What caused Ethereum DApp transaction volume to surge 83%?

The recent surge in activity on the Ethereum network diverges from broader cryptocurrency market trends and even contradicts other usage indicators.

JinseFinance

JinseFinance

Author: Pedro Source: ModularMedia Translation: Shan Ouba, Golden Finance

Dive into the permission layer of chain abstraction and explore how wallet abstraction can achieve the future of "one account, one balance".

Chain abstraction depicts a vision that "in the future, using blockchain will no longer require additional attention to the blockchain itself and its poor user experience".

In simple terms, this means that as a user, you don't have to worry about all the complexities involved in interacting with the blockchain (managing multiple wallets, gas fee tokens, etc.). All information about the chain is abstracted from the user by default, and you just use the application.

Ultimately, the goal is to make the blockchain experience closer to the traditional Internet, where users can switch seamlessly between applications. Think about your experience using the Internet in your daily life - when you buy shoes on Nike.com, you don't sit there thinking about which cloud service the website uses. You just visit the website and buy the shoes.

However, this is not the case in the current crypto world, not necessarily because you want to know (although yes, many of us do), but more so because you have to know.

Let’s take a look at today’s web3 experience. Let’s say you are a Polygon user who has just heard about a cool new NFT coming to the Base network.

First, you need to find a cross-chain bridge to transfer your MATIC from Polygon to Ethereum

Once you receive your MATIC on Ethereum, you must go to a DEX (such as Uniswap) and exchange your MATIC for ETH.

Then, you need to make sure the Base network is added to your wallet. (You only connected Polygon initially)

Once you’ve added Base to your wallet, you can find and use the cross-chain bridge to transfer ETH from Ethereum to the Base network.

Once you’ve successfully bridged ETH to BaseOnce on Base, you can visit the site to mint NFTs.

Okay, you’re finally done - but there were a lot of steps (and we skipped a lot!).

Now let’s extrapolate this to +1000 chains, which is where the modular revolution is headed and things start to get crazy and impractical. Not for the average user at all.

As a result of this experience, web3 ended up with user silos within each blockchain. The huge friction of moving funds across chains means that users remain siloed into specific ecosystems, reducing the incentive for true innovation and new users face a huge barrier to entry when entering the space.

This is where chain abstraction comes in.

Ideally, you wouldn’t have to go through all of these steps. You’d only have to download your wallet once, not worry about connecting to the specific network the dapp you want to use is deployed on, and you’d only have to fund it once, while paying the gas fee with whatever assets you own. Essentially, just fund your wallet and use the app; there’s nothing else to do beyond that, and for the end user, it’s just one step.

This is the promise of chain abstraction.

Chain abstraction isn’t a single product or solution, but the result of multiple teams working together to make this experience possible.

Chain abstraction simplifies the interaction between users and multiple blockchains by creating a layer that manages the complexity behind the scenes. It decouples the user experience and applications from the underlying infrastructure, enabling a seamless and user-friendly interface across different blockchain networks. In this modular blockchain future we are heading towards, where thousands of new chains will be spawned, chain abstraction ensures that users can interact with these different ecosystems without having to understand or manage the complexity involved.

The web3 experience starts to feel like the traditional internet experience we are all used to.

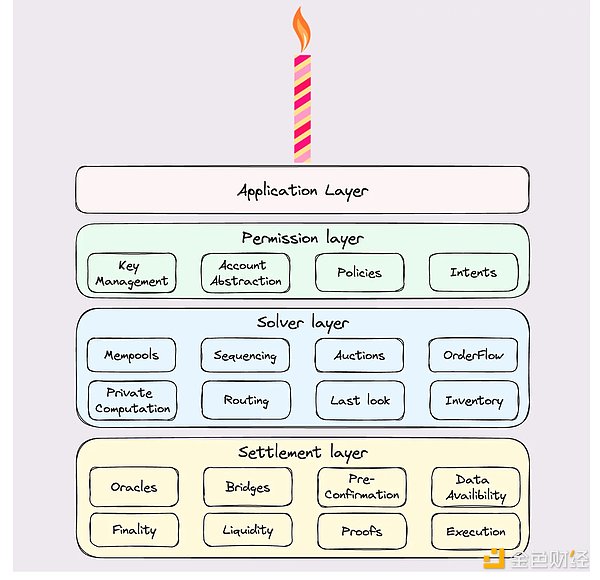

As mentioned above, the vision of this chain-abstracted world requires multiple teams to work together across different layers - each solving a different problem, but working together to achieve the end goal of a chain-abstracted state.

Nonetheless, these layers are expressed differently:

The chain abstraction stack, developed by Everclear (formerly Connext), focuses on an intent-centric approach to chain abstraction.

Particle Network’s multi-layer framework categorizes chain abstraction solutions through three interoperable layers.

The CAKE framework, proposed by Frontier Research, provides a comprehensive mechanism to categorize and understand the fine-grained technologies that make up chain abstraction.

As Particle Network’s Tabasco told me, “We don’t think of these frameworks as necessarily competing, they basically just express different levels of granularity”.

For the purposes of this series, we’ll use the CAKE framework as a reference when distinguishing between layers.

Over the next few weeks, we will be focusing on different layers of the CAKE framework, starting here with the Permissions Layer (called the Account Layer in the other two frameworks), which is a key component of the chain abstraction that controls how users interact with dapps and the blockchain network.

Specifically, we will explore the key elements that make up the Permissions Layer (or sub-layers within the layer, if you will). We will touch on Account Abstraction, Wallet Abstraction, Intents, and Orchestration. Together, these components allow us to achieve a "one wallet, one account" future.

The permission layer sits at the top of the CAKE stack and acts as an interface between the user and the blockchain. At this layer, users interact with dapps by connecting their wallets and requesting specific results or “intents”. Essentially, this layer is responsible for abstracting all technical complexities away from the end user, ensuring a seamless user experience.

In essence, the permission layer abstracts the complexity of blockchain interactions by managing user intents (whether they are transactions, staking operations, or other blockchain-related activities) and ensuring they are executed securely, accurately, and efficiently.

Now, let’s take a look at account abstraction and intents to see how these technologies enable the future of wallet abstraction.

Generally speaking, there are two types of blockchain accounts: Externally Owned Accounts (EOA) and Contract Accounts. (Although we should mention that OneBalance recently introduced a new account type called "Trusted Accounts").

Traditionally, we are used to using EOAs - Metamask, Phantom, and most early wallets are like this. However, the functionality of EOAs is limited to basic operations such as initiating transactions and interacting with smart contracts. Furthermore, EOAs are tied to a single key pair (public and private), meaning that if you don’t have access to the private key, you don’t actually have access to the account.

Until recently, with the rise of ERC-4337, EOAs were the only way to interact and sign transactions on Ethereum — ERC-4337 isn’t the first standard designed to bring account abstraction to Ethereum, but as of now, it’s the most accepted.

Enter the smart contract wallet, which is enabled by contract accounts.

Contract accounts bring account abstraction to users. Contract accounts are managed by smart contract code, meaning that the behavior of the account is controlled by arbitrary custom logic. In short, this will change the wallet experience from a one-size-fits-all model to one that better suits your own preferences, whether in terms of security, execution, or other parameters.

Let’s take a look at some of the benefits of account abstraction.

The benefits of account abstraction cover three different use cases:

Signature Abstraction:As you know, every transaction you want to submit on a given network requires you to provide a signature, which is traditionally done using a private key - meaning that anyone who controls this private key can access the funds in a given account. With signature abstraction, users can define custom authorization rules, such as: transaction limits, multi-part approvals, social recovery, and fund freezing.

Fee Abstraction:This enables users to pay for gas fees with any token, and also enables teams to completely remove gas fees from their applications - fees still need to be paid, but teams sponsor the costs themselves using a "Paymaster" contract (which is part of the account abstraction model).

Nonce Abstraction (Batching):Typically, when doing a simple swap, you must (1) approve the transaction, and (2) execute the transaction. Rather than splitting this swap into two separate transactions, we batch them into one transaction (approving and executing the swap all at once).

Similarly, since the account itself is a smart contract, developers can write any type of logic in it.

Intent

As Particle Network has stated in a previous post, account abstraction has not yet had its “aha” moment because it only covers half of the equation.

“Account Abstraction improves the user experience from onboarding to expression, but still doesn’t solve the path from expression to outcome.”

In other words, account abstraction makes it easier for users to enter the world of web3 and manage the complexity of having an account, however, users still have to manage every on-chain operation they want to achieve - now imagine wanting to perform cross-chain operations - things get even more complicated.

This is where intents come in.

Intents, as the name suggests, refer to the intention or action that a user wants to perform on-chain, such as sending tokens, staking, or bridging. More specifically, intents refer to the outcome that a user wants, rather than the path to achieve the outcome. This shifts the perspective from transaction-based to requirement-based.

The permission layer takes these high-level intents and converts them into executable instructions that the blockchain can process.

Let’s look at an example.

Traditional Trading Approach:Suppose you want to exchange 100 DAI (a stablecoin) for ETH on a DEX like Uniswap. Traditionally, you would execute this trade by specifying the exact DEX and parameters (e.g., “I want to exchange 100 DAI for ETH on Uniswap with a 0.5% slippage tolerance”). This approach focuses on the details of the trade and requires you to manually select the platform and parameters.

Intent-focused Approach:However, your true intent may be broader: “I want to exchange 100 DAI for as much ETH as possible at the lowest possible cost.” The specific choice of DEX, gas fees, and slippage parameters are not your primary considerations. Instead, your intent is to achieve the best value for your DAI.

In intent-centric design, the system interprets your intent and automatically routes your trade to the best path — whether that’s using a different DEX, aggregating liquidity across multiple platforms, or splitting a swap into multiple trades to minimize slippage and fees. As mentioned above, the focus shifts from specifying steps to defining the desired outcome.

This approach allows users to focus on their real goals without getting bogged down by the complexity of individual trades. It also makes the ecosystem more accessible to non-experts who may not be familiar with the best platforms or strategies to achieve their goals.

So where does the term “wallet abstraction” come from?

Wallet abstraction aims to simplify the user experience by consolidating all blockchain interactions into a single interface, allowing users to interact with multiple chains and handle complex transactions with ease.

The wallet abstraction builds on previous concepts (account abstraction and intent) to create a unified wallet experience that abstracts away the complexity of managing multiple keys, accounts, balances, and gas tokens across different blockchains.

The wallet abstraction primarily addresses the state/balance fragmentation problem, allowing accounts to maintain consistent balances across all chains, eliminating the need to manually bridge between balance states (chains).

The goal is to create a "one account" future where users can seamlessly interact with the entire blockchain ecosystem.

Unified Balance Management: The wallet abstraction enables a single account to manage balances and transactions across multiple chains. Users no longer need to manually bridge assets or manage multiple accounts for different chains. The wallet interface provides a unified view of all balances, making interaction with various blockchains seamless and intuitive.

Simplified Transactions: By removing the complexity of handling multiple accounts, users can perform transactions across different chains from a single interface. This reduces the friction involved in cross-chain interactions and promotes greater interoperability within the ecosystem.

Arcana is a modular L1 blockchain that recently unveiled its new vision to create a chain abstraction protocol designed to remove the complexity of handling multi-chain assets and gas fees. This allows users to enjoy a smooth multi-chain experience with just one wallet and a unified balance, without having to worry about the nuts and bolts of bridging or paying gas fees across multiple chains.

While this vision was only officially announced a few months ago, Arcana has been building products in the abstract space for some time.

Auth SDK: A decentralized solution that provides email and social login to applications and instantly generates secure non-custodial wallets for users within the application.

Gasless SDK: Leverages account abstraction to allow developers to collect gas fees from users. In other words, developers can sponsor gas fees and make your dapp free for users.

SendIt:A consumer application that enables crypto transfers with just an email.

It’s also important to clarify how Arcana handles assets and transactions. Arcana does not store user assets. Instead, users always keep their assets in their own wallets, just like they would with any External Owned Account (EOA) wallet. This approach prioritizes the current landscape where most users interact with EOA, rather than directly with smart contract accounts, which are still evolving in the Ethereum ecosystem under the account abstraction.

At the core of the Arcana solution are:

A modular universe-based L1 verifies user intent and acts as a state machine as the basis for any coordination between users or solvers/fillers.

MPC (Multi-Party Computation) network, ensuring secure, distributed signatures for solver settlements and rebalancing.

The various activities undertaken by the Arcana Chain Abstraction protocol include:

Intent Initiation: When a user expresses an intent, such as to transfer funds or interact with a dApp, funds from the user’s source chain (regardless of where they hold their assets) are temporarily pooled into Arcana Vaults.

Solver/Filler Fulfillment: Solvers and Fillers then fulfill the user’s intent on the target chain. These entities ensure that the user’s action is completed without requiring the user to manually bridge assets or interact with multiple chains.

MPC Network Validation: After a user’s intent is fulfilled, Arcana’s MPC Network runs to ensure that the Solver or Filler who completed the task is entitled to the corresponding settlement. This requires a distributed consensus of the nodes in the network.

Threshold Signatures: MPC succeeds when a threshold number of nodes sign the validity of the intent, confirming that the solver/filler did in fact complete the task correctly.

Vault Settlement: Once verified, the Arcana Vault will verify the signature from the MPC network and proceed to settle the funds with the solver/filler, completing the process.

This is a demo showing off the Arcana Chain Abstraction Suite in action.

In this demo, we can see the chain abstraction application in action - Aave.

Traditionally, when using a dapp like Aave, users have to choose which network they want to use from Aave - Lending dapp connects to multiple chains, each with their own markets and yields. Adding chain abstraction to the mix allows users to see all markets on all chains under one interface.

Arcana’s wallet gives users the total balance of assets held across different chains. For example, I have 5 USDC each on Ethereum, Arbitrum, and Polygon, but on my Arcana wallet I only see a unified balance of 15 USDC. Again, no bridging involved at all.

This will ultimately lead to a better developer experience, as you no longer have to worry about redeploying your app on every chain you want to steal users from. Instead, you can deploy your app once on Arcana’s L1 and automatically connect with users (and apps) on other networks supported by Arcana.

Particle Network is leading the way in chain abstraction with Universal Accounts, designed to simply provide users with a single account and balance that can be used on any chain. With Universal Accounts, Particle Network eliminates the need to manually manage assets across different chains; forget about bridging or trying to remember which chains you hold funds on. Their stack provides three key features: Universal Accounts, Universal Liquidity, and Universal Gas. Universal Accounts simplify user access by merging multiple blockchain identities into one, while Universal Liquidity and Universal Gas facilitate seamless cross-chain transactions and payments without the hassle of manual conversion. Essentially, use funds on any chain to pay for transactions and their associated gas fees.

Here’s a demo showing Particle Network in action.

Let’s look at an example of Universal Accounts in action:

Alice discovers a Play-to-Earn dApp. The dApp is hosted on Arbitrum and leverages Particle Network’s Universal SDK to enable Universal Accounts.

Alice starts using the dApp. Assets in her wallet (Polygon-native) are used for basic dApp interactions. Bridging is automatic and is performed automatically as she interacts.

After playing for a while, Alice earns some tokens. She uses them to buy an NFT for her friend Bob’s birthday. Unbeknownst to her, the NFT is hosted on Optimism. She can seamlessly send it to Bob’s Universal Account. Importantly, throughout her entire experience, Alice only used a single gas token.

Bob decides to take out a loan on his NFT on Solana and use the proceeds to buy the meme Bitcoin Ordinal. He can do this in just a few clicks, in a matter of minutes, from the same account.

Just use the applications and forget about the underlying chain they use; this is essentially what universal accounts enable.

Particle Network’s architecture supports universal accounts, leveraging layer 1 blockchains that are responsible for coordinating and settling cross-chain transactions on external chains (powering the universal gas and universal liquidity features mentioned earlier).

Capsule is an embedded wallet service that has been used by teams such as Hedgehog, a registered investment advisor focused on bringing traditional financial practices to DeFi. Hedgehog leverages Capsule's self-custodial wallet infrastructure to provide users with non-custodial storage of digital assets that meets its product-specific security standards. Capsule uses distributed multi-party computation to ensure that user funds are never stored in one place, allowing Hedgehog to transact on any EVM or ECDSA compatible chain. Capsule supports customized authentication methods such as biometrics, email, or social, which provide wallet recoverability. In addition, Capsule also provides advanced automation capabilities to enhance the functionality of users like Hedgehog by enabling secure automation such as portfolio rebalancing and flexible wallet access rights.

OneBalance provides users with a unified solution through its "trusted account" system, solving the complexity of managing digital assets across multiple blockchains. These accounts consolidate users' assets and make it easier to manage funds across different chains without the need for multiple wallets. Trusted accounts are designed to ensure that transactions are secure and efficient, focusing on trust and reliability. OneBalance also introduces a mechanism called “resource locking” to enhance transaction security by temporarily locking part of the user’s assets as collateral during the transaction process. This ensures that the transaction is completed smoothly and reduces the risk of transaction failure or fraud - good news if you are a solver.

XION is an L1 blockchain built for consumer adoption through chain abstraction. Most chain abstraction protocols focus primarily on chain/rollup interoperability issues, while XION takes a different approach by building an L1 that leverages full protocol-level abstraction to solve application distribution and interoperability fragmentation problems. It enables developers to build consumer-ready applications (solving the distribution problem) and extends its seamless user experience to unify users, liquidity, and enable composable applications across ecosystems (solving the fragmentation problem). From a user perspective, this means using familiar login methods (such as email), Web2-like transactions with a single click, no plugins, no seed phrases, no gas fee complexity, and the ability to interact across all devices.

Essentially, the permission layer simplifies the user experience by abstracting the technical details of blockchain interactions. It manages the complexity of blockchain operations in the background, allowing users to interact with dapps as easily as they interact with traditional web applications. This is a fundamental step towards the vision of chain abstraction, where users no longer need to worry about the underlying blockchain infrastructure - they only need to interact with the services they want to use.

The recent surge in activity on the Ethereum network diverges from broader cryptocurrency market trends and even contradicts other usage indicators.

JinseFinance

JinseFinanceDecentralized applications (dApps) are open-source peer-to-peer networks running on blockchain technology and are used in various industries such as gaming, medicine, governance, and file storage.

JinseFinance

JinseFinanceEIP-3074 enables EOA to have the same rich execution capabilities as contracts, opening up many new application scenarios.

JinseFinance

JinseFinanceHow to host the DAPP frontend, backend and data on Ethereum? EthStorage proposes two solutions.

JinseFinance

JinseFinanceIt is hard for veteran players in the Web3 world not to know StepN. Recently, this Web3 application that once promoted the "Move To Earn" gameplay to the world has finally made new moves after two years of silence.

JinseFinance

JinseFinanceThe OP_Return Wars of 2014 reveal a clash of cultures within the Bitcoin community, influencing Dapp development. While Ethereum offered technical advantages, it was the Bitcoin community's resistance to alternative use cases that accelerated the migration to alternative platforms.

Cheng Yuan

Cheng Yuan JinseFinance

JinseFinanceThe Dapp space keeps going strong, with 1.92 million dUAW connected in the last seven days.

Finbold

FinboldTrust Wallet, one of the most notable decentralized wallets, has added support for Solana decentralized apps (dApps).

Others

OthersImplementation of liquid staking addresses worrisome price fluctuations and helps users to generate higher rewards by combining staking payouts and DApp yield.

Cointelegraph

Cointelegraph