Author: CoinMarketCap Research & Footprint Analytics; Compiler: Vernacular Blockchain

Bitcoin’s role in DeFi (decentralized finance) is changing dramatically. From being a simple peer-to-peer transfer at first, the world’s first cryptocurrency is now gradually emerging as a powerful force in the DeFi field, beginning to challenge Ethereum’s long-standing dominance.

By comprehensively interpreting the current status and growth trajectory of the Bitcoin ecosystem through on-chain data, we found a clear picture: BTCFi (the combination of Bitcoin and DeFi) is not just a technological shift, but may also trigger a paradigm shift in Bitcoin’s role in DeFi. As we will explore in depth, the impact of this shift may redefine the landscape of the entire DeFi field.

01. The rise of BTCFi

In 2008, Satoshi Nakamoto launched Bitcoin, which was originally designed as a peer-to-peer electronic cash system. While this architecture is revolutionary in the crypto asset space, it has significant limitations in more complex financial applications such as DeFi.

02. Bitcoin’s original design and its limitations in DeFi

Core design elements and their limitations:

1) UTXO model: Bitcoin uses the unspent transaction output (UTXO) model, which is effective in processing simple transfers but lacks the flexibility required to support complex smart contracts.

2) Limited scripting language: Bitcoin’s scripting language is limited in design, mainly to avoid security vulnerabilities. However, this limitation also prevents it from supporting complex DeFi applications because it has a limited number of executable opcodes.

3) Lack of Turing Completeness: Unlike Ethereum, Bitcoin’s scripts are not Turing complete, which makes it difficult to implement complex state-dependent smart contracts, which are critical to many DeFi protocols.

4) Block size and transaction speed: Bitcoin’s 1MB block size limit and 10-minute block generation time cause its transaction processing speed to be much lower than other blockchains focused on DeFi.

While these design choices enhance Bitcoin’s security and decentralization, they also create obstacles to implementing DeFi functionality directly on the Bitcoin blockchain. The lack of native support for features such as loops, complex conditions, and state storage makes it very difficult to build applications such as DEX, lending platforms, or liquidity mining protocols on Bitcoin.

03. Early attempts and developments in introducing DeFi on Bitcoin

Despite these limitations, Bitcoin’s strong security and wide application have prompted developers to look for innovative solutions:

1) Colored coins (2012-2013): This was one of the early attempts to expand Bitcoin’s functionality. Colored coins represent and transfer real-world assets by “coloring” specific Bitcoins and attaching unique metadata. Although this is not true DeFi, it lays the foundation for the development of more complex financial applications on Bitcoin.

2) Counterparty (2014): This protocol introduced the ability to create and trade custom assets on the Bitcoin blockchain, including the first NFT. Counterparty demonstrates the potential for developing more complex financial instruments on Bitcoin.

3) Lightning Network (2015 to present): The Lightning Network is a second-layer protocol designed to improve transaction scalability. It opens up the possibility for more complex financial interactions, including some preliminary DeFi applications, by introducing payment channels.

4) Discrete Log Contract (DLC) (2017-Present): Proposed by Tadge Dryja, DLC allows complex financial contracts to be implemented without changing the Bitcoin base layer, providing new possibilities for derivatives and other DeFi tools.

5) Liquid Network (2018-Present): This is a sidechain-based settlement network developed by Blockstream that supports the issuance of crypto assets and more complex Bitcoin transactions, paving the way for DeFi-like applications.

6) Taproot Upgrade (2021): By introducing Merkle Alternative Script Tree (MAST), Taproot compresses complex transactions into a single hash, reducing transaction fees and memory usage. Although it is not a DeFi solution in itself, it improves Bitcoin's smart contract capabilities, making it easier and more efficient to implement complex transactions, laying the foundation for future DeFi development.

These early developments laid the foundation for Bitcoin's functionality to expand from simple transfers to more applications. Despite the challenges of introducing DeFi on Bitcoin, these innovations also demonstrated the potential of the Bitcoin ecosystem. These foundations paved the way for a wave of innovation in second-layer solutions, sidechains, and Bitcoin DeFi, which we will explore in depth next.

04. Key Innovation: Implementing Smart Contracts on Bitcoin

In recent years, the Bitcoin ecosystem has seen the emergence of multiple protocols that aim to introduce smart contracts and DeFi capabilities to the world's first cryptocurrency. These innovations are changing the purpose of Bitcoin, making it more than just a store of value or a medium of exchange. Here are some of the main protocols that drive Bitcoin to implement smart contracts:

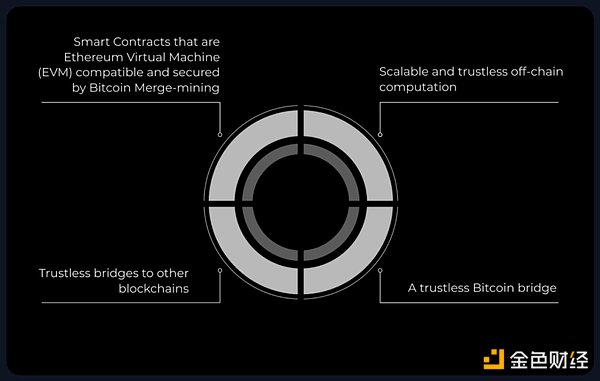

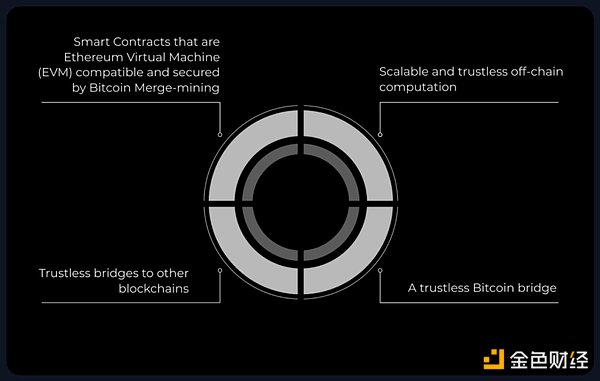

1) Rootstock: As a pioneer in Bitcoin smart contracts, Rootstock is the longest-running Bitcoin sidechain and has become an important foundation for the BTCFi ecosystem.

It utilizes 60% of Bitcoin’s hashrate, supports dual mining, and is compatible with the Ethereum Virtual Machine (EVM), so that Ethereum smart contracts can run on Bitcoin. Rootstock’s unique Powpeg mechanism ensures seamless conversion between Bitcoin (BTC) and Rootstock Bitcoin (RBTC), and its “defense in depth” security model emphasizes simplicity and robustness.

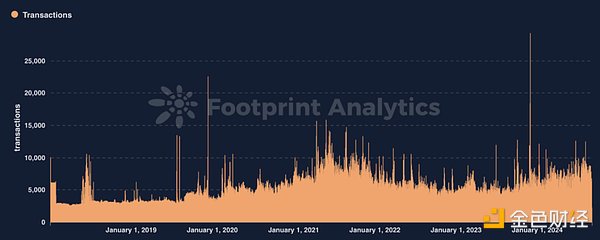

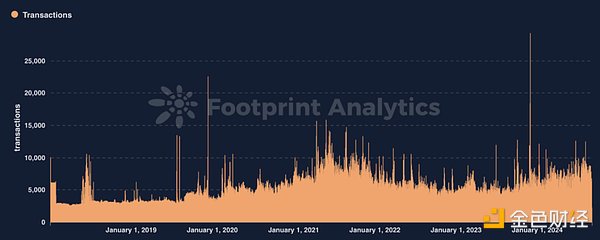

Since the launch of the mainnet in 2018, Rootstock’s on-chain activity has grown steadily, and Footprint Analytics noted that it has established itself as a stable and scalable solution in the Bitcoin ecosystem.

2) Core: Core is a Bitcoin-based blockchain that is tightly integrated with Bitcoin and compatible with the Ethereum Virtual Machine (EVM).

Core stands out for its innovative dual-staking model, which brings Bitcoin and Core together. Through non-custodial Bitcoin staking, Core establishes a risk-free rate of return for Bitcoin, effectively turning Bitcoin into a yield asset. Core reports that 55% of Bitcoin mining power is delegated to its network, which helps enhance its security in DeFi applications.

3) Merlin Chain: Merlin Chain is a relatively new Bitcoin second-layer network dedicated to unlocking Bitcoin's DeFi potential and is gaining more and more attention. It integrates ZK-Rollup technology, decentralized oracles, and on-chain fraud prevention modules to provide Bitcoin holders with a full set of DeFi features. Merlin's M-BTC is a wrapped Bitcoin asset that earns staking rewards, opening up new avenues for yield generation and participation in DeFi.

4) BEVM: BEVM represents an important advancement in bringing Ethereum's extensive DeFi ecosystem directly to Bitcoin. As the first fully decentralized and EVM-compatible Bitcoin layer 2 network, BEVM uses Bitcoin as fuel, allowing Ethereum decentralized applications (DApps) to be seamlessly deployed on Bitcoin. BEVM is supported by mining giant Bitmain and has pioneered the concept of "computing power RWA", which may unlock new value dimensions for the Bitcoin ecosystem.

Key innovations of Bitcoin layer 2 networks and sidechains:

Tokenized Bitcoin assets;

Smart contracts and EVM compatibility;

Bitcoin with yield;

Enhanced scalability and privacy.

These protocols are not just replicating Ethereum's DeFi strategy on Bitcoin, but are opening up new directions by leveraging Bitcoin's unique characteristics. From Rootstock's deep defense mechanism, to Core's dual staking model, to Merlin's comprehensive DeFi solution and BEVM's computing power RWA innovation, the BTCFi field is developing rapidly.

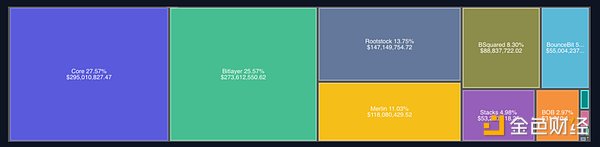

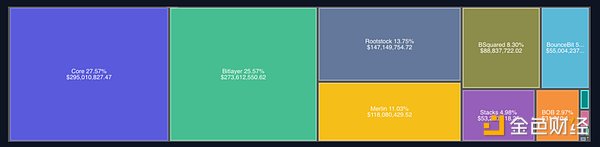

As of September 8, 2024, the total locked value (TVL) of Bitcoin's second-layer solutions and sidechains reached $1.07 billion, a 5.7-fold increase since January 1, 2024, and an astonishing 18.4-fold increase since January 1, 2023.

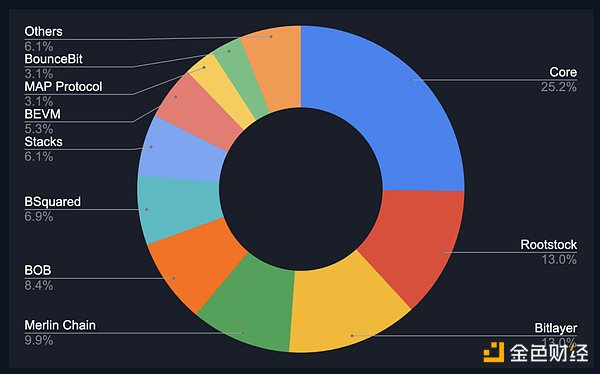

Core leads with 27.6% of the total locked value (TVL), followed by Bitlayer with 25.6%; Rootstock with 13.8%; and Merlin Chain with 11.0%.

05. The current status of Bitcoin DeFi

With the continuous development of the Bitcoin DeFi ecosystem, some key projects have emerged and become important participants, driving innovation and user adoption. These projects rely on Bitcoin's second-layer solutions and sidechains to provide various DeFi services:

1) Major BTCFi projects

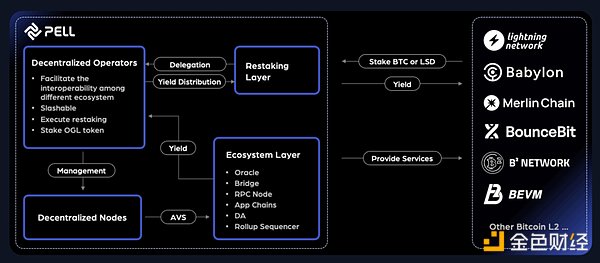

Pell Network (multi-chain)

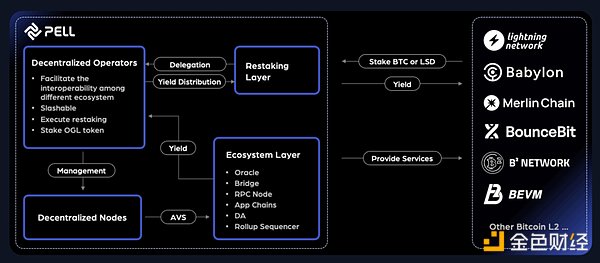

Pell Network is a cross-chain re-staking protocol that aims to improve the security of the Bitcoin ecosystem and optimize returns. Users earn rewards by staking Bitcoin or liquid staking derivatives (LSD), while decentralized operators are responsible for running verification nodes to ensure the security of the network. Pell provides a range of active verification services such as oracles, cross-chain bridges, and data availability, supporting a wider Bitcoin second-layer ecosystem. With its strong infrastructure, Pell aims to become an important participant in providing liquidity and securing the crypto economy, driving sustainable growth of the Bitcoin economy.

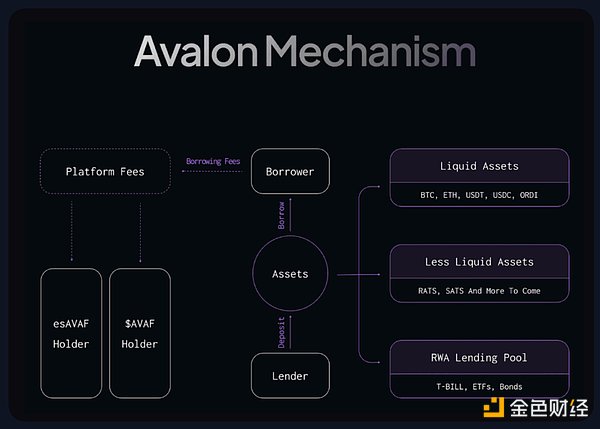

Avalon Finance (Multi-chain)

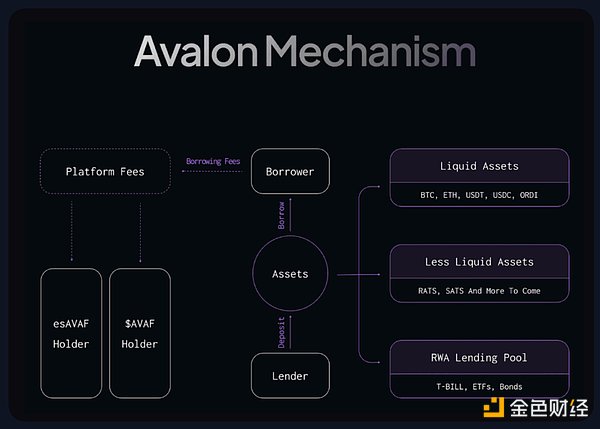

Avalon Finance is a multi-chain DeFi platform that spans Bitlayer, Core, and Merlin Chain, and is known for its comprehensive lending and trading services in the BTC DeFi ecosystem. Avalon's main services include over-collateralized lending for major assets and less liquid assets, with dedicated segregated pools. The platform also integrates derivatives trading, enhancing the functionality of its lending services. In addition, Avalon has launched an algorithmic stablecoin designed to optimize capital efficiency, making it a versatile and secure DeFi solution in the Bitcoin ecosystem. Its governance token AVAF adopts the ES Token model to incentivize liquidity provision and protocol usage.

Colend Protocol (Core)

Colend Protocol is a decentralized lending platform built on the Core blockchain, where users can safely borrow Bitcoin and other assets. By leveraging Core's dual-collateral model, Colend seamlessly integrates with the broader DeFi ecosystem, increasing the utility of Bitcoin in DeFi. Its key features include decentralized and immutable transactions, multiple liquidity pools with dynamic interest rates, and a flexible collateral system.

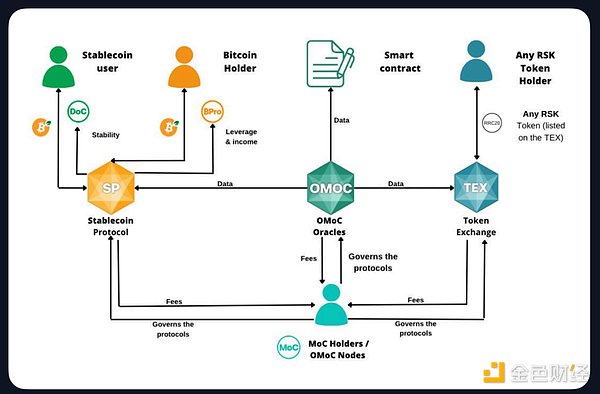

MoneyOnChain (Rootstock)

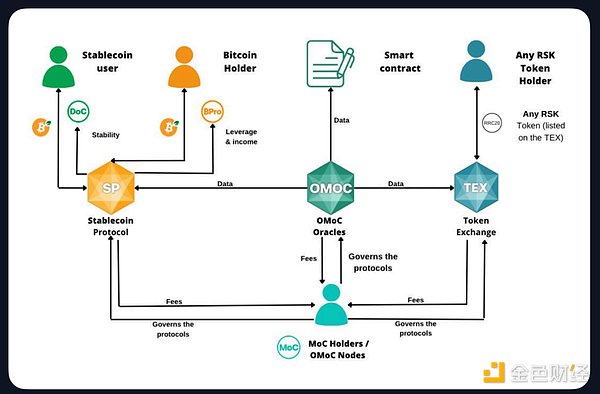

MoneyOnChain is a comprehensive DeFi protocol built on Rootstock that allows Bitcoin holders to increase asset returns while retaining full control of their private keys. The core of the protocol is the issuance of a stablecoin called Dollar on Chain (DoC), a stablecoin fully collateralized by Bitcoin, designed for users who want to keep the value of their Bitcoin holdings pegged to the US dollar. In addition, MoneyOnChain also offers Token BPRO, which enables users to obtain leveraged exposure to Bitcoin and thus achieve passive income.

The protocol is structured based on a risk-sharing mechanism and adopts a proprietary financial model to cope with extreme market volatility. At the same time, it also includes a decentralized Token exchange platform (TEX), a decentralized oracle (OMoC), and a governance token (MoC), enabling users to participate in protocol decision-making, pledge, and obtain rewards.

Sovryn (Multi-chain)

Sovryn is a DEX and one of the most feature-rich DeFi platforms built on Bitcoin, designed to enable users to trade, borrow, and earn income using Bitcoin. Sovryn spans two platforms, BOB and Rootstock, and provides a variety of DeFi services, including trading, exchange, liquidity provision, staking, and borrowing. The platform focuses on building a permissionless financial layer for Bitcoin and integrating with other blockchains, making it a unique multi-chain platform in the Bitcoin DeFi ecosystem.

Sovryn's governance token SOV plays a key role in managing decentralized protocols through the Bitocracy system, representing voting rights and rewarding users who actively participate.

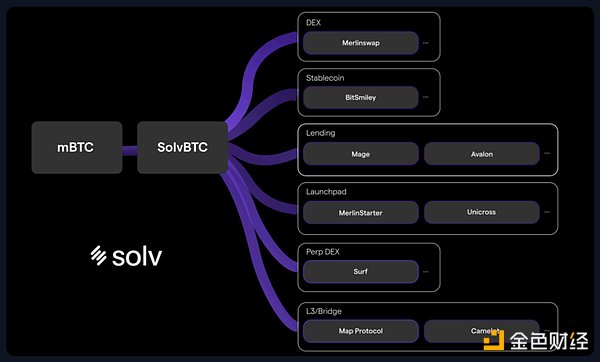

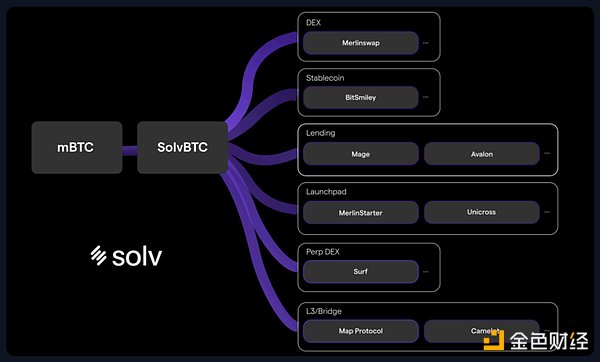

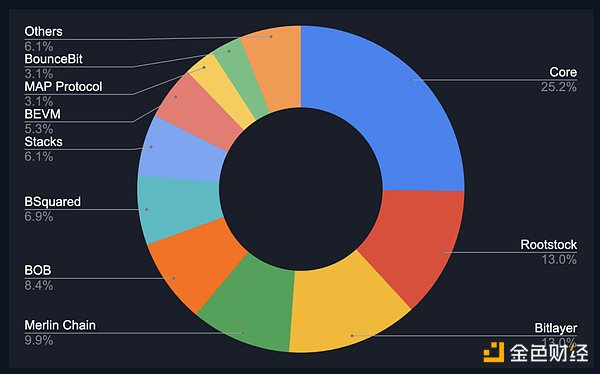

Solv Protocol (Merlin Chain)

Solv Protocol is at the forefront of NFT financialization, enabling users to create, trade, and manage on-chain credentials. The protocol aims to tokenize and aggregate the returns of various DeFi protocols in the Merlin Chain ecosystem. Its flagship product, SolvBTC, is a yield token that allows Bitcoin holders to earn yield while maintaining liquidity. Solv Protocol is committed to building a strong liquidity layer through staking and other yield-generating activities. This flexibility makes it an important DeFi project on Merlin Chain to help unlock new financial opportunities in the Bitcoin ecosystem. These projects highlight the dynamic and rapid development of the Bitcoin DeFi space, each contributing unique features to expand the ecosystem's reach. As of September 8, 2024, Core leads the Bitcoin DeFi space with 25.2% of active projects, further consolidating its core role in the ecosystem. Rootstock and Bitlayer are important players, each supporting 13.0% of projects, reflecting their importance in improving liquidity and capital efficiency in the Bitcoin DeFi ecosystem. Merlin Chain also plays a key role in expanding Bitcoin DeFi functionality with a 9.9% share of projects. Other platforms such as BOB (8.4%), BSquared (6.9%) and Stacks (6.1%) contributed to the diversity of the ecosystem, while BEVM (5.3%), BounceBit (3.1%) and MAP Protocol (3.1%) drove overall growth with their professional solutions.

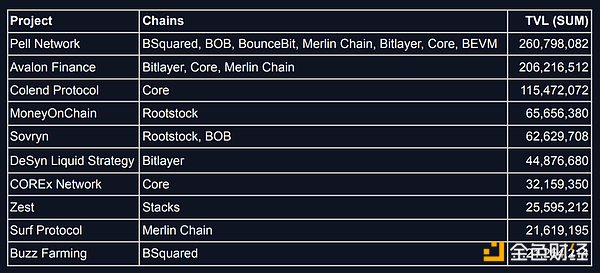

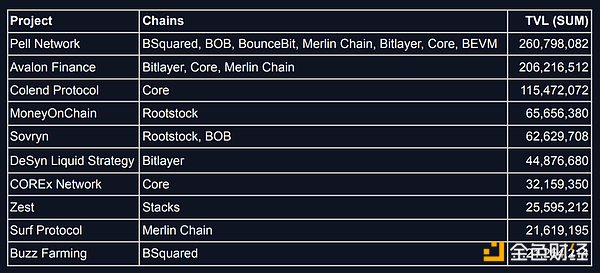

Pell Network became the leading DeFi project with a total locked value (TVL) of $260.8 million, confirming its leadership in the NFT financial field. Avalon Finance and Colend Protocol, with TVLs of $206.2 million and $115.5 million, respectively, are also important players. Other noteworthy projects include MoneyOnChain and Sovryn, which demonstrate the diversity of the BTCFi space, ranging from liquidity mining to stablecoins.

2) Key narratives in major BTCFi projects

Security and decentralization first: Bitcoin's DeFi ecosystem is based on security and decentralization as core principles. Bitcoin's unparalleled security framework is the foundation of the BTCFi ecosystem, ensuring that all innovations follow these basic principles.

Bitcoin as a programmable token: BTCFi is changing the role of Bitcoin to make it not just a store of value, but a programmable token. This change enables the possibility of a new generation of complex financial applications through the use of smart contracts. For example, Solv Protocol’s SolvBTC, which has been called “the first Bitcoin with yield,” provides yield through neutral trading strategies in its yield pool, as well as in DeFi protocols such as Ethereum, Arbitrum, and Merlin Chain.

Interoperability with Ethereum: BTCFi leverages the strengths of both networks by building a bridge with EVM-compatible solutions for the Ethereum DeFi ecosystem. This interoperability creates powerful synergies, combining the security of Bitcoin with the flexible smart contract capabilities of Ethereum. For example, Core executes smart contracts through the EVM, which means that decentralized applications (dApps) developed for Ethereum can be easily transferred to the Core blockchain without major modifications.

Unlocking Capital in Bitcoin: The BTCFi ecosystem is unlocking a large amount of capital for DeFi purposes, providing yield opportunities while allowing users to retain investment exposure to Bitcoin, thereby expanding the utility and appeal of Bitcoin in DeFi.

3) Comparative Analysis with Ethereum DeFi

As Bitcoin DeFi continues to develop, it becomes increasingly important to compare it with Ethereum DeFi. In particular, it is important to focus on how Bitcoin operates in the Ethereum ecosystem through wrapped assets like wBTC and renBTC, and what lessons we can learn from Ethereum's development history.

4) Ethereum DeFi VS Bitcoin and Native Bitcoin DeFi

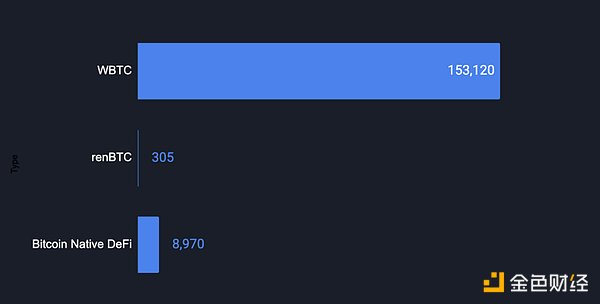

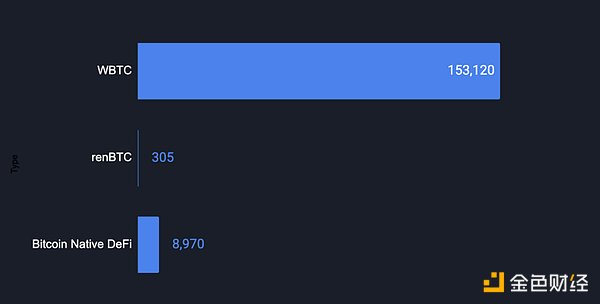

The integration of Bitcoin into the Ethereum DeFi ecosystem is mainly achieved through wrapped assets like wBTC and renBTC. These tokens enable Bitcoin holders to convert BTC into ERC-20 tokens, thereby accessing Ethereum's vast DeFi ecosystem, which can be used on Ethereum platforms such as MakerDAO, Aave, and Uniswap.

There are significant differences in the use of BTC in these two ecosystems. As of September 8, the number of BTC locked in Ethereum DeFi protocols was 153,400, far exceeding the 89,700 in Bitcoin's native DeFi ecosystem. This trend is due to Ethereum's mature and diverse DeFi infrastructure, which provides a wider range of financial products, including borrowing, trading, and liquidity mining.

While wrapped Bitcoin Tokens like wBTC allow users to obtain liquidity and more advanced DeFi features, they also rely on custodians and cross-chain bridges, which may increase risks. In contrast, native Bitcoin DeFi projects, although smaller in scale, operate within Bitcoin's own security framework, avoiding many of the risks associated with cross-chain transfers. However, Bitcoin DeFi is still in its infancy, and the range of financial services provided is still limited compared to Ethereum.

06. What the development of Ethereum can teach Bitcoin and vice versa

1) Lessons that Bitcoin can learn from Ethereum:

Product diversity: Ethereum's success in DeFi is largely due to its provision of a variety of financial products and services, such as DEX and synthetic assets. In order to promote the development of Bitcoin DeFi, it is necessary to expand its product range beyond lending and stablecoin services. Developing more complex financial instruments and interoperability solutions may attract more users.

Developer ecosystem: Ethereum has fostered an active developer community that continues to innovate and build new projects on the platform. Bitcoin DeFi projects can also leverage Bitcoin's strengths by promoting a more active developer ecosystem and encouraging the creation of more new protocols and applications.

Interoperability: Ethereum's DeFi ecosystem performs well in interoperability within itself and with other blockchains. Enhancing the interoperability of Bitcoin DeFi with other chains, including Ethereum, could open up new opportunities for users, allowing them to leverage the strengths of both ecosystems.

2) Lessons Ethereum can learn from Bitcoin:

Security and decentralization: Bitcoin’s emphasis on security and decentralization is unmatched. Ethereum projects can take inspiration from Bitcoin’s conservative attitude, ensuring that these core principles are not sacrificed while innovating rapidly. This is particularly important as Ethereum transitions to more scalable solutions such as Layer 2, where security issues must be carefully addressed.

Simplicity and robustness: While Bitcoin’s scripting capabilities are relatively simple and robust, its lack of flexibility makes it less vulnerable than Ethereum’s complex smart contracts. Ethereum developers can prioritize keeping it simple and robust in their smart contract designs to reduce security risks.

Value storage focus: While Ethereum is known for its smart contract capabilities, Bitcoin’s dominance in value storage remains strong. The Ethereum ecosystem can explore ways to enhance its value storage function, perhaps by integrating more Bitcoin-based assets to attract users who value security and asset preservation.

Although Bitcoin DeFi is still in its early stages, it has significant growth potential if it learns from the experience of Ethereum's mature ecosystem. At the same time, Ethereum can also learn from Bitcoin's advantages in security and decentralization to further consolidate its DeFi products. As the two ecosystems develop, their cooperation and mutual learning may drive the next stage of growth in DeFi.

07. Challenges and Opportunities

As this field continues to develop, technical and regulatory barriers must be addressed, while technological advances and emerging growth areas also bring significant expansion opportunities.

1) Technical barriers

There are many technical challenges to achieving the development of DeFi on Bitcoin. The first is scalability, which is a major issue because Bitcoin's base layer has limited transaction processing capacity due to block size and block time constraints. Unlike Ethereum, which already has a variety of mature Layer 2 solutions, Bitcoin's Layer 2 and sidechain ecosystem is still in its infancy, which limits the range of DeFi applications that can be effectively supported.

Second, interoperability is also a major challenge. How to connect Bitcoin with other blockchain ecosystems without compromising security or decentralization is quite complex and requires innovative solutions.

2) Regulatory concerns

As Bitcoin DeFi continues to develop, regulatory scrutiny is expected to intensify. Governments and financial regulators may impose stricter regulations on DeFi services, especially in terms of AML and KYC. Bitcoin's decentralized and pseudo-anonymous nature makes compliance complicated and may affect the adoption and development of Bitcoin DeFi. Therefore, finding a balance in these regulatory environments is crucial for the sustainable growth of Bitcoin DeFi.

08. Future Opportunities

1) Technological Progress

Bitcoin DeFi has a lot of room for technological progress. Improving Layer 2 solutions, such as more efficient and secure sidechains, and developing more scalable and interoperable frameworks may significantly enhance the capabilities of the Bitcoin DeFi ecosystem. In addition, advances like secret log contracts (DLCs) and privacy-preserving technologies (such as zero-knowledge proofs) may make more complex and secure financial applications a reality.

2) Forecast of Future Growth Areas

As the Bitcoin DeFi ecosystem continues to mature, multiple areas show strong growth potential. It is expected that yield-generating products, DEXs, and cross-chain liquidity pools will attract more and more attention. At the same time, as institutional interest in Bitcoin continues to increase, DeFi products targeting institutional needs, such as custody solutions, compliant financial instruments, and Bitcoin-backed stablecoins, are also expected to have higher demand. These developments provide opportunities for high returns on investment for early adopters and innovators in the Bitcoin DeFi space.

09. Conclusion

Looking ahead, the Bitcoin DeFi ecosystem will continue to expand, driven by technological advances and growing institutional interest. Developing more scalable Layer2 solutions, improving interoperability, and launching more sophisticated financial products are critical to this expansion. As the ecosystem matures, it is expected that yield-generating products, DEXs, and institutional-oriented DeFi services will attract a lot of attention and funding.

However, this growth will also face challenges, especially in dealing with the changing regulatory environment and overcoming technical difficulties related to scalability and security. Solving these issues is critical to maintaining the growth momentum of Bitcoin DeFi and ensuring its long-term success.

In summary, the future of Bitcoin DeFi looks promising, with abundant opportunities for innovation and growth. As the ecosystem continues to evolve, it has the potential to have a profound impact on the entire DeFi ecosystem and make Bitcoin a core player in DeFi.

Weiliang

Weiliang