Written by: WolfDAO, TaxDAO

As more and more traditional financial institutions and even non-financial institutions begin to carry out private crypto fund business and allocate crypto-related assets, it becomes more important to operate private crypto funds in compliance. This article will summarize the types and characteristics of crypto funds with different strategy attributes, trading methods, and sources of funds, as well as the macro-regulation of private crypto funds. In combination with the operation cases of compliant funds, it will introduce the operation process of private crypto fund business and the key elements of compliant operation of private crypto funds.

I. Definition and classification of private crypto funds

1. What is a private crypto fund

1.1 Definition and characteristics of private crypto funds

In a broad sense, a fund refers to a certain amount of funds established for a certain purpose. It mainly includes trust investment funds, provident funds, insurance funds, retirement funds, and funds of various foundations. The common feature is that a dedicated manager (Asset Manager) centrally manages investments, thereby creating higher investment returns. These funds can be invested in the primary market (venture capital, private equity) and the secondary market.

Private Crypto Fund is a non-publicly issued investment fund, mainly for institutional and individual investors with a certain wealth and risk tolerance, focusing on investing in crypto assets and related projects. The holdings may include crypto assets, crypto options and futures, crypto company stocks, RWA assets, etc. The fund combines the characteristics of private funds and the uniqueness of crypto assets. Its characteristics that distinguish it from other private funds can be summarized as follows:

Specific investment scope: Private crypto funds focus on the crypto asset market, including digital currencies, blockchain projects, decentralized finance (DeFi) applications, etc.

Large value volatility: The value volatility of crypto assets far exceeds that of traditional financial assets. The valuation of unsecured crypto assets (such as most digital currencies) is mainly based on speculative demand, so the price fluctuates greatly. This high volatility brings potential high-yield opportunities to investors, but also increases investment risks.

Different regulatory attitudes in different countries: There are significant differences in regulatory attitudes towards crypto assets in different countries. For example, the regulatory policy of the United States on cryptocurrencies is vague and constantly changing, while Japan legalized Bitcoin and included it in the regulatory scope earlier. Private crypto fund managers need to pay close attention to changes in regulatory policies in various countries to adjust investment strategies and reduce compliance risks.

Low transparency: Private equity funds themselves have low transparency, and the anonymity and decentralization of the crypto asset market further exacerbate this opacity. Therefore, private crypto funds need to establish a sound information disclosure system and investor protection mechanism.

1.2 Differences between Private Crypto Funds and Traditional Private Funds

Private crypto funds and ordinary private funds are similar in many ways, but there are some key differences due to their different investment targets and market environments.

(1) Investment targets

Private crypto funds: focus on cryptocurrencies, blockchain technology, and related digital assets. They may invest directly in cryptocurrencies (such as Bitcoin and Ethereum), or they may invest in blockchain start-ups, tokenized assets, and other projects related to the blockchain ecosystem.

Ordinary private funds: usually invest in assets in traditional financial markets, such as stocks, bonds, real estate, private enterprise equity, or other traditional asset classes. Ordinary private funds have more diverse investment targets, but they are all based on the traditional economic system.

(2) Risk and volatility

Private crypto funds: The cryptocurrency market is extremely volatile and faces greater risks, including market volatility, technical risks (such as hacker attacks), regulatory risks (different countries have different regulatory attitudes and policies may change constantly), and liquidity risks (some tokens or crypto assets may be difficult to quickly liquidate).

General private equity funds: Although they still face market volatility, changes in the economic environment and specific industry risks, these risks are generally more controllable and have more historical data. The investment targets of general private equity funds usually have a longer market history and a clearer regulatory framework.

(3)Regulatory environment

Private crypto funds: Limited by the regulatory environment of the cryptocurrency market, they may face more uncertainties. Different countries have different regulatory policies on cryptocurrencies and related assets, which may affect the operation and investment strategy of the fund.

General private equity funds: Generally subject to strict financial supervision and laws and regulations, with clear compliance requirements. The investment targets are usually in a more mature and regulated market.

(4)Investor types

Private crypto funds: Usually attract investors who have a deep interest in cryptocurrencies and blockchain technology, and these investors may be more willing to accept the opportunities brought by high volatility and innovative technologies.

General private equity funds: The investor group is broader, usually including high-net-worth individuals, institutional investors, pension funds, and endowment funds seeking relatively stable returns.

(5) Technology dependence

Private equity crypto funds: They are highly dependent on technology and require the management team to have the ability to understand and apply cutting-edge technologies such as blockchain technology, smart contracts, and decentralized finance (DeFi).

General private equity funds: They rely more on traditional financial analysis, market research, and portfolio management skills, and are relatively less dependent on technology.

(6)Liquidity

Private crypto funds: The liquidity of the cryptocurrency market can be very high, but it may also lead to liquidity risk due to insufficient market depth or the nature of specific assets. In particular, this liquidity risk will increase significantly when the market fluctuates violently.

Ordinary private equity funds: The investment targets generally have relatively certain liquidity arrangements, although they may still face liquidity constraints, especially when investing in long-term assets such as private enterprises or real estate.

These differences show that although the two are similar in fund structure, they are significantly different in terms of investment targets, risk tolerance, regulatory environment and market technical requirements.

2. Classification of Private Crypto Funds

Private crypto funds are investment funds that focus on the crypto asset market. Their types can be divided according to different classification standards. The following are some common ways to classify private crypto funds based on investment targets, operating methods, etc.:

(1) Classification by investment targets

Direct investment funds: These funds mainly invest directly in cryptocurrencies, blockchain projects or NFTs (non-fungible tokens). They purchase and hold these assets in the hope of gaining returns when the asset value rises.

Indirect investment funds: Indirect investment funds may indirectly participate in the crypto asset market by investing in corporate equity, fund shares or derivatives related to crypto assets. For example, investing in the equity of cryptocurrency exchanges, blockchain technology companies or crypto-asset mining companies.

(2) Classification by operation mode

Closed-end funds: Closed-end funds determine the size of the fund when they are established and will not accept new investments within a certain period of time. Such funds usually have a fixed duration and are liquidated or transformed after expiration. Among private crypto funds, closed-end funds can ensure that fund managers have a stable fund size for a period of time, which is conducive to their long-term investment layout.

Open-end funds: Open-end funds allow investors to subscribe or redeem fund units at any time during the fund's duration. Such funds usually have good flexibility and can be adjusted according to market demand and investor preferences. However, in the case of large fluctuations in the crypto asset market, open-end funds may face greater liquidity pressure.

(3)Classification by investment strategy

According to different investment strategies, private crypto funds include active, passive, neutral, fixed income and other types.

The income earned by passive strategies is the income generated by the rise in currency prices. In the field of crypto assets, it is mainly reflected in tracking the overall performance of several highly liquid currencies (such as Bitcoin, Ethereum, etc.) and passively profiting from the rise in currency prices.

Neutral strategies hedge market fluctuations (Delta) through long-short hedging and using derivatives and other tools to control the long-term overall risk exposure to around 0, and pursue absolute returns that are unrelated to the rise and fall of currency prices. Common arbitrage and market-making strategies are both neutral strategies.

Active strategy means that the fund manager believes that there is a target price through some kind of analysis model or prediction, and trades around the target price. If the current price is lower than the target price, go long, if the current price is higher than the target price, go short, and adjust the position according to the difference between the current price and the target price. The income comes from both the market (Beta) and the excess income (Alpha) generated by subjective judgment.

Fixed income funds mainly obtain income through "bonds". Although there are no standard bonds in the field of crypto assets, there are a large number of over-the-counter loans, that is, non-standard bonds. This type of fund can obtain income by lending or by earning interest spreads in lending. Similar to traditional fixed income funds, the income is relatively stable, but in actual operation, it requires strong risk control capabilities (such as collateral management). DeFi is a financial activity based on smart contracts on the blockchain, which has certain fixed income attributes.

(4) Other classification methods

In addition, private crypto funds can also be classified according to other factors such as fundraising sources and investment stages. For example, according to the fundraising source, they can be divided into private equity funds and private securities funds; according to the investment stage, they can be divided into angel funds, venture capital funds, etc.

II. Development status of global private crypto funds

1. Crypto fund scale

In recent years, the total market value of cryptocurrencies has shown a fluctuating growth pattern, and as of the time of writing this article, it has exceeded US$2.3 trillion. According to the data of Crypto Fund Research, although the scale of crypto funds accounts for a small proportion of the total fund scale, as of the end of 2023, nearly 900 crypto funds have been established worldwide, covering hedge funds, venture capital funds, index funds and other types. In addition, according to Galaxy's report, crypto asset funds performed strongly in 2023, with assets under management reaching $33 billion, among which Bitcoin dominated the market and became the most popular investment target for funds.

2. Main registration places of crypto funds

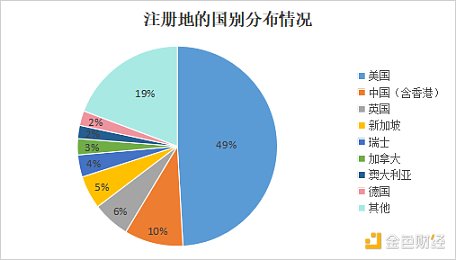

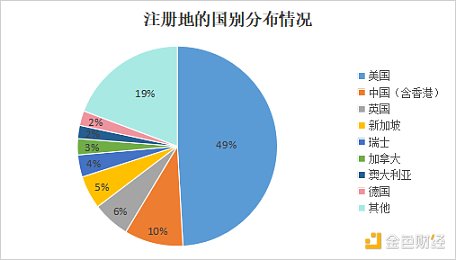

In terms of the distribution of registration places, although the registration places of private crypto funds are not yet available, based on the data of Crypto Fund Research, we can still see the overall distribution of crypto fund registration places in the form of charts.

In terms of countries, the United States has been favored by nearly half of the crypto funds and has become the most important registration place for crypto funds. At the same time, it should also be noted that although the Chinese government, especially the mainland government, has adopted a more conservative attitude towards crypto assets, crypto funds registered in China still account for a large proportion, supported by the huge economic scale and investment demand.

Figure 1: Global distribution of major registration locations of crypto funds

3. Introduction to well-known private crypto funds and their situations

3.1 Pantera Capital

Pantera Capital is a private equity fund established in 2003 and headquartered in California, USA. Pantera Capital is the world's first investment fund focusing on blockchain technology and digital currency. The assets it manages include multiple funds and portfolios focusing on Bitcoin, ICO (initial coin offering) and decentralized finance (DeFi). According to its official website, Pantera Capital manages $4.8 billion in blockchain-related assets.

3.2 a16z Crypto

a16z Crypto is headquartered in California, USA. It is a venture capital fund under the famous venture capital firm Andreessen Horowitz that focuses on Crypto and Web3 startups. a16z Crypto has a wide portfolio, covering blockchain infrastructure, decentralized applications (dApps), payment systems, etc. According to its official website, a16z Crypto manages more than $7.6 billion in assets in four funds and has a wide influence in the industry.

3.3 Galaxy Digital

Founded in 2018, it is headquartered in New York, USA. It is an investment management company founded by former hedge fund manager Mike Novogratz that focuses on digital assets and blockchain technology. Galaxy Digital offers a variety of cryptocurrency-related investment products, including hedge funds, venture capital funds and asset management services. According to its official website, Galaxy Digital currently manages approximately $2.1 billion in assets, has a significant position in the cryptocurrency industry, and is often active in industry news.

3.4 AnB Investment

AnB Investment is a separate portfolio company (SPC) registered in the Cayman Islands. It operates two funds, a quantitative multi-strategy fund and a neutral strategy fund. The main investment targets are crypto assets and DeFi, mainly earning Alpha returns brought by market fluctuations. The total AUM of the fund is US$50 million, and the minimum investment per investor is US$100,000. Both funds are open for subscription and redemption on a monthly basis. The income sources of the operating fund are management fees and performance sharing. According to AnBInvestment's promotional materials, the management fee is 2.4% and the performance share is 20% based on the high water mark method. The main expenses of the operating fund are strategy, trading, auditing, operations, risk control, legal-related systems and manpower expenses.

3.5 HashKey Digital Investment Fund

The fund will officially accept investor subscriptions from September 1, 2023. The fund is licensed by the Hong Kong Securities and Futures Commission and managed by HashKey Capital Limited. The managed portfolio is 100% composed of virtual assets. HashKey Capital is launching a compliant secondary liquidity fund. The fund will use less than 50% of its investment in Bitcoin and Ethereum, the two largest cryptocurrencies, and will also diversify its allocation and invest in some other currencies.

III. Overview of the main international regulatory rules for private crypto funds

At present, some international organizations and some countries have made relevant provisions on the supervision of private crypto funds. The following will list and introduce some of them:

Figure 2: Cryptocurrency supervision process of major global regulatory agencies

1. U.S. Securities and Exchange Commission (SEC) on the applicability of securities laws

In 2017, the U.S. Securities and Exchange Commission (SEC) released the famous "The DAO Investigation Report". The report pointed out that some cryptocurrencies and initial coin offerings (ICOs) may meet the definition of "securities" set forth in the Securities Act of 1933 and the Securities Exchange Act of 1934. Therefore, these crypto assets need to comply with the corresponding securities regulations, including registration, information disclosure, anti-fraud protection, etc. This provision is particularly aimed at crypto projects and token issuances that raise funds and promise future profits or returns. For example, if tokens raise funds through ICOs and give holders corresponding rights, dividends or other economic benefits, they may be considered securities. For these assets, issuers must register with the SEC, or apply for exemptions, and must also disclose financial and other important information on a regular basis to ensure that investors are fully protected.

Since then, the SEC has strengthened its supervision of cryptocurrency funds, and crypto funds have had to comply with existing securities laws. For example, cryptocurrency funds must undergo necessary registration or obtain exemption qualifications when it comes to securitized tokens or other similar products. In addition, fund managers must ensure that the fund's operations comply with "qualified investor" regulations and meet corresponding anti-money laundering, anti-fraud and other compliance requirements.

The SEC's regulatory oversight of crypto assets has increased year by year, reflecting its emphasis on investor protection and market stability. In 2020, the SEC issued the Cryptoasset Framework, which further clarified the criteria for what crypto assets are securities. This framework focuses on assessing factors such as whether the purchaser of the token expects to profit from the efforts of others, whether the project team plays a central role in the development and marketing of the asset, and whether the project has decentralized characteristics. Of course, if the Financial Innovation and Technology Act of the 21st Century (FIT21 Act) is ultimately passed, the SEC's relevant standards may need to be adjusted.

2. EU Market Abuse Directive (MAD) and Market Abuse Regulation (MAR)

The Market Abuse Directive (MAD) and the Market Abuse Regulation (MAR) have been applied since 2018 and are a comprehensive framework developed by the European Union to prevent market manipulation, insider trading, and illegal disclosure of insider information. These regulations are designed to prevent illegal activities such as market manipulation and insider trading. Since 2018, MAR has been explicitly applied to financial instruments in the cryptocurrency market. For example, if crypto assets are considered "financial instruments" (such as securitized tokens), they must comply with MAR regulations, including preventing insider trading, market manipulation and improper disclosure of information. In addition, traders involved in crypto assets, especially those who trade on regulated markets or have the potential to affect market prices, are subject to market abuse regulations. This is aimed at ensuring that investors receive fair information and preventing the market from being distorted by illegal activities.

3. Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) Requirements of the Financial Action Task Force (FATF)

FATF is an international body that sets global standards for anti-money laundering and counter-terrorist financing. In 2019, FATF issued guidance on virtual assets and virtual asset service providers (VASPs), clarifying for the first time the anti-money laundering and counter-terrorist financing requirements in the field of crypto assets. The guidelines impose strict AML/CFT requirements on virtual asset service providers (VASPs). Specific rules include: requiring VASPs to conduct customer due diligence (CDD), including collecting and verifying customer identity information; for transactions above a certain amount, VASPs need to report suspicious activities to the relevant authorities; and monitor cross-border transactions. When institutions are directly involved in activities such as custody, management, transfer or trading of virtual assets, they will be considered VASPs and need to comply with FATF's AML and CFT requirements. Currently, countries around the world are beginning to gradually incorporate FATF's guidelines into their national laws, requiring crypto funds to follow these AML/CFT standards.

4. European Investment Funds Directive (AIFMD)

AIFMD was originally passed in 2011 to strengthen the supervision of European alternative investment funds. With the rise of crypto funds, the scope of application of AIFMD has been expanded to include crypto asset funds since 2020, requiring fund managers to ensure appropriate information disclosure and risk management to protect the interests of investors. Specific rules include: fund managers need to disclose the fund's investment strategy, asset allocation and risks to investors on a regular basis; sufficient compliance measures must be in place to avoid conflicts of interest and ensure informed consent from investors. As a result, crypto funds in Europe are strictly regulated to ensure that investors' rights and interests are protected.

5. EU "Markets in Crypto Assets Act" (MiCA)

In order to build a unified regulatory framework for the crypto asset market, the EU issued Regulation No. 2023/1114 in 2023 - the "Markets in Crypto Assets Act" (MiCA), which was formally voted on at the European Parliament meeting on April 20, 2023. It will officially take effect on June 30 this year and the transition period will end on June 30, 2026. As part of the EU's digital financial strategy package, MiCA covers the registration, operation, and investor protection requirements of crypto funds, clarifies the scope of application of the bill, the classification of crypto assets, the regulatory subjects and the corresponding information reporting system, the business restriction system, and the behavioral supervision system. It is the most comprehensive digital asset regulatory framework to date, covering 27 EU member states and another 3 countries in the European Economic Area (EEA) (Norway, Iceland, and Liechtenstein). It will provide a clear legal framework for crypto assets and achieve regulatory consistency within the EU.

Fourth, Overview of Global Tax Policies for Private Crypto Funds

Many countries are actively formulating or improving tax policies to ensure that the income and transaction income of cryptocurrency funds can be accurately declared and taxed according to law, including capital gains tax, goods and services tax, value-added tax, etc.

1. United States

Income tax: In the United States, private crypto funds can be organized in the form of limited partnerships (LP), limited liability companies (LLC) and corporations (specifically divided into C and S companies), and the tax policies applicable to the three are not the same. LP partners directly bear losses, share profits and pay income tax; LLCs have flexibility in choosing tax structures. They can choose to pay taxes as sole proprietorships, partnerships, S corporations or C corporations; Corporations need to face double taxation issues, because the profits earned by the Corporation are subject to corporate income tax, and if the profits are distributed to shareholders as dividends, the shareholders are also required to pay personal income tax. Therefore, considering the high return potential of crypto assets, taking the form of a Corporation may not be conducive to reducing the overall tax burden of private crypto funds and their investors.

Capital Gains Tax: Capital gains tax in the United States is divided into short-term capital gains tax and long-term capital gains tax. Short-term capital gains refer to gains from assets held for no more than one year, while long-term capital gains refer to gains from assets held for more than one year. The short-term capital gains tax rate is the same as the taxpayer's ordinary income tax rate; the long-term capital gains tax rate is usually lower than the short-term capital gains tax rate and is divided into three levels based on their annual total income and tax status, namely 0%, 15% and 20%.

The IRS issued a notice on virtual currency transactions as early as 2014 (Notice 2014-21), explaining the treatment of virtual currencies in federal income tax. In the notice, all crypto assets are regarded as property rather than currency, and therefore apply the general tax principles of property transactions. This means that most crypto asset transactions are subject to capital gains tax. When trading crypto assets that are subject to capital gains tax, investors need to deduct their cost basis from the sale price to calculate the capital gain or loss and pay the corresponding capital gains tax. The period of time (divided into 1 year units) for holding crypto assets determines the capital gains tax rate. If crypto assets are held for more than 1 year, investors are subject to long-term capital gains tax, which is generally lower than short-term capital gains tax, which applies to holdings of no more than 1 year.

2. European Union

Value Added Tax (VAT): The EU has different tax policies on cryptocurrencies, with some countries charging VAT on crypto asset transactions and others exempting them. For example, countries such as Ireland and Germany do not charge VAT on Bitcoin transactions, but in Italy and Spain, these transactions may be subject to VAT.

MiCA (Market in Crypto-Assets Act): The introduction of MiCA aims to provide a legal framework for crypto-assets that are not covered by existing EU financial services legislation; promote the development of crypto-assets and the wider use of distributed ledger technology (DLT) by establishing a sound and transparent legal framework to support innovation; ensure appropriate consumer and investor protection and market integrity; and further enhance financial stability, taking into account that some crypto-assets may be widely accepted.

3. United Kingdom

Due to the common law tradition and the flexibility of crypto-assets, the British government did not choose to formulate a complete set of crypto-asset tax laws, but instead incorporated them into the existing tax framework based on the nature and purpose of crypto-assets, mainly levying income tax and capital gains tax on them. The collection methods of these two taxes are the same as other types of income and assets. Taxpayers need to calculate their income and profits from crypto-assets in each fiscal year according to their own circumstances and declare them on the corresponding tax return. The UK also provides some tax exemptions or relief measures, such as personal relief, personal savings account (ISA) relief, annual exemption amount, etc.

4. Singapore

Income Tax: Singapore does not tax capital gains, which makes Singapore a very friendly jurisdiction for private crypto funds. However, if cryptocurrency transactions are regarded as business income, income tax is required.

Goods and Services Tax (GST): Singapore originally planned to impose goods and services tax on cryptocurrency transactions, but from January 1, 2020, GST has been stopped on payment cryptocurrency (DPT) transactions.

V. OECD's Regulatory and Tax Compliance Framework

The Organization for Economic Cooperation and Development (OECD) is one of the most influential international organizations, and its member countries have always paid attention to the regulation and taxation of crypto assets. In recent years, the OECD has gradually formed several important policies and frameworks in the regulation and tax compliance of crypto assets and related funds by expanding the scope of application of old regulations and formulating new policies, aiming to regulate the operation of private crypto funds and ensure their tax transparency and compliance worldwide. Therefore, it is necessary to pay special attention to and summarize the OECD's regulatory and tax compliance framework.

1. Crypto-Asset Reporting Framework (CARF)

With the popularity of crypto assets, the OECD has realized that the existing tax information exchange standards (such as the Common Reporting Standard CRS) cannot fully cover the specific needs of crypto assets. To this end, the OECD proposed CARF in 2022 to strengthen the exchange and transparency of tax information on crypto assets.

CARF requires crypto asset service providers (such as private crypto funds) to report their clients' crypto asset transactions to the tax authorities in their countries. The report includes the client's identity information, transaction amount, asset category, etc. It provides a global unified standard that enables tax authorities in various countries to effectively exchange information related to crypto assets to prevent tax evasion.

2. Common Reporting Standard (Common Reporting Standard, CRS)

CRS is a global standard launched by the OECD in 2014 to combat cross-border tax evasion through automatic exchange of information. Although CRS was initially mainly applicable to traditional financial assets, in recent years, countries have gradually included crypto assets in its scope of application.

CRS requires financial institutions (including crypto funds) to collect and report customer tax information. This information includes the identity of the account holder, account balance, interest income, etc., and the relevant information will be automatically exchanged between tax authorities of various countries.

At the 2024 G20 Summit in Brazil, the participating countries have decided to expand the automatic exchange of information mechanism (AEOI) with CRS as the core to the field of crypto assets, requiring crypto asset service providers (RCASP) to report the crypto asset information of their non-resident customers and automatically exchange this information with the tax authorities of the countries where these customers are located, thereby improving tax transparency in the field of crypto assets and preventing tax evasion and tax avoidance.

3. Base Erosion and Profit Shifting Action Plan (Base Erosion and Profit Shifting, BEPS)

The Base Erosion and Profit Shifting Action Plan is a global initiative jointly launched by the OECD and the G20 to address the risks of base erosion and profit shifting by strengthening international tax rules. With the rise of crypto assets, some of the BEPS Action Plans (such as Action 1 and Action 13) have also begun to apply to crypto assets and private crypto funds.

The main contents include:

Tax challenges of the digital economy: BEPS Action 1 explores how to address the tax challenges brought by the digital economy (including crypto assets). The plan encourages countries to implement measures to ensure the tax fairness of crypto assets.

Country-by-Country Reporting (CbCR): BEPS Action 13 requires multinational corporate groups, including private crypto funds, to submit country-by-country reports to tax authorities, disclosing their income, pre-tax profits, taxes paid, etc. in various countries. This helps countries identify and combat profit shifting.

JinseFinance

JinseFinance