Author: Alana Levin, Variant Fund Investment Partner; Translator: 0xjs@黄金财经

Every six months or so, I write an internal reflection on the current state of cryptocurrency and where it’s headed. I thought it was worth publishing my most recent one for public reading.

This article is divided into three parts: what’s working, other things that have happened (or are happening), and new things I’m looking forward to.

I tried to base most of my analysis on data, but it’s undeniable that my opinions are inadvertently revealed. Hopefully this is an interesting article. If the response is positive or the feedback is productive, I’ll consider sharing more of these internal reflections in the future.

Existing Products

The good news is that a lot of things are working and going well. The development of these things—many of which I call “big ideas” because they can effectively change the status quo—should create new opportunities as a secondary effect of their success.

For clarity, I use the term “what’s working” to refer to projects or trends that are showing signs of sustainable product-market fit, are scaling the crypto market, or both.

So what factors seem to be working or growing right now? I have listed 10 factors that I believe are showing signs of “product availability” (non-exhaustive list):

1. Stablecoins

2. Bitcoin as an alternative asset

3. Farcaster, an early but growing social network

4. Asset creation

5. Community-created and trained AI models

6. Solana

7. Ethereum

8. Zora

9. Coinbase

10. On-chain exchanges

11. Bonus: Blackbird

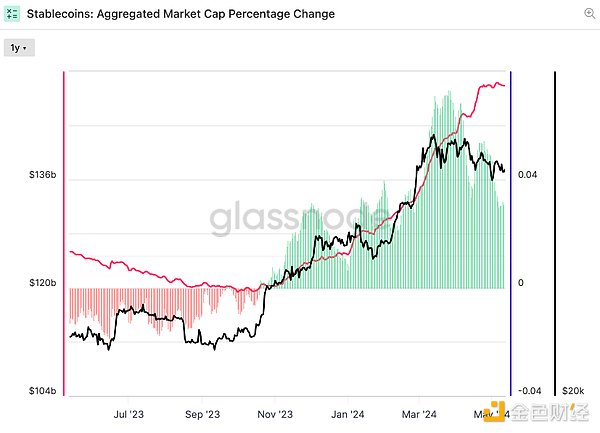

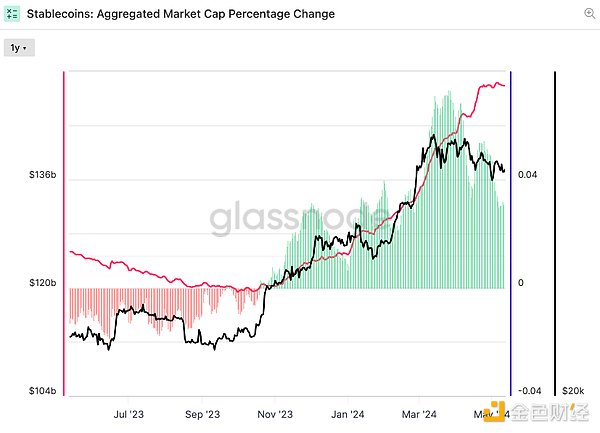

#1: Stablecoins

On-chain stablecoin supply has seen ~$25 billion in net supply inflows year to date. Overall, inflows have been positive since November 2023. Permissionless global access to the dollar continues to enjoy strong product-market fit.

#2: Bitcoin as an alternative asset

Fewer than a dozen Bitcoin spot ETFs were approved in January. As of early June, the value of Bitcoin spot ETFs exceeded $80 billion. (I follow the trackers of Blockworks and The Block for data).

Gold seems to be a powerful analogy for understanding institutional allocations to Bitcoin: whether or not you believe the asset represents a hedge against inflation, it is an alternative to traditional stocks, and its value has a certain degree of social consensus. One could argue that Bitcoin is so much better than gold — because it’s easier to transfer, has a known supply cap, and the asset is being adopted on the balance sheets of some companies and countries — that its market cap could one day surpass that of gold.

In private markets, Q1 was marked by a surge in projects that seek to extend Bitcoin’s utility. These projects include (many) Bitcoin smart contract layers, on-chain lending protocols, and explorations into how Bitcoin’s economic security budget can be used to help secure other chains. I’d guess that any fruits of these developments will likely come to fruition in the second half of the year.

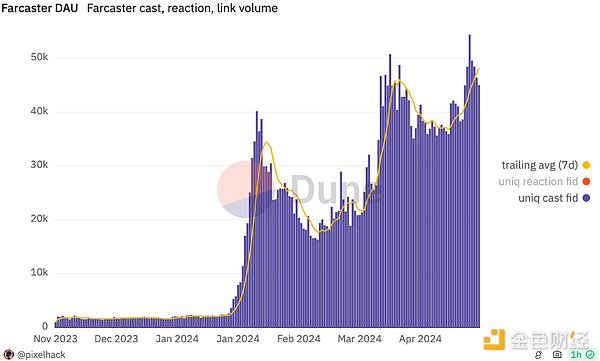

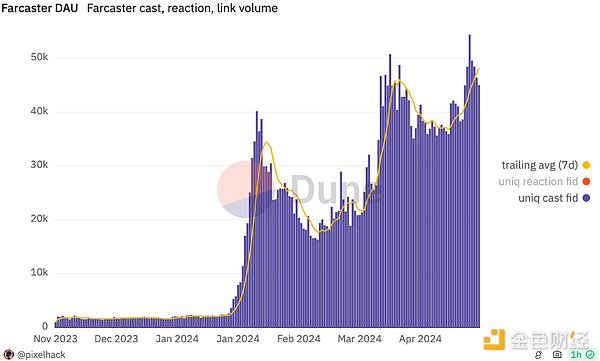

#3: Farcaster

Farcaster, a social network built on an open protocol rail, is starting to enjoy meaningful growth.

The turning point came in late January, with the launch of Frames, app-like widgets that allow people to share and interact directly in the social feed of the Farcaster client.

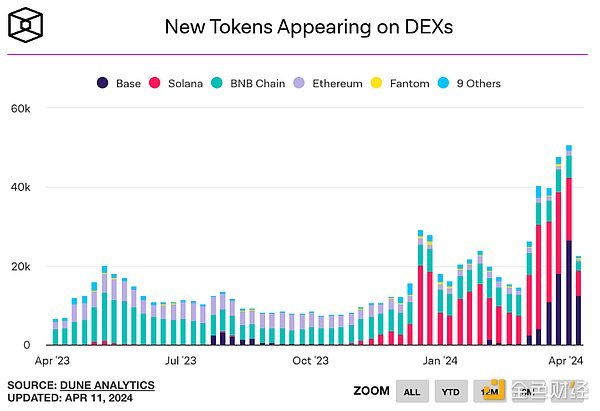

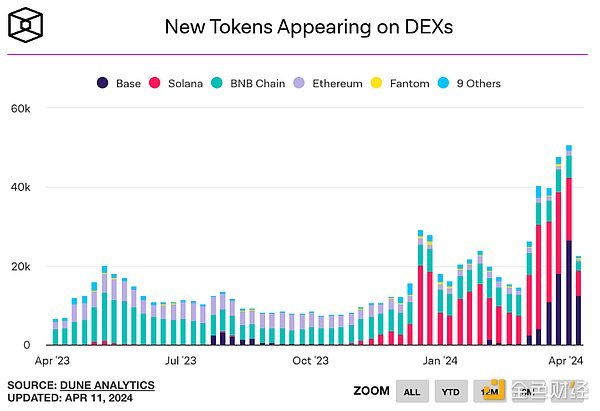

#4: Asset Creation

The number of newly created tokens continues to increase. One way to track this trend is to look at the number of new tokens appearing on DEX (decentralized exchanges). Activity seems to be driven primarily by asset creation on Base and Solana.

On Solana specifically, over 10,000 new tokens have been created every day in the past few weeks.

Source: SolScan

Source: SolScan

Many of these new assets are in the form of memecoins (tokenized memes). I wouldn’t describe myself as an active person in the memecoin space, but I do recognize a very real and engaged group of users who are enthusiastic about participating.

It’s worth noting that the emergence of these new assets has had some unexpected but productive byproducts for the broader ecosystem. For example, we’ve seen more experimentation with new tools, such as Solana’s token extension. A token called $BERN innovates token economics using Solana’s new token extension: if someone sells their tokens, 5% of that transaction is destroyed (as a redistribution mechanism to remaining holders). The popularity of $BERN becomes a mandatory feature for wallets to adopt token extension standards — standards that are productive because they enable complex payment splitting, confidential transfers, etc. Without $BERN, who knows how long it would take to adopt token extensions. Overall, my main point is that asset creation seems to be a trend that is going to keep coming back. Regardless of your views on these assets, having issuance and exchanges are still two excellent choices in value flow. #5: Community Created and Trained AI Models Clearly, we are heading towards a world with a lot of LLM opportunities, low cost to create, and lots of options. In that world, where does value accrue? I think value is derived from scarce resources. So in a world with abundant compute, abundant content, and abundant tools, the question becomes: what is scarce? One answer is taste and attention. The difficulty is that taste and attention are fairly intangible resources. Even if we can measure them (e.g. “screen time” can be a measure of attention), it’s hard to put these metrics in dollars.

We’re starting to see crypto play out by tightly tying finance to taste and attention activities. Specifically, community-created and trained AI models that have some kind of productive output — such as a good or service that can be sold or licensed (e.g. art, movies, intellectual property, etc.) — can reward participants. For models with subjective outputs, community participants act as tastemakers by training the model to their cultural preferences. The incentive to choose good taste is strong: the more tasteful the output, the more it should sell.

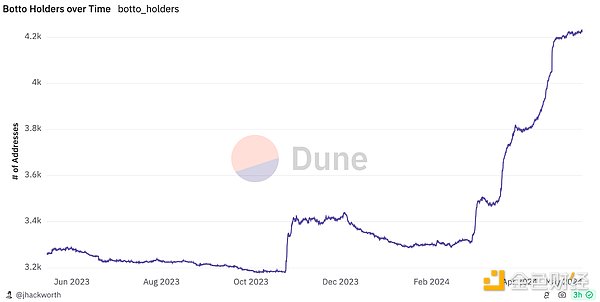

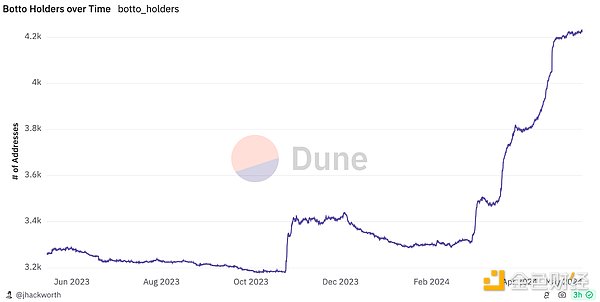

We’re starting to see some of this emerge in real, effective ways. Botto is my favorite example. It’s an autonomous artist, and $BOTTO token holders can help train the model every week.

Botto’s artwork is high quality and getting better, as evidenced by the rising prices of Botto’s works at auction every week. Meanwhile, the network of owner participants is growing:

I think we’ll start to see more AI models created and trained by the community, especially as known and validated examples like Botto become more prominent.

Some companies are addressing the attribution challenge from the top down, through litigation, data licensing agreements, or both. If we assume that the status quo represents less than 1% of model-based output five years from now, there’s clearly room for other attempts to solve the attribution problem and assign contribution value. Crypto offers a unique and valuable solution. Crypto strengthens economic and creative attribution. Significantly, it also allows anyone, anywhere to participate.

In an old blog post, Chris Dixon mused:

“There’s a famous quote: ‘The future is already here — it’s just not evenly distributed.’ An obvious follow-up question is: if the future is already here, where can I find it?”

Community-created and trained models are one area where we have a small but growing number of projects that point the way to a broader future.

#6: Solana

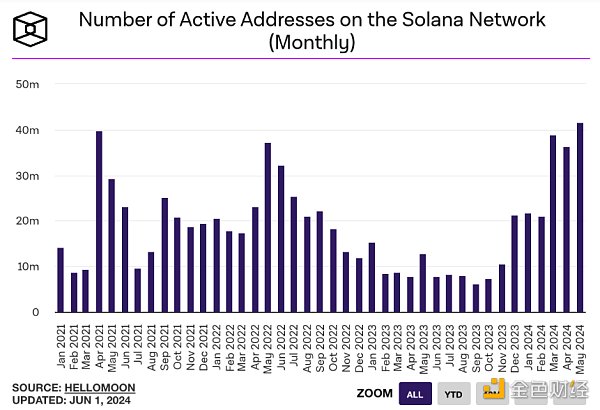

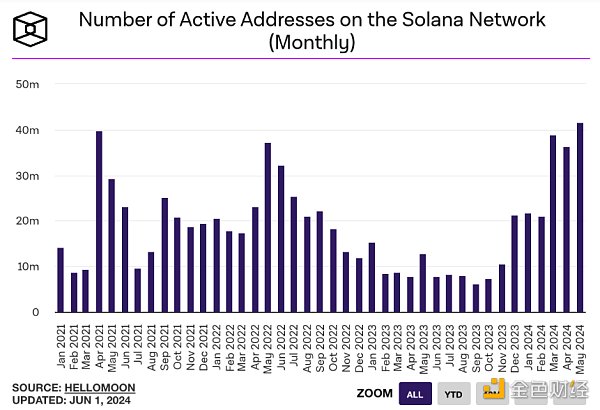

Daily active addresses interacting with Solana are 2-3x higher than this time last year, roughly coinciding with the peak activity period of the 2021 cycle. The number of monthly active addresses increased 3-4x over the same time frame and hit an all-time high in May 2024:

The network has also begun to generate meaningful fee revenue, beginning to prove the hypothesis that Solana's low fees will be compensated by greater user activity/volume.

The network has also begun to generate meaningful fee revenue, beginning to prove the hypothesis that Solana's low fees will be compensated by greater user activity/volume.

Conclusion: Solana’s trajectory shows that something is working, and working in a meaningful way. Solana is here to stay.

#7: Ethereum

The Ethereum ecosystem has also made significant progress. There are two ways to describe this growth: focusing on Ethereum itself, and looking at the Ethereum chain system as a whole (i.e. including the Ethereum roadmap).

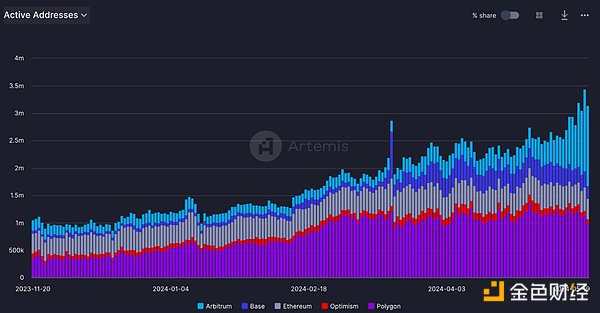

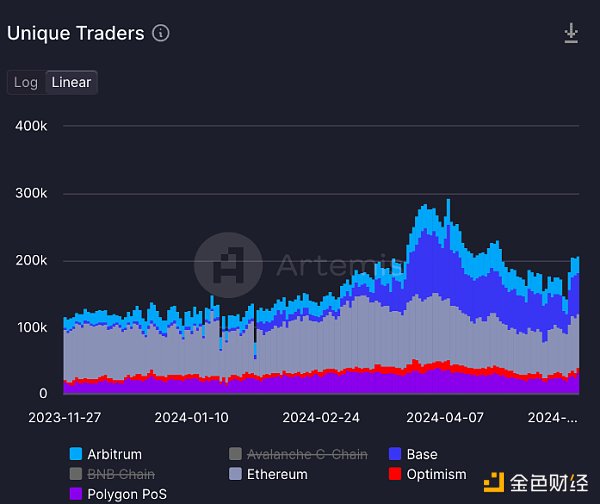

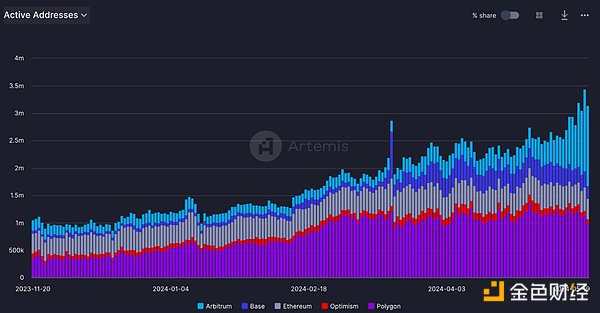

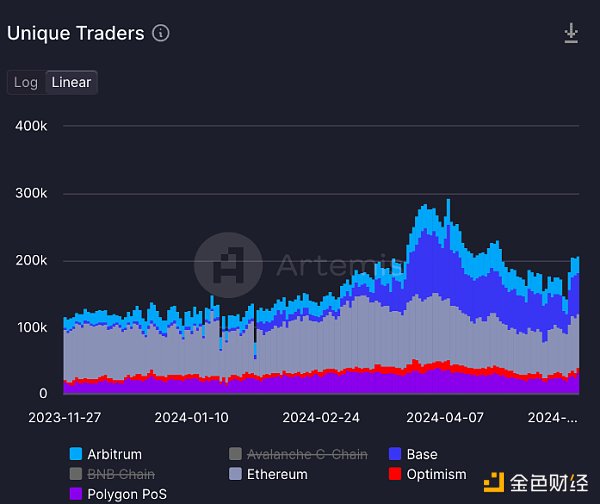

Ethereum itself has also seen significant growth in monthly active addresses. The 30-day average has increased by about 30% year to date, and is only about 10% below the 2021 peak. A more comprehensive look at the Ethereum ecosystem also shows significant signs of growth. I have summarized the daily active addresses of the top five Ethereum blockchains (Ethereum, Arbitrum, Base, Optimism, and Polygon) in the figure below. These five blockchains were chosen in part because they have rich application ecosystems and developers.

Key Points: Ethereum has been one of the most important ecosystems in the cryptocurrency space.

#8: Zora

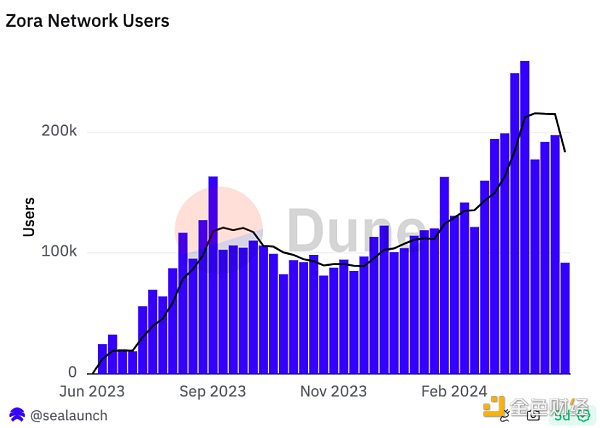

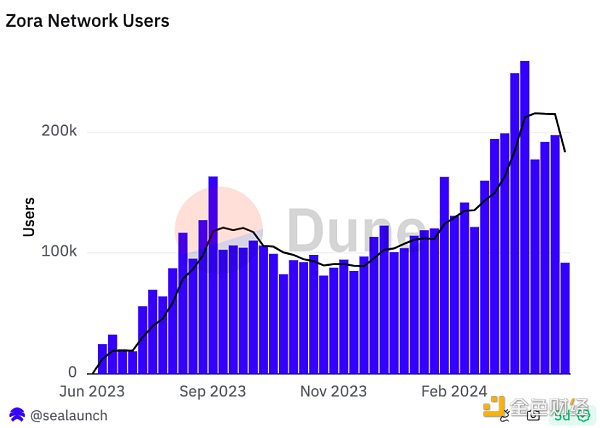

Zora Chain (also known as Zora Network) has been online for nearly a year. During this time, the network has been finding its footing. Weekly active users have grown by about 60% year-to-date, recently breaking a new high of 250,000. The chain also has a profit margin of about 34%, meaning that Zora can keep about a third of the ETH that users spend on transaction fees.

Zora Chain helps validate the idea that applications with sufficient distribution can begin to vertically integrate with other parts of the stack, such as block space, to unlock more attractive economics.

Zora Chain helps validate the idea that applications with sufficient distribution can begin to vertically integrate with other parts of the stack, such as block space, to unlock more attractive economics.

#9: Coinbase

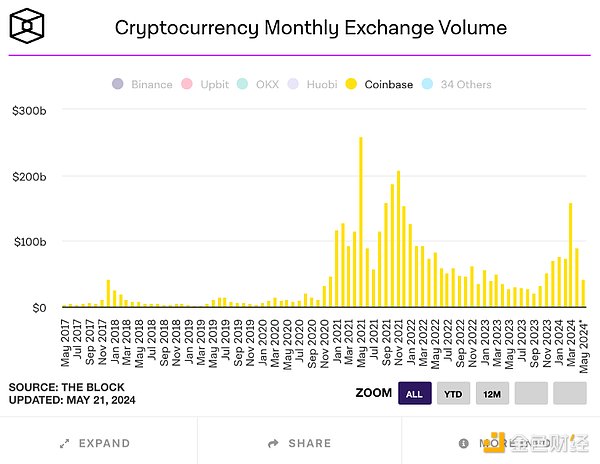

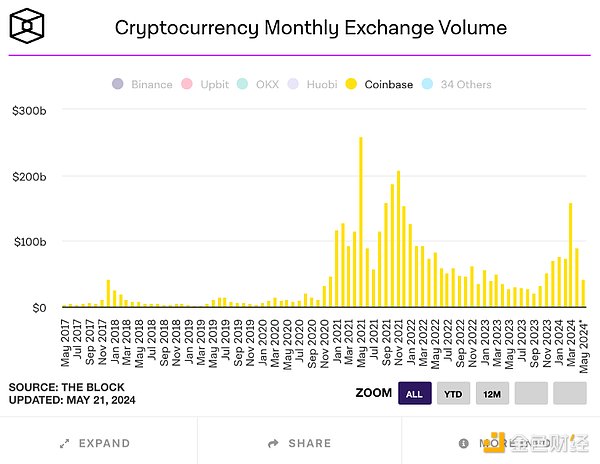

Coinbase also had a strong start to the year. It is listed as the custodian of 8 of the 11 Bitcoin spot ETFs. The exchange business also continued to make progress - trading volume reached a high of $157 billion, a number not reached since November 2021.

Transaction fees still account for a large portion of Coinbase's revenue. In the first quarter, the platform's transaction fee revenue exceeded $1 billion (about two-thirds of its quarterly revenue).

But it is also worth noting that Coinbase continues to diversify its revenue sources away from transaction fees alone. Blockchain reward revenue and custody fee revenue both doubled from last year. Stablecoin revenue is close to $200 million, with the growth of USDC circulation offsetting (slightly) lower interest rates. Coinbase's membership suite Coinbase One has more than 400,000 users. Coinbase's layer 2 protocol Base generates millions in on-chain fees every month.

Coinbase’s success proves what (until recently) many assumed is true: that many meaningful new business models can be built around crypto primitives.

#10: On-chain exchanges

On the main Ethereum chain, Uniswap has roughly doubled the number of unique users (traders) from six months ago.

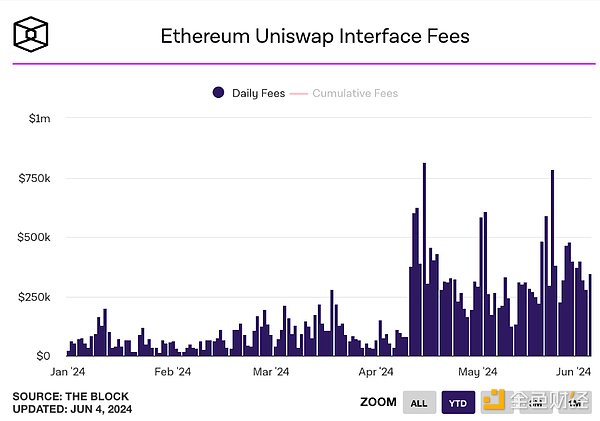

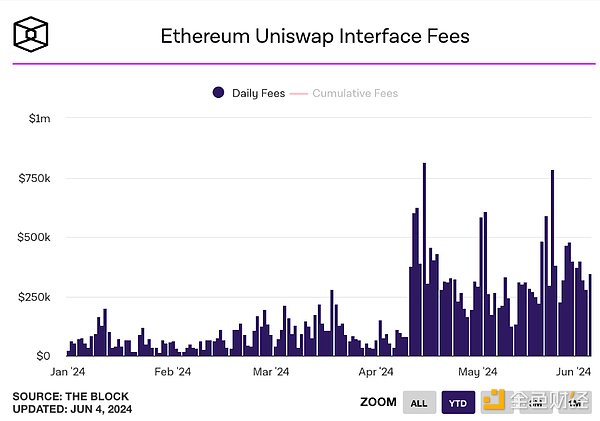

One definition of a successful protocol is that a successful business can be built on top of it. We’re seeing this with on-chain exchanges like Uniswap Labs’ interface driving revenue growth:

One definition of a successful protocol is that a successful business can be built on top of it. We’re seeing this with on-chain exchanges like Uniswap Labs’ interface driving revenue growth:

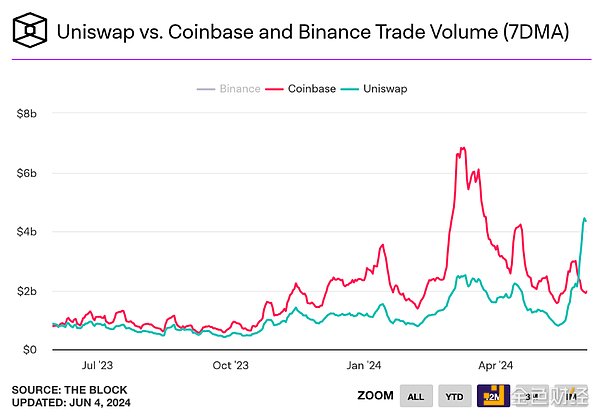

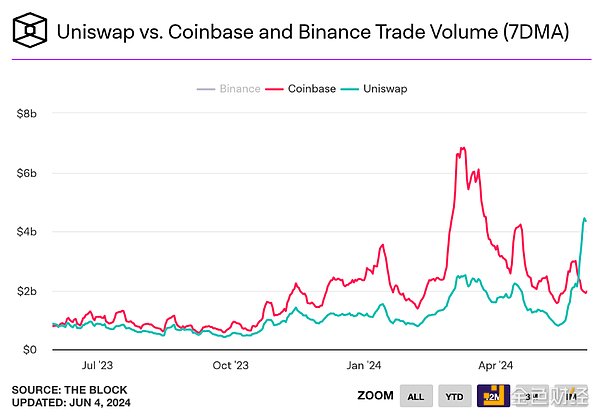

The Uniswap protocol’s 7-day moving average of volume also recently surpassed Coinbase:

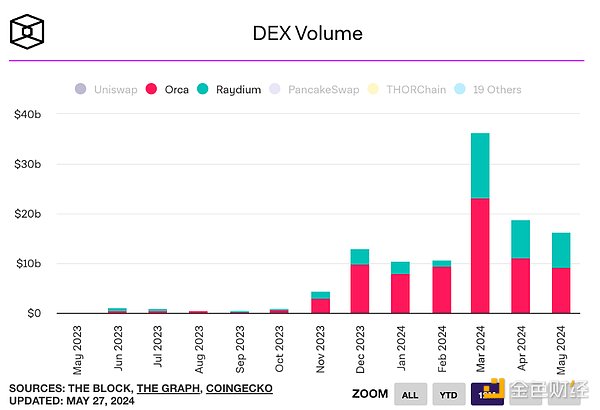

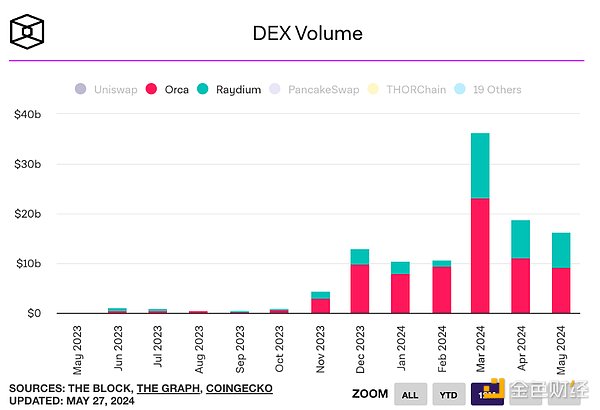

Importantly, the growth we’re seeing in on-chain exchanges isn’t just happening on Ethereum. In Solana, the leading two DEXs, Orca and Raydium, have also seen significant growth:

On-chain protocols facilitate tens (if not hundreds) of billions) of value exchanged each month, and that’s no joke. Protocols and interfaces are very real revenue-generating projects. In cases where centralized institutions exist (such as interface businesses), I expect we’ll see a portion of those profits reinvested into improving security, robustness, and user experience.

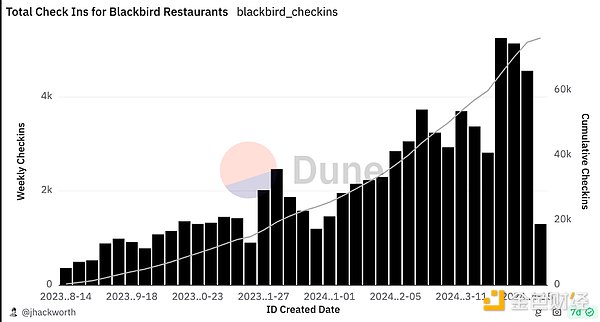

#11 (Bonus): Blackbird

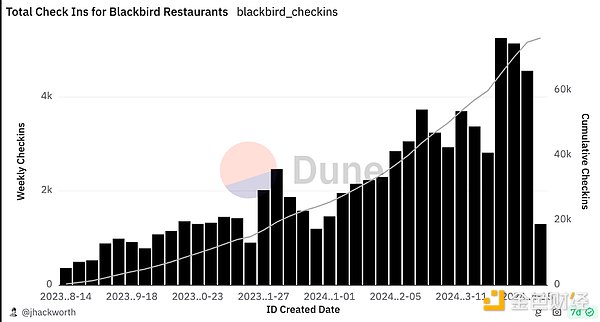

Blackbird is a loyalty and rewards program for the restaurant industry, built with crypto. When a user checks in at a restaurant associated with Blackbird, the app mints them an NFT - a digital artifact of their visit and a data point for the restaurants in the network to understand their customers’ dining habits. Today, Blackbird is primarily based in New York City.

The Blackbird user base continues to grow in daily check-ins.

Personally, Blackbird has changed my own dining habits: I used to let my friends choose where we should go to eat, but now I become more active in recommending places for us (and mainly use the Blackbird app to guide where might be interesting places to eat).

Other Things That Have Happened

Other notable trends over the past two quarters include the rise of social finance and the proliferation of new chains (mostly L2 and L3 in the Ethereum ecosystem). While I think it’s too early to say whether they’re actually working, it’s worth noting that these trends are having a significant impact on how users behave on-chain and how developers evolve their business models.

#1: The Growth of Socialfi Apps

A large number of financialized social (“Socialfi”) apps have emerged. Several of them are already generating millions in fees. Friendtech and FantasyTop are two of the most popular apps I know of. Clearly, some users find these apps interesting and are willing to participate in them. Providing users with something new to do on-chain is a good thing.

I’m skeptical about the sustainability of some of these business models. Speculation alone doesn’t seem like enough to drive long-term success. But that’s okay. Some of these apps may only need minor tweaks to achieve more sustainable business models. Attracting attention—even if it’s fueled by speculation—provides an opportunity to monetize that interest in a variety of other ways. However, the crucial second step is of course the hardest part.

#2: The Proliferation of New Chains

We’re also seeing the launch of many new chains (particularly L2 and L3). For these chains in the Ethereum ecosystem, the underlying technology doesn’t seem to be a substantial point of differentiation. Instead, brand and community trump everything. Coinbase’s launch of L2 Base may be the epitome of a strong brand. Even without the direct token incentives that other chains use to attract talent, the chain has a (rumored) growing developer ecosystem.

So far, we’ve seen chains attempt to differentiate in three ways:

Underlying technology. For example, integrated chains vs. modular chains, or optimistic rollups vs. zero-knowledge rollups.

Chain economics. To my knowledge, Canto is the first chain in recent years to try to redistribute transaction fees to developers in the ecosystem. Blast and Berachain are currently experimenting with various other types of revenue generation and economic distribution. It’s unclear how sustainable these efforts are — both from an overall economic perspective and from the perspective of providing a long-term competitive advantage.

Brand and community. A chain’s culture and/or reputation can be a halo that attracts developers: it may enhance the perception that developers will get more help (from the community or other developers) when building in the ecosystem, it can provide reputational protection in the eyes of certain consumers (“no one will get in trouble for choosing a MacBook” or something like that), and/or the values espoused by the chain’s community may align with the developer’s own ideology.

Mature blockchains have all three of these elements. Take the two blockchains I highlighted above as “already working”: Ethereum and Solana. Ethereum pioneered the EVM, implemented EIP-1559 (using a portion of transaction fees as a mechanism for redistributing to ETH holders), and has developed a strong developer community and ethos around its technology. Solana popularized integrated blockchains, was the first to make low fees commercially viable, and has a community that was literally forged in fire during the 2022-2023 downturn.

My hypothesis is that the next wave of blockchain differentiators will stem from external integrations. Examples might include seamless access to other funding sources (like a Coinbase account), screens like KYC for wallets, or verifying that someone is a human. This is a very broad design space, and one I’m excited to explore more deeply.

Looking Ahead

Looking back on the past six months, my main takeaway is that we’re still talking about the same things we were talking about 6-12 months ago, but with more maturity in terms of “what works.” With this maturity, many platforms should and will transform into opportunity creation platforms as a byproduct of their success. With growth comes growing pains, and those pains create space for third parties to provide solutions.

Forecasting the growth of these major platforms can also provide a basis for thinking about future directions. I’m most focused on new forms of distribution and new building blocks.

New Distribution and Better Building Blocks

On the distribution side, some of the growth vectors I’m excited about include: Farcaster at a larger scale, the Telegram app with more robust wallet capabilities, and interfaces like the World App continuing to attract more people (it’s now at 10 million)

There are also many exciting new building blocks. Coinbase launched a Smart Wallet that lets users pay directly from their Coinbase accounts. Reservoir’s Relay protocol helps eliminate the experience of users bridging funds between chains, making a “one-click” checkout experience on-chain finally possible. World ID continues to develop, promising a way to authenticate between people and agents. And much more.

This may sound a little vague. I sometimes get frustrated when I read something that seems more like abstract hope than reality, so I’ll try to illustrate here with a concrete example of what these building blocks and new distribution channels can achieve.

Take modern advertising, a multi-billion dollar market that touches almost every business. I’d guess that despite decades of improvements in attribution and targeting, it’s still inefficient. Now imagine what an “ad” on Farcaster would look like:

A company could send a coupon directly to a targeted customer’s wallet (since every account has an associated wallet).

The coupon could be based on a mention of a similar product in a post created by the consumer, or a post liked by the user.

The business can operate with confidence that the data will always remain open and accessible (i.e. no worries about the API being shut down or the price being jacked up), allowing the business to invest in improving the effectiveness of that distribution channel.

Budgets are only spent when a consumer converts to a sale (i.e. uses the coupon).

Overall, this seems like a win-win for both business and consumer, enabled by an open social graph, embedded payment channels, and verifiable digital identities.

Mature blockchains point to the future

Another noteworthy takeaway from the “What’s Already Done” section is that there are now several solid and growing ecosystems (Ethereum, Solana, Bitcoin). These three ecosystems compete on unique differentiators, and each ecosystem’s respective strengths put production pressure on the others to continually improve. For example, Solana’s success with low fees and high throughput has driven Ethereum to continually innovate at the base layer and L2. Similarly, Ethereum’s having multiple clients may set a goal for Solana to achieve client diversity (e.g., the upcoming Firedancer client). Bitcoin was the first to achieve true institutional adoption, but has begun experimenting with implementing new programmable elements (with Ordinals, Runes, and potential OP_CAT upgrades). Broadly speaking, I would summarize this as each ecosystem continually trying to achieve roughly the same functionality as the others. Looking at where each ecosystem currently stands — and the positive relative traits exhibited by its peers — can serve as a guide to improvements that each ecosystem might try to implement.

This feels very positive-sum. I’m a tennis fan, so I’ll use a tennis analogy. If Federer, Nadal, and Djokovic hadn’t competed against each other, they probably wouldn’t have reached the same level of athleticism. Each pushed the others to improve their own level, and the result is really great tennis. I think the same is true of what we’re seeing on different chains in crypto today. Everyone is making more progress faster because there’s production pressure to improve. The result is a net gain for the industry as a whole.

Some New Ideas

There’s a lot of ideal infrastructure and applications to be built. I’m interested in some untapped areas with potential:

Different forms of credentials. Credentials (certificates, attestations, etc.) are valuable resources that are put on-chain: putting a credential on a public ledger has the benefit of both marking the time of issuance and verifying the issuer. An example of such a credential might be a workplace verification — a receipt from an employer that proves that someone has worked at a certain company for a certain period of time. I’ve seen many attempts at attestations in crypto. I think the key here is to identify credentials that have real economic value — like employment verification — and focus on those markets.

Price Differentiated Assets (PDAs). These goods have real economic value, but there is a wide variation in the willingness to pay for them among market participants. Restaurant reservations are a great example. Recently an article about an underground reservation market in NYC went viral: popular reservations were being hacked by bots and resold for thousands of dollars on exclusive secondary markets. To me, if one assumes that this financialization is inevitable, then making these “assets” as transparent and accessible as possible seems to benefit both diners and restaurants. Restaurants can more easily see the transfer history of reservations, and more potential consumers can participate. Tokenizing reservations could even enable some kind of programmatic price cap, or revenue sharing with restaurants. This is just one example. There are many more markets where real assets with fundamental economic value are mispriced or inefficiently priced due to opaque or limited access to the market. New forms of token distribution. There are many opportunities to nudge people’s existing behaviors with token rewards as a byproduct of activities they would have done anyway. Blackbird is the first and most notable example: eating out is already a common activity, but the existence of Blackbird rewards may have changed where and how often some users choose to eat out. This can be applied more broadly to areas where people are already spending time and money but lack consistency or loyalty in their spending activities. In particular, I’d look for categories where merchants could benefit from some kind of alliance or cooperative effect (in terms of more data/insight into consumer behavior between merchants), and where there’s a strong opportunity to increase customer loyalty (via nudge-style incentives).

Admittedly, it’s an open question whether any of these ideas have unique “old legs.” They mostly strike me as ideas that have been around for a while but haven’t been fully explored (and therefore deserve further experimentation).

Conclusion

This reflection represents much of what I think has been happening in the cryptocurrency space recently, but importantly not all of it. Some areas it doesn’t cover but could (or should) include the growth of permanent storage solutions (like Arweave), the maturation of Defi protocols into true financial platforms (like Morpho), and Telegram’s impressive push for TON.

Joy

Joy

The network has also begun to generate meaningful fee revenue, beginning to prove the hypothesis that Solana's low fees will be compensated by greater user activity/volume.

The network has also begun to generate meaningful fee revenue, beginning to prove the hypothesis that Solana's low fees will be compensated by greater user activity/volume.

Zora Chain helps validate the idea that applications with sufficient distribution can begin to vertically integrate with other parts of the stack, such as block space, to unlock more attractive economics.

Zora Chain helps validate the idea that applications with sufficient distribution can begin to vertically integrate with other parts of the stack, such as block space, to unlock more attractive economics.

One definition of a successful protocol is that a successful business can be built on top of it. We’re seeing this with on-chain exchanges like Uniswap Labs’ interface driving revenue growth:

One definition of a successful protocol is that a successful business can be built on top of it. We’re seeing this with on-chain exchanges like Uniswap Labs’ interface driving revenue growth: