Author: Leo Park, Jay Jo, and Yoon Lee Translation: Vernacular Blockchain

Summary:

Sony is moving into Web3 in pursuit of a new phase of growth. Major initiatives include the acquisition of a centralized exchange (CEX), the launch of the Soneium blockchain mainnet, and the development of a stablecoin.

Sony's Web3 strategy focuses on three pillars: non-financial (entertainment and games), financial (stablecoins, security tokens), and infrastructure. By connecting these areas, Sony aims to build a comprehensive Web3 ecosystem.

Under the vision of "Beyond Borders", Sony's approach will accelerate digital transformation, create new revenue streams, and enhance synergies.

1. Introduction

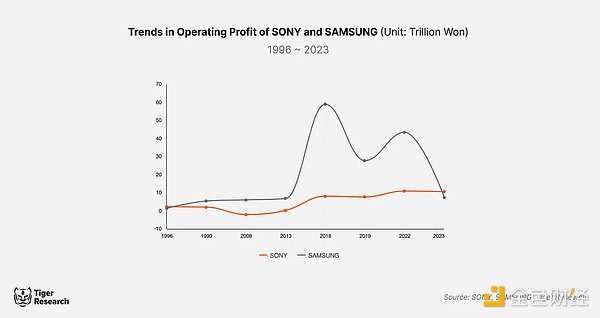

Once a symbol of Japan’s economic growth and a leader in electronics, gaming, and entertainment, Sony’s dominance began to wane in the 2000s. The company struggled to adapt to the rapid transition from analog to digital, exposing it to competitive pressure from companies such as Samsung. This difficulty in responding to market changes plunged Sony into crisis.

In response, Sony took decisive steps to overcome challenges and embark on a new phase of growth. The company significantly reduced its reliance on the electronics business, which once accounted for 70% of its total revenue, and instead focused on the future-oriented entertainment industry. This bold restructuring laid the foundation for future growth and profitability. By 2023, Sony will surpass Samsung’s operating profit for the first time in 24 years – an achievement that, while likely temporary, highlights the success of Sony’s transformation and innovation.

Sony’s pursuit of innovation has gone one step further. At its recent annual strategy meeting, the company announced its commitment to pursuing innovation beyond industry boundaries, under the slogan “Beyond Boundaries”. This is in line with Sony’s recent move into the Web3 space. This report will examine Sony’s blockchain initiatives and explore its vision for the Web3 industry. In doing so, we aim to gain insight into Sony’s future vision for the Web3 space and its strategic direction.

2. Sony Group officially enters the Web3 industry

Sony's pursuit of innovation has gone a step further. At its recent annual strategic meeting, the company announced that it would be committed to pursuing innovation beyond industry boundaries, with the slogan "Beyond Boundaries". This is consistent with Sony's recent move into the Web3 field. This report will examine Sony's blockchain initiative and explore its vision for the Web3 industry. By doing so, we aim to gain insight into Sony's future vision for the Web3 field and its strategic direction.

2017: Sony Global Education develops a blockchain-based digital education platform

2018: Sony Corporation, Sony Music and Sony Global Education jointly develop a blockchain digital content copyright management system

2018: Sony Computer Science Laboratories (CSL) develops cryptocurrency hardware wallet technology using IC cards

2020: Sony develops a blockchain-based database platform for the Dutch smart city research project

1) Business expansion through the acquisition of CEX

In August 2023, Sony acquired the centralized trading platform "WhaleFin", marking its official entry into the trading business. WhaleFin, originally launched as DeCurret, is a Japan-registered centralized exchange service provider that was acquired by Amber Group in 2022 and eventually fully acquired by Quetta Web, a wholly owned subsidiary of Sony Group.

Recently, Sony rebranded WhaleFin as "S.BLOX" with an eye on expanding its exchange business. The company aims to enhance the user experience of the exchange and create new value in crypto trading by leveraging the diverse business connections of the Sony Group. Despite these ambitions, S.BLOX is currently inferior to other exchanges in terms of competitiveness. The platform only offers nine cryptocurrencies, has low trading volumes, and generates 20 times more revenue than Bitflyer, the leading Japanese exchange, raising questions about its future potential.

Nevertheless, there is still room for synergistic development through Sony's acquisition. Centralized exchanges, as the gateway to the Web3 industry, can create significant synergies through businesses that rely on them, especially under the current challenges of cryptocurrency entry and exit. In addition, Sony's combination of various Web3 industries is expected to help exchanges improve their competitiveness.

2) Soneium, Sony’s blockchain infrastructure business

Sony Blockchain Solutions Labs announced its official entry into mainnet business with plans to launch Ethereum’s second-layer blockchain “Soneium”, about a year after establishing a joint venture with Startale Labs.

With this announcement, the name of the joint venture was changed from “Sony Network Communications Laboratories” to “Sony Blockchain Solutions Labs”. Sony Group holds a 90% stake in the joint venture, with Startale Labs holding the remaining 10%. Given Sony Group’s controlling position, the joint venture is expected to play a core role in Sony’s Web3 strategy, providing infrastructure for the application and integration of Web3 technologies across various departments.

Sony Blockchain Solutions Lab’s strategic approach is notable in that it goes beyond just launching a new mainnet. By integrating Astar’s zkEVM technology into Soneium, Sony aims to leverage this technological asset to accelerate business development. This approach is consistent with Sony’s recent track record of success through bold innovation, which contrasts with Japan’s traditionally conservative corporate culture.

The personnel structure is equally noteworthy. Sony Blockchain Solutions Lab is led by Jun Watanabe, former president of Sony Network Communications and member of the board of directors of Startale Labs. He is also responsible for Sony Group’s cryptocurrency trading platform S.BLOX. This leadership arrangement not only highlights the potential for collaboration within the Sony Group, but also hints at closer business opportunity links between Startale Labs and Astar Network.

3) Sony's Stablecoin Business

Sony has shown a strong intention to enter the stablecoin market. According to a report by Nikkei in April, Sony Bank of Sony Financial Group has begun experimenting with issuing stablecoins based on a variety of fiat currencies, including the yen. The move appears to be aimed at exploring the potential of using stablecoins as a digital payment method within the wider Sony Group.

At the same time, Soneium's involvement in stablecoins has also boosted interest in stablecoin-related businesses within the Sony Group. In September, Soneium announced a partnership with Circle, which issues the dollar-backed stablecoin USDC, to support USDC in the Soneium ecosystem.

This move has sparked discussions about whether Sony will issue its own stablecoin on the public Soneium mainnet. However, this plan is expected to face significant challenges. Regulators have indicated that issuing stablecoins on a public mainnet, especially bank-issued stablecoins, is risky and requires potentially time-consuming regulatory changes.

Despite these difficulties, the participation of leading Japanese Internet banks like Sony Bank is seen as a positive signal for the industry. If Sony Bank can successfully issue a stablecoin on Soneium, it will be able to support a variety of applications, including cross-border payments through integration with USDC. Future developments in this area deserve close attention.

3. Where will Sony's Web3 business go?

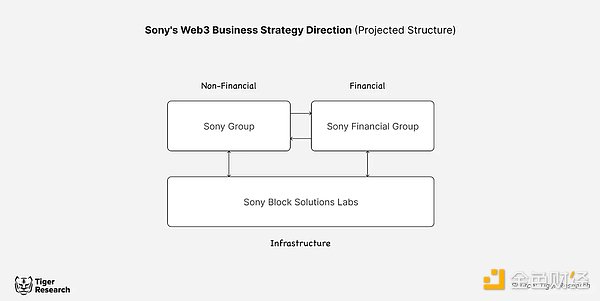

Sony plans to adopt a comprehensive Web3 business strategy covering multiple subsidiaries. This strategy is likely to be built around three key pillars: 1) non-financial sectors, 2) financial sectors, and 3) infrastructure.

The non-financial sector is expected to be led by the Sony Group, especially focusing on leveraging Web3 technology in entertainment and games. Sony Music has already launched NFTs based on its artist intellectual property and is actively exploring the commercialization of music IP through Web3 technology. Discussions on leveraging Web3 in the gaming industry are heating up, as evidenced by recent patents on NFT and SFT technologies.

The financial sector is expected to be led by Sony Financial Group, which is currently preparing to spin off from the Sony Group. They will focus on the combination of Web3 technology with the financial industry, including stablecoins and security tokens. Sony Bank is already conducting research and development on stablecoins and is the first Japanese bank to sell loan bonds as security tokens. Building on this, Sony Financial Group is expected to further expand the application of Web3 technology in the financial sector.

Finally, Sony Blockchain Solutions Lab is expected to manage the infrastructure that serves as the basis for all Sony Web3 initiatives. Although the lab is actually part of the Sony Group due to Sony's controlling stake, it is expected to provide infrastructure services to Sony Group and Sony Financial Group, acting as a bridge between the two. Sony Blockchain Solutions Lab is expected to become a core force in promoting synergy in Sony's Web3 business by making efficient use of Sony's assets.

These three areas may be organically connected to each other. For example, a stablecoin issued by Sony Financial Group could be used as a payment method within the Sony Group, or Sony's various intellectual property assets could be tokenized by Sony Financial Group. This rich opportunity for collaboration will allow Sony to build a comprehensive Web3 ecosystem covering its diverse business areas.

4. Conclusion

Sony dominated the electronics market in the 1990s with the Walkman, but had difficulty diversifying in the 2000s. The rise of Apple's iPod weakened the position of the Walkman, while competition from Korean companies such as Samsung and LG in the LCD TV market threatened Sony's position. The company failed to keep up with the rapid transition from analog to digital, leaving it in a vulnerable position.

To recover, Sony adopted a "select and focus" strategy. They cut underperforming businesses and invested heavily in core areas with high growth potential. As part of this transformation, Sony has identified blockchain technology as a new growth driver and is actively exploring related business opportunities. Combining blockchain with Sony's rich entertainment content, including games, music and movies, is expected to create innovative user experiences and business models.

Sony's approach is likely to accelerate the digital transformation of its existing business areas while opening up new sources of revenue. In line with its recent vision "Beyond Boundaries: Maximizing Synergies within the Group", blockchain technology is expected to play a key role in creating synergies between Sony's divisions. We will wait and see how this long-time industry leader uses blockchain to create new value and strengthen its market position.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance Catherine

Catherine WenJun

WenJun XingChi

XingChi Dante

Dante Bernice

Bernice decrypt

decrypt