When we look back at the GameFi-related projects (GambleFi is currently also classified as a GameFi project) that have received high financing and outstanding performance over the past 23 years, the high financing is mainly concentrated in the infra construction of the GameFi track such as the game platform and the game Layer3, and the most eye-catching ones are the pump.fun casino, which has attracted countless people since the beginning of the year, and the explosive Not and Telegram dot-dot mini-game ecosystems. This article will analyze the defensive investment logic behind this investment phenomenon and our attitude towards this investment logic.

1. GameFi market financing overview

Source: InvestGame Weekly News Digest#35: Web3 Gaming Investments in 2020-2024

2. A detailed analysis of three market phenomena in the past year, the logic, changes and doubts behind them

2.1 Phenomenon 1: Game platforms evolve from pure platforms to channels for attracting new users

“In addition to their strong survivability and long life cycle, game infrastructures have gradually evolved into channels for attracting new users, which is why they are so favored by VCs.”

Source: PANTERA

In addition, for the top game ecosystem, there is more than one fund like Pantera that has invested heavily in the ecological tokens of the top game platform - Ton. Ronin is also the secondary first choice of many VCs. The reason why the Ton ecosystem and Ronin are so popular with VCs may be attributed to the gradual evolution of the platform's role. The nearly one billion users carried on Telegram, the new users attracted to Web3 by small games such as Not, Catizen, and Hamster (Not users 30M, Catizen users 20M, paid users 1M, Hamster users 0.3B), or the new user groups that flow from the ecological traffic on Ton to the exchange after the listing of the coin, have brought new blood to the entire crypto world. Since March this year, Ton has announced more than $100 million in ecological incentives and multiple league bonus pools, but the later on-chain data shows that $Ton's TVL does not seem to have increased significantly with the outbreak of mini games. More users are directly converted to exchanges through pre-charge activities of exchanges. On Telegram, the lowest CPC (Cost-Per-Click) cost is only $0.015, while the average cost of acquiring a new account or customer on an exchange is $5-10, and the cost of acquiring each paying user is even more than $200, with an average of $350. The cost of acquiring and converting customers on Ton is much lower than that of the exchange itself. This also indirectly confirms why exchanges are now scrambling to list various Ton mini game tokens and memecoins.

Ronin's own accumulated user base provides many more customer acquisition opportunities for individual games to find users on their own, which can also be seen from the fact that high-quality games such as Lumiterra and Tatsumeeko have been migrated to the Ronin chain. The ability to increase users and attract new users that gaming platforms can bring seems to have become a new angle of favor.

2.2 Phenomenon 2: Short-term projects dominate the market and become the new favorite, but the user retention ability is questionable

"In the secondary market with poor liquidity, the flywheel and money-making effect of many games are directly and forcibly castrated, and the perpetual game becomes a one-time game. In the current bad cyclical environment, these short-term projects are closer to the defensive investment options of VCs' risk aversion, but whether the long-term retention ability of users is worthy of VCs' optimism and expectations, we still have doubts."

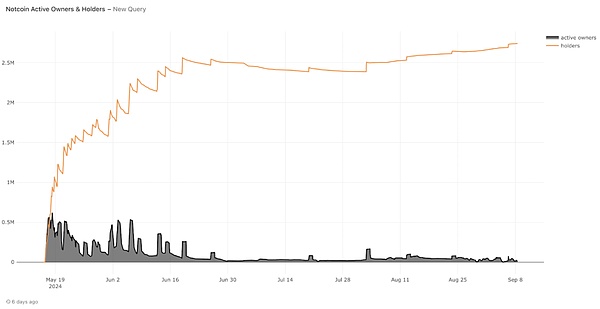

Take a look at the economic model of Not (short-term projects)

Source: Starli

From the former P2E game earning money, simple game level settings, auto chess mode, Pixel's vegetable planting and tree chopping to earn coins, to Not's popular click-to-earn, these projects with GameFi titles are gradually simplifying or even taking off the shell of Game. When the market is happy to pay, is it that everyone's acceptance is increasing, or is it becoming impetuous and impatient? Accept that since the essence of most GameFi is to use interaction instead of mining machines to run nodes to mine, why bother with those complicated game steps and modeling costs? It is better to use all the costs originally needed to develop the game as the initial cake of this Ponzi mine, and both parties will benefit.

Not This economic model is different from the previous GameFi flywheel model. The one-time unlocking of full circulation does not require the investment of initial costs. Users can exit the airdropped tokens as soon as they get them, and VCs no longer have to worry about locking up for two or three years. It is directly castrated from the continuous mining model to a short-term version that is more similar to the full circulation of memecoin. In addition, similar to the platform's new user assignment, the simple monetization game mechanism has attracted new users of Web2 to participate in Web3, and new users who have received airdrops and cashed out have been transferred to exchanges. The user traffic brought to the ecosystem and exchanges may be another reason why VCs are so optimistic about such projects.

The nature of the flywheel cycle and short-term projects are more in line with the current market, and the mid- and late-stage investment returns are questionable

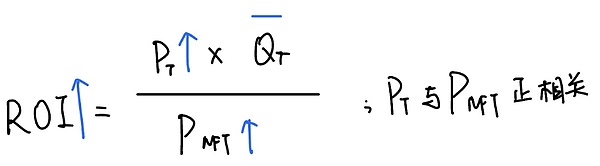

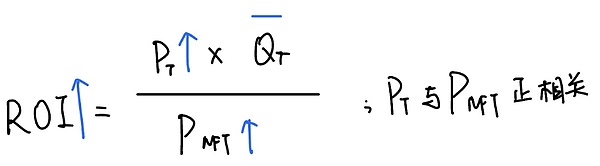

The former P2E (Play-To-Earn) game has a complete economic cycle, and whether the flywheel of this economic cycle can run depends on whether the players can calculate an acceptable ROI (Return on Investment). ROI=Net Profit/Net Spend is put into the P2E game, that is, the expected future income (the value of the mined mine)/NFT cost (mining machine cost). Therefore, in the P2E game, the formula for calculating the participants' income is:

ROI = Value of Future rewards/Acquisition Cost of NFT

Ignoring wear and tear and electricity costs for the time being, the larger the calculated ROI, the stronger the incentives for players. How to make the ROI as large as possible? Let's take a look at the formula.

Source: Starli, IOSG Ventures

Value of Future Rewards = Quantity of Future Rewards * Price of Future Rewards

V=P*Q

Value of Future Rewards = Quantity of Future Rewards * Price of Future Rewards

style="text-align: left;">When the value of income increases, either the amount of income obtained increases, that is, the token reward increases; or the price of income obtained increases, that is, the token price increases.

Bringing it into the Web3 economy, basically all token output settings are arcs that show a convergence trend, just like the halving cycle of Bitcoin. As time goes by, the output of tokens will become less and less, and the difficulty of mining will become higher and higher. Perhaps more expensive mining machines, that is, rarer NFTs, will have higher income, but it also adds extra costs. So when the quality of mining machines is not changed, the increase in the amount of income does not make sense.

Then there is a greater possibility that the price of future income will increase, that is, the price of the coins mined by players has been growing steadily. There is sufficient buying volume in the secondary market, and there will be no oversupply. Buying orders eat up all selling orders and there is still an upward trend. In this way, the numerator in ROI becomes larger.

When the denominator in ROI becomes smaller, ROI will naturally become larger, which means that the acquisition cost of NFT as a mining machine becomes lower. If the price of NFT traded in project tokens becomes lower, either the demand for the NFT becomes smaller and the supply becomes larger, or the price of the token as a medium of exchange and standard of measure decreases, causing the NFT price to fall from the outside.

The decrease in demand is naturally because the game's money-making attribute has weakened, and players have turned to other games with higher ROI to find opportunities. For settlements in other fiat currencies such as Ethereum solona, affected by the market, the price of mainstream currencies has fallen, and altcoins will definitely not be better. In this way, the price of NFT and the price of tokens must be positively correlated. Therefore, the numerator becoming larger and the denominator becoming smaller cannot exist at the same time. Their increase or decrease is synchronous and there is even a certain proportion of interaction between them.

This means that the most likely way to achieve a larger ROI is to increase the price of the expected return, and NFT will rise synchronously, but the increase is less than or equal to the increase in the price of the currency. The ROI can maintain stability or rise slowly, constantly motivating players. In this case, the new funds entering the Ponzi scheme are external forces and new additions, acting as amplifiers, and only when the price of the currency goes up in the bull market can the flywheel of the P2E game run. When the ROI is stable or even rises slowly, players will continue to reinvest the money they earn to snowball, and injection exceeds withdrawal. Axie is the most successful example of a flywheel cycle. Looking back at the games in this cycle, it seems that most of them were short-term fomo before going online, and then fell to the bottom overnight after FG. All tokens unlocked by airdrops became selling pressure, and after cashing out, they looked for the next one. There is no subsequent ROI, no reinvestment of funds and flywheel cycle, which has become the short-term responsibility of Diamond Hand. P2E is less heard, P2A is quietly popular, play to airdrop is a very scary concept, this title is like a one-time label for the game. The purpose of swindling is just to sell the airdrop to cash out when it is listed, rather than continuously looking for opportunities to earn in this game ecosystem. Although the times are different, the behavior of selling coins is the same, but in the current weak secondary market and the dead time of altcoins, the secondary coin price cannot run the flywheel, and there is no strong market maker to protect the market. The flywheel and money-making effect of many games are directly forcibly castrated, from loop to short-term, and the perpetual game becomes a one-time game. Looking back at the performance of Catizen and Hamster after TGE from this perspective, it also indirectly proves that the economic model is designed for the short term. There is no need to run the flywheel behind, so there is no need to pull the market. For such projects, we still have doubts whether the mid-to-late Token Funding is a deal with considerable returns.

The flywheel cycle requires a more sophisticated economic model and cost investment, while the short-term only requires the expectation of airdrop, because the task is achieved after listing, and the subsequent economic model can be castrated. The airdrop expectation is to make money from the liquidity difference between the primary and secondary markets. We can understand these short-term projects as another form of fixed deposit before reinvesting into the economy. Players invest the cost and traffic of NFT or pass cards as principal, give the time cost of retaining funds, and wait until the coin is listed to earn airdrop income and leave.

Such projects do not require cross-cycle operation time and uncertain economic cycles, and do not rely entirely on the market environment and fomo sentiment. The short and brilliant life cycle, the full circulation unlocking model allows VCs to no longer have the trouble of locking positions and have a faster exit time. At present, when the cyclical environment is not good, these short-term projects are closer to the defensive investment options of VCs' risk aversion.

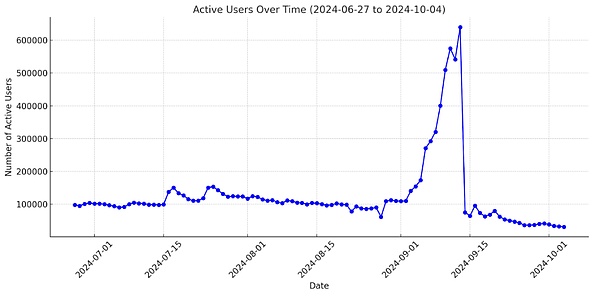

Users’ long-term retention ability is questionable

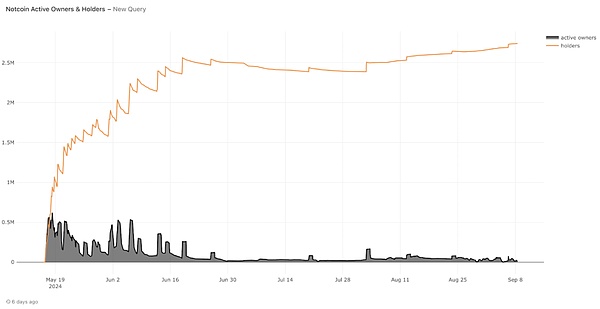

Whether it is Not, Catizen, hamsters or Dogs, they have brought a large wave of new user growth to exchanges such as Binance. But how many long-term users are actually retained in the ecosystem or on the exchange? Does the value of the new users match the expectations and investment of VCs?

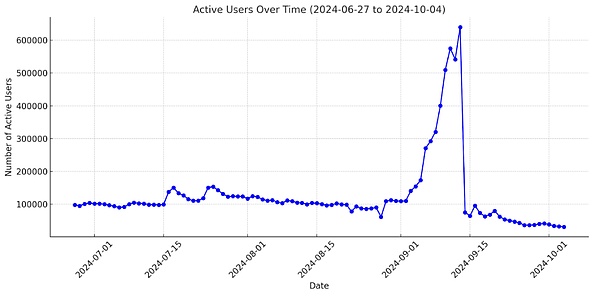

Source: IOSG Ventures

Let’s take a look at Catizen, one of the hottest mini-games in the Ton ecosystem. It only took one day for the number of active users to drop from 640,000 before the coin was issued to 70,000, and the subsequent user retention data was even more sluggish. From the perspective of long-term users, even if the game content does not change, after the airdrop expectation no longer exists, up to 90% or more of the users will immediately withdraw, and only about 30,000 people will eventually settle and remain. Does such a user retention rate meet the expectations of investors and achieve the purpose of attracting new users? Even if the users who received the airdrop turn to the exchange to bring an immediate wave of user growth, after selling the airdrop to realize the cash, will these users abandon Catizen like abandoning it? When the product itself transforms into a viral campaign, a short-term project for the purpose of attracting new users, even if it brings a wave of growth to the ecosystem in the short term, can the users who really settle down meet the expectations of the ecosystem and the exchange and be worthy of this investment? We still have doubts.

2.3 Phenomenon 3: Top VCs deploy casinos to earn commissions, but are there a lack of expectations for coin issuance and Value Capture?

“Infra projects and secondary transactions are closely related to the macro market. When the market trend is strong, funds are more willing to stay in the market to take advantage of the gains of various hot spots. In an environment where there is no strong desire to buy and sell in the secondary market, relying on casinos and pump.fun’s pvp to earn commissions and kill rates has become a more prudent and conservative defensive choice for VCs. But where does customer acquisition come from? The platform and tools lack expectations for coin issuance, and the commission is inferior to GameFI project investment, which is also worth considering.”

Monkey Tilt, which was led by Polychain Capital on February 12 this year and followed by Hack VC, Folius Ventures, etc., provides everyone with a collection of football betting websites and online casinos endorsed by large funds. Myprize, an online casino that announced on March 24 that Dragonfly Capital led the investment and a16z and other large VCs participated in a total investment of $13 million, is even more bold. The homepage gameplay openly appears with sexy dealers dealing cards online and live broadcast options.

Source: MyprizePump.fun, the logic of casino platforms earning commissions and cash flow

When the market is cold and volatile, the election is undecided, and the US interest rate cuts are repeatedly delayed and continue to consume market expectations, in such garbage time, coupled with the double stimulation of the emergence of BOME (Book of MEME) and other magical coins and 100x and 10,000x coins this year, people's gambling nature is greatly stimulated, and more money flows into the chain and pump.fun to find the so-called next "golden dog". Look at the time when pump.fun appeared, which was also during the period of continuous fluctuation after solona was pulled up.

What is the biggest casino in Web3? Many people may have the answer to this question in their minds. The 125X leveraged perpetual futures contracts in top exchanges such as Binance and OKX, and the 200X or even 300X leverage in small exchanges. Compared with the maximum daily fluctuation of 10% for A-shares and 20% for ChiNext, the Tokens that are T+0 and have no price limit are superimposed with 100 times leverage, that is, less than 1% of the currency price fluctuation can make you lose all the principal of the order.

The rising or falling contracts of the currency price can participate in it in the form of long or short. In essence, the ultra-short-term contracts are just betting on the size of the period from entry to exit, and the odds are set from 5 times to 300 times. Exchanges make a lot of money by charging order opening fees, position holding fees, forced liquidation (explosion) fees, etc. The logic is the same. Casinos usually earn rakes or kill rates when they are the bankers.

If Infra projects and secondary transactions are closely related to the macro market environment, when the macro environment is clear and the market is going up, funds are more willing to stay in the market to take advantage of the large increases in various hot spots, with considerable returns and lower risk factors. In the current market volatility, funds seem to flow to casinos and pvp, using high leverage to bet on returns that cannot be reached at the moment. High leverage magnifies the increase and naturally also magnifies the decrease. In the current market where the market is jumping back and forth, the rake earned by exchanges and platforms may be more objective than in unilateral market conditions.

In the current market volatility and user gambling, funds and heat seem to flow to casinos and pvp. The rake earned by casinos and tool products has become a stable income with demand and increment, which also conforms to the defensive investment logic of earning rake. However, there are also certain problems with the rake revenue of casinos or platforms.

Lack of coin issuance expectations and value capture

For platform projects like pump, even if they have become phenomenal platforms and have made a lot of money from trading flows, they still lack the expectation of coin issuance. Whether from the perspective of the token itself, the necessity and practicality of the token in the ecosystem, or from the perspective of supervision, as long as there is no coin issuance, there will be no securitization violations that will be targeted by the SEC. Similar casinos or platforms lack real coin issuance expectations.

On the other hand, under the premise of no coin issuance expectations, rake money and casino logic are more suitable for sideways fluctuations and cannot predict future hot spots. Pumping money relies on the popularity and activity of memes or gambles on the chain. It is an intermediate tool to meet demand rather than the demand itself, and lacks the real value capture. The recent behavior of pump.fun in selling Sol for cash can also be seen (as of September 29, it has sold Solana tokens worth about 60 million US dollars, accounting for about half of its total revenue). In the absence of coin issuance expectations and value capture, pump.fun has relied on the prosperity of $SOL while causing considerable selling pressure on the market. Although pump.fun will undoubtedly bring many positive effects to the entire Solana ecosystem, such as increased trading activity, new users attracted to the Solana ecosystem by meme summer, stable demand and buying for $SOL, purchasing power chasing after seeing the price increase of $SOL, meme players gradually evolving into long-term users and ecosystem supporters of $SOL, promoting the prosperity of the entire ecosystem, driving premiums, etc. But the problem still exists. It takes from the people and sells to the people. It collects $SOL as a fee and throws the selling order into the market. The closer the total sales amount is to the total revenue, the more neutral the impact of pump.fun itself on the price of solana will be, and the more it will act as a stabilizer. There may even be a negative premium (only selling orders but no buying orders). When it is in the rising growth stage, pump.fun's positive impact on the solana ecosystem is very strong, and it may grow exponentially; but when it is mature enough and in the platform stage, the relatively fixed selling pressure (selling pressure as handling fee income) minus the smaller positive impact may result in greater selling pressure.

Combined, the performance of similar gambling platforms will definitely lag behind the GameFi project with real value capture.

In addition, the investment income of most VCs is the dividends of pumping. Under the logic that equity exit is unrealistic and lacks the expectation of coin issuance, they can only wait for the next round of mergers and acquisitions to exit, and the exit cycle is long and difficult.

3. Conclusion: Casinos and platforms may underperform GameFi, short-term project retention has deteriorated, and past defensive investments are cautious

Whether it is to pull settled users to new games, or to rely on the user base to convert new Web3 users, one of the main functions and value directions of the game platform seems to have evolved into a new channel. However, for projects that rely on such platforms to convert users as real value through short-term projects, the long-term retention rate of users does not seem to be proven by time and data. In the absence of coin issuance expectations and value capture, gambling platforms seem to underperform GameFi, which has real value capture and PMF, in a bull market.

We are still cautious about defensive investments in the past market, and we are more eager to find products and high-quality games that have not yet formed a consensus and have few investors. Such games can convert future willingness to pay into higher retention rates, higher in-game consumption and on-chain activity due to their quality. This will eventually translate into higher value of tokens.

Kikyo

Kikyo