Ethereum vs. Solana: Advantages and Challenges

This article compares Ethereum and Solana, exploring their strengths and weaknesses. We hope that readers will gain a clearer understanding of the uniqueness of each platform.

JinseFinance

JinseFinance

< span style="font-size: 14px;">Vitalik Buterin | Founder of Ethereum

One of my most unforgettable memories ten years ago , is a pilgrimage to the area of Berlin known as the “Bitcoin Community”: a place in the Kreuzberg district where there are about a dozen shops, just a few hundred meters apart, all accepting Bitcoin as a method of payment . The heart of this community is "Room 77", a restaurant and bar run by Joerg Platzer. Not only does it accept Bitcoin payments, it also serves as a community center, attracting open source developers, political activists of all stripes, and other diverse figures.

Room 77, 2013. Source: my article from 2013 on Bitcoin Magazine.

Another similar memory from about two months ago was PorcFest (“ Porc" for "Porcupine" for "Don't Tread on Me"), a gathering of liberals in the woods of northern New Hampshire. There, the main way to get food is through small pop-up restaurants like Revolution Coffee and Rebel Soup Salad Smoothies, which of course also accept Bitcoin payments. Here, discussing Bitcoin’s deep political significance and using it in everyday life coexist.

The reason I mention these memories is that they remind me of the deeper vision behind cryptocurrencies: we are not here to just create isolated tools and games, but to comprehensively build a freer and more open social and economic system in which technological, social and economic parts adapt to each other.

Early visions of "web3" were of this type, moving in a similarly idealized but slightly different direction. The term "web3" was originally coined by Ethereum co-founder Gavin Wood, and represents a different way of thinking about Ethereum: rather than what I initially thought of as "Bitcoin plus smart contracts," Gavin sees it more broadly Consider it one of a series of technologies that can come together to form the base layer of a more open Internet.

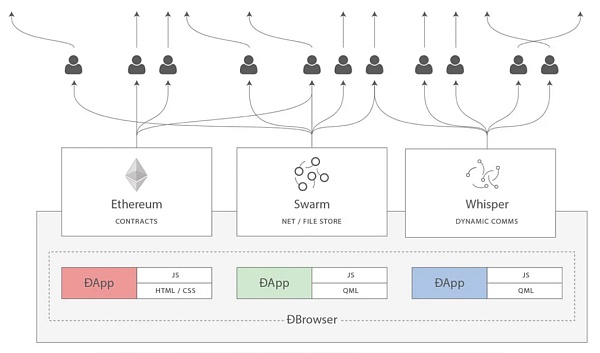

A diagram used by Gavin Wood in many of his early talks

In When the free and open source software movement began in the 1980s and 1990s, software was simple: it ran on your computer and read and wrote files stored on your computer. But today, most of our important work is collaborative, often at scale. So even if the underlying code of the app is open and free, your data is routed through a centralized server operated by a company that can read your data at will, change the rules, or cancel your access at any time. Access rights. So if we want to extend the spirit of open source software into today's world, we need to give programs access to a shared hard drive to store content that multiple people need to modify and access. So what is Ethereum and sister technologies like peer-to-peer messaging (originally Whisper, now Waku) and decentralized file storage (originally just Swarm, now also IPFS)? They are a public decentralized shared hard drive. This was the original vision from which the now ubiquitous term “web3” was born.

Unfortunately, since around 2017, these visions have somewhat receded into the background. There’s very little talk about consumer cryptocurrency payments, the only non-financial application using it at scale is ENS, and there’s a huge ideological rift in which a sizable portion of the non-blockchain decentralized community believes the crypto world is a A distraction rather than a like-minded spirit and powerful ally. In many countries, people do send and save money via cryptocurrencies, but they usually do so through centralized means: either through internal transfers from a centralized exchange account, or by trading USDT on Tron.

Having lived through that era, I believe the primary reason for this shift is the rise in transaction fees. When the cost of writing on the chain is only $0.001, or even $0.1, you can imagine people making all kinds of applications that use the blockchain in various ways, including non-financial applications. But when transaction fees exceed $100, as happened at the peak of the bull market, only one type of user is willing to participate—in fact, they are willing to participate even more because they have become richer because the price of the currency has increased: that Just a gambler. It’s acceptable for a moderate amount of gamblers, and I’ve met many people at events who initially joined crypto for the money, but ended up staying for the ideals. But when they become the largest group using the chain at scale, it changes public perception and the internal culture of the crypto space, and leads to many of the other negative impacts we’ve seen over the past few years.

Now, fast forward to 2023. We actually have a lot of good news to share on core challenges like scalability, as well as on the various "side quests" of building a realistic cyberpunk future:

Rollups start to really exist.

After a period of lull following the regulatory crackdown on Tornado Cash, second-generation privacy solutions like Railway and Nocturne are starting to gain traction.

Account abstraction has become popular.

Light clients, long forgotten, begin to really exist.

Zero knowledge proofs, a technology we thought would be decades away, has now emerged and is becoming more and more suitable for developers used and will soon be available for consumer applications.

Two things: the growing awareness that unfettered centralization and over-financialization should not be “the be-all and end-all of crypto” and the above-mentioned The key technologies that are finally starting to materialize provide us with an opportunity to move things in a different direction. Specifically, making at least part of the Ethereum ecosystem truly the permissionless, decentralized, censorship-resistant, open-source ecosystem we originally wanted to build.

What are these values?

These values are shared not only by many in the Ethereum community, but also by other blockchain communities and even non-blockchain decentralized Communities share this, although each community has its own unique combination of these values and the emphasis on each value varies.

Open global participation: Anyone in the world should be able to participate as a user, observer, or developer, as equally as possible. Participation should be permissionless.

Decentralization: Minimize the application's dependence on any single participant. In particular, an application should continue to work even if its core developer disappears forever.

Censorship Resistance: Centralized actors should not have the power to interfere with the operation of any specific user or application. Concerns about bad actors should be addressed at higher levels of the architecture.

Auditability: Anyone should be able to verify the application's logic and its ongoing operation (e.g., by running a full node) to ensure that it follows its The rules run as claimed by the developers.

Trusted neutrality: The base layer infrastructure should be neutral, and in a way that even people who do not trust the developers can see its neutrality Sexual way.

Build tools, not empires. Empires seek to capture and trap users within walled gardens; tools accomplish their tasks but otherwise interoperate with the wider open ecosystem.

Collaborative mentality: Even when competing, projects within an ecosystem share software libraries, research, security, community building, and other things that are of mutual value to them cooperation in the field. Projects strive to achieve a positive-sum game, not only with each other, but also with the wider world.

It is very possible to build something within the crypto ecosystem that does not adhere to these values. One could build a system that is called a "second layer" but is actually a highly centralized system secured by multi-signatures, with no intention of ever moving to something more secure. One could build an account abstraction system that attempts to be "simpler" than ERC-4337, but at the cost of introducing trust assumptions, which ultimately eliminates the possibility of a public memory pool and makes it harder for new builders to join. One could build an NFT ecosystem where the content of the NFT is needlessly stored on a centralized website, which is more fragile than if those components were stored on IPFS. One could also build a staking interface that point users unnecessarily to what is already the largest staking pool.

Resisting these pressures is difficult, but if we don’t we risk losing the unique value of the crypto ecosystem and rebuilding one that is additionally inefficient and redundant A clone of the existing web2 ecosystem.

It took sewers to make the Teenage Mutant Ninja Turtles

The crypto space is an unforgiving environment in many ways. Dan Robinson and Georgios Konstantiopoulos made this point vividly in a 2021 article discussing the background of MEV, arguing that Ethereum is a dark forest where on-chain traders are constantly faced with being traded by bots The risk of exploitation is that these robots themselves are also easily counterattacked and exploited by other robots, etc. This is true in other ways as well: smart contracts are hacked regularly, user wallets are hacked regularly, centralized exchanges fail even more spectacularly, and so on.

This is a huge challenge for users in the encryption field, but it also provides an opportunity: it means we have a space to experiment and incubate And get rapid on-site feedback on a variety of security technologies to address these challenges. We have seen successful responses to the challenge in different contexts:

Everyone wants the Internet to be safe. Some seek to make the internet safe by promoting approaches that rely on a single specific actor, whether a company or government, who can serve as a centralized anchor of security and truth. But these approaches sacrifice openness and freedom and lead to the growing tragedy of a “divided internet.” People in the crypto space place a high value on openness and freedom. The level of risk and high financial stakes means that security cannot be ignored in the crypto space, but a centralized approach to security implementation is not feasible for a variety of ideological and structural reasons. At the same time, the crypto space is at the forefront of very powerful technologies such as zero-knowledge proofs, formal verification, hardware-based key security, and on-chain social graphs. These facts taken together mean that, for the crypto space, an open approach to improving security is the only way to go.

This all goes to show that the crypto world is a perfect testing environment to actually apply its open and decentralized security approach to a real-life high-stakes situation environment and mature it to the point where it can be applied in the wider world. This is one of my visions for the idealized and chaotic parts of the crypto world, and how the crypto world as a whole and the broader mainstream world can transform their differences into symbiotic relationships rather than ongoing tensions.

Ethereum as part of a broader technology vision

In 2014, Gavin Wood introduced Ethereum as one of a set of tools that could be built on, the others being Whisper (decentralized messaging) and Swarm (decentralized storage). The former has received significant emphasis, but with the turn toward financialization around 2017, the latter two have unfortunately received less attention. Despite this, Whisper continues to exist as Waku and is actively used by projects like decentralized messaging app Status. Swarm development continues and now we also have IPFS, which is used to host and serve this blog.

In the past few years, with the rise of decentralized social media (such as Lens, Farcaster, etc.), we have had the opportunity to revisit these tools. Additionally, we have another very powerful new tool to join the trio: zero-knowledge proofs. The most widespread application of these technologies is as a way to improve Ethereum's scalability, namely ZK rollups, but they are also very useful for privacy. In particular, the programmability of zero-knowledge proofs means we can escape the false dualism of “risk of anonymity” vs. “KYC-verified and therefore secure” while simultaneously enabling privacy and many kinds of authentication and verification.

An example in 2023 is Zupass. Zupass is a system based on zero-knowledge proofs. It is incubated at Zuzalu and is used not only for authentication of face-to-face events, but also for online authentication to the voting system Zupoll, Twitter-like Zucast, etc. The key feature of Zupass is that you can prove that you are a resident of Zuzalu without revealing which member of Zuzalu you are. Additionally, each Zuzalu resident can only have one randomly generated cryptographic identity per application instance they log into (e.g., a poll). Zupass was so successful that it was later adopted for Devconnect's ticket processing within a year.

A zero-knowledge proof that, as an employee of the Ethereum Foundation, I have permission to enter the Devconnect shared office space.

Perhaps the most useful application of Zupass so far is voting. A variety of polls have been conducted, some on politically controversial or highly personal topics, and there is a strong need for people to protect their privacy using Zupass as an anonymous voting platform.

Here we can begin to see the outlines of an Ethereum-esque cyberpunk world, at least on a purely technical level. We can hold Ethereum and ERC20 tokens, as well as various NFTs, and use a privacy system based on stealth address and privacy pool technology to protect our privacy while preventing known bad actors from profiting from the same anonymity set. Whether in our DAO, to help decide changes to the Ethereum protocol, or for any other purpose, we can use zero-knowledge voting systems that can use a variety of credentials to help identify who has the right to vote and who does not : In addition to the token-based voting done in 2017, we can also have anonymous voting by people who contribute enough to the ecosystem, people who participate in enough activities, or one vote per person.

Face-to-face and online payments can be enabled through ultra-cheap transactions on L2 that leverage data availability space (or off-chain data secured with Plasma) as well as data Compression provides users with ultra-high scalability. Payments from one rollup to another can be achieved through decentralized protocols such as UniswapX. Decentralized social media projects can use various storage layers to store activities such as posts, retweets, and likes, and use ENS (using CCIP on L2) for usernames. We can achieve seamless integration of on-chain tokens with off-chain proofs and personal holdings in a zero-knowledge proof manner through systems such as Zupass.

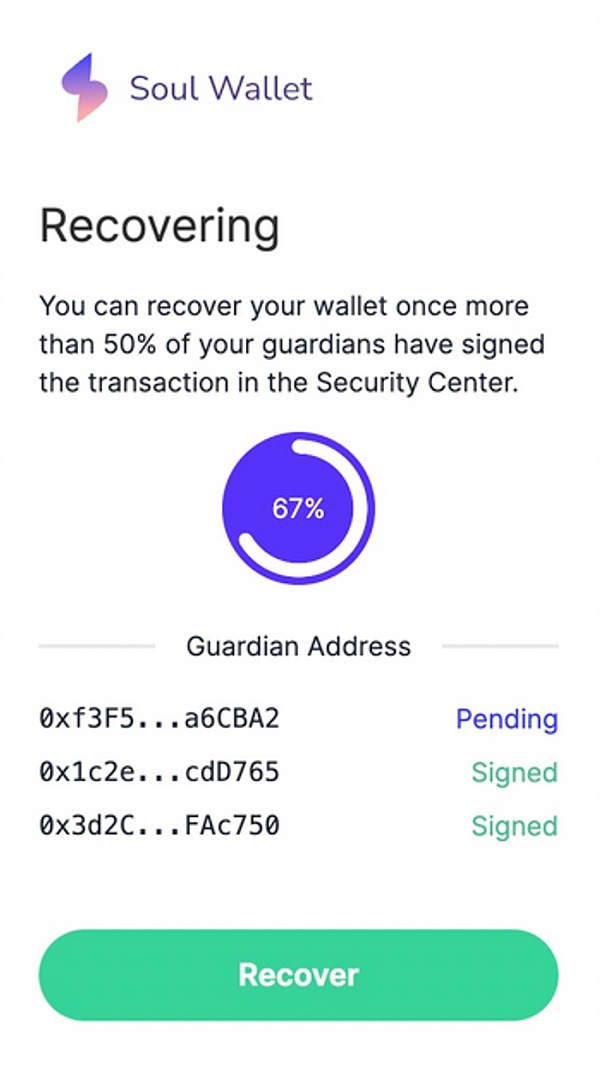

Mechanisms such as quadratic voting, cross-tribal consensus finding, and prediction markets can be used to help organizations and communities govern themselves and stay informed, based on blockchain and zero Knowledge-proven identities can insulate these systems from centralized internal censorship and external coordinated manipulation. Sophisticated wallets can protect people as they participate in dapps, user interfaces can be published to IPFS and accessed as .eth domains, and hashes of HTML, javascript, and all software dependencies can be updated directly on-chain via the DAO. Smart contract wallets, originally designed to help people not lose their tens of millions of cryptocurrencies, will expand to protect people's "identity roots", creating a more secure system like "Sign in with Google" from a centralized identity provider .

"Soul wallet recovery interface". I personally would rather trust my funds and identity to a system like this than a centralized web2 recovery system.

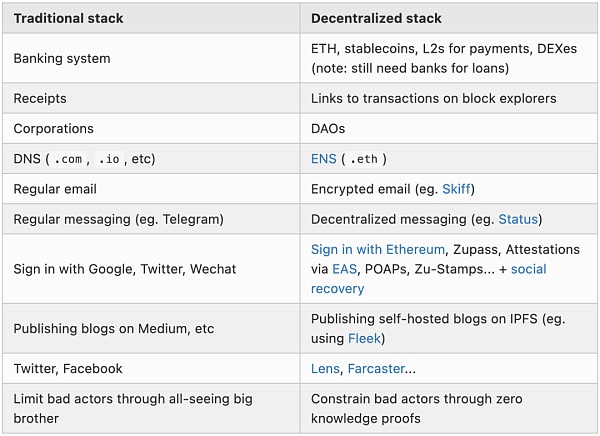

We can think of the broader Ethereum ecosystem (or "web3") as creating an independent technology protocol stack that is compatible with traditional Competition for centralized protocol stacks. Many people mix the two protocol stacks, and there are often clever ways to combine them: with ZKEmail, for example, you can even make an email address one of the keepers of your social recovery wallet! But at the same time, there are many synergies in using different parts of the decentralized stack, especially if they are designed to better integrate with each other.

One of the benefits of thinking of it as a stack is that it fits well with Ethereum's pluralist ethos. Bitcoin attempts to solve one or at most two or three problems. Ethereum, on the other hand, has many sub-communities that focus on different areas. There is no single dominant narrative. The goal of this stack is to promote this diversity while working toward increasing interoperability among it.

Say “people who do Corrupting influences and bad people, people who do Y are the real ones” is easy. But this is a lazy response. To be truly successful, we not only need a vision for the technology stack, but also a social stack that makes the construction of the technology stack possible.

The advantage of the Ethereum community is that in principle we value incentives. PGP wanted to let everyone have cryptographic keys so that we could actually sign and encrypt emails, and it basically failed for a few decades, but then we got cryptocurrencies and suddenly millions of people had it in their hands publicly with them associated keys, we can start using those keys for other purposes—including going back to the starting point of encrypted email and messaging. Non-blockchain decentralized projects are often chronically underfunded, while blockchain-based projects have been able to secure $50 million in Series B funding. We got people to stake their ether to secure the Ethereum network, not out of charity on the part of the stakers, but out of their own self-interest—and we gained $20 billion in economic security as a result.

At the same time, incentives alone are not enough. DeFi projects often start out humble, collaborative, and maximizing open source, but sometimes begin to abandon these ideals as they grow in size. We can incentivize stakers to participate with very high uptime, but it is much harder to incentivize stakers to decentralize. This may simply not be possible through intra-protocol means alone. Many key parts of the “decentralized stack” described above do not have viable business models. The governance of the Ethereum protocol itself is significantly de-financial – making it more robust than other ecosystems whose governance is more financial. This is why it’s valuable for Ethereum to have a strong social layer that can forcefully enforce its values in places where pure incentives cannot — but without creating a form of “Ethereum consensus” that becomes a new form of political correctness "concept.

A balance needs to be found between these two aspects, but a more appropriate term is not balance, but integration. There are many people who initially came into contact with the crypto space out of a desire to get rich, but then they came to understand the ecosystem and became ardent believers in building a more open and decentralized world.

How do we truly achieve this integration? This is a critical question, and I suspect the answer lies not in some magic solution but in a series of technologies arrived at through iteration. The Ethereum ecosystem has been more successful than most in encouraging a collaborative mentality among second-tier projects. The large-scale public goods funding of Gitcoin Grants and Optimism’s RetroPGF round in particular is also very helpful, as it provides another revenue channel for developers who are unwilling to sacrifice their values, even if they don’t see any traditional business model. But these tools are still in their early stages, and there is still a long way to go to improve these specific tools, as well as identify and cultivate other tools that may be better suited to specific problems.

This is where I see the unique value proposition of the Ethereum social layer. There’s a unique middle ground blend of valuing incentives without being consumed by them. There is a unique blend of valuing a warm and cohesive community while remembering that feeling "warm and cohesive" from the inside can easily look "oppressive and exclusive" from the outside, and valuing the rigidity of neutrality, open source, and censorship resistance Norms, as a safeguard against the risk of community drives going too far. If this mix is realized well, it will in turn be in the best position to realize its vision on both an economic and technological level.

This article compares Ethereum and Solana, exploring their strengths and weaknesses. We hope that readers will gain a clearer understanding of the uniqueness of each platform.

JinseFinance

JinseFinanceThe Dencun hard fork has been completed on the Goerli, Sepolia and Holesky testnets, and the mainnet will be launched on Epoch 269568 (approximately March 13, 2024).

JinseFinance

JinseFinanceHeroes of Mavia launches MAVIA token, engaging 100,000 players and NFT holders, with its value spiking 36% amidst a $95 million trading frenzy.

Brian

BrianInternational soccer superstar Lionel Messi has ventured into the world of esports by joining KRÜ Esports as a co-owner

Aaron

AaronLee Jung-hoon will not go to prison after Judge Kang Gyu-Tae proclaimed him not guilty of committing fraud.

cryptopotato

cryptopotatoOne of the significant discussions surrounding the Ethereum Merge launch is the hard fork of the Proof-of-Work.

Bitcoinist

BitcoinistDanny Ryan details the path forward for scalability and explains the possibility of stateless Ethereum, while sharing how the Merge will affect future upgrades.

Future

Future

Bitcoinist

BitcoinistWhile previous announcements cited a launch in the second quarter of 2022, Tim Beiko believes the "merger" will take "a few months" longer than planned.

链向资讯

链向资讯

Please enter the verification code sent to