Source: Chainalysis; Compiled by Deng Tong, Golden Finance

In response to increasing financial pressure from Western sanctions, Russia has enacted a major legislation that legalizes cryptocurrency mining and allows the use of cryptocurrencies for international payments. According to Bloomberg, the bill was signed into law by President Vladimir Putin on August 8, and crypto payment trials are scheduled to begin this month.

This is a significant departure from the government's previous stance, with the Central Bank of Russia (CBR) pushing for a complete ban on cryptocurrencies in 2022. The new law, which will take effect in September for cross-border payments and in November for cryptocurrency mining, will enable Russian businesses to use cryptocurrencies for international trade and authorize approved entities to mine digital assets.

Putin called on Russia to “not miss the opportunity” to regulate cryptocurrencies, highlighting their growing role in global payments and their potential to reduce reliance on the U.S. dollar. Key officials, including the bill’s author Anton Gorelkin and Central Bank of Russia Governor Elvira Nabiullina, explicitly acknowledged that the legislative change is intended to mitigate the impact of sanctions and facilitate international payments.

Russia’s Shifting Attitude Towards Cryptocurrency

Despite recent legislation, Russia still prohibits the use of cryptocurrencies for domestic payments. However, this has not curbed the widespread use of cryptocurrencies in the country. In fact, Russia consistently ranks high in our annual Global Crypto Adoption Index, which is consistent with our broader observation that blanket bans on cryptocurrencies tend to be ineffective because they do not significantly curb usage, but rather push it into informal or less regulated channels.

Meanwhile, cryptocurrency-related banking services were also on the rise in Russia before the recent legislation. Russian billionaire Vladimir Potanin’s Rosbank paved the way for cross-border cryptocurrency payments for businesses last June, Kommersant reported, and several other banks followed suit.

Sanctions Evasion Through Cross-Border Payments

The Russian Central Bank is leading the charge to integrate cryptocurrencies into Russia’s cross-border payments financial system, creating an experimental infrastructure that will allow approved Russian businesses and entities to use digital currencies for international trade. Approved mining entities will also be allowed to use cryptocurrencies to settle transactions, according to an official statement.

These recent cryptocurrency legislative efforts are part of Russia’s broader push to develop alternative payment mechanisms to ease pressure from Western sanctions while reducing reliance on the U.S. dollar, which has been a long-standing goal of Russia, especially amid heightened geopolitical tensions.

Central Bank of Russia: New Scope of Regulatory Powers

The new legislation solidifies the Russian Central Bank’s control over cryptocurrencies, allowing it to closely regulate and monitor these transactions. While the Russian Central Bank is still testing its central bank digital currency (CBDC), with the digital ruble expected to launch in 2025, the legislation allows for the use of existing cryptocurrencies under central bank oversight.

Russia has been exploring various ways to circumvent the U.S.-dominated financial system, including blockchain-based initiatives with the BRICS community and a possible partnership with Iran to launch a gold-backed stablecoin. The SPFS — Russia’s alternative to the SWIFT financial messaging system — is another key component of the strategy, though its use remains limited.

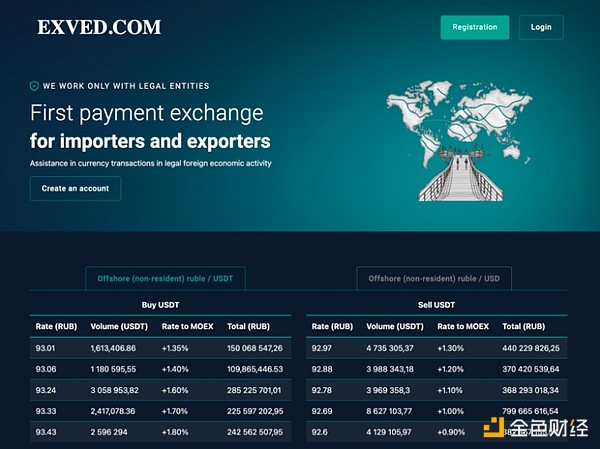

Exchanges that may handle international transactions

According to a report by Bloomberg, authorities are exploring ways to legalize cryptocurrency exchanges. “We haven’t found a solution yet,” said Finance Minister Anton Siluanov. However, Russia is moving forward with plans to launch two new cryptocurrency exchanges in St. Petersburg and Moscow, according to Russian news outlet Kommersant. The St. Petersburg exchange will reportedly be supported by the infrastructure of the St. Petersburg Currency Exchange (SPCE), though SPCE has denied involvement, according to state news agency Interfax. Despite regulatory inconsistencies, Russia already has a thriving cryptocurrency ecosystem.

Some of Russia’s largest non-KYC exchanges, such as Tetchange, 100btc, Bitzlato, Suex, and Garantex, are located in or near the Federation Tower, a two-story skyscraper complex located within the Moscow International Business Center, also known as Moscow City. While some of these services, such as Suex OTC, have seen a reduction in activity following their designation by the U.S. Treasury Department, others, such as Garantex, have maintained a steady level of operations.

Garantex is a core player in the Russian cryptocurrency market and is likely to continue to play a significant role despite being designated by the Office of Foreign Assets Control (OFAC) and the Office of Financial Sanctions Implementation (OFSI) in the United States and the United Kingdom, respectively. The centralized exchange (CEX) has processed a large number of transactions for Russian and Iranian designated participants, demonstrating its utility in sanctions evasion. Under the new legislation, the Russian government could formally or informally exploit services such as Garantex given its deep liquidity on major blockchains. Although Garantex has processed nearly $100 billion in transactions since 2018, this large-scale activity does not necessarily equate to large-scale state-sponsored sanctions evasion and should be assessed with caution. It is important to note that not all Garantex users are Russian nationals or reside in Russia, nor do they act on behalf of the Russian government. Furthermore, a large amount of sanctions evasion activity occurs outside of official government channels and through traditional off-chain methods, such as private investment vehicles and offshore shell companies.

Another exchange that could use crypto to evade sanctions is Exved, which works closely with InDeFi Bank, co-founded by Garantex founder Sergey Mendeleev and former KGB officer and media mogul Alexander Lebedev. Exved has been facilitating imports and exports even before the new legislation was enacted.

In addition, InDeFi, which offers a wide range of DeFi products such as yield farming and flash loans, has been involved in efforts to launch a ruble-backed stablecoin on the Ethereum network, according to the InDeFi white paper and news reports.

Against the backdrop of shifting legislative stances, Russia’s cryptocurrency business has had mixed success. On one hand, Garantex represents a success story while other global exchanges have exited the Russian market, citing compliance issues, with some local exchanges even shutting down altogether. Last year, Binance sold its Russian operations to CommEX, which suspended services earlier this year, reflecting the broader challenges of doing business in Russia following the full-scale invasion of Ukraine in February 2022.

While it is difficult to quantify the true impact of certain sanctions actions, the fact that Russian officials point to the impact of sanctions on Moscow’s ability to handle cross-border trade suggests that the impact is enough to inspire a sense of urgency to legitimize and invest in once-condemned alternative payment channels.

Cryptocurrencies that can be used for payments

Russia is planning to launch a yuan and BRICS stablecoin, backed by new cryptocurrency exchanges being developed in St. Petersburg and Moscow, according to Kommersant. Additionally, centralized stablecoins such as USDT and USDC may also be considered given their liquidity and widespread global popularity, but their centralized control and regulatory responsiveness pose disruption risks. The digital ruble could also play a role once launched, but its appeal to other countries remains uncertain given the severe economic sanctions against Russia. Finally, entities permitted to mine could potentially mine Bitcoin, which remains highly liquid and popular around the world.

The Challenge of Scaling for On-Chain Sanctions Evasion

Russia’s moves to integrate cryptocurrencies into its financial system could increase its ability to circumvent the U.S.-dominated financial system and engage in non-dollar-denominated trade.However, given that Russia’s total foreign exchange reserves stand at just under $500 billion, of which approximately $300 billion remains frozen in U.S. dollars, euros, and pounds, large-scale on-chain sanctions circumvention remains highly unlikely. As we have explored previously, current cryptocurrency markets simply do not have the liquidity to accommodate transactions of such magnitude.

While large-scale sanctions circumvention at the national level is unlikely, small-scale sanctions circumvention on-chain could still have significant national security, compliance, and investigation implications. Government-affiliated actors who may seek to exploit the new developments include fundraisers supporting pro-Russian militants in Ukraine, facilitators of capital flight for oligarchs and other politically exposed persons, or Russian-speaking instant exchangers with no KYC requirements, providing on- and off-ramps for sanctioned Russian banks. These small-scale activities can have a significant impact, highlighting the wider security and compliance risks associated with such transactions.

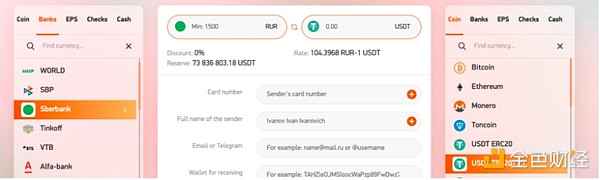

Below we can see the interface of a Russian instant exchanger.

Users can transfer funds from accounts at sanctioned Russian banks, such as Sberbank, and exchange them for cryptocurrencies without any KYC. This means that users can effectively avoid the fiat currency ban on sanctioned Russian banks.

Russia’s shift in attitude toward cryptocurrencies is a calculated response to Western sanctions, with an eye toward an alternative financial system that is less reliant on the U.S. dollar. The success of this initiative will depend on how effectively Russia overcomes regulatory hurdles, manages sanctioned entities, and builds the necessary infrastructure and foreign partnerships to support these transactions.

Impact of Crypto Mining Bill

In addition to shoring up its economy during wartime, Russia is also attempting to surpass the United States as a global leader in cryptocurrency mining.

The recently passed Crypto Mining Bill introduces a structured framework for cryptocurrency mining, creating a register that allows Russian legal entities and entrepreneurs to engage in mining activities. The framework is designed to regulate large-scale mining operations, while small-scale mining operations under energy consumption restrictions will not be considered. Language from an early draft of the mining bill was removed, suggesting that authorities may be trying to avoid actions that would adversely affect Russia’s robust cryptocurrency ecosystem. In particular, Kremlin-aligned Russian news outlet RBC reported that a proposed ban on organizing cryptocurrency trading was removed from the final version of the bill, averting a potential shutdown of central Russian exchanges and providing miners with a legal way to monetize their activities.

Under the new law, miners must report their activities to local financial monitoring agency Rosfinmonitoring and provide wallet addresses to security services, effectively legalizing their operations under state supervision. This regulatory move also raises important questions about the classification of cryptocurrency mining outside of Russia, especially in light of broad sectoral sanctions imposed by the United States and Europe on Russia’s energy sector. While international sanctions targeting Russia’s energy resources continue, Russia’s authorization and oversight of cryptocurrency mining demonstrates its strategic alignment with national interests.

Next Steps: Implications for Authorities, VASPs, and TradFi

While these legislative changes may enhance Russia’s ability to engage in international trade via cryptocurrencies, they may also increase vigilance among U.S. and EU authorities — especially regarding counterparty risk and ties to some of Russia’s more significant trading partners, such as China and Iran. As these bills increase the connectivity of global trade, Western authorities are likely to continue to focus on monitoring and mitigating the risks associated with both on-chain and off-chain financial activities of sanctioned entities.

More broadly, many heavily sanctioned countries, from Venezuela to Russia to Iran, have historically attempted to use alternative payment mechanisms, including cryptocurrencies, to circumvent sanctions—an approach that is fraught with challenges. The transparency of blockchain technology enables investigators to monitor and disrupt the flow of funds in real time. Wallet addresses associated with CEXs, mining services, and other on-chain entities can be identified, attributed, and potentially sanctioned. Furthermore, liquidity constraints in cryptocurrency markets mean that attempts to move large amounts of assets on-chain could draw the attention of blockchain observers and even destabilize the entire market.

For virtual asset service providers (VASPs) and traditional financial institutions, these developments highlight the importance of increased counterparty due diligence on Russian mining entities. Overall, these changes make it more difficult for CEXs to deal with Russian entities, consistent with Russia’s broader trend toward de-risking and de-banking since its full-scale invasion of Ukraine.

Chainalysis’ suite of on-chain data, monitoring, and investigative tools enables investigators and compliance professionals to proactively monitor these networks and take disruptive action, making it increasingly difficult for designated entities to abuse cryptocurrencies to evade sanctions.

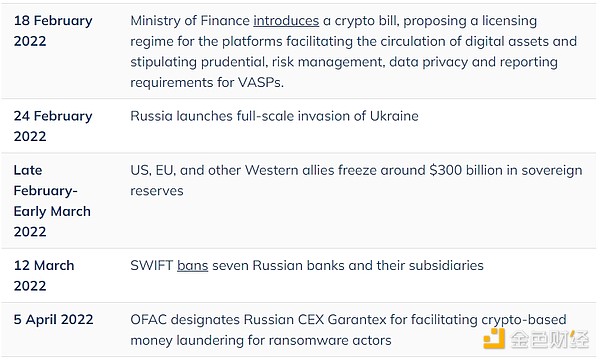

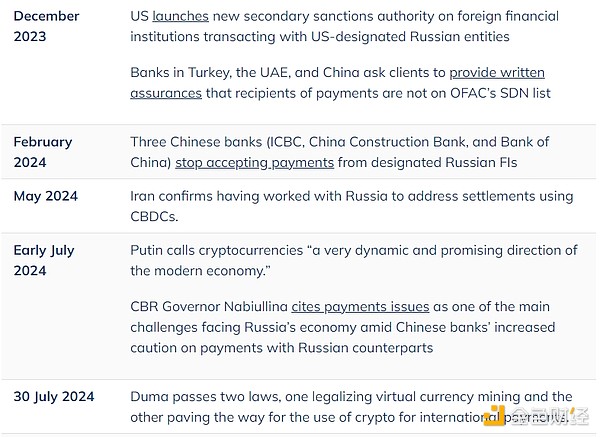

Timeline of Russia’s shift in stance on digital assets

Edmund

Edmund

Edmund

Edmund WenJun

WenJun JinseFinance

JinseFinance Edmund

Edmund Cheng Yuan

Cheng Yuan decrypt

decrypt Cointelegraph

Cointelegraph Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph