Source: Vernacular Blockchain

The "inscription craze" that has been launched in recent times has really made many people feel a bit at a loss. Why is the "air" of seemingly worthless logic It will be popular. The community shouts "make inscriptions" every day. It seems that many people have not yet figured out what "make inscriptions" means. It feels like the wave is about to pass quickly. What is the end of these extremely controversial things? Can it be sustained? Today we will talk about the nature, value logic and doubts of the inscription, what exactly is the "beating" of the Bitcoin inscription.

01 Inscription, the Essence of BRC20

Bitcoin as early as January 3, 2009 The genesis block records the first inscription on Bitcoin. Satoshi Nakamoto engraved the title of the front-page article of The Times that day on the chain in hexadecimal - The Times 03/Jan/2009 Chancellor on brink of second bailout for banks (on January 3, 2009, the chancellor was on the verge of implementing a second bailout for banks).

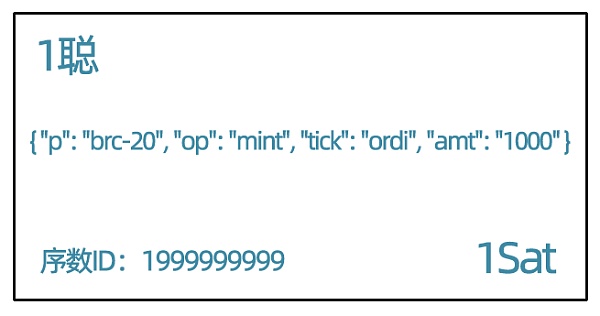

"Inscription" and "Inscription" are used because the information recorded on the anti-fragile decentralized blockchain is just like the information recorded on the hard What is engraved on the stone will never be erased. In the past, people also engraved 1314 on the Bitcoin chain to remember special information. Now, the issuance and circulation of Token can be tracked by serializing Satoshi, the smallest unit of Bitcoin. If you think about it carefully, the current BRC20 is similar to the ancient Yap Island stone coins.

Yap Island Stone Coins

Yap Island Stone Coins

In fact, there are many very similar examples in modern society, which can also help to understand the inscriptions and BRC20:

1990 In 1991 and 1991, in order to commemorate that Disney banknotes were submitted to the U.S. government for approval and became circulated currency for the first time, a special 1-dollar banknote was issued (with a first-day cover, stamped with a Walt Disney image stamp, and the pattern was Mickey Mouse).

Disney and Mickey commemorative banknotes with a face value of 1 US dollar

Disney and Mickey commemorative banknotes with a face value of 1 US dollar

Of course, there are also "dragon banknotes" that are being snapped up in China and other commemorative coins printed on coins of different denominations. With the superior anti-counterfeiting, independent numbering and circulationability of legal tender banknotes, these commemorative banknotes have become very unique collectibles. It is obvious that a commemorative banknote with a face value of 1 US dollar is much larger than 1 US dollar.

The carrier of the inscription is to replace the banknote with the smallest unit of Bitcoin or the smallest face value: Satoshi. When some satoshis are engraved with NFT patterns, BRC20 Token issuance, transactions and other script information, Bitcoin also gives these information special properties such as anti-counterfeiting and non-tampering. With these attributes, the NFT and BRC20 engraved on Bitcoin have the strongest network in the encryption industry as "backing", full of anti-fragility, and the Fomo of meme, so Bitcoin The craze for inscriptions is not like a flash in the pan like many new concepts, but has a certain vitality. BRC20 even shows an upward spiral trend. Of course, the driving factors behind the inscription craze are not limited to these...

Using the analogy of commemorative banknotes to represent BRC20

Using the analogy of commemorative banknotes to represent BRC20

02 The driving force behind the craze for inscriptions

It is not easy to explain the logic behind the phenomenon of inscription fever. It may not be as simple as we think. It is at least composed of the following driving forces:

1) Meme: a mysterious power that is difficult to explain.

Meme is a mysterious power that is difficult to explain. Fomo emotion is the main driving force of memes. Most memes are always It is called "air" with disdain. However, perhaps precisely because it is "air", it opens up the ceiling of imagination compared to other things with detailed roadmaps and accurate concepts. It is no longer limited to the positioning of white papers, but believes that it gives consensus and value. Whether it is early Bitcoin or BRC20, it is air but not air. It is more of a carrier of emotional trend speculation at this time.

This phenomenon has been present in other markets for a long time, so we have seen some special phenomenon-level popular events and figures such as the Spring Festival Gala, the appearance of certain celebrities who suddenly became popular, and the aura of Musk Just by posting on Twitter, there will be many memes to carry people's emotions in a short period of time. Whether it's fomo or eating melon, as long as there is market demand, it will appear. Of course, some capital and institutions are indispensable behind the scenes.

2) BRC20 brings innovative targets to the market

BRC20 looks a lot like NFT but is not an NFT. It is similar to a homogeneous Token but is a bit different. Too same.

Compared with ERC20 (Ethereum’s mainstream homogeneous token protocol), BRC20 seems to be more open and fair, and is backed by the consensus of the number one crypto asset. During the ERC20 wave in 2017, Ethereum’s status was not special. stable.

Compared with ERC721 (Ethereum’s mainstream NFT protocol), BRC20 can mint one by one like NFT, but it is easier to add liquidity. It is very convenient for homogeneous accounting, and you can directly access the trading pairs of major leading platforms. This eliminates the past problems of NFT liquidity being easily exhausted.

3) Bitcoin Ecological Expectations

The meme has been changing over the past few years, and now this thing is coming up again. The Bitcoin ecosystem has become even more out of control. The status of Bitcoin’s big brother is as stable as Mount Tai. It exists as a consensus totem in the crypto community, and Bitcoin ecology such as BitcoinFi and Bitcoin NFT has actually been brewing for a long time. In fact, it has been expanded since 2013. There are voices and attempts at digital gold functions, but due to the impossible triangle problem, expansion has not been able to be solved, and predecessors have been groping.

Ethereum was also developed from the idea of expanding smart contracts proposed by Vitalik, who was still in the Bitcoin community in the early days. In recent years, the explosion of the Ethereum ecosystem and the implementation of Layer 2 have stimulated the development of the Bitcoin ecosystem to a certain extent. The successful experience and paths explored by the Ethereum ecosystem as a test field have given Bitcoin ecosystem developers direction and sufficient confidence.

Ever since, on the basis of the existing expansions such as Bitcoin Segregated Witness, the Ordinals protocol and the BRC20 protocol, which were the first to be implemented, successfully combined punch...

4) Forced by the pressure of halving and driven by the internal motivation of the Bitcoin community

Although each of the previous Bitcoin halvings was followed by a bull market, most of the Bitcoin community Everyone knows that system rewards are getting less and less, and it is unlikely that block producers can maintain stability every time simply relying on system rewards. Therefore, the Bitcoin community, including the block producer group, is eager to see the Bitcoin ecosystem prosper. Get up and solve this problem that affects the sustainable development of the Bitcoin system before the halving.

On January 12, according to Dune data, the cumulative fee income of Bitcoin Ordinals inscription casting exceeded 5506 BTC, which is approximately US$254 million (calculated based on the current price of 46032/BTC). Obviously the inscription has already It has begun to bring quite high returns to block producers, and block producers have also become one of the main beneficiary groups of Bitcoin Inscription, especially BRC20.

The cumulative cost of inscription casting, source: Dune analysis

The cumulative cost of inscription casting, source: Dune analysis

5) Bitcoin ETF and the general environment

To talk about the biggest expectations this year, Take the Bitcoin spot ETF, which is highly anticipated by the crypto industry. Outside the crypto industry, there is an environment of the end of the U.S. dollar interest rate hike cycle.

Regarding the expectation of Bitcoin spot ETF, a lot of popular science and interpretation has been done on the vernacular blockchain in the past, and its importance and significance must have been self-evident. In terms of the general environment, the end of the U.S. dollar interest rate hike cycle in 2024 or even entering the interest rate cut channel means that the liquidity of the U.S. dollar will increase and more funds will flow into the market. Coupled with the imminent Bitcoin halving, and the superposition of multiple major expected positives, Bitcoin ecological expectations are even higher. The expected foreshadowing brings more certainty to funds, and the sustainability of the inscription craze is once again full. .

03 If it is regarded as a vulnerability by core developers, will it be reset to zero?

With the backing of Bitcoin consensus, Bitcoin Inscription memes seem to have a good opportunity to develop at the right time and place, but they are still questioned by some people, and many opponents have issued sharp criticisms. sound.

What has attracted the most attention recently is the attitude of some Bitcoin core developers, such as Luke Dashjr, a Bitcoin core developer and the founder of the Eligis mining pool. Luke has previously denounced Mingmin and BRC20 on social platforms many times, believing that Mingmin is using a vulnerability in BitcoinCore to send spam information to the blockchain. In short, opponents like Luke want to treat these protocols as loopholes to be fixed and sealed. Subsequently, Luke submitted a relevant proposal. One stone stirs up a thousand waves!

Because Bitcoin Core developers hold the "big power" to modify the Bitcoin client, many people feel that Inscription is about to end, because once the "vulnerabilities" they claim are fixed, then the Ordinals protocol will NFT, including all BRC-20 Tokens, will have their traces erased and returned to zero.

However, the "loophole" theory and the panic of a small number of people did not cause violent vibrations in the market. After simple consolidation, some BRC20 even continued to rise "like nothing happened".

So, in the face of opposition from core developers, why are everyone still so calm?

In fact, Bitcoin Core developers are a huge decentralized organization, and Luke is just one of them. It does not mean that if anyone objects to this thing, Bitcoin Core will implement modifications. . To take a step back, even if most people in Bitcoin Core agree,it may not be possible to successfully upgrade the client, because the power to upgrade the client lies in the hands of the block producers. The Bitcoin community , the identities of block producers and developers also overlap, and Inscription has long been closely related to their interests. Maintaining the stable and sustainable development of the Inscription protocol will bring more benefits than disadvantages to the Bitcoin ecosystem and most people in the Bitcoin community. of.

Most people are sure that Luke and other opponents cannot make waves. Even though Luke controls a mining pool, you must know that there are several mining pools with the largest computing power behind supporting BRC20. These mines Pools actually represent the interests of block producers.

Recent news revealed that, as expected, Luke’s proposal to ban inscriptions was rejected by many core developers. Bitcoin Core developer Ava Chow concluded that the proposal was so controversial that there was no need to continue the discussion.

Existence is reasonable, and the inscription will probably continue to exist under the consensus driven by strong interests.

04 Summary

Obviously, the inscription craze is not a coincidence, the Bitcoin community and ecology We were already prepared, but this bottom-up innovation surprised the capital, which went from being aloof and arrogant to joining. Even if BRC20 is not a perfect protocol, it is unknown whether a better protocol will replace it in the future. But what is certain at present is that it has opened the door to the Bitcoin ecosystem, and the rise of the Bitcoin ecosystem is a foregone conclusion.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Max Ng

Max Ng JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance JinseFinance

JinseFinance