Author: Stephen Katte, CoinTelegraph; Compiler: Wuzhu, Golden Finance

Bitcoin first appeared on January 3, 2009, when Satoshi Nakamoto mined the genesis block, minting the first cryptocurrency. In the years since, some wallet addresses have accumulated a large portion of the supply.

According to the Blockchain Council, more than 19.71 million bitcoins have been issued to miners as block rewards. Satoshi Nakamoto's white paper stipulates that there will only be 21 million bitcoins in total, which means that most of them are already in circulation.

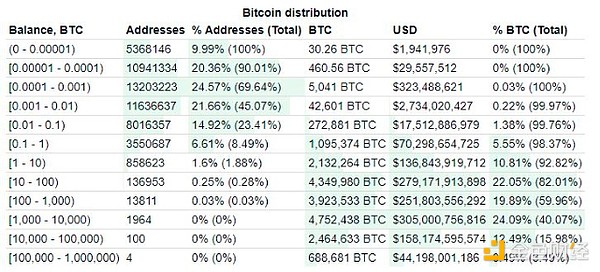

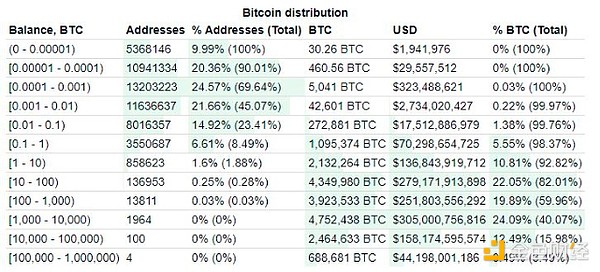

BitInfoCharts data shows that About 1.86% of wallet addresses (more than one million) hold more than 90% of the total BTC currently in circulation.These individuals or entities, known as "whales," hold large amounts of cryptocurrency.

Bitcoin Rich List: Source: BitInfoCharts

Caroline Bowler, CEO of Australian cryptocurrency exchange BTC Markets, said in an interview that the concentration of BTC ownership in a small number of addresses has both challenges and benefits.

"On the one hand, it raises concerns about market manipulation, centralization and liquidity constraints," she said.

“On the other hand, it provides these large shareholders with tremendous market influence, strategic advantages and exclusive opportunities.”

For the broader BTC ecosystem, the centralization of cryptocurrencies highlights the importance of continuing efforts to promote decentralization and enhance market stability to mitigate potential risks associated with unequal wealth distribution, Bowler said.

Satoshi Nakamoto’s original BTC white paper proposed a decentralized peer-to-peer transaction system without the need for financial institutions or intermediaries. His goal was to wrest financial control away from the elite.

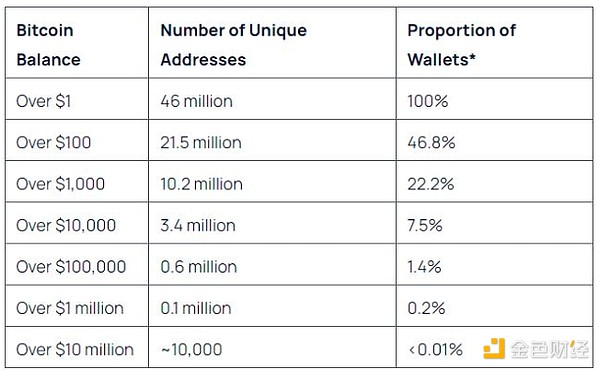

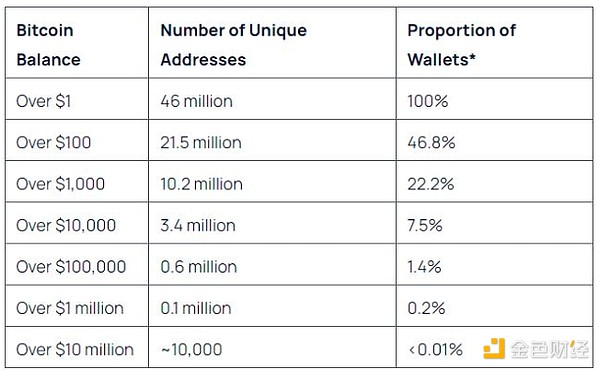

According to Exploding Topics, there are just over 46 million BTC wallets holding at least $1 worth of it. Less than half of those wallets have more than $100 worth of the cryptocurrency.

Bitcoin wallet balances. Source: Exploding Topics

BitInfoCharts data shows that only four wallets hold between 100,000 and 1 million BTC, totaling 688,681 BTC. The next 100 largest holders hold a total of 2,464,633 BTC. These 104 addresses together account for about 15.98% of the total supply.

Bowler speculates that if the entire BTC supply is accumulated by a small group of "whales", the entire ecosystem will change.

"100% of Bitcoin concentrated in a few addresses will fundamentally change the dynamics of the Bitcoin ecosystem," she said.

“It would centralize control, undermine the core principles of decentralization, and could lead to market manipulation, loss of trust, and increased regulatory scrutiny.”

Meanwhile, Bowler said these theoretical holders could have unprecedented power over the BTC network and its future. She believes this outcome could damage BTC’s reputation and drive users to more decentralized alternatives.

“If 100% of Bitcoin is in the hands of a few people, then interest in and development of Bitcoin is likely to fade,” she said.

“The significance of Bitcoin is that it is universal, and transactions and uses are popular among ordinary people. If it loses this popularity, then it is likely that an alternative will emerge.”

Unprecedented market control, but that’s all

Phillip Lord, president of cryptocurrency payment app Oobit, pointed out that if a small number of addresses own most of the BTC, these whales will gain more control over the market, but they still cannot change the Bitcoin network or protocol.

“This centralization may affect the market because these addresses can affect the price of Bitcoin through large transactions,” he said.

“However, owning such a large percentage of Bitcoin does not necessarily mean that one can directly control the protocol or change its code.”

Whales already have a significant impact on Bitcoin market dynamics, and the huge amounts of Bitcoin they hold give them the power to sway supply and demand. As a result, traders and others in the space tend to keep a close eye on any transactions made by whales.

When whales increase their Bitcoin reserves, prices tend to surge, while selling some of their holdings can cause prices to fall.

Source: CryptoQuant/Cryto India

Lord said there is a distinction between BTC as a cryptocurrency and the Bitcoin network, which is the decentralized infrastructure of the project.

While individuals can own BTC as tokens, the Bitcoin network follows the principle of decentralized architecture.

Lord believes that the protocol or code can be changed, but it requires a decentralized consensus process rather than controlling a majority of BTC. Changes are proposed through Bitcoin Improvement Proposals (BIPs), which are then discussed and reviewed by the community.

“For a change to be implemented, it must have broad support from miners, developers and node operators,” Lord said.

“Once enough consensus is reached, the changes are incorporated into a new version of the Bitcoin software, which users can choose to adopt. If a supermajority adopts the new version, the changes become part of the Bitcoin protocol.”

Governance model relies on community consensus

Jonathan Hargreaves, global head of business development at Elastos, a Web3 ecosystem that develops layer 2 solutions for Bitcoin, saidThe concentration of wealth in the hands of the top 1% of people remains a core problem for the global economy.

According to Oxfam International, a British nonprofit, 81 billionaires own more than 50% of the world’s total wealth.

If BTC goes down this path, Hargreaves said, “centralization could lead to centralization.” This could change the “founding principles of Bitcoin,” which seek to redefine the social contract to achieve global consensus.

However, he argues that any amount of BTC provides no additional control over the network, and the only additional benefit is wealth.

“Bitcoin and decentralized currencies initially promised greater inclusion, but this goal has not materialized as expected,” Hargreaves said.

“However, Bitcoin’s governance model does not give holders the power to change its core mechanisms. Key principles such as the 21 million bitcoin limit and non-inflationary nature are immutable, so the 1% gain is limited to wealth creation opportunities.”

Some aspects of the BTC code have been modified or removed in the past. Operation Concatenate (OP_CAT) is an opcode that allows users to combine two data sets into a single transaction script, but it was disabled by Satoshi Nakamoto in 2010 for security reasons.

Hargreaves said the governance model relies on community consensus involving developers, node operators, miners, core development teams and technical staff, similar to a typical open source project.

"Ownership concentration itself may not be a direct threat, but financial concentration may erode these principles over time," Hargreaves said.

"However, it is expected that these community stakeholders, including Satoshi, may resist attempts to influence or purchase consensus. Therefore, I view 100% BTC ownership not as a threat, but as an attempt to purchase the Bitcoin network."

Nothing stops whales from holding all Bitcoin

Sasha Ivanov, founder of the Waves Tech ecosystem, said that at this stage there is no mechanism that can provide "fair distribution and prevent the traditional Pareto wealth distribution," where the top holders own all BTC.

He believes that whale addresses that own the largest supply of a particular asset bring them material benefits because they can indirectly control prices and engage in market manipulation.

"The big players have the financial power to bend the development prospects in the direction they see fit," he said.

"This could lead to the complete centralization of Bitcoin, as the community will not be able to withstand financial incentives and will be driven entirely by the vision of a group of big players."

JinseFinance

JinseFinance