.

As a large institutional investor, MicroStrategy's continued optimism for Bitcoin may have an impact on other crypto whales, and its investment strategy also shows its contrast Confidence in the long-term value of Bitcoin, which may encourage other crypto whales to continue to hold or increase their holdings of Bitcoin, coupled with MicroStrategy’s successful investment, may attract other crypto whales to follow suit, which may also lead to a decline in the price of Bitcoin rise further.

Summary

At this stage, most Some institutions continue to be optimistic about the long-term growth trend of BTC, but some practitioners are also warning of potential correction risks. As BTC reaches a new all-time high, the question that investors are most concerned about right now is undoubtedly whether BTC can stand firm here and continue its upward trend. Let us wait and see.

Sanya

Sanya