Author: Cycle Network Source: medium Translation: Shan Ouba, Golden Finance

TL;DR

The development of chain abstraction was inspired by centralized exchanges (CEXs), and went through stages such as DEX + bridging and intention models, and finally reached the concept of chain virtualization. This innovative infrastructure provides seamless cross-chain functionality by abstracting the complexity of interacting with multiple blockchain networks while maintaining security and decentralization. Projects like Cycle Network are leading this change through technologies such as Verifiable State Aggregation (VSA), providing developers and users with a unified interface and bridge-free cross-chain liquidity. This marks a key step in the mass adoption of decentralized applications (dApps) and blockchain technology. Uniswap's transformation to Unichain further demonstrates this evolution, proving that chain abstraction can solve bottlenecks in decentralized finance (DeFi) and drive the development of the next generation of Web3 applications.

1. Introduction

With the growing demand for improving user experience, simplifying multi-chain development, and unifying decentralized liquidity, the concept of chain abstraction first came into focus in 2023, which is expected to be a key turning point in driving mass adoption. The basic idea of chain abstraction is deeply rooted in many important products in the blockchain industry. In fact, we have witnessed the evolution of chain abstraction since 2017. To further elaborate on this evolution, I think it is necessary to explore three ultimate philosophical questions: What is chain abstraction? Where does it come from? Where will it go?

2. Definition: What is chain abstraction

The rapid increase in the number of blockchains has brought fragmentation challenges to users and developers. Users must deal with complex cross-chain transaction procedures, as well as multiple cross-chain fees and slippages due to liquidity fragmentation. Developers need to deploy on multiple chains to cover users on all chains. Incompatibilities in factors such as finality, security models, and proof of verification also limit developers’ ability to innovate in building multi-chain environments. For example, in a recent article, Vitalik stressed the importance of open standards such as cross-L2 transfers to achieve better alignment and open collaboration within the Ethereum ecosystem.

To address these issues, chain abstraction aims to abstract and encapsulate the functionality of multi-chain systems, allowing users and developers to interact with blockchains without having to understand the underlying operations.

For users: Chain abstraction can significantly reduce the learning curve for complex cross-chain operations in Web3 applications.

For developers: Through a unified interface, chain abstraction can significantly reduce the development barriers to creating dApps and greatly improve the portability of dApps between different blockchain ecosystems.

3. Development History: Where Chain Abstraction Comes From and Where It Will Go

3.1 Centralized Exchanges (CEXs): Early Chain Abstraction and Its Centralization Dilemma

As the solution with the largest user base in the industry, CEXs remain the most successful application for implementing cross-chain transactions. CEXs provide Web3 users with a cost-effective trading environment, meeting the main needs of early Web3 adopters. With the emergence of decentralized mining solutions and the expansion of multi-chain ecosystems, CEXs eliminate the need for users to independently manage multi-chain assets. Instead, they provide simplified access through centralized intermediaries, allowing users to easily participate in on-chain products such as DeFi liquidity mining, PoS staking, and even financial services. It is worth noting that at one time, exchanges also acted as voting agents in PoS projects.

However, in an industry driven by decentralized technology, most users rely on centralized intermediaries to participate in innovative products, which obviously contradicts the core principle of decentralization.

3.2 DEX+Bridge: Solutions and Challenges in the Multi-Chain Era

With the development of decentralized blockchain networks, DeFi products such as Uniswap have emerged, providing convenient and user-friendly interfaces that enable users to directly participate in on-chain transactions. However, the growth of multi-chain ecosystems has brought huge barriers for users to enter the blockchain field. Therefore, the combination of decentralized exchanges (DEXs) and cross-chain bridges has become a widely adopted solution to solve the multi-chain challenge. Users can use DEX to exchange their existing assets into intermediary tokens, which can then be transferred to the target chain through a cross-chain bridge and converted into the desired tokens through another DEX on the destination chain.

However, the high gas fees and operational complexity on the chain, coupled with the associated security risks, have caused many users to turn back to centralized exchanges (CEXs) as the key intermediaries connecting different blockchain networks.

This raises a key question: In DEX+bridging solutions, how can we provide a seamless user experience like CEXs under the challenges of high gas fees, operational complexity, and security risks? Therefore, the focus of solutions has shifted to chain abstraction.

4. Exploration: Where will chain abstraction go?

Currently, solutions to achieve chain abstraction can be roughly divided into two main approaches.

4.1 Intent-centric solutions: based on the DEX+bridging problem

First, the proposed solution is to solve the problems brought about by the DEX+bridging combination. In the DEX+bridge scenario, users usually have the following needs: they want to exchange token b on chain A for token d on chain C, and they need to pay a (Gas fee on chain A), and they also need c (Gas fee on chain C) to complete the future transfer of d tokens. This process involves at least three exchanges and cross-chain operations, which is extremely complicated. However, the user's actual intention is to simply exchange b for d. Therefore, the user-intent-centered intent model allows users to only express their desired end result, and the protocol and application layers are responsible for handling the complex intermediate steps to provide a nearly seamless user experience.

Although the intent model simplifies on-chain operations, the increasing complexity of on-chain requirements (such as LRT redemption and cross-chain MEV) brings new challenges. The development of infrastructure designed to simplify these operations (such as cross-chain bridges and abstract accounts) lags behind the complexity of on-chain activities. In fact, the current intent implementation has not significantly reduced the complexity of multi-chain interactions. On the contrary, transaction execution and total cost rely heavily on third-party solutions and fail to meet widely adopted standards.

4.2 Chain Virtualization: Inspired by CEX Experience

Another solution is chain virtualization, which solves the fundamental problem of multi-chain fragmentation and attempts to replicate the seamless experience of centralized exchanges.

In the virtualization framework, the establishment of unified basic liquidity is crucial. Drawing on the architecture of CEX, the concept of chain virtualization was proposed. This innovative infrastructure technology aims to abstract the complexity of managing multiple heterogeneous blockchain networks, enabling developers and users to interact with different blockchain ecosystems through a unified interface. This eliminates the need for trust intermediaries such as bridges, allowing developers to focus on innovation and programming without worrying about the complexity of different blockchain protocols. Users can also enjoy a seamless user experience at the CEX level on the chain, which is very beneficial for enhancing user acquisition and promoting the mass adoption of blockchain technology.

The concept of virtualization was proposed by the core members of Cycle Network in 2019, and by the end of 2022, they launched the development of Cycle Network. In 2023, Placeholder also mentioned the importance of virtual Rollup in an article, thus verifying the prospects of Cycle's research direction since 2019.

Through Verifiable State Aggregation (VSA), Cycle Network supports bridgeless cross-chain liquidity abstraction, enabling secure, trustless interaction across Bitcoin and EVM-compatible blockchains. This infrastructure has changed the blockchain field, making the development of cross-chain decentralized applications (dApps) easier while maintaining cross-chain security and verifiability.

As chain virtualization matures, it can be compared to the development of cloud infrastructure on the traditional Internet. Just as cloud technology abstracts the complexity of physical server management and drives the explosive growth of Internet applications, chain virtualization will accelerate the arrival of true Web3 native universal programmability, opening up the next wave of dApp innovation growth and large-scale adoption.

5. Frontier Examples of Chain Abstraction

I have selected the following projects as examples to further illustrate the importance of chain abstraction. Each project represents its unique technical approach.

5.1 Intent Model

5.1.1 Everclear: Improving the Efficiency and Decentralization of Intent Solvers

Technology/Product Features

As mentioned above, in the intent model, users specify the desired end result, and solvers (fillers, forwarders) execute the intent and get paid. In this process, most operations rely on third-party execution, and solvers play a key role. However, many solvers are still centralized at present.

Everclear proposes a solution from the perspective of a decentralized solver, aiming to reduce reliance on centralized entities and achieve a more decentralized intent execution process.

Everclear focuses on solving problems such as inefficient rebalancing that arise in the intent model. To eliminate this inefficient cross-chain overhead, Everclear proposes a clearing layer in which intents with opposite directions can offset each other, thereby reducing the cost of rebalancing.

Here is its architecture and the steps for the solver to execute intent:

Create intent messages: Users generate intents and periodically send intent messages from the source chain to the central domain through the transport layer (Hyperlane).

Auctions: In the central domain of Everclear Rollup, intents that can be matched become deposits, while intents that cannot be matched become invoices. These invoices enter a Dutch auction, which is gradually discounted (up to a maximum threshold) until they are bought and cleared.

Padding Messages: When a solver executes an intent, a padding message is sent from the target domain to the central domain, using a transport layer (Hyperlane).

Settlement Messages: When both the intent and padding messages arrive in the central domain, a settlement message is sent from Everclear Rollup to the target domain. The solver gets paid.

Stakeholders

Product Level:

Infrastructure Level:

Roadmap

5.1.2 Particle Network: User-friendly universal account

Technology/Product Features

In order to solve the problems of cross-chain asset non-composability and complex user interfaces with high barriers to entry, Particle Network has focused on wallet abstraction since 2022 and expanded to chain abstraction earlier this year.

Wallet Abstraction: The first phase of Particle Network focuses on wallet abstraction, lowering the threshold for Web2 users to enter Web3. Its Smart Wallet as a Service (WaaS) has the following features:

Embedded Wallet: The wallet and the operations of authorizing transactions and signatures are directly embedded in the application, and users do not need to switch to a third-party wallet.

Social Login: In addition to Web3 wallets, users can also log in using Web2 social accounts (such as Google, Apple, X accounts, and emails).

Integration with Account Abstraction (AA): Developers can integrate AA into their dApps, enabling smarter features such as Gas sponsorship and batch transactions.

Chain Abstraction: Particle Network has further expanded to chain abstraction by introducing modular Layer 1 in March 2024 and launching universal accounts in July 2024.

At the application level, universal accounts have two highlights:

Universal Accounts: A slogan highly summarizes: "One account, one balance, support any blockchain".

Universal Gas: For example, $ETH can be used to pay for Gas on the Particle testnet.

However, a necessary condition for these two functions is universal liquidity. Particle Network achieves universal liquidity through the design of "swap and release":

Swap: When a user conducts a cross-chain transaction, its universal account (UA) interacts with the native DEX to exchange existing tokens for intermediary tokens (such as $USDT) accepted by liquidity providers (LPs).

Release: LP receives these assets on the source chain, deducts a small fee, and releases the corresponding amount of necessary assets on the target chain. This is similar to the solver in the intent model.

Stakeholders

Roadmap

2022: Particle Network is established

2024Q1: Upgrade from wallet abstraction to chain abstraction and launch Particle Layer 1

2024Q3: Launch universal account

5.2 Virtualization

5.2.1 Polymer: Bringing Cosmos IBC to Ethereum

Technology/Product Features

Polymer aims to become a "port city" between blockchains, enhancing its interoperability by introducing Cosmos IBC to Ethereum. However, Ethereum itself does not support IBC. Therefore, Polymer proposes a solution for virtual IBC.

In the native IBC framework, there are four steps to pass a data packet:

Pass: pass the data packet containing the data to the channel.

Update: The forwarder obtains the latest state of chain A and updates the chain A client on chain B.

Forward: The forwarder forwards the data packet to chain B.

Verify: Chain B verifies the data packet based on its knowledge of the state of chain A. However, Ethereum and its Layer 2 do not support IBC, so it cannot adopt this design. Instead, it can outsource the transfer task (the overhead associated with IBC) to Polymer. Polymer solves this problem with its innovative “virtual IBC” (vIBC), which consists of the following parts:

vIBC Core Layer (Layer 2)

This is the smart contract implementation of the IBC processor, similar to an IBC post office, responsible for processing cross-chain messages so that they can be understood by Layer 2.

vIBC Forwarder

It establishes communication between Layer 2 and the Polymer Hub, similar to a “bilingual” postman who understands both IBC and smart contracts.

vIBC module on Polymer Hub (Polymer's Layer 2)

This module receives vIBC core events on Layer 2 and translates them into something that the standard IBC module can understand, similar to translating a foreign language letter and telling the locals how to act.

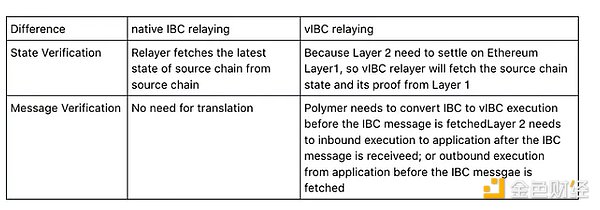

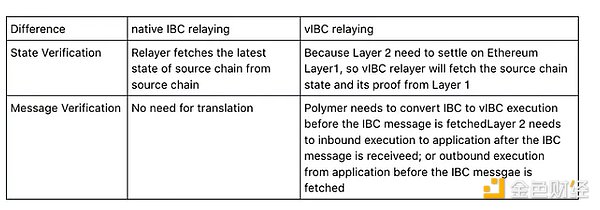

Two major differences from native IBC forwarding and vIBC forwarding:

Stakeholders

Product level: Layer 2, Raas providers and abstract protocols that require IBC interoperability.

Infrastructure level: Verification service providers (such as Lagrange, Witnesschain, etc.) can integrate with Polymer Hub to provide different verification solutions to help developers optimize their use cases.

Roadmap

5.2.2 Cycle Network: Virtualization

Technology/Product Features

In order to truly achieve inter-chain virtualization (defined in Section 4.2), it is key to ensure verifiable and trustless aggregation of states between different chains, which may have incompatible definitions of finality.

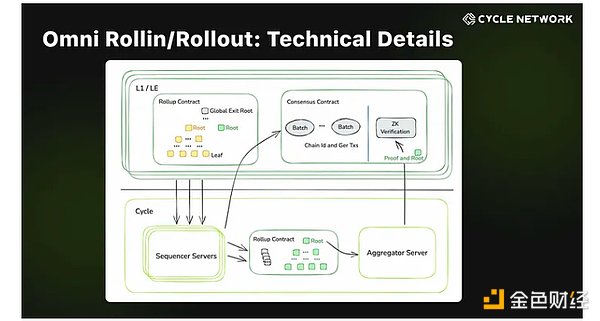

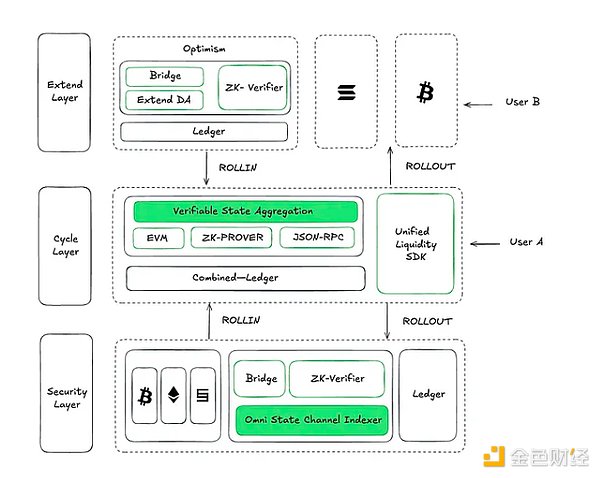

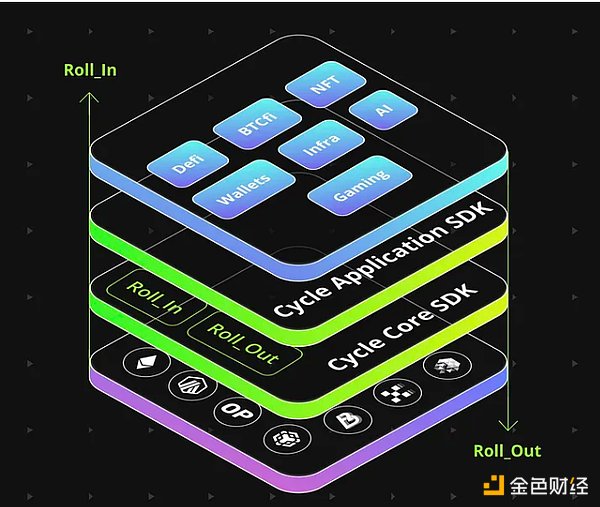

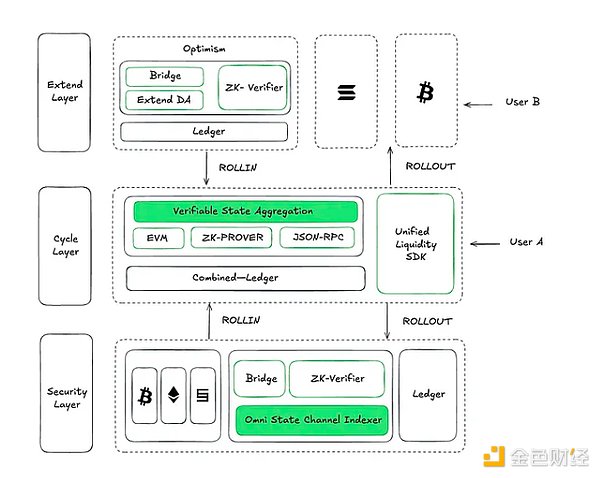

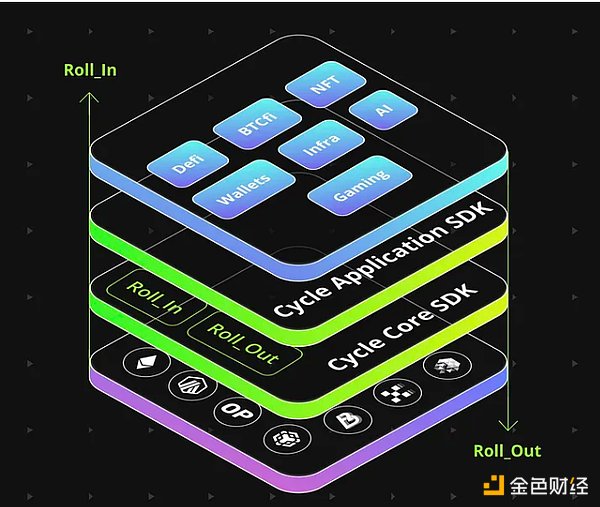

Cycle Network proposes a full-chain state solution based on Verifiable State Aggregation (VSA) and Full State Channel Indexer (OSCI). From the perspective of layered blockchain architecture, Cycle's framework can be divided into security layer, extension layer, and Cycle layer.

Security Layer

This layer inherits the security and stability of Ethereum. The consensus mechanism guarantees state security, ensuring that two nodes will not present conflicting results. It also provides a guarantee that transactions are finalized within a limited time.

Extension Layer

The extension layer consists of source and target chains (such as Layer 2 and application chains). Cycle Network establishes an endpoint on each chain to verify that the information received constitutes a complete set, allowing fully decentralized indexers to achieve extended data availability for these chains.

Cycle Layer

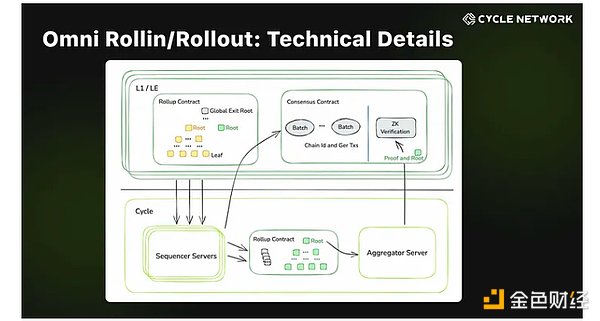

All transactions in Cycle Network, including cross-chain transactions between the security layer and the extension layer and internal transactions within the Cycle layer, together generate the aggregate state of Cycle. The root state of Cycle is generated by zkEVM and submitted to the chain on the extension layer for verification.

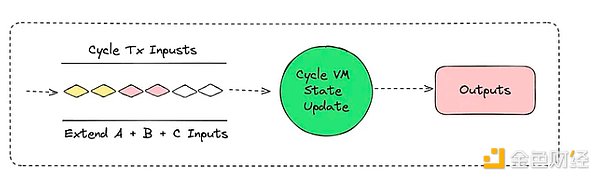

The core module of this design is VSA implemented through OSCI. The figure below shows the transition of the state machine of Cycle Network as the extension layer continues to increase.

State Synchronization

Chains in the Extension Layer update their states to the Cycle Layer, as indicated by the vertical arrows. The horizontal arrows within the Cycle represent the block production process from left to right. Each block in the Cycle layer is also synchronized to the Ethereum mainnet for verification and finalization.

Cycle State Updates

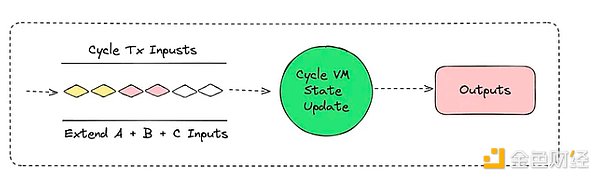

When a new chain joins the Extension Layer, as shown below, its transactions (white transactions) are processed by OSCI along with transactions from other chains (yellow and red transactions), resulting in state updates in the Cycle VM (green). As long as the order of transactions is certain, the final state is certain. Since the necessary data required to rebuild the Cycle is available, third parties can verify all finalized states on the Cycle.

Thanks to the verifiable and trustless design of the Cycle layer, chain virtualization is seamlessly implemented through the Rollin and Rollout interfaces, and developers can integrate in just 30 minutes. This simplified process not only improves development efficiency, but also provides bridge-free access to comprehensive cross-chain liquidity, enabling developers to have unparalleled capabilities in their projects. In addition, the upcoming Cycle application SDK will support more assets and provide direct access to enable specific use cases. This advancement will effectively meet a variety of customization needs and provide solutions for specific use cases and development environments.

Stakeholders

Product level:

Layer 1/Layer 2, hoping to achieve long-term ecological expansion by increasing the number of accessible users.

Developers who hope to significantly improve development efficiency through virtualization.

dApps that need access to full-chain liquidity.

Assets that want to find use cases across chains.

Infrastructure level:

Roadmap

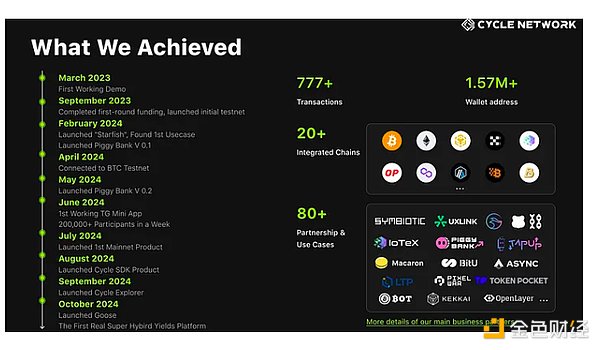

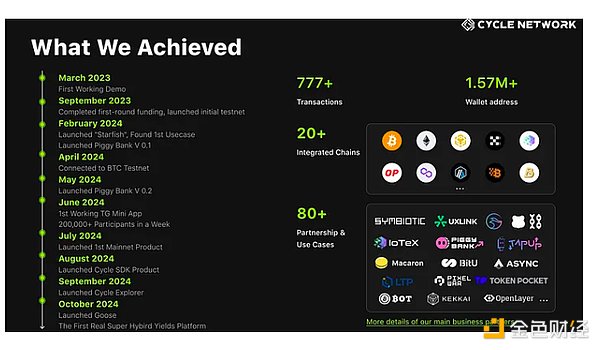

2022: Cycle Network is established

March 2023: The first demonstration is successful

February 2024: The first testnet StarFish and the first product PiggyBank are launched

April 2024: Connected to the BTC testnet

May 2024: PiggyBank V2 is launched

June 2024: The first TG mini application is launched, attracting more than 200,000 users to participate

Q4 2024: Beta mainnet is about to be released

To date, more than 777,000 transactions have been completed on Cycle Network, connecting more than 1.57 million wallets, with 300,000+ users and more than 80 partners. As the first full-chain asset management platform on Cycle Network, PiggyBank has witnessed the issuance of more than 250,000 assets.

6. From Uniswap to Unichain: Cross-chain based on Rollup is the future

From Uniswap v1 to v4, and then to UniswapX and Unichain, the development path of Uniswap Labs is a perfect example of the above evolution. Over the past six years, Uniswap has always followed a consistent principle: identifying the bottleneck of decentralized finance (DeFi) and solving it.

Analyzing the history of Uniswap, there are several key features worth noting:

Three eras: from decentralized exchange (DEX) to application chain (Appchain)

With the change of mission, the versions of Uniswap can be divided into three eras. The DEX era laid the foundation of DeFi, the intention era showed experiments to improve user experience (UX), and the DeFi chain era showed that cross-chain solutions based on Rollup may be the most promising way to trigger the future of DeFi.

Inspired a group of similar projects

After each new version is released, there are usually many similar projects inspired by its solutions to follow up, which is not limited to the Ethereum ecosystem, but also includes DeFi in other Layer 1. For example, the automatic market maker (AMM) in v1, the centralized liquidity in v3, the transaction netting processing in v4, and the intention model in UniswapX.

Chain abstraction as the key to driving the next generation of DeFi

While ensuring decentralization and a seamless user experience, Uniswap takes chain abstraction as the next step and announces Unichain as a new strategy to solve the problem of liquidity fragmentation.

The same concept as chain virtualization further proves the feasibility and reliability of chain virtualization to support future Web3 innovations and become the foundation of future DeFi. Cycle Network has been working on chain virtualization for two years, with the goal of enabling developers on all chains to access chain virtualization through a unified interface without having to migrate to other chains. The complexity of handling multiple blockchain networks has been simplified to Rollin and Rollout interfaces, and projects can be seamlessly integrated in 30 minutes to obtain cross-chain liquidity without leaving their original blockchain.

7. Conclusion

In summary, the evolution of chain abstraction from CEX inspiration to virtualization marks an important progress in blockchain technology. This journey, from CEX inspiration to including DEX + bridging and intent models, eventually evolved into chain virtualization, which abstracts complexity and empowers developers and users through a unified interface. The evolution from Uniswap to Unichain also emphasizes that virtualization is the key to solving the current DeFi bottleneck and lays the foundation for the future DeFi "home".