VanEck: How high can the SOL price go? What makes the ETH price bleak?

Solana uses a monolithic structure that enables the network to leverage speed and efficiency that modular blockchains cannot.

JinseFinance

JinseFinance

Written by: Jake @ Antalpha Ventures, Blake @ Akedo Games, Jawker @ Cipherwave Capital

Games cannot be made well by "first this and then that". Games that are made overnight are unlikely to pass the long-term test of the market. This series of Web3 game analysis articles will stand from the perspective and assumptions of the long-term stable development of the Web3 game field, and systematically analyze the subdivisions of Web3 games in different chapters from four perspectives: tokens and economic systems, core mechanisms and gameplay systems, industrialized production and production (art and programming), and testing and operations. Among them, the content of the core mechanism and gameplay system is an internal document and will not be published publicly for the time being. You are welcome to communicate with the author separately about this part.

This series of articles hopes to sort out Web3 games logically, rather than simply listing and piling up information. Web3 games are an industry with strong content and consumption attributes. The author adheres to the concept of "It doesn't matter whether the cat is black or white, as long as it catches the mouse, it is a good cat", calmly and objectively analyzes Web3 games from multiple angles, and refuses to be swayed by superstition, authority, prohibition, slogans, doctrines, prejudices and emotions. Based on the assumptions of the free market and Hayek's ideas, the views and thoughts in this article are only used for research and analysis, for readers' reference, and do not constitute investment advice. Investment is risky, and you need to be cautious when entering the market. If you have any other questions about Web3 games, please contact Jake, Blake or Jawker on Twitter for discussion.

This is the first article in the Web3 Gaming analysis series: tokens and economic systems. Although the core mechanism and gameplay system of the next article will be involved in the numerical part, due to the deposit and withdrawal properties of Web3 Gaming, this token and economic system are becoming more and more important, so they are analyzed separately in the first article. An excellent token and economic system can be icing on the cake, but it cannot be a timely help. Some of the thoughts and theories in this article can be applied not only to games, but also to other types of Crypto applications.

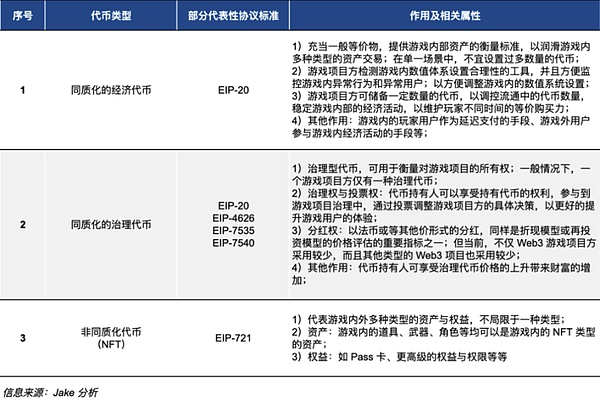

It is generally believed that there are two types of token assets issued on the chain, one is homogeneous tokens (such as tokens supported by the ERC-20 standard), and the other is non-homogeneous tokens (such as assets supported by the ERC-721 standard); in actual applications, Web3 games have different requirements for different types of tokens, and potential multiple types of homogeneous and non-homogeneous tokens will be used in the game. Tokens, as credit symbols on the chain, do not directly create wealth, but can only realize the transfer of wealth. The direction and duration of the transfer depend on the attributes of money and patience. Chips and assets will have unique attributes and positioning, and will eventually depend on asset narratives or assumptions. The attributes of funds determine what kind of narratives and assumptions will be paid for. The following table lists some of the potential token types needed in Web3 games, including homogeneous economic tokens, homogeneous governance tokens, and non-homogeneous tokens.

Game project owners can use a variety of homogeneous and non-homogeneous tokens, but it should be noted that when it comes to Web3 game tokens, the number of tokens issued is not a standard for measuring the economic model of a game project owner. If a high-quality project owner can use only a single token to regulate the economic system in the game, it is completely unnecessary to adopt a dual-token or even multi-token economic model. At the same time, it is worth noting that the right to issue assets is tempting enough to make Web3 game project parties addicted. Unlike the issuance of stablecoins (stablecoin project parties reserve a variety of collateral and are subject to strict restrictions on collateral), Web3 game project parties are unanchored issuance assets, and the supporting collateral is the development expectations, cash flow and credit of Web3 game projects. If the project party abuses the right to issue assets, it will cause the relative price of assets inside and outside the game to fall, damage the purchasing power and asset rights of player users, and affect the experience of consumer-level users. Game project parties need to use the right to issue assets with caution.

According to the above analysis, different analysis methods are needed for different types of tokens. The following is a brief analysis of three types of assets:

Similar to the points, gems, gold coins, silver coins and other systems in traditional games, homogenized economic tokens will play a similar role in different subsystems of Web3 games: providing a price measurement standard for game assets and lubricating transactions between game users in different subsystems and between different subsystems in the game. In actual applications, a single economic token is more often used in the same subsystem, rather than dual tokens or multiple types of tokens; otherwise, in actual applications, the project party needs to keep the equivalent purchasing power of multiple tokens for the same game assets at all times. Therefore, for the project party, there is no need to add extra work to maintain the stability of the exchange rate between multiple tokens in a single subsystem, so a single subsystem only needs to issue a single token. At the same time, if the project party can use a single token to maintain and lubricate transactions within multiple subsystems, issuing additional tokens will be a completely unnecessary option. For the same type of NFT assets, if multiple homogeneous economic tokens are issued to match and trade with them, multiple trading pairs will also cause confusion among players and users; and the purpose of economic tokens is to facilitate transactions. If the issuance of economic tokens violates the original intention of convenient transactions, it is completely unnecessary. In this type of token application, game project parties should try to avoid the price of economic tokens within the game from fluctuating. If there is a sharp change in the price of assets measured by token prices, the purchasing power of consumers will change dramatically, affecting the consumer's gaming experience and driving consumer-level users out of the market; and if the market fluctuates sharply and the trading pool is deep enough, it will attract arbitrage institutions, hedge funds, quantitative trading institutions and other types of institutions to enter the market. The final outcome of this situation will make Web3 games become a shell, and the real "players" are institutional users, not consumers. Of course, Web3 game project owners can choose stablecoins pegged to the US dollar for settlement and transactions, but in this case, it can be regarded as transferring part of the "coinage rights" to the outside, and it can also be regarded as the credit expansion of the US dollar credit on the chain. If the general equivalent used for settlement and transaction fluctuates or even collapses, it will lead to the collapse of the internal economy of Web3 games. In an ideal situation, the purchasing power of economic tokens and legal tender issued by Web3 project owners for in-game assets should be kept within a controllable range, and the average annual depreciation can be in the range of 2% - 4%.

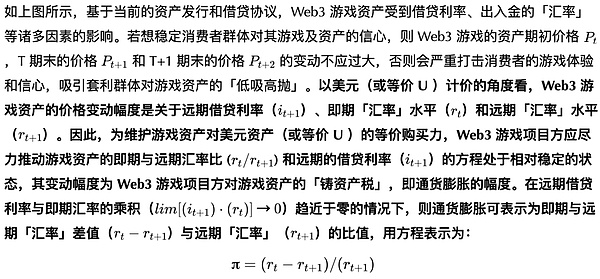

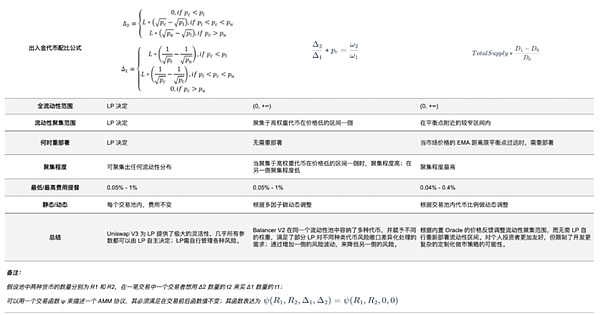

For the issuance and regulation of homogeneous economic tokens, Web3 game project parties can adjust their own economic token models based on the currency issuance theory in traditional finance. Reference books include Monetary Economics by Peter Howells and Keith Bain, Monetary Economics: Theory and Policy by Carl E. Walsh, Monetary Economics by Ben Bernanke, Michael Woodford, and Jordi Gali and Monetary Policy Frameworks: A Synthesis by Frederic S. Mishkin. At the same time, referring to Uniswap's AMM constant product mechanism, game project parties can adjust the circulation quantity and price of economic tokens through the mechanism shown in the figure below.

Information source: Uniswap V3 White Paper

When using Uniswap, project parties need to create trading pairs and inject sufficient liquidity into trading pairs. In the new version V3, due to the different liquidity densities in different price ranges, each small range with the same liquidity density needs to be calculated separately. When crossing the range boundary, the next range needs to be calculated similarly. Game project parties can adjust the price to the target price range based on the calculation. However, when using Uniswap, project parties need to pay attention to effective and real liquidity. When the price leaves the position range, the liquidity of the position will no longer be active, and no handling fees can be obtained. At this price point, liquidity will consist entirely of one token, as the other token is exhausted. If the price re-enters the range, liquidity will become active again. At the same time, Web3 game project parties can choose products with other AMM mechanisms. The following is a horizontal comparison of AMM mechanism products. (It can also be applied to other types of homogeneous tokens)

Information source: Altonomy Ventures research; Jake sorting and analysis

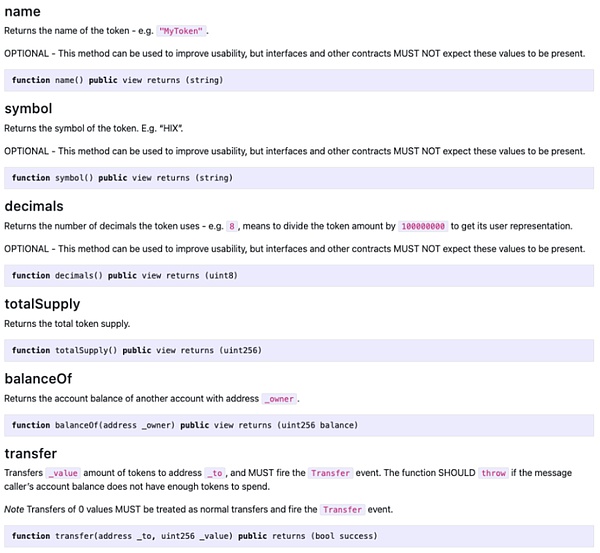

However, it should be noted that if the game project party puts the tokens used for circulation on the chain, the maximum extent to which the project party can regulate the internal economic system will be limited. As shown in the figure below, due to the parameter setting requirements of the ERC-20 protocol standard, the project party has a maximum limit on the number of tokens issued. Therefore, when it reaches the limit, the game project does not have enough tokens to regulate the number of tokens in circulation, and ultimately cannot control the price of economic tokens.

Information source: Ethereum Improvement Proposals (ERC-20)

Although the holder structure of economic tokens will experience large price fluctuations during the bull-bear conversion cycle, if the game project party has sufficient token reserves, it will smooth out the price fluctuations of economic tokens to a certain extent.

Generally speaking, holders of homogeneous governance tokens enjoy the right to propose, vote and share dividends, etc. At the same time, Web3 game project owners can divide the rights of governance tokens, and divide the right to propose, vote and share dividends into different sub-tokens; or use assets such as NFT to grant different permissions. The following will analyze several aspects of governance tokens.

For the right to propose and the right to vote, addresses holding a certain proportion of governance tokens have the right to exercise the right to propose, participate in corporate governance and influence the direction of the company's development, while other addresses holding tokens can amend, vote and reject the proposal. In this way, a positive cycle is formed to guide the direction of game projects to develop in the direction preferred by the market. But at the same time, for game project owners, it is necessary to be cautious about the right to propose and vote, prevent the proliferation of democratic politics and the abuse of rules, and avoid the situation of democracy for the minority and tyranny for the majority. Since it is impossible to guarantee that everyone can have a deep and correct understanding of the project and its future development, the project party should try to avoid excessive dispersion of governance tokens in the holding structure of governance tokens; in the design of the token structure, the project party should try to allocate governance tokens to addresses that have a deep understanding and are beneficial to the development of the project. If there is a tyranny of minority decision-making, and most addresses blindly follow, it will magnify the rights and interests of the minority, just as Heshen said: Today the emperor killed Wang Danwang, and the people of Hangzhou cheered. If he kills Lord Ji tomorrow, the people of Hangzhou will cheer as well.

As for the dividend right, in the traditional financial system, the dividend discount model and dividend reinvestment model related to the dividend right can be used to value the project, but in the Web3 world, there is a lack of enough project parties that practice based on fiat currency dividends; in the current market, if Web3 game project parties have dividends, most of them will be in the form of governance tokens, but in this case, it will cause selling pressure on governance tokens, and the falling price of governance tokens will drive market pessimism and leave a negative impression on the project party. Therefore, in the current market, the project can only be valued through the relative valuation method; but in actual application, since the project party has not disclosed all its financial and operating information, even if it is disclosed, it has not been audited, so the relative valuation method is available, but the credibility is still low. Therefore, under the current circumstances, there is a lack of a strong and credible valuation model for the comprehensive evaluation of the governance token price and the project; from this perspective, the governance token is, to a certain extent, a memecoin linked to the project party.

To avoid the memecoin situation, in the current Ethereum protocol proposal, there are similar dividend rights protocols for project parties to refer to, such as ERC-1726 (closed), ERC-4626, ERC-7535 and ERC-7540. Ideally, the project party can adopt one of the standards and distribute dividends in fiat currency (the equivalent form of U) in proportion to the addresses holding governance tokens. Other on-chain asset categories, such as on-chain bonds and assets, pledge income, treasury bonds and other similar on-chain assets can adopt similar standards. It is undeniable that in the evaluation system of off-chain and on-chain assets, the valuation system based on project cash flow is still one of the most effective valuation methods.

Similar to economic tokens, the structure of governance token holders will also affect the price level of governance tokens during bull-bear transitions; if the profile of governance token holders is value-oriented, long-termist, or insensitive to price fluctuations, the price drop will be relatively low during the bull-bear transition cycle; the specific fluctuation and time still need to be determined based on the token holding structure.

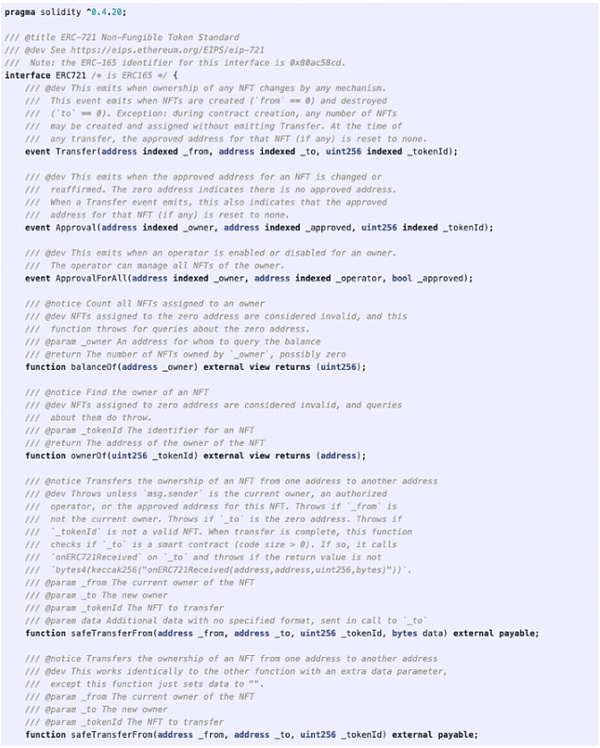

Non-fungible tokens generally refer to assets issued by Web3 game projects, including but not limited to avatars, pets, equipment, props and other types of assets. This type of asset is generally supported by protocols such as ERC-721 and ERC-1155. For non-fungible tokens, the author's previous NFT Revolution: Exploring Protocols, Valuation, and Business Models analyzed NFT's protocols, valuation methods and business models in more detail. For Web3 game project parties, the token economics of NFT still needs to pay attention to the following points.

First, similar to the situation of economic tokens, NFTs need to have consumption and usage scenarios for Web3 games. Without consumption and usage scenarios, NFT assets will become "meme NFTs" related to game project parties. Similarly, the structure of NFT holders will affect the price fluctuation range of NFTs. Especially when bulls and bears switch, arbitrage users are more willing to give up their "chips" than consumer users. Different consumer preferences will drive different types of user groups to behave differently.

In addition, in the current situation, the buying and selling pricing method of NFTs is different from the AMM trading system of homogeneous tokens. Pricing will be relatively subjective, and for project parties, it is impossible to directly build a trading pool for users to trade. Therefore, in the current situation, the transaction form of Orderbook is adopted. Limited by transaction efficiency and the psychological expectations of both parties to the transaction, transactions in the form of Orderbook need to balance liquidity and price slippage. As for Web3 game project parties, if all the parameters of NFT can be brought into play in the game, then the price of the same type of NFT assets should theoretically be linked to the parameter settings, that is, the price should be a function of the various parameters of NFT. However, due to the current lack of relevant protocols and middleware, some optimization solutions for NFT transactions in Web3 games will be proposed later.

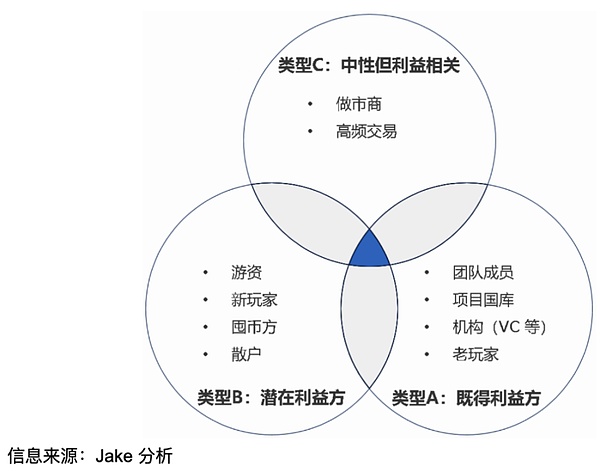

Regarding the profitability of Web3 games, many Web3 users believe that playing Web3 games can make money, and even simulated the yield curve, but none of them clearly identified a significant source of income. Without a source of income, users rushing in are very likely to become the source of income and the counterparty of the source of income. There is an opportunity to benefit from Web3 games, but you cannot rely on the Play-to-earn economic model to make a profit (in the form of legal currency or U). As mentioned above, tokens, as credit symbols on the chain, do not directly create wealth, but can only realize the transfer of wealth. The direction and duration of the transfer depend on the properties of money and patience. Chips and assets will have unique properties and positioning, and will eventually be attached to asset narratives or assumptions. The properties of funds determine what kind of narratives and assumptions will be paid for. As the counterparty of the player user, the project party is both the maker of the rules and the "player" holding a large number of "chips". It is difficult for ordinary players to compete directly with them. Chips and assets will have unique properties and positioning, and will eventually be attached to asset narratives or assumptions. The properties of funds determine what kind of narratives and assumptions will be paid for. As the counterparty of the player user, the project party is both the maker of the rules and the "player" holding a large number of "chips". It is difficult for ordinary players to compete directly with them. The following is a brief analysis of the types of income sources.

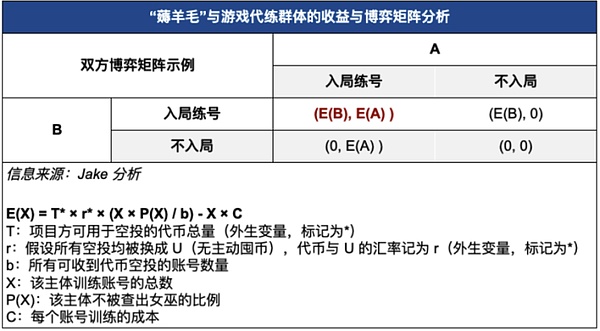

In the market, project parties generally use the ERC-20 protocol to issue tokens. Due to the restrictions of the protocol, the number of tokens issued is limited and the supply is fixed. Users are affected by emotions such as greed and fear. The demand for tokens by profit-seeking users will drive up the price of tokens, which will further stimulate the demand for purchases by profit-seeking users. The book income of users who already hold tokens will increase. Therefore, in this case, the demand side is the main driving force for the rise in coin prices. Therefore, from the perspective of the demand side of tokens, in the structure of token holdings, the dynamic game between new token holders and vested interests (existing users, project parties, team members, investment institutions, coin hoarders, etc.) affects the price of tokens. First, give priority to the analysis of the two-party game, and then analyze from the perspective of the multi-party game. The following table is a simplified matrix diagram of the two-party "wool grabbing" (there will be a multi-party game analysis framework later). Taking into account the complexity of real projects and studios, we first make some assumptions:

The airdrop rules of the project are open and transparent, the total amount of airdrop tokens is fixed and will be fairly airdropped to addresses that meet the rules;

The project party will check for witches, but there is a probability that no witch will be found;

The cost of each account of the "薅羊毛" and game leveling studio is the same;

After the studio receives the tokens, it will immediately take the initiative to exchange them for U, that is, the studio will not take the initiative to hoard coins and affect the "exchange rate";

The studio does not know the total number of addresses that can receive token airdrops;

The account operations of the studio are all consistent.

Based on the above assumptions, the studio does not know the total number of addresses that can be airdropped, and cannot directly calculate the total number of tokens received (calculating benefits and costs). Therefore, in order to maximize benefits, the studio will not choose to stop training, and the game between studios is to increase the proportion of airdrop addresses, that is, (). In this case, under the background of the game between the two parties, both will choose to enter the game to train, so they will eventually fall to the Nash equilibrium point of the matrix: (E(B), E(A)). This Nash equilibrium point is similar to the Nash equilibrium point in the prisoner's dilemma. In real life, due to factors such as cost, inconsistency in account operations, witch checks and the airdrop ratio of the project party, the airdrop ratio obtained by the studio in the end is not as expected, and it is very easy to lose more than the gain. And in real life, there is not only a game between studios, but also a multi-party game between new token holders and vested interests (existing users, project parties, team members, investment institutions, and coin hoarders, etc.).

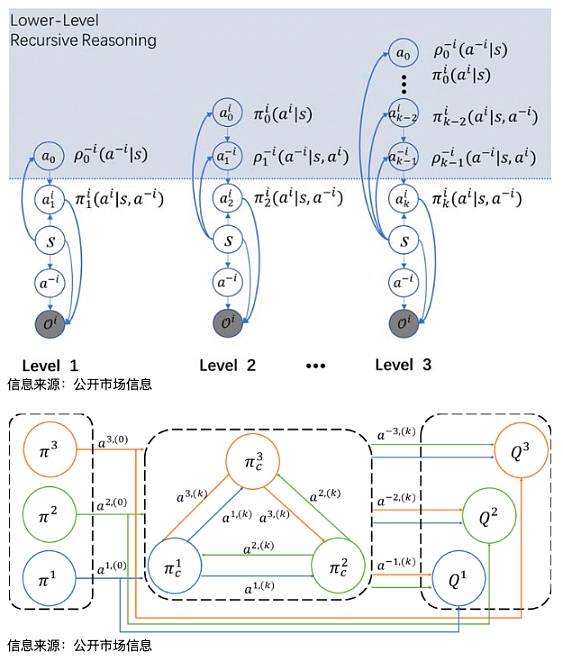

But as mentioned earlier, tokens, as credit symbols on the chain, do not directly create wealth, but can only achieve the transfer of wealth. The direction and duration of the transfer depend on the attributes and patience of the money. Chips and assets will have unique attributes and positioning, and will eventually depend on asset narratives or assumptions. The attributes of funds determine what kind of narratives and assumptions will be paid for. Similarly, there is no difference between 100 BTC. The different attributes, preferences and risks behind the assets determine that their addresses will make different behavioral decisions. Understanding the distribution structure and counterparties of tokens is very important for tokens and economic systems. The trading mechanism of AMM can also illustrate this point. K-level Reasoning in economics provides a good interpretation and analysis of the reasoning and behavior of both parties in this form. The following figure shows a description of the K-level recursive reasoning graph model. In this model, the symbol a represents the depth of thinking. The modeling of the opponent is approximated by the function ρ-i. The 0-order model refers to the situation where the opponent is considered to be completely random. In the model diagram, the light blue area represents the thinking process of agent i for recursive reasoning. The calculation of each stage includes the calculation results of the previous stage, and the deeper level of the agent will backtrack and get the optimal result of the current round. For example, the 2-order model includes the calculation results of the 1-order model. In real life, the actual situation will be far more complicated than the model analysis. This model is for readers' reference only and does not constitute investment advice.

Regarding dividends, currently Web3 game projects rarely adopt this method, and most Web3 game projects allow users to pledge assets: users can get rewards by staking assets, but this pledge will not directly destroy the user's pledged assets, so this type of pledge will become one of the ways for users to earn income. In order to lock the liquidity of tokens, many project parties use the method of "staking tokens, rewarding tokens, points, sub-tokens, Pass NFT" to incentivize users, but in the actual operation process, there will be several problems. When the game project rewards staking, the rewarded tokens, points, sub-tokens or other types of game assets show a high inflation growth. If there are not enough consumption scenarios to undertake the selling pressure of token assets, then at some point in the future, the selling pressure of the rewarded assets will cause the relative price of the assets to fall rapidly: that is, if there is no change on the demand side, even if staking can reduce the circulation in the short term and limit the price drop, the increase in rewards will lead to an increase in supply, which will in turn drive selling pressure and price drops. In the long run, Web3 game project parties use divergent user revenue functions to maintain the number of users and stable user demand, which will squeeze the project party's long-term credit, which is tantamount to drinking poison to quench thirst. The solution is to increase the demand of users, whether it is the demand of new users or the expansion of new demand points of existing users, which can effectively slow down the trend of falling prices of tokens and other assets.

The main problems of most Ponzi's dividend and staking income economic models are as follows: First, Web3 game project parties cannot maintain a stable high annualized rate of return for a long time. The source of income is unclear. Secondly, the demand side was not accurately analyzed, and the demand side portrait was not accurately analyzed, such as distinguishing between consumers and investors. There was no clear understanding and beneficial measures for the preferences of consumer-level users. The project party failed to launch clear measures to cater to consumer-level users and could not achieve the retention of economic benefits. Moreover, in the fragile economic model, the project party is unable to maintain a stable economic system (asset prices, token prices, etc.) for a long time; once a whale holding a large number of "chips" smashes the market, it will amplify panic. Web3 game parties can detect the following indicators to judge Ponzi's profit model, which is convenient for correction to obtain long-term stable development. 1) Whether the profit function is a divergent function. 2) The source of income. 3) The impact of the deposit and withdrawal of new users on the yield of existing users. Game project parties can solve Ponzi's economic model problems in a variety of ways: such as auxiliary financial facilities, convergent profit functions, Slashing mechanisms, etc.

Other potential gameplay such as airdrops and incentive tasks can increase user participation and enthusiasm, and promote community activity and interactivity. Through airdrops, users can get some rewards for free, increasing their favorability and trust in the platform. Incentive tasks can guide users to complete specific activities to obtain additional rewards.

Based on the above analysis, the revenue sources of Web3 games include multiple sources. However, it should be noted that for game project owners, if they want to meet the requirements of long-term development, they still need to meet the following standards:

From the perspective of the project owner: Retained earnings in the form of legal currency (or equivalent U), that is, in the balance sheet, retained earnings are positive; and in the cash flow statement, net cash flow from operating activities is positive; (In this case, external economic compensation can be given to the project owner in the form of legal currency or in the form of equivalent legal currency, such as advertising denominated in legal currency or equivalent U)

From the perspective of the user: The amount of capital invested by all participating users in the game is greater than the amount of capital withdrawal, that is, ∑(Input) ≥ ∑(Output), (same currency); at the same time, the utility of the user can at least fill the gap between capital withdrawal and capital investment, that is, ∑(Input) ≤ ∑(Output) + ∑(Utility), ( Same currency)

From the user's perspective, the entertainment and consumption attributes of the game are its most basic attributes and the basis for users' continued investment; if the two conditions are combined, it will be found that the user's utility is the cornerstone for Web3 game project parties to achieve surplus retention under the conditions of sustainable development.As for financial attributes, they can play a role of icing on the cake for Web3 game project parties, rather than sending carbon in the snow. The financing and scheduling capabilities that break the limitations of time and space cannot actually solve the user's utility problem in the long run, unless it is a "casino-like" Web3 game project party. (Users have a chance to win or lose, but the form is not limited to the game form of traditional casinos; the source of income for the project party is pumping.) Moreover, according to the supply and demand theory, the growth in demand for game assets will drive up game prices, but if the growth in demand for its assets is only regarded as the financial return that the game itself brings to users, it is nothing short of a blind eye. It not only ignores the laws of economics, but also ignores the development of Web3 games and the expansion and maintenance of new player users by Web3 games.

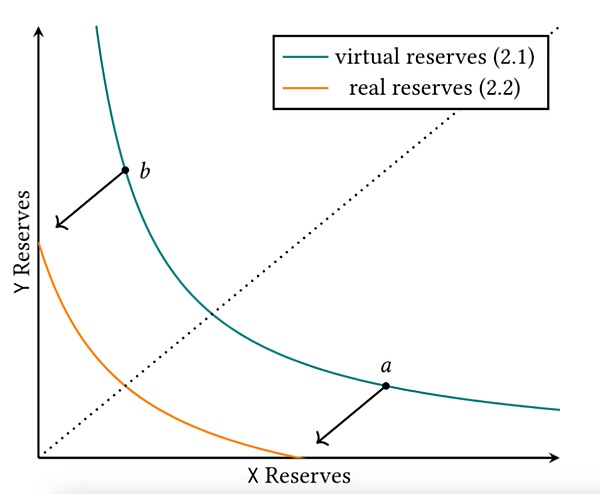

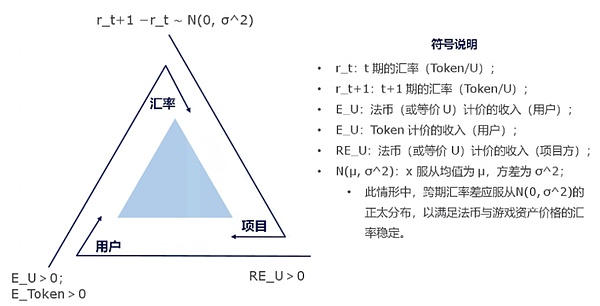

There have always been two views on the direction of Web3 games: financialization of games and gamification of on-chain finance. The gamification direction of on-chain finance will be more difficult than the financialization direction of games, mainly for the following reasons: First, the problem of the counterparty. Wealth will not be created out of thin air, nor will it disappear out of thin air. It will only be transferred from one place to another with the help of token carriers. Then the counterparty will become other users (gambling) or the project party itself (subsidy). Project parties can provide subsidies in the short term for the purpose of motivating users and marketing, but long-term excessive subsidies are unsustainable. (Examples outside of Web3 games: subsidies for group-buying users in the Hundred Group Wars of the group-buying model, subsidies for diners by Ele.me and Meituan in the food delivery war, subsidies for passengers by Uber and Didi, subsidies for cyclists by Mobike and ofo; subsidies for users by some express apps) Although token pricing is adopted, due to the influence of factors such as token price fluctuations under the credit system (Token/U exchange rate analysis model) and consumption in real life, game project parties still need to maintain retained earnings denominated in legal currency; and the game between opponents will push game project parties to become a casino-like business model, that is, users have a probability of winning and a probability of losing, but the form is not limited to the game form of traditional casinos; the source of income for the project party is pumping. Secondly, the problem of long-term yield. As mentioned above, it is difficult to maintain a high yield for a long time. Affected by factors such as the trading pool, the larger the amount of funds, the more difficult it is to achieve a high yield.

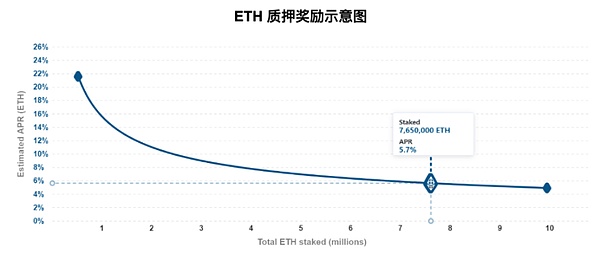

Moreover, the revenue and penalty mechanism is not well set. For example, the staking mechanism. Many game project parties blindly imitate the economic model of infrastructure and set up a staking mechanism. But taking the staking mechanism of Ethereum as an example, by staking Ethereum, block rewards and transaction fees can be obtained. When the amount of funds for Ethereum Staking is higher, the yield of staking will decrease. The two show a negative correlation. At the same time, if the staking node does evil, the penalty mechanism of Ethereum will affect the decline of revenue, or even negative revenue. Therefore, the staking mechanism of Ethereum can maintain the stability of network operation, reward nodes that maintain the network, and punish nodes that damage the network with the help of the staking mechanism. But in Web3 games, there is no reward for staking tokens to pledgers who promote the network, and there is no penalty income from pledgers who damage the network. Only locking the liquidity of game assets through staking has not completely solved the problem of divergent revenue function of game assets. In the absence of some parameters, the mismatch between the asset pledge mechanism and the model required by the game is not conducive to the long-term development of the game.

Information source: public market information

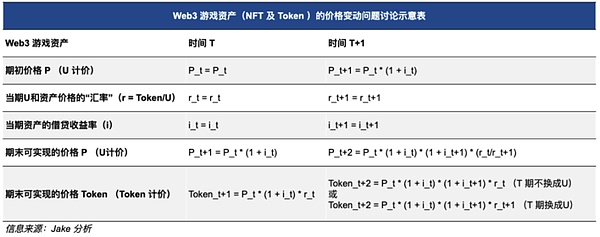

The supply and demand relationship determines the current token price, and the "exchange rate" (Token/U) between withdrawals and deposits is its manifestation. An open economic system is more complex than a closed economic system, and it also brings more potential expansion scenarios and application space. Since the credit system associated with Web3 games supports the long-term development of Web3 projects and the potential demand for tokens, the Web3 game project guides users and institutions to trust the game system, which is one of the key measures to promote the increase in token demand. The attributes and patience of users and institutions determine the time they can hold tokens. Web3 game tokens and assets will ultimately be attached to asset narratives or assumptions. The nature of funds determines what kind of narratives and assumptions will be paid for. In the subdivision direction of Web3 Gambling, users are not fools, they just want fair games, or at least fair games on the surface, rather than being arbitrarily harvested and robbed by institutions or "dealers". When the token holding structure is unhealthy, or the profit-to-odds ratio is not appropriate, users will naturally leave. This conclusion is not limited to Web3 Gambling, but also applies to some other Web3 fields. For example, the issuance quantity and price changes of Memecoin can better reflect this phenomenon. Due to the past trading history, some institutions have arbitrarily harvested users, and users' credit to some institutions has decreased. The "one-wave" projects and "guillotine" harvests of retail investors by some institutions in the past seem to be vivid. Therefore, the current tokens with high FDV and institutions are increasingly unpopular with retail investors, so retail investors will turn from high FDV and low circulation projects to Memecoin transactions to seek fairer PvP games.

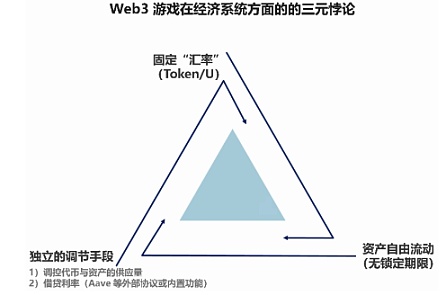

At the same time, because traditional Web2 games do not have access to deposits and withdrawals, the attributes and necessity of finance have not been fully utilized in traditional games, and because traditional technology has not fully demonstrated other rights such as asset ownership, use rights, and lending rights, Web3 games will be more powerful in terms of the space they can play. In an open economic system, the resources and personnel that can be mobilized far exceed those in a closed economic system. Financial attributes give in-game assets more flexibility, fully improve the user's ability to allocate assets in time and space, and can separate the ownership and use rights of assets. Since Web3 tokens and assets have greater liquidity, assets and tokens that can have access to gold still need to meet the "impossible triangle" conditional restrictions of the Web3 game economic system, that is, at most two of the three conditions of fixed exchange rate (Token/U), free flow of assets and tokens, and independent means of regulation (such as regulating the supply of assets and tokens, and lending rates under internal and external conditions). Therefore, in the process of designing the game's economic mechanism, Web3 game numerical planning needs to break through the limitations of Web2 games, transcend the assumption of a closed economy, and seek a balance in the impossible triangle to achieve the stability of the game's numerical system and financial equilibrium.

Information source: Jake Analysis

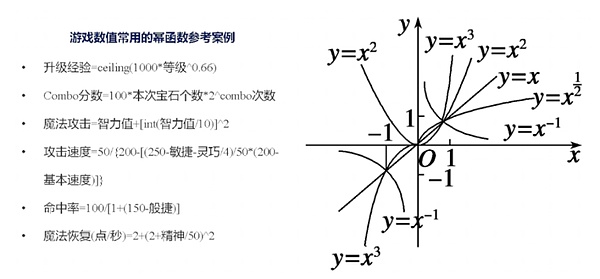

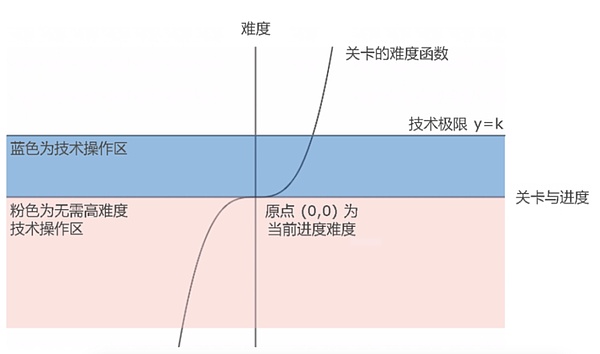

Due to the attributes of deposits and withdrawals, dynamic gaming among multiple parties, and price fluctuations, the numerical system and economic design in the game are even more important. The factors that game planners will pay attention to include but are not limited to type, time, function, experience, etc. This article will make a rough analysis, and the next chapter of this series will analyze the numerical system and economic design of the game in detail from the perspective of numerical planning. The numerical planner of the game, that is, the game balance designer, is responsible for the design of the rules and systems for the balance of the game, including AI, levels, and other content other than the plot, which all require numerical planning. For example, the weapon damage value and HP value seen in the game, including the combat formula, etc. are all designed by the numerical planner. The numerical system needs to maintain the balance of the game (cost-benefit ratio, combat balance, numerical balance, etc.), formulate strategic numerical designs (directly adjust the numerical value and cost-effectiveness, numerical upper and lower limits and probability distribution, fairness and system balance, combat mechanism bottom line and algorithm a posteriori, etc.), and consider the frustration of players (the difference between the actual cost and the expected benefit will not lead to excessive or low frustration, thereby affecting the player's gaming experience). From the perspective of game design and planning, the numerical part can be divided into the following parts:

Combat values: the values of various attributes in battle and their distribution relationship, growth rate and game balance, including numerical planning in competitive games;

Economic/system values: involving the economic structure between various systems, the rhythm of players' income from investing time in the game, and the planning of monetary value;

Activity/operation values: in various activities and operations in the game, how to meet the needs of players with different paying abilities to improve the comfortable experience of all players;

Others: A game with combat as the theme will usually set up a special battle plan to coordinate the combat values in the game.

Web3 Game Numerical Formula Case Reference

Game numerical planning is a dynamic process that needs to be constantly adjusted based on data such as player positioning and preferences, actual operation conditions, and player feedback. In MOBA games, this may involve research on map size, character movement speed, various attributes, career growth trends, skill burst damage ratio, equipment effects, and the impact of advanced attributes on combat. Game developers need to have a deep understanding of players' interests to ensure that the game can attract and retain players. The second article in this analysis series will analyze the direction of game numerical planning in detail, which will not be elaborated in detail in this article. At the same time, you can refer to relevant books on game numerical values, such as "Balance Master: Game Numerical Combat Design". The following figure is an example of a game numerical system.

Information source: public market information

Information source: public market information

Moreover, the deposit and withdrawal properties of Web3 allow tokens and in-game assets to be traded with some fiat currencies (or tokens pegged to fiat currencies), and build Web3 The trading pairs of project assets and various fiat currencies (or tokens pegged to fiat currencies) are, to a certain extent, a form of credit expansion of the corresponding fiat currency (the fiat currency of the corresponding trading pair), that is, the number and categories of assets denominated and supported by the fiat currency increase. In the current market, the mainstream is still the credit expansion of the US dollar; at the same time, since it involves multiple types of fiat currencies (or multiple tokens pegged to fiat currencies), the theories and practices of triangular arbitrage theory and foreign exchange derivative transactions in traditional international finance can be applied to the assets and tokens of Web3 games.

If the Web3 game project party sets the target population as game users or consumers, it will avoid the situation of rapid death to a certain extent. However, in actual applications, due to the lack of more complete theoretical and protocol support, the Web3 game project party cannot issue assets related to depreciation or amortization. Therefore, in the actual operation process, the actual profit point does not come from the game users with a consumption nature, but from the increase in demand, which leads to an increase in the price of the assets sold. If there is no actual consumption scenario and cash flow related evaluation method, the price of assets (homogeneous and non-homogeneous tokens) is very easy to fall. Even if liquidity is increased, the direction of decline cannot be reversed. In this case, in the process of rapid decline in demand, it is very easy to cause a death spiral for the game project. The following are several theories and protocols/middleware directions that Web3 game projects need to consider when designing games.

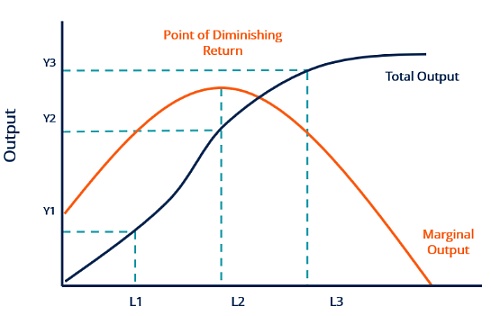

Margin refers to a small adjustment to a decision or change, and the result caused by the small adjustment is the marginal effect. In economics, marginal theory focuses on the study and discussion of the additional effects or changes caused by increasing or decreasing a unit of quantity under specific circumstances. Marginal theory has applications in many fields of economics. In mathematics, dy/dx can be used to express differentials, which refers to the rate of change of function f(x) at point x.

Information source: public market information

From a marginal perspective, when analyzing Web3 game users, the player's revenue function equation and cost function equation can be used to measure every step of rational profit-seeking users. For example, assume that in a Web3 game, all users are profit-seeking, not consumers. Then, for users, only when the marginal benefit is greater than the marginal cost will they take the next action, such as entering the next level, raising the next pet, or operating and building the next building; in this case, the game project party can monitor the flow of tokens in the game and find the most profitable ways for players to facilitate the adjustment of the parameters within the game, reduce the user's benefits or increase the user's costs, and reduce the outflow rate of capital in the game.

Information source: public market information

The following table shows a case where NFT utility and price are distorted. In all levels from level 1 to level 8, the return ratio of type A NFT assets is higher than that of type B NFT assets, so rational users will buy type A NFT assets instead of type B NFT assets. For the project party, the issuance of type B NFT assets brings low purchase volume and low returns, so it is completely unnecessary to issue type B NFT assets, and the purchase increment brought will not meet expectations.

Information source: Jake analysis

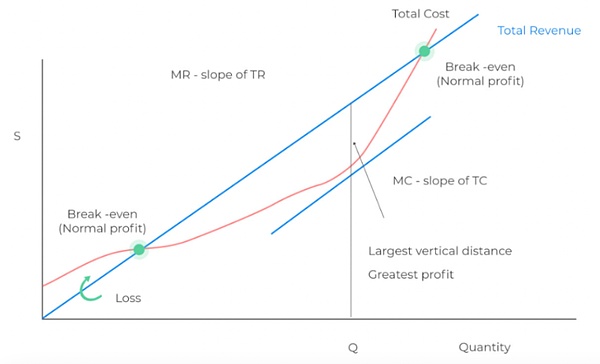

From the perspective of marginal theory, Web3 game project owners can test the cost-benefit ratio of each new user, that is, profit/cost. If the cost of acquiring and subsidizing users exceeds the benefits brought by the users, the Web3 game project owners need to adjust their numerical system to avoid greater losses; and, assuming that the Web3 game project owners insist on doing things for the long term, they should avoid using the Ponzi economic model that quickly absorbs profit-seekers in the short term. The Ponzi economic model can only be established in the short term and cannot achieve a stable economic state in the long term. This requires sacrificing the money of some users to pay interest and returns to another part of users. In the long run, returns denominated in legal currency are not established. If the project party insists on the Ponzi economic model for a long time, there will be two consequences: due to the influence of high returns and high selling pressure, the long-term asset price will show a downward trend, or because the high returns denominated in fiat currency cannot be maintained for a long time, the Web3 game project party needs to subsidize profit-seekers, which will eventually lead to the "treasury" of the game project party being emptied. That is, if there is a lack of sustained growth in external demand for game assets, then in the Ponzi economic model, the stable exchange rate between fiat currency and game asset prices, the high returns brought by game assets to players, and the positive capital inflow (retained earnings) of the project party's treasury cannot remain stable in the long run. The project party can check the income and cost of a single user, that is, check whether the high return of the user is subsidized at the expense of the investment funds of other users, and can adjust the relevant values in time to avoid falling into the long-term growth dilemma and trap of the Ponzi economic model.

Information source: Jake analysis

As mentioned above, it doesn’t matter if the cat is black or white, as long as it catches the mouse, it is a good cat. From the experience of Web2 games, under the same currency measurement, some accounting rules and game realization methods are still applicable to Web3 games. Being wrapped up in so-called doctrines, authorities, prohibitions, slogans, prejudices and emotions, Web3 games will be greatly restricted and constrained in realization and profitability. For the sake of so-called correctness and doctrine, ignoring the analysis and production framework of the game, abandoning the profitability under the same token or currency, it is difficult for Web3 games to fully achieve self-circulation in terms of profitability within the life cycle of the game, and can only rely on "coinage rights" or "new asset casting and issuance rights" to achieve the transfer of assets and wealth in alternative forms. Therefore, Web3 games still need to consider the benefits and costs of a single user. Some of the monetization methods under Web2 games can be used as references for Web3 game production: subscriptions (weekly cards/monthly cards/point cards/pass cards/paywalls), in-app purchases of game assets, advertising monetization, paid downloads, transaction fees and taxes, paid game peripherals, and many other methods. Especially in the in-app purchase of game assets, the user behavior of players and the plot, levels, scenes, tasks, etc. in the game need to consider the costs and benefits of new users in a single scene and a single consumption activity. From a mathematical and economic perspective, the benefits of new users and retained users must exceed their corresponding costs in order to achieve the self-circulation of the game's internal economic system. This game operation section will be explained and analyzed in detail in the Web3 game operation and distribution section.

For Web3 game project parties, the right to mint and issue tokens or other NFT assets is the right to obtain income in the process of issuing currency and other assets, which is backed by the credit of the project party. For project parties, there is no need to use other methods (such as trading pumping), just "minting new assets" can bring convenient income. New assets can play a variety of roles in Web3 games, such as the utility within a certain section of the game, lubricating various sections within the game, facilitating operational monitoring and regulating user behavior in the game, etc.

However, the right to mint and issue assets is so tempting that, to some extent, it will make project parties obsessed and addicted. Since issuing new assets can directly bring in income, the motivation of project parties to maintain old assets and enable the utility of old assets will decrease. From a long-term perspective, excessive use of the right to mint and issue assets is like drinking poison to quench thirst. It will not only lead to a depreciation trend for both new and old assets issued, but also lead to the collapse of the project's credit system. Without restrictions, the right to mint coins and assets a hundred years ago would be abused, and the same will be true a hundred years later. Therefore, for game projects, if they want to maintain and survive in the long term, they need to carefully manage the right to mint and issue assets.

In general, from the perspective of token systems and economics, issuing new assets without using existing assets, including governance tokens, economic tokens, NFT assets and other types of assets, will be considered a tax and exploitation of existing asset holders. In theory, due to the decline in the purchasing power of fiat currency over new and old assets, the "inflation" brought about by the new supply of assets will lead to a reduction in the prices of new and old assets, accompanied by a credit tightening of the project party. If the project party relies heavily on asset issuance, this behavior will seriously affect the stable operation of the economic system inside and outside the game, asset liquidity will be in short supply and downward trend, the expected decline in asset prices will further promote the depreciation of assets, and it will be difficult for the game project party to use external compensation to adjust the internal economic system of Web3 games. Therefore, without considering external parameters, the project party pursuing long-term growth will not use seigniorage as the main source of income, but transaction pumping and taxation as the main source of income.

Based on the above analysis, the number of newly released and issued assets should be a function equation about new users and their purchasing power. New users and their purchasing power should theoretically push up the price of issued assets. Similarly, the decline in the number of active users, or even when users leave the Web3 game, the price of issued assets will decline. In this case, it will seriously affect the consumer experience. Therefore, if you want to maintain equivalent purchasing power for assets or tokens, retained users and their purchasing power are irrelevant variables in the new asset issuance function. If factors such as the amount of money spent on buying remain unchanged during game operations, then in the differential equation of the new asset issuance function for the number of new users, the purchasing power parameter of the new users can be roughly equal to the purchasing power parameter of the retained users. In the differential equation, the specific parameters of purchasing power depend on the purchasing power parameters of real consumer users in different regions. As one of the important parameters for the number of new asset issuances, the number of new users depends on many factors such as the launch of the game, community operations, and channels. In addition, some external factors are also independent variables of the function equation for the number of newly released and issued assets, such as factors affecting the macroeconomic environment and external liquidity.

The cash flows of Web3 game products and insurance products are completely opposite. The cash flow brought by traditional insurance products is stable and continuous, and will bring book losses at the later payment time point. However, the nature of game products and insurance products is completely opposite, with greater risks and high initial investment costs. Cash flow will only be brought in the later stage, and the cash flow is unstable. From the perspective of financial products, Web3 games need to use models to calculate the return on investment.

The commonly used recovery model calculation formula is ROI=LTV/cost. When ROI=1 means full recovery, LTV=cost, but simply reducing costs without considering the quality of payment cannot shorten the recovery cycle, so try to reduce costs while keeping LTV unchanged, or if LTV increases, you can appropriately accept higher costs and obtain economic benefits with ROI as the guide. A successful Web3 game, the subsequent LTV can continue to grow, all accompanied by high retention data, so when measuring and testing, you need to pay attention to the data of related indicators such as retention. When LTV grows slowly, the retention data will drop very quickly, and it is difficult to achieve long-term stable development.

Combined with the third part of this series of articles (testing and operation), different types of products and data will have different recovery cycle characteristics. Light mobile games are mainly casual games. Most of the light mobile games and small games that buy traffic have advertising monetization, and a small number of them are in-game purchases + advertising monetization. Generally speaking, the recovery cycle of light games with in-game purchases is usually within one week. The reason is that the game is not deep enough and the gameplay cannot support the long-term retention of players, so it must be recovered in a short time. Casual games without ads generally have weaker monetization capabilities, but the player retention time is long, and the payback period is about 6 months. Medium mobile games are between light and heavy, taking into account both gameplay and charging. Types include cards, strategy, placement, and cultivation. The recovery cycle is similar to heavy, generally 3-4 months. The gameplay of heavy mobile games is more in-depth, and the operation activities will be continuously updated. The player stickiness is high, but the population coverage is not as good as that of medium and light mobile games. The recovery cycle is about 2-3 months, and the LTV growth characteristics are that the second day is twice that of the first day, and the 7th day is 2-2.5 times that of the next day (only represents some games).

Source: Public market information

In reality, it is far more complicated than the ideal model. Different types of games have different payment models. A 40% - 50% ROI on the first day does not necessarily mean that the financial data is excellent. It is still necessary to combine subsequent growth and retention to calculate the recovery. In addition, since Web3 games are still risky "input-output" products, the estimation of the payment model requires at least 7-14 days of test data as a sample, and based on the growth of test data, the growth of future purchases and delivery can be calculated. For the optimization strategy of the data model, the core gameplay and mechanism system in the game can be specifically adjusted according to the test data of the game, and the operation can also adjust the activity arrangement, community interaction and delivery channels. Specific reference test data include retention, churn time, ARPU, churn events, etc. (For details, please refer to the third part of this series: Testing and Operation)

To prevent game players from over-relying on a certain in-game asset, such as weapons and equipment, defensive equipment, etc., Web3 games need to set the durability of game assets, that is, the depreciation and amortization attributes of game assets. Players need to continuously invest resources to maintain game assets, otherwise the utility of game assets will gradually approach zero. At the same time, the setting of game asset durability encourages players to acquire new assets or repairs, and promotes the circulation and balance of the in-game economic system. Players need to continue to participate in the acquisition, trading and use of resources to maintain the economic activity, balance and dynamism of the game.

Web3 game project parties can use commonly used NFT or Semi-NFT asset protocols (such as EIP-721, EIP-1155, EIP-3525) as the protocol standard for the issuance of game assets. However, Looking at the NFT or Semi-NFT asset protocol standards, there are strict constraints and descriptions on core indicators such as quantity, address, and byte data. However, from the perspective of game assets, the protocol standards lack the time limit of assets, depreciation and amortization methods (such as accelerated depreciation, uniform depreciation, decelerated depreciation, etc.), depreciation and amortization coefficients, initial utility parameters of assets, interest rates and other indicators. Among them, indicators such as interest rates will be one of the important indicators to be explored in Web3 RPG games. The current NFT and Semi-NFT asset protocol standards have failed to fully tap into the attributes of consumer goods or consumables of assets. Therefore, in actual operations, Web3 games and other Web3 applications are also unable to continuously motivate players to purchase and maintain assets and continue to play the role of assets. The following is a display of the EIP-721 protocol standard.

Information source: public market information

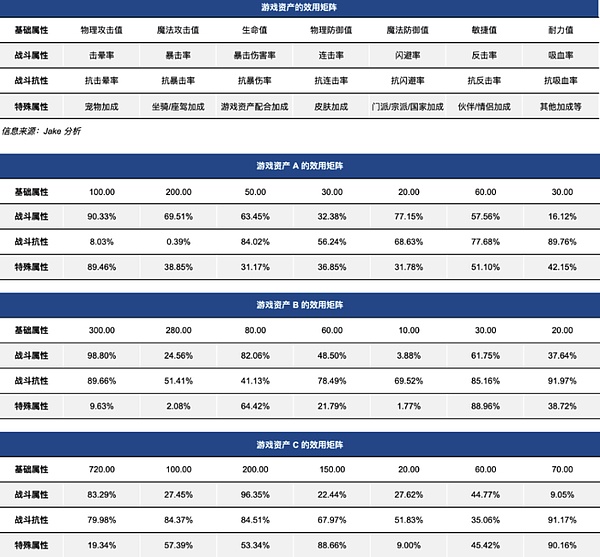

As mentioned above, since the current asset protocol standard lacks core parameter settings for several asset types, the corresponding middleware is still vacant based on the new asset protocol standard. In addition, the secondary trading system based on its middleware cannot be built, and the liquidity of its secondary assets cannot be guaranteed. From the perspective of the project-side demand of Web3 games, some in-game assets cannot be put on the chain due to the lack of new asset protocols. Even if they are put on the chain, the utility of the assets in the game cannot be fully utilized. In addition, due to the limitations of the middleware and trading system, the relevant pricing mechanism of assets is imperfect, and the liquidity of the secondary market will also be greatly affected. Take the following matrix data structure to represent the equipment system of Web3 games as an example analysis:

Information source: Jake analysis

The above are three game asset cases A, B, and C. The corresponding basic attributes, combat attributes, combat resistance, and special attributes in the matrix data structure are all different. Therefore, in theory, different asset utilities will have different pricing in the same Web3 game (same pricing mechanism). However, the middleware based on the current asset protocol lacks a pricing mechanism for its asset utility. In addition to the factors affecting the utility of Web3 game assets, external factors will also affect the pricing mechanism of Web3 game assets, such as the asset life cycle, asset depreciation and amortization method, asset depreciation and amortization coefficient, interest rate, external economic environment, etc.. Art factors will also be one of the subjective factors affecting the purchase of players and users, but there is currently a lack of quantitative indicators to clarify the external compensation of art factors for the utility of game assets.

Combining the above analysis, whether it is homogeneous or non-homogeneous tokens, tokens related to Web3 games will not directly create wealth out of thin air. Tokens and assets are a carrier of wealth transfer. Tokens and assets will have unique attributes and positioning, and will eventually find an address to pay for the asset narrative or hypothesis. After the project party establishes a trading pool, users on the demand side can obtain many consumer and financial utilities, and potential rent-seeking addresses will also participate in the game and fight between addresses. Web3 games use blockchain innovation, but still need to meet the conditions and restrictions in terms of "accounting", "exchange rate" and "finance". Since Web3 games have the attributes of deposits and withdrawals, the numerical system and economic design in traditional games are more important. However, due to the lack of some parameters in the underlying protocols of current homogeneous and non-homogeneous tokens, such as the lack of time, depreciation coefficients and methods in asset-related protocols, the attributes of current on-chain assets cannot be fully utilized. In the future, more middleware and applications based on new protocols will flourish. It is worth noting that the right to mint tokens and assets granted to Web3 game project parties may lead to abuse. The right to mint coins and assets a hundred years ago would be abused, and so would it be a hundred years later. This article is the first in the Web3 game analysis series. Please look forward to the next article in the Web3 game analysis series (II) Industrialized production and production (technology and art). Among them, the content of the core mechanism and gameplay system is an internal document and will not be published publicly for the time being. You are welcome to communicate with the author separately about this part.

Solana uses a monolithic structure that enables the network to leverage speed and efficiency that modular blockchains cannot.

JinseFinance

JinseFinanceWhat makes this "second generation running shoe" project so attractive? Can it replicate the phenomenal success of STEPN in 2022?

JinseFinance

JinseFinanceWith the new year and new atmosphere, Chief Analyst Sirius has compiled twenty key narratives that our team will focus on this year, covering everything from underlying infrastructure to top-level applications. It is destined to be a very busy year.

JinseFinance

JinseFinanceFrom custody application denial to severing of ties, forced exits, lawsuits, and more, these back-to-back challenges have put Binance under the spotlight, and not in a good way.

Catherine

CatherineWeb3Go will continue to monitor the development of Hooked Protocol by providing in-depth onchain data analysis.

Web3Go

Web3GoThe firm ends SPAC deal under which it would have become a listed company.

Others

OthersINTERNET CITY, DUBAI, Jul. 14, 2022 – LBank Exchange, a global digital asset trading platform, has listed Fan2Go (FNTG) on ...

Bitcoinist

BitcoinistWhen it comes right down it, the long-term success of a crypto platform is not based on memes and hype. ...

Bitcoinist

BitcoinistSolana Labs Co-Founder Anatoly Yakovenko announced a suite of products aimed at harvesting crypto’s potential to integrate with smartphones. According ...

Bitcoinist

BitcoinistThe future is now. Both Stripe and Primer joined forces with OpenNode for separate payment solutions. The Stripe App will ...

Bitcoinist

Bitcoinist