Author: Lucas Kiely, Chief Investment Officer of Yield App, CoinTelegraph; Compiled by: Deng Tong, Golden Finance

On the surface, the ratio of U.S. debt to GDP does not seem that bad on a global scale. In 2023, this was below the average among Group of Seven (G7) countries (123%) and about half below that of the world's most indebted country, Japan, whose debt stood at 255% of GDP in 2023.

Looking at the numbers alone, it’s easy to think this isn’t a problem. After all,Japan has handled its growing debt load relatively well over the years. Its economy remains stable, with the Nikkei 225 up about 31% from last year (as of May 10), outperforming the S&P 500. But in reality, the two countries have very different economic conditions, which means what works for Japan is unlikely to work for the United States.

The significant difference between the two is the composition of their debt ownership . In Japan, nearly 90% of debt is owned domestically by its citizens and institutions. By comparison, about a quarter of U.S. debt is managed by international debt buyers. Therefore, it needs to ensure that its debt remains attractive to them by paying a sufficiently high yield relative to its global competitors - especially as the ratio of debt to GDP is getting higher and higher. Thelending to the government has become riskier.

In fact, Fitch Ratings downgraded the United States last year. Government debt rose to AA+ from AAA. At the time, the news was denied by the United States. Officials were "arbitrary and based on outdated data." Later this year, Moody's downgraded the United States. The debt outlook is negative, which is also largely ignored by the market.

But investors should be more concerned because the United States will not sit back and watch its debt soar to Japan-like levels. For one thing, Japan's net debt is well below its total debt-to-GDP ratio, meaning it holds more foreign assets than it owes other countries—the exact opposite of the United States. This makes it easier for Japan to manage its growing debt.

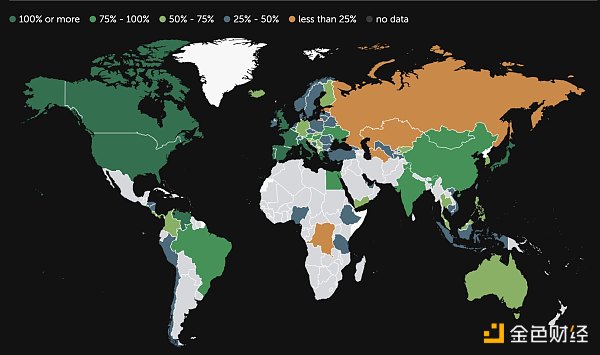

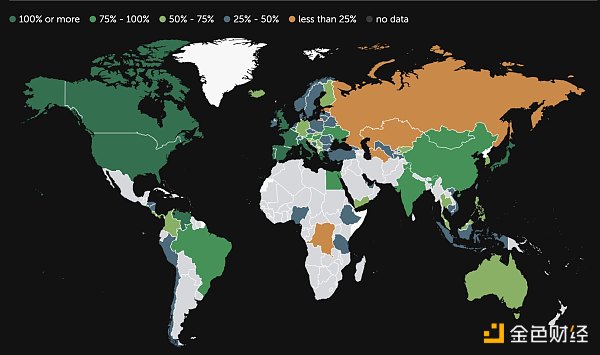

Map of global debt-to-GDP ratios as of 2022. (Dark green indicates a higher ratio, orange indicates a ratio below 25%.) Source: International Monetary Fund

Japan is also not plagued by inflation like the United States. Its inflation rate currently stands at 2.7%, after peaking at 4.3% in January 2023. This is a far cry from the U.S. inflation rate of 9.1%. This target was reached in June 2022. The Fed is still struggling to control sticky inflation, which makes soaring debt levels particularly dangerous because it could add fuel to the fire.

As we all know, the solution to inflation is restrictive monetary policy. But higher interest rates mean higher debt repayments, consumer dissatisfaction, and ultimately an economic slowdown. In fact, the Fed already faces all of these problems. Consumer confidence is starting to falter, debt repayments topped $1 trillion last year, and growth in the first quarter of this year was much lower than anyone expected.

So much so that we now hearrumors of stagflation - this is a particularly unideal economic situation. Inflation continues to rise while economic growth stagnates. Here, higher debt also creates a problem because it limits the government's ability to use fiscal powers to mitigate an economic slowdown. As a result, the Fed finds itself in something of a Catch-22 situation, especially given that it has all but committed to a rate cut next.

In an election year, keeping interest rates high for an extended period of time may also cause dissatisfaction among voters. However, so far, both Democratic and Republican candidates seem to have completely ignored an issue that cannot be ignored: the growing U.S. debt. Neither side has proposed any meaningful policies to address the problem. But with the debt-to-GDP ratio now above 100% and expected to continue rising rapidly over the coming decades, governments will have to face reality sooner or later.

So what does this mean for cryptocurrencies? Paradoxically, What all this might mean for assets like Bitcoin is a net gain, and Bitcoin could become a safe-haven asset as concerns about soaring U.S. debt grow. Typically, rising debt levels also lead to currency depreciation. While the United States, like Japan, may be able to avoid such a scenario due to global dependence on the dollar, a high share of foreign debt also makes the dollar particularly vulnerable.

Coupled with expectations of an interest rate cut later this year, it is unlikely that the U.S. dollar will maintain its current strength. Of course, this is a boon for Bitcoin, which is widely seen as a hedge against U.S. dollar weakness.

So the predicament the United States finds itself in is not necessarily bad news for the cryptocurrency market, depending on how out of control things get. For example, if the United States defaults on its debt - of course, it won't default. This would be disastrous for all markets, including digital assets. However, a weaker dollar and some loss of confidence in the United States may be just what is needed for the next wave of cryptocurrency gains.

JinseFinance

JinseFinance