Author: HighFreedom, Source: Author's Twitter @highFree2028

Is the biggest variable micro-strategy (hereinafter referred to as MSTR) in this round of bull market a LUNA-like Ponzi scheme operation mode? What is the essence of MSTR? Why is the MSTR model a "catalyst" for BTC growth? Will the MSTR model break the four-year cycle of the currency circle or even the eternal bull market? Through which dimensions can we observe the MSTR model and even the end of this cycle?

Note 1: The article involves many charts and is divided into 7 chapters. Since Twitter does not support long articles, it is forced to be divided into 7 threads

Note 2: Points 1, 2, and 3 are mainly basic information. Friends who have basically zero knowledge of MSTR can start from 1

Note 2: All contents of 4, 5, and 6 are in-depth thinking and analysis. Friends who are very familiar with MSTR can start directly from 4

Basic content

1. Introduction to MSTR fundamentals: the company's original main business, shareholder structure, and revenue.

2. Analysis of the core strategy of buying coins: historical analysis of buying coins, cost and amount of coins held, company debt situation, and core KPI of the buying coin strategy (Bitcoin per share).

3. Analysis of the source of funds for crazy buying coins: 21/21 PLAN, that is, the 42 billion US dollar coin buying plan, "ATM market price selling stocks" and "Convertible bonds (hereinafter referred to as CB)".

"Convertible bonds" is one of the essential operations and the core observation object for whether there will be a spiral collapse in the future. This content will be analyzed in detail below.

In-depth analysis

4. The core of the game: CB basics, why MSTR's CB is so popular, who is buying MSTR's CB, and what is the essence of CB.

5. Discussion of the MSTR model: What does MSTR's premium to BTC represent, and what is the essence of MSTR as a company? What does MSTR's premium represent? When should MSTR's stock be bought or sold?

6. When will the game stop: Will the dusk of the MSTR model and the end of BTC come? From which dimensions can we observe? If a downward spiral unfortunately occurs, what will happen?

Key time points

7. The key timetable for MSTR to enter the Nasdaq NQ100 this month.

(The picture shows a page from the 2024Q3 MSTR financial report. MSTR currently holds 386,800 BTC)

1. Introduction to MSTR fundamentals:

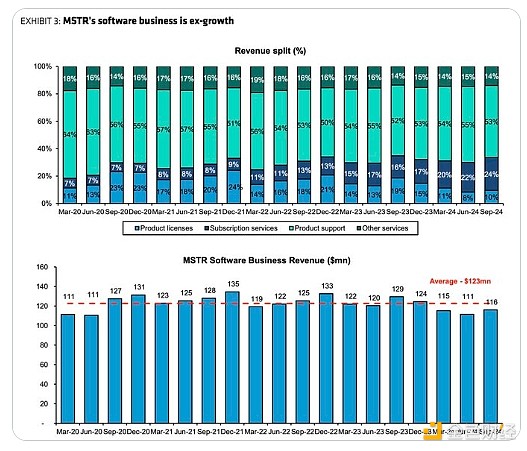

The company's original main business: BI software, classified as "technology" on Bloomberg, with annual software revenue of approximately US$400 million.

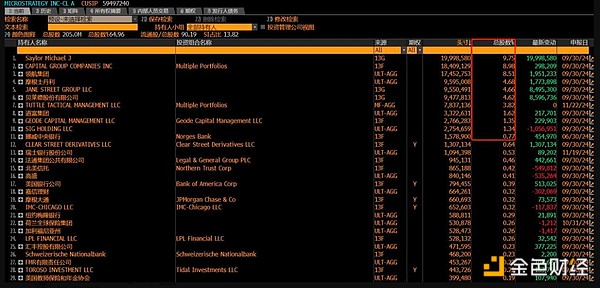

Company shareholder structure: According to the data disclosed at the end of Q3 2024, boss Saylor is the largest shareholder, holding 9.75% of the shares; the other top ten shareholders are basically clients of various asset management companies or the money held by the asset management companies themselves (but it should be noted that for ordinary A shares, Saylor's holdings are B shares, and each B share has ten times the voting rights of A shares, so Saylor still has the final say in the company).

The company's existing financial situation: there should be about 3 billion US dollars in cash on the account (just announced last Friday); liabilities (mostly convertible bonds) are about 7 billion.

2. Core strategic analysis of buying coins:

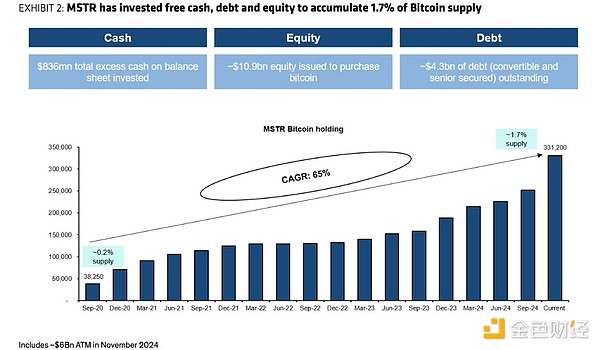

Long-term bullish on BTC/USD, continue to buy BTC. Using internal cash accruals, equity and debt, 386,700 bitcoins were acquired at a price of approximately $22 billion (cost of approximately $56,849), which is currently worth approximately $36 billion at a BTC price of $95,000. Reference: https://saylortracker.com.

Long-term bullish on BTC/USD, continued to buy BTC. The company started its first purchase of coins in September 2020 during the last bull market, when the average price was 10,419 USD and 16,796 BTC were purchased.

Using internal cash accruals, equity and debt to acquire 386,700 bitcoins at a price of approximately US$22 billion (cost of approximately USD 56,849), currently worth approximately USD 36 billion at a BTC price of USD 95,000.

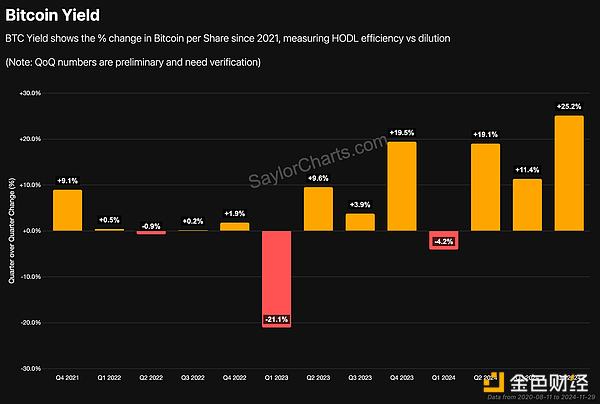

Core of the company's KPI: Bitcoin per share (called BTC Yield in the financial report)The core meaning is that, shareholders, don't worry about me issuing additional shares to dilute everyone's interests, or borrowing money to buy coins, as long as the share of BTC corresponding to each share in your hand continues to increase (don't worry about my stock price going up and down in the short term, I just want to buy coins everywhere anyway).

Note: How MSTR continues to increase BTC Yield will be discussed later.

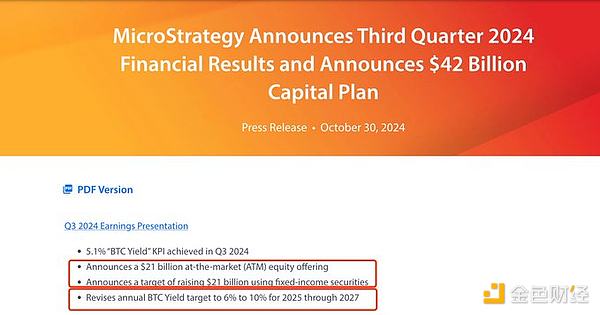

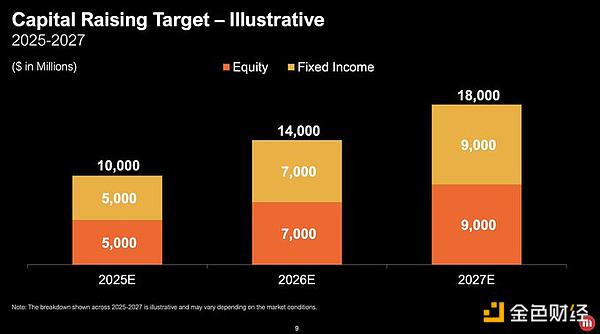

3. The sources of funds for the crazy purchase of coins: 21/21 PLAN is a plan to buy coins worth 42 billion US dollars in the next three years

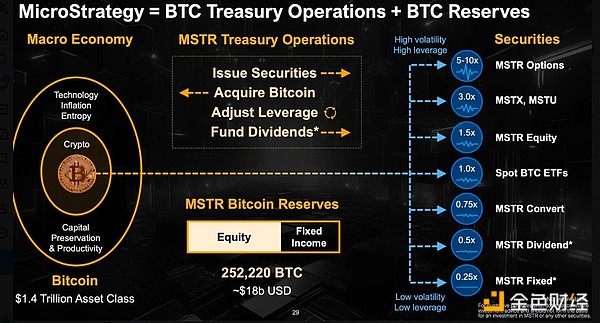

There are usually two ways for a listed company to raise funds: one is to issue additional shares to bring in more shareholders (equity financing); the other is to issue bonds, write an IOU and borrow money from others (debt financing).

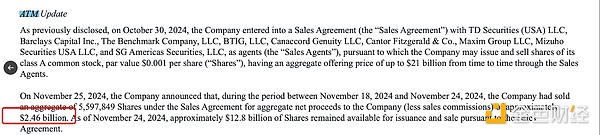

MSTR's ATM market price selling stocks:MSTR will issue 21 billion worth of stocks at one time on October 30, 2024. Please note that it will issue a large number of stocks at one time, and then it can sell the stocks at any time during intraday trading in the next three years, and no announcement is required before selling the stocks (the so-called At the market "ATM").

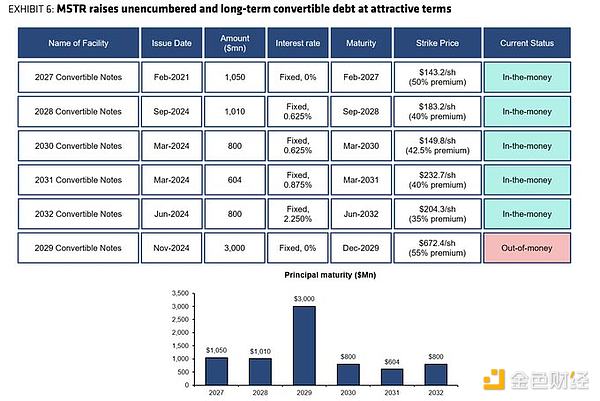

MSTR's Convertible bonds (hereinafter usually CB)" are issued:Debt financing is carried out through the issuance of CB. CB is different from ordinary bonds. It has both stock and debt characteristics. The following will discuss in detail. I think this is also the core of MSTR's game.

According to the latest regulatory filings: 8.2 billion of the 21 billion ATM stock quota has been used, and 3 billion of the 21 billion CB quota has been used.

4. The core of the game: through channels such as CB, funds that are optimistic about BTC but cannot participate have the opportunity to enter the market

Convertible bonds (CB) basic knowledge: Convertible bonds are bonds themselves, which can be converted into stocks after certain agreed conditions are met. It is essentially a call option of corporate bonds + company stocks. But please note that if the company goes bankrupt, the order of repayment is ordinary bonds> convertible bonds> shareholders, so the repayment order of CB should be later (there is no free lunch in the world).

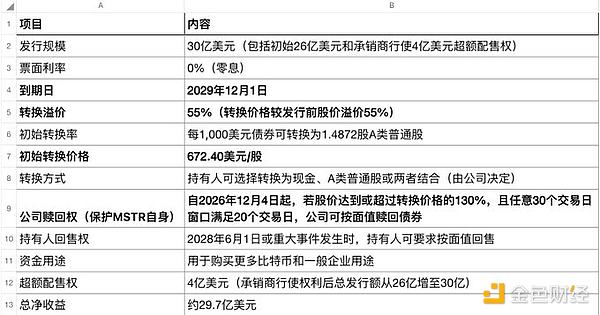

Take the 3 billion USD issued on November 21, 2024 as an example: 0 interest, principal protection (to some extent), 5 years, with call options, premium of 55%.

In layman's terms

Case 1 (good case): only if the stock price reaches 672 USD within five years, the creditor can convert the bond into stock. If the stock price rises to 700 USD, the profit ratio is (700 - 627) / 672 = 4.2%.

Case 2 (bad case): if the company's stock price never reaches 672 USD within five years, the creditor can only wait for MSTR to return the cash after five years (for example, if a CB of 100 million USD is purchased, the creditor can only recover the principal of 100 million USD at that time).

Who is helping MSTR issue CBs: various large traditional investment banks such as Barclays.

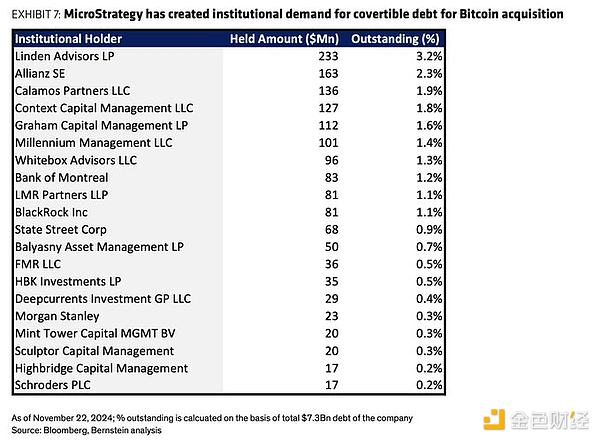

Who is buying CBs: hedge funds that do volatility strategies and long only debt and insurance funds that are optimistic about BTC but cannot buy coins directly.

To be honest, hedge funds that do volatility strategies don’t excite me. These people may not have any faith in Bitcoin. For example, Bitcoin’s recent volatility vol is at a high level, so they short vol, and vice versa.

What excites me most here is that Germany’s largest insurance company like Aliianz, with a scale of 2 trillion euros in insurance funds, has begun to participate in BTC, and is likely to be a net long position in BTC.

Why Aliianz doesn’t buy coins directly: Because the nature of many funds determines that they cannot buy BTC.

Imagine that you are a bond fund manager who manages a scale of 100 billion US dollars, and you are also optimistic about BTC. However, the nature of bond funds can only be invested in government bonds and corporate bonds. Such fund nature determines that it is impossible to buy BTC spot or BTC call options. In addition, you will find that the target return of your fund may be 6% or 7%, and the majority is government bonds. For MSTR's convertible bonds, it is basically the super alpha in your position.

At this time, MSTR said, brother, buy my company's convertible bonds. This product is highly linked to the rise and fall of BTC. And my product guarantees your principal. As long as the company does not go bankrupt, I will return the money to you in five years; if BTC doubles and reaches your exercise price, for example, I take 70% and you take 30%. (To some extent, it is very similar to the boss of a real business in real life saying: "Brother, I heard that you are good at cryptocurrency trading. How about this, I will give you 20 million, you help me trade cryptocurrency, and we will split the profit 55-50. But there is a requirement, I want to protect my principal).

Such products are of great attraction to funds that are optimistic about BTC but cannot participate at present. Products like CB open up a channel for insurance funds and bond funds to participate in the rise and fall of the BTC market. There is a great lack of such products in the current market, which is why CB's subscription is abnormal(Last month, it was originally planned to issue 1.75 billion US dollars of CB, but it was too popular, and 3 billion was directly issued two days later).

The essence of CB: It essentially speeds up the level of funds participating in BTC.

For hedge funds, it is a good leg in the volatility long-short strategy. To be honest, these people are not friends of us old leeks.

For bond funds and insurance funds, it is equivalent to doing BTC long with us through the CB product only net long family.

CB stock situation: There are six periods of CB in the market. Investors in the first five periods have made a lot of money with the rise of the currency price and MSTR stock price (this thread can’t put the picture, you can see the market price of each period of convertible bonds, the latest market quotation for the 2028 period is 224, and the holder’s yield is 124%).

5. Discussion on the MSTR model:

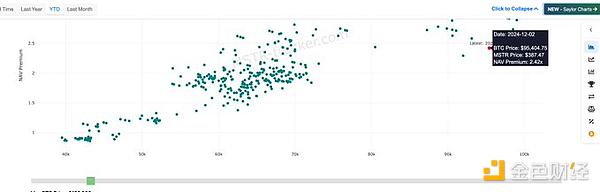

What does the premium of MSTR to BTC represent? When should I buy and sell the company's stocks? What is the essence of MSTR?

MSTR's premium:

I think it represents the acceleration of BTC's rise in the future (the historical average of the premium is 75%. Now the premium has fallen from the high of 3 a few days ago to around 2.5).

When to buy and sell MSTR's stocks:

If you think that BTC will accelerate in the next period of time, then buy MSTR directly; conversely, if you think that the price of BTC will be flat in the future, then sell MSTR.

The essence of MSTR:

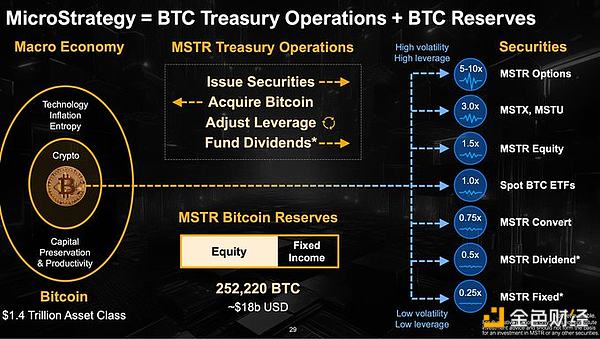

Using BTC as the underlying asset, it issues financial products that meet the needs of funds with different returns and risks (very similar to the work of traditional investment banks, helping stocks to be issued and listed IPOs, etc.).

6. When will the game stop: the transfer of BTC ownership and the catalyst role of MSTR

Accelerated transfer of BTC ownership:

To be honest, I have been trading in cryptocurrencies for 8 years, and my solid belief in BTC comes from two points:

1. A good tool to hedge against excessive money printing by human sovereign governments: Since the unconventional monetary policy of QE quantitative easing was introduced in Japan in the 1990s and the United States after 2008, sovereign governments will print a lot of money when they encounter problems. This thing is like drug gambling, once you get addicted, it is difficult to quit. In the end, it is bound to lead to a large amount of over-issuance of currency, and the underlying properties of BTC determine that it is the best tool that can be found on the market to take over excessive currency.

2. Accompanying BTC growth: I think that on the one hand, the market value of BTC is getting bigger and bigger, and on the other hand, the circle of funds participating in BTC is getting bigger and bigger, the so-called transfer of BTC ownership:

Hacker IT men -> High net worth individuals -> Technology companies -> Fund institutions -> Small countries -> Large countries

MSTR uses various financial tools to introduce funds that may not be able to participate in BTC for many years in the future in advance, which is, to some extent, an overdraft of the BTC price.

For example, insurance funds and bond funds may not be able to participate in BTC until the next cycle in 2028, but through tools such as CB, in the form of nearly principal preservation, funds that want to participate but cannot directly buy coins to participate, such as insurance funds, are converted into on-site spot long forces, and now they are on the train in 2024.

To put it simply, the price of the coin may not rise to 150,000 until the end of 2025, but a company like MSTR may be able to raise the price to 150,000 within three months.

When will the game end:

But what if MSTR's leveraged coin trading method comes to an end one day? I think it's like this:

If MSTR can't issue various products such as bonds in the future, and has greatly overdrawn the future price increase, but at the same time there is no larger fund to take over to buy BTC, BTC may usher in a terrifying spiral decline like LUNA.

For example, MSTR raised the price of the coin to 250,000 within a year. At this time, it can't issue bonds anymore, and no one buys them; but if the US pension funds, small sovereign governments, etc. have greater financial strength and don't take over, it will be troublesome.

So, if I can give Saylor some advice one day: don’t run too fast in the front, don’t add too much leverage, otherwise the terrifying spiral decline will cut off the path of BTC’s ownership transfer, seriously hurting its vitality.

Finally, I would like to list my observation dimensions for everyone:

The dusk of the MSTR model and the top of BTC Observation dimensions:

1. The popularity of the primary market subscription of various subsequent products such as CB (If the primary market subscription of subsequent CBs is not so popular, then you may have to start worrying; it is best to find the investment bank that helps MSTR issue CBs, they are the first line to know the cold and warm).

2. The premium of CB issuance and the financing cost: CB is essentially a financing tool with financing costs. MSTR is essentially a call that sells its own stocks, which is a behavior of shorting BTC at a high level; these funds that buy CBs are essentially buying this call. You can see that the November CB was issued at an exaggerated 55% premium. If the subsequent premium is getting lower and lower, it actually means that the call value attached to investors is getting higher and higher, that is, the financing cost is getting lower and lower.

3. The progress of the entry of larger funds:If CB gradually stops issuing, then more powerful funds such as pension funds will take over. At this time, it is necessary to closely observe the attitude and trend of these big brothers towards BTC.

Note: I originally thought that the top of this market was basically the same as the external monetary cycle on the one hand and the internal OG shipment situation on the other hand; but as the MSTR model gradually matures, I think it is necessary to include the analysis framework and system when the MSTR model will come to an end.

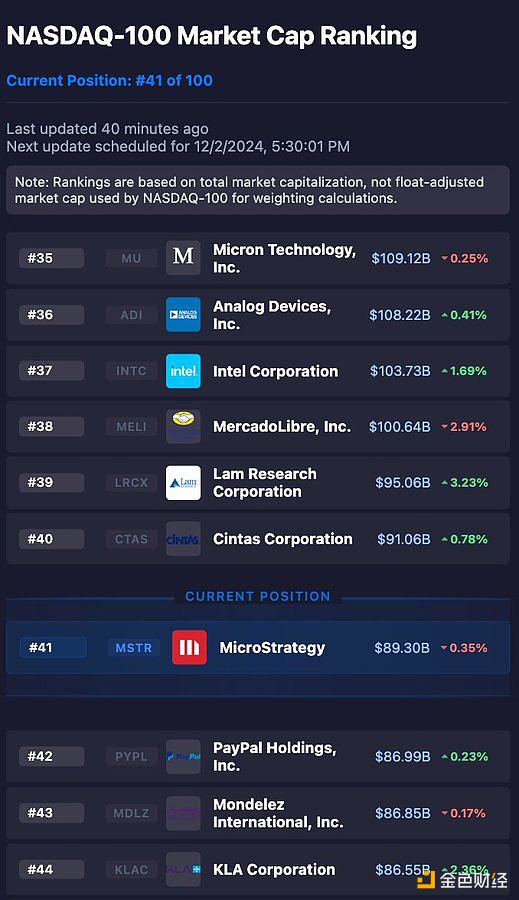

7. Timeline for entering the Nasdaq in December

The Nasdaq will adjust its constituent stocks at the end of each year, and MSTR currently meets all requirements.

Key time 1:

After the US stock market closes on December 13: The Nasdaq Editorial Committee will announce the constituent stock adjustment announcement.

Key time 2:

On December 23, the opening day of the US stock market: MSTR is officially included in the index and starts trading.

Finally, I would like to talk about the significance of MSTR's inclusion in the Nasdaq:

1. Passive allocation of funds: The aggressive scale of the Nasdaq is about 300 billion US dollars. According to the market weighted proportion allocation, there may be 1.5-2 billion funds that will passively buy MSTR.

2. Expand BTC fund consensus: Imagine that all Chinese aunts can also buy some Nasdaq funds when they open Alipay. In essence, they passively allocate a little bit of MSTR stocks, and more essentially, they passively allocate a little bit of BTC. In fact, I think the importance of this to BTC may be no less than the listing and trading of the US BTC SPOT ETF on January 10 this year in the long run.

Finally:

Please protect the BTC in your hands and welcome the bigger main rising wave in 2025. Don’t hand over your precious chips easily until the game is about to stop.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Sanya

Sanya Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph