Kakao founder Brian Kim arrested: once the richest man in South Korea, accused of price manipulation

Kakao's founder Kim Bum-soo arrested for price manipulation in SM Entertainment acquisition.

Huang Bo

Huang Bo

Author: Arthur Hayes, Founder of BitMEX; Translator: Deng Tong, Golden Finance

What do you do when the market is down but you are about to win an election?

If you are a politician, the answer to this question is simple. Your first goal is to ensure re-election. Therefore, you print money and manipulate prices to rise.

Imagine that you are Kamala Harris, the Democratic candidate for the United States President, facing the powerful Orange Man (Orange Man, the name given to former US President Donald Trump by American society). You need everything to go well because a lot of things have gone wrong since the last time you were Vice President. The last thing you need on Election Day is a raging global financial crisis.

Harris is a savvy politician. Given that she is Obama's puppet, I bet he is warning her how serious the consequences would be if the 2008 global financial crisis came to her doorstep a few months before the election. US President Joe Biden is working in the vegetable garden, so people think Harris is in control of the situation.

The collapse of Lehman Brothers in September 2008, sparking a truly global financial crisis, came as George W. Bush was nearing the end of his second term as president. Given that he was a Republican president, one could argue that part of Obama’s appeal as a Democrat was that he was a member of the other party and therefore not responsible for the recession. Obama won the 2008 presidential election.

Let’s refocus on Harris’ dilemma: how to respond to the global financial crisis sparked by the unwinding of Japan’s massive yen carry trade. She could let it run its course and let the free market destroy over-leveraged businesses and let wealthy baby boomer financial asset holders experience some real pain. Or, she could instruct U.S. Treasury Secretary bad-girl Janet Yellen to solve the problem by printing money.

Like any politician, regardless of party affiliation or economic beliefs, Harris would instruct Yellen to use the monetary tools at her disposal to avert a financial crisis. Of course, that means the printing presses will start rolling in some way, shape, or form. Harris doesn’t want Yellen to wait—she wants her to act forcefully and now. So if you agree with me that the unwinding of the yen carry trade could cause the entire global financial system to collapse, you also have to believe that Yellen will act no later than the opening of Asian trading next Monday, August 12.

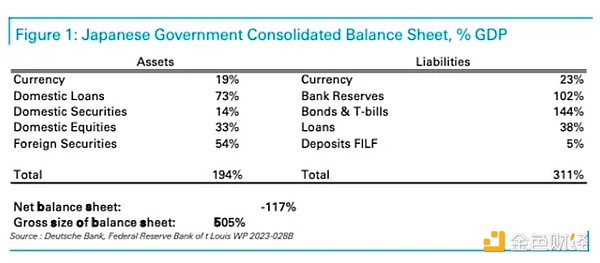

To give you an idea of the size and magnitude of the potential impact of the unwinding of the Japanese corporate carry trade, I’ll walk you through an excellent research note from Deutsche Bank dated November 2023. Then I’ll walk you through how I would craft a bailout plan if I were appointed head of the U.S. Treasury.

What is a carry trade? A carry trade involves borrowing in one low-interest currency and then buying a financial asset in another currency that has a higher yield or a higher probability of appreciation. When the loan needs to be repaid, the money is lost if the borrowed currency appreciates relative to the currency of the asset you purchased. If the borrowed currency depreciates, the funds make money. Some investors hedge currency risk, some don’t. In this case, Japanese companies don’t need to hedge their borrowed yen because the Bank of Japan can print unlimited amounts of yen.

Japanese companies are the Bank of Japan, businesses, households, pension funds, and insurance companies. Some entities are public, some are private, but they all work together to improve Japan, or at least they intend to.

Deutsche Bank wrote an excellent report on November 13, 2023 titled “The World’s Biggest Carry Trade.” The author asks a rhetorical question: “Why didn’t the yen carry trade blow up and bring down the Japanese economy?” The situation today is very different from the end of last year.

The storyline is that Japan is overloaded with debt. Hedge fund bros are betting that Japan is about to collapse. But those who bet on Japan always lose. Many macro investors are too bearish on Japan because they don’t understand Japan’s combined public and private balance sheets. This is an easy psychological mistake for Western investors who believe in individual rights. But in Japan, the collective reigns supreme. So certain actors that are seen as private in the West are just substitutes for the government.

Let's deal with the liabilities side first. These are where the money for the carry trade comes from. Yen is borrowed this way. They incur interest costs. The two main items are bank reserves and bonds and treasury bills.

Bank reserves - these are the funds that banks hold with the Bank of Japan. This is a large amount because the Bank of Japan creates bank reserves when it buys bonds. Keep in mind that the Bank of Japan owns nearly half of the Japanese government bond market. As a result, the amount of bank reserves is huge, at 102% of GDP. These reserves cost 0.25%, which the Bank of Japan pays to the banks. For reference, the Fed pays 5.4% for excess bank reserves. This financing cost is almost zero.

Bonds and Treasuries – These are Japanese government bonds issued by the government. Due to the market manipulation of the Bank of Japan, Japanese government bond yields are at rock bottom levels. As of the time of this posting, the current 10-year Japanese government bond yield is 0.77%. This financing cost is negligible.

In terms of assets, the broadest item is foreign securities. These are financial assets owned abroad by the public and private sectors. One of the large private holders of foreign assets is the Government Pension Investment Fund (GPIF). With $1.14 trillion in assets, it is one of the largest pension funds in the world, if not the largest. It owns foreign stocks, bonds, and real estate.

When the BoJ prices bonds, domestic loans, securities, and stocks all do well. Finally, the depreciation of the yen, due to the large amount of yen debt created, has pushed up domestic stock and real estate markets.

The USDJPY (white) rose, which means the yen weakened against the dollar. The Nasdaq 100 (green) and Nikkei 225 (yellow) followed suit.

Overall, Japanese companies have taken advantage of the financial repression implemented by the Bank of Japan to finance themselves and have been highly rewarded by the weak yen. This is why the Bank of Japan has been able to continue to implement the world's loosest monetary policy even as global inflation has risen. It's been damn profitable.

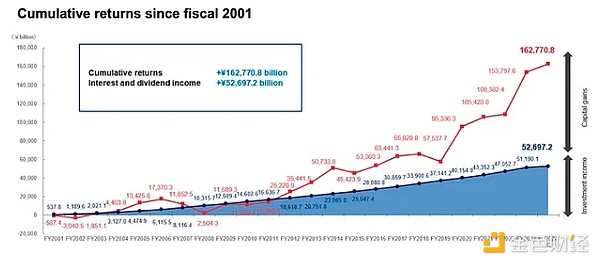

Source: GPIF

GPIF has performed well, especially in the past decade. In the past decade, the Japanese yen has depreciated significantly. As the yen depreciated, the returns on foreign assets have risen sharply.

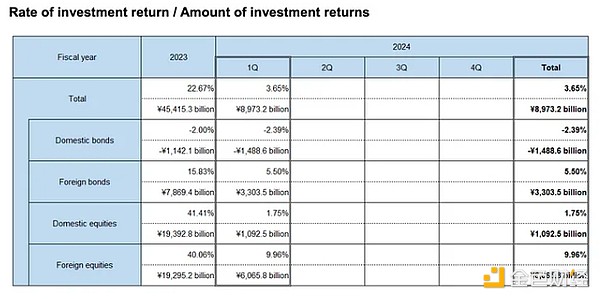

Source: GPIF

GPIF would have lost money last quarter if it weren’t for the stellar returns on its overseas equity and bond portfolios. The domestic bond losses came as the BoJ’s withdrawal of YCC sent JGB yields higher and prices lower. However, the yen continued to weaken as the spread between the BoJ and the Fed got wider than Sam Bankman-Fried’s eyes when he discovered the Emsam pill.

Japanese companies traded massively. With a total exposure of 505% of Japan’s GDP at about $4 trillion, they were carrying $24 trillion in value at risk. As Cardi B said, “I hope you park that big Mack truck in this little garage.” She must be rapping about the Japanese men who are in power in the land of sunset.

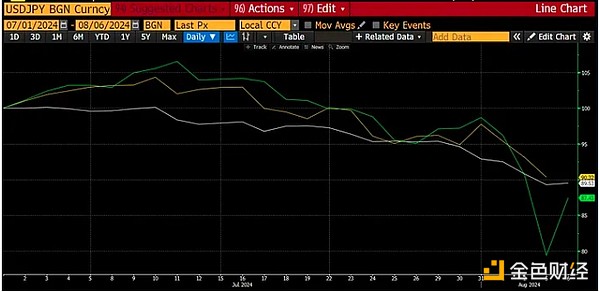

The trade obviously worked, but the yen got too weak. At the beginning of July, the USD/JPY exchange rate was 162, which was unbearable because domestic inflation was raging then and now.

The Bank of Japan does not want to stop this trade immediately, but wants to slowly exit over time...they always say that. Takashi Ueda succeeded Takashi Kuroda as the Governor of the Bank of Japan in April 2023, and Takashi Kuroda was the main architect of this massive trade. He took the opportunity to exit. Takashi Ueda is the only fool left among the qualified candidates who wanted to commit seppuku by trying to unwind this trade. The market knew Takashi Ueda would try to get the Bank of Japan out of this carry trade. The question was always the speed of normalization.

What would a disorderly unwinding look like? What would happen to the various assets held by Japanese companies? How much would the yen appreciate?

To unwind its position, the Bank of Japan would need to raise interest rates by stopping its purchases of JGBs and eventually selling them back into the market.

On the liability side, what would happen?

If the Bank of Japan hadn’t been constantly pushing down JGB yields, they would rise as the market demanded, with yields at least matching inflation. Japan’s consumer price index (CPI) rose 2.8% year-on-year in June. If JGB yields rise to 2.8%, higher than any bond yield at any point on the yield curve, the cost of debt of any maturity would increase. The interest costs on bond and treasury bill liabilities would surge.

The Bank of Japan would also have to raise the interest it pays on bank reserves to prevent those funds from escaping its clutches. Again, given the notional amounts involved, that cost would rise from near zero to huge.

In short, if interest rates are allowed to rise to market-clearing levels, the Bank of Japan will have to pay billions of yen in interest each year to maintain its position. Without the revenue from asset sales on the other side of the ledger, the Bank of Japan will have to print huge amounts of yen to keep its debt serviced. Doing so will make the situation worse; inflation will rise and the yen will fall. Therefore, assets must be sold.

On the asset side, what happens?

The Bank of Japan’s biggest headache is how to sell its vast trove of JGBs. Over the past two decades, the Bank of Japan has destroyed the JGB market through its various quantitative easing (QE) and yield curve control (YCC) programs. For all intents and purposes, the JGB market no longer exists. The Bank of Japan must force another member of Japanese corporate to do its duty and buy JGBs at prices that will not bankrupt the Bank of Japan.

Japanese commercial banks were forced to deleverage after the real estate and stock market bubbles burst in 1989. Bank lending has been stagnant ever since. The Bank of Japan began printing money because businesses were not borrowing from banks. Given that banks are in good shape, it is time to bring several quadrillion yen worth of Japanese government bonds back onto their balance sheets.

While the Bank of Japan can tell banks to buy bonds, banks need to move the capital somewhere. As Japanese government bond yields rise, profit-seeking Japanese businesses and banks holding trillions of dollars in overseas assets will sell those assets, repatriate the capital to Japan, and deposit it in banks. Banks and these businesses will buy large amounts of Japanese government bonds. The yen appreciates due to the capital inflows, while Japanese government bond yields do not rise to levels that would cause the Bank of Japan to go bankrupt when it reduces its holdings.

The biggest loss is the fall in the prices of foreign stocks and bonds that Japanese companies sell to generate the capital repatriation. Given the huge scale of this carry trade, Japanese companies are the marginal price makers for stocks and bonds around the world. This is especially true for any US-listed securities, as their markets are the top destination for funding capital for the yen carry trade. Given that the yen is a freely convertible currency, many TradFi trading books reflect Japanese companies.

As the yen depreciates, more and more investors around the world are encouraged to borrow in yen and buy US stocks and bonds. Because leverage is high, as the yen appreciates, everyone rushes in at the same time.

I showed you a chart earlier that shows what happens when the yen depreciates. What happens when it appreciates a bit? Remember the earlier chart that showed USD/JPY falling from 90 to 160 in 15 years? In 4 trading days, it fell from 160 to 142, as shown below:

USDJPY (white) rose 10%, Nasdaq 100 (white) fell 10%, and Nikkei 225 (green) fell 13%. The percentage increase in the yen and the decline in the stock indices were roughly 1:1. Extrapolating further, if USDJPY reaches 100, a 38% gain, the Nasdaq would fall to about 12,600 and the Nikkei to about 25,365.

USDJPY to 100 is possible. A 1% reduction in Japanese corporate carry trades equates to about $240 billion in notional value. That’s a huge amount of capital at the margin. Different players in Japanese corporates have different secondary priorities. We saw this with Norinchubo, Japan’s fifth largest commercial bank. Their carry trades have partially gone bust and they have been forced to start unwinding their positions. They are selling foreign bond positions and covering forward USDJPY FX hedges. This announcement was made only a few months ago. Insurance companies and pension funds will be under pressure to disclose unrealized losses and exit trades. Along with them are all the copy traders whose brokers will quickly liquidate them as currency and stock volatility rises. Remember, everyone is closing the same trade at the same time. Neither we nor the elites who manage global monetary policy know the total size of the yen carry trade financing positions hidden in the financial system. The opacity of the situation means that an overcorrection will quickly occur in the other direction as the market gradually reveals this highly leveraged part of the global financial system.

Why does bad girl Yellen care?

Since the 2008 global financial crisis, I think China and Japan have saved the Pax Americana from a worse recession. China has undertaken one of the largest fiscal stimulus in human history, expressed through debt-fueled infrastructure construction. China needs to buy goods and raw materials from the rest of the world to complete projects. Japan has printed huge amounts of money through the Bank of Japan to increase its carry trade. Japanese companies have used these yen to buy US stocks and bonds.

The US government has received a lot of revenue from capital gains taxes, which is the result of the stock market surge. From January 2009 to early July 2024, the Nasdaq 100 has risen 16-fold, and the S&P 500 has risen 6-fold. Capital gains taxes are around 20% to 40%.

Despite record high capital gains taxes, the U.S. government is still running deficits. To finance the deficits, the U.S. Treasury must issue bonds. Japanese companies are one of the largest marginal buyers of U.S. Treasuries…at least until the yen starts to appreciate. Japan helps afford the U.S. debt to profligate politicians who need to buy votes with tax cuts (Republicans) or various forms of welfare checks (Democrats).

Total U.S. debt outstanding (yellow) is at the top right. However, the 10-year Treasury (white) yield has been range-bound, with little correlation to the growing debt.

My view is that the structure of the U.S. economy requires Japanese companies and their imitators to continue this carry trade. If this trade ends, the U.S. government's finances will be in tatters.

My assumption of a coordinated bailout of Japanese corporate carry trade positions is based on the belief that Harris will not have her electoral chances diminished just because some foreigners decided to exit some trade that she may not even understand. Her voters certainly don’t know what’s going on and don’t care. Their stock portfolios are either up or they’re not. If not, they won’t show up on Election Day to vote Democrat. Turnout will determine whether the clown emperor is Trump or Harris.

Japanese corporate positions must be closed, but some assets cannot be sold on the open market. This means some government agency in the United States must print money and lend it to some members of Japanese corporate.Allow me to reintroduce myself. My name is Central Bank Swap Agreement (CSWAP).

How would I conduct a bailout if I were bad girl Yellen?

On Sunday evening, August 11, I will be issuing a communique (I am speaking as Yellen):

The U.S. Treasury, the Federal Reserve, and our Japanese counterparts have discussed at length the market turmoil of the past week. In this call, I reiterated my support for the use of the dollar-yen central bank swap lines.

That’s it. To the public, this may seem completely harmless. This is not a statement that the Fed will cave in and make aggressive rate cuts and restart quantitative easing. This is because the public knows that doing any of these things will cause already uncomfortably high inflation to accelerate again. If inflation runs rampant on Election Day and is easily traceable to the Fed, Harris will lose.

Most American voters have no idea what the CSWAP is, why it was created, or how it can be used to print unlimited amounts of money. Yet the market will rightly view this as a stealth bailout because of what the facility will be used for.

The Bank of Japan borrows billions of dollars and provides yen as collateral to the Fed. The number of times these swaps are rolled over is determined by the Bank of Japan.

The Bank of Japan privately talks to large corporations and banks, telling them that it is prepared to exchange dollars for U.S. stocks and U.S. Treasuries.

This transfers ownership of foreign assets from Japanese corporations and banks to the Bank of Japan. These private entities own large amounts of dollars, and repatriate that capital back to Japan by selling dollars and buying yen. They then buy Japanese government bonds from the Bank of Japan at the current high prices/low yields. The result is an inflated size of CSWAPS outstanding, and this dollar amount is similar to the amount of money the Fed is printing.

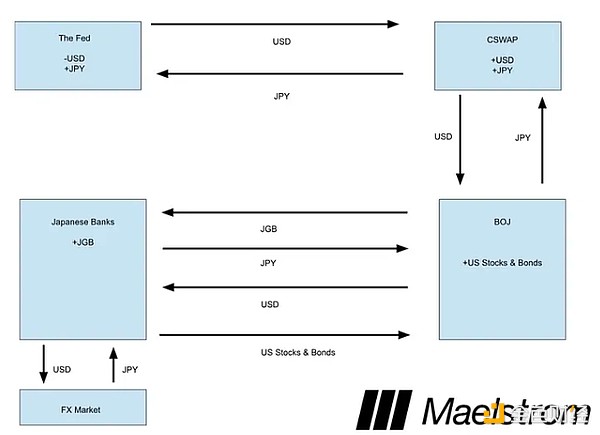

I've created an ugly box and arrow plot that will help illustrate the process.

It's the net effect that matters.

Fed - They increased the supply of dollars, in other words, in return they received yen that was previously generated by the growth of the carry trade.

CSWAP - The Bank of Japan owes the Fed dollars. The Fed owes the Bank of Japan yen.

BoJ - They now hold more US stocks and bonds, which will rise in price due to the rising amount of dollars due to the growing CSWAP balance.

Bank of Japan - They now hold more Japanese government bonds.

As you can see, there is no impact on the US stock or bond markets, and the total carry trade risk of Japanese companies remains unchanged. The yen appreciates against the dollar, and most importantly, U.S. stock and bond prices rise as the Fed prints dollars. The added bonus is that Japanese banks can issue unlimited yen-denominated loans with newly acquired JGB collateral. This trade re-inflates both the U.S. and Japanese systems.

The carry trades for Japanese companies will unwind; of that, I am sure. The question is when the Fed and the Treasury will print money to mitigate the effects of their Pax Americana.

If U.S. stocks plunge on Friday, August 9, so that both the S&P 500 and Nasdaq 100 fall 20% from their recent July all-time highs, some kind of action is likely over the weekend. The level for the S&P 500 is 4,533; the level for the Nasdaq 100 is 16,540. I also expect the 2-year US Treasury yield to be around 3.80% or lower. This yield was reached during the regional banking crisis in March 2023, which was resolved through the bank term funding program bailout.

If the yen starts to depreciate again, the crisis will end in the short term. The liquidation will continue, although at a slower pace. I think the market will have another temper tantrum between September and November as the USD/JPY pair continues to move towards 100. There will definitely be a response this time, as the US presidential election will be held in a few weeks or days.

It is difficult to trade in crypto.

Two opposing forces influence my crypto positioning.

Liquidity Positive Forces:

After a quarter of net restrictive policy, the US Treasury will be a net injector of US dollar liquidity as it will issue Treasury bills and may drain the Treasury General Account. This policy shift was spelled out in the recent quarterly refunding announcement. TL;DR: Bad girl Yellen will inject between $301 billion and $1.05 trillion between now and the end of the year. I will explain this in a follow-up article if necessary. Negative Liquidity Force: This is the strength of the yen. The unwinding of the trade leads to a coordinated global sell-off of all financial assets as increasingly expensive yen debts must be repaid. Which force is stronger really depends on how quickly the carry trade is unwound. We have no way of knowing this in advance. The only observable effect is the correlation between Bitcoin and USD/JPY. If Bitcoin is trading in a convex manner, meaning that Bitcoin rises when the USD/JPY pair strengthens or weakens significantly, then I know that the market is anticipating a bailout if the Yen is too strong and liquidity provided by the U.S. Treasury is ample. This is convex Bitcoin.If Bitcoin falls when the Yen strengthens and rises when the Yen weakens, then Bitcoin will trade in sync with the TradFi market. This is correlated Bitcoin.

If the market is pointing to convex Bitcoin, I will be aggressively adding to my position because we have hit a local bottom. If the market is pointing to correlated Bitcoin, then I will be sitting on the sidelines and waiting for the final market capitulation. The biggest assumption is that the BoJ does not change course and cut the deposit rate to 0% and resume unlimited JGB purchases. If the BoJ sticks to the plan laid out at the last meeting, the carry trade will continue to unwind.

This is the clearest guidance I can give at this time. As always, these trading days and trading months will determine your returns in this bull cycle. If you must use leverage, use it wisely and constantly monitor your positions. When you have a leveraged position, you better hold onto your bitcoin or shitcoins. Otherwise, you will be liquidated.

I still have the last of August to enjoy.

Kakao's founder Kim Bum-soo arrested for price manipulation in SM Entertainment acquisition.

Huang Bo

Huang BoThe source of income for the Ethena protocol is spot staking income + short position funding rate income. The introduction of BTC collateral dilutes the staking yield, and the calm market and Ethena's large number of short positions reduce the funding rate income.

JinseFinance

JinseFinanceSince the fall of FTX, Binance has sought to position itself as a lender of last resort, establishing the Industry Recovery Initiative.

Beincrypto

BeincryptoIn a new development, the venture capital arm of the largest global crypto exchange, Binance Labs, has made a foray into Web3 technology.

Bitcoinist

BitcoinistThe mindfulness community is working to provide answers to that question.

NFT Now

NFT NowA popular trade drove up funding rates to lifetime highs for ether futures.

Coindesk

CoindeskBitcoin funding rates have been on a bearish trend in recent months. It has now spent one of its longest ...

Bitcoinist

BitcoinistOn-chain data shows Bitcoin funding rates have sunk into deep negative values, something that could pave way for a short ...

Bitcoinist

BitcoinistThe developers are currently working on a security upgrade and plan to increase the number of validator groups to 21 before making the Ronin Bridge live again.

Cointelegraph

CointelegraphThe majority of traders expect fresh Bitcoin price losses after a difficult end to the week, data suggests.

Cointelegraph

Cointelegraph