It took the Romans about 500 years to build the aqueduct.

Before the aqueduct was built, residents relied mainly on local water sources: rivers, springs, and streams. In addition, residents could get water from underground wells and ancient cisterns that collected rainwater.

This meant that the entire water supply was scattered throughout the country, hindering Rome's growth. Demand outstripped supply, and in addition to basic sanitation, water was necessary for the development of Roman industry, including mining, agriculture, and mills.

So, over the course of five centuries (the middle and late half of the empire), Rome built 11 aqueduct systems, including pipes, tunnels, bridges, and canals. The aqueducts brought in fresh water from sources as far as 57 miles from the city, supplying more than 1.5 million cubic yards of water per day (750 liters per person per day).

The Romans routinely drilled wells in their homes. Blockchains have done essentially the same thing — attracting large amounts of crypto capital to power their networks, but that capital is effectively trapped within their respective ecosystems.

Thankfully, it didn’t take long for crypto to build its own plumbing system.

Crypto is now busy building aqueducts. Monolithic chains like the Ethereum mainnet, Binance Smart Chain, and Solana have largely absorbed the majority of crypto capital staked, both directly to the chain itself through validators and through their DeFi ecosystems. Liquidity staking protocols like Lido, Rocket Pool, and Jito help mine some of that locked capital, tokenizing staking receipts so they can be traded, loaned, or otherwise put to use in liquidity pools. These allow crypto stakers to maintain productivity of their digital assets after contributing to the economic security of platforms like Ethereum and Solana. According to DeFiLlama, about $54 billion in crypto is currently locked in these liquidity staking protocols, accounting for more than half of the total value locked in DeFi. Restaking protocols like EigenLayer, Karak, and newcomer Symbiotic are looking at how to direct productivity to secure other platforms, rather than for trading and liquidity farming, with the goal of channeling liquidity to smaller-scale financial products that also need economic support to ensure their functioning.

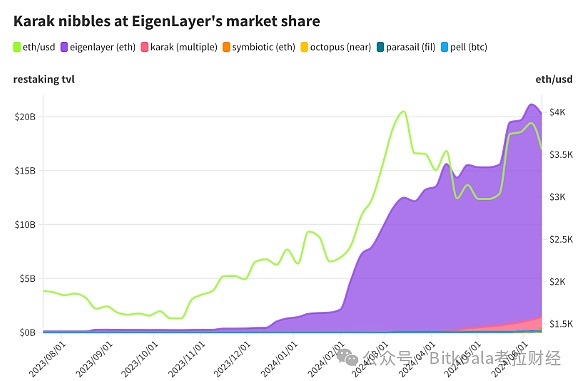

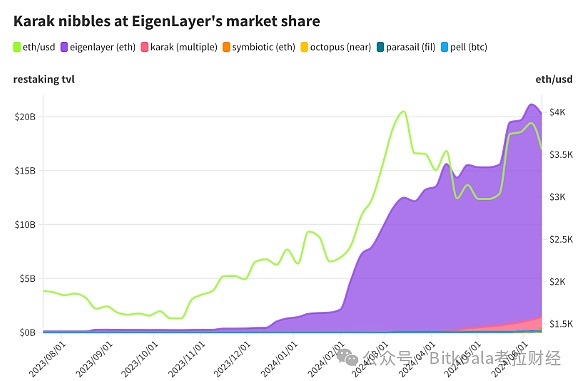

To date, $20 billion has been locked up in these crypto aqueducts, much of it locked up by EigenLayer, which now has about a dozen actively validated services.

Karak has surpassed the $1 billion mark in market cap as it builds out its ecosystem, though it accepts other types of collateral in addition to staked ether, including wrapped bitcoin and stablecoins.

The Romans couldn’t get enough water, and crypto users couldn’t get enough yield. Both dynamics led to an explosion of infrastructure.

It worked for the Romans — until it didn’t. That’s best blamed on governance.

Some important data

Currently, the pledge rate of ETH supply has exceeded 27%, up from 24% in January.

One-third of the pledged ETH is through liquid pledge applications such as Lido. Another 9% is pledged through re-pledge protocols, mainly EigenLayer.

According to DeFiLlama, $175 million of WBTC, FIL and NEAR are currently invested in smaller pledge platforms Pell, Parasail and Octopus.

BTC is struggling to regain $67,000 after falling 6% in the past week.

NOT, UNI, and TON led the rebound, with the former up 21% in the past day, but still down 4% over the past week.

Tracking the (Modular) Money

As curious as everything should be, let’s focus on what’s interesting in crypto – where the money is going and who’s interested in what.

Last week, we saw modular blockchain solutions raise millions of dollars, and in the first quarter of this year, we also saw some money flowing into other similar projects.

Naturally, how VCs view modular crypto, which, while hot, is still small.

Vance Spencer, co-founder of Framework Ventures, said interest in modular is “down from last year.” “I doubt the wave of interest will return until we see more adoption,” he added.

At the same time, “monolithic architectures have the advantage of allowing deep integration and optimization across modular boundaries, leading to higher performance…at least initially,” a16z Crypto general partner Ali Yahya wrote in January. But he praised modular technology stacks for allowing “permissionless innovation,” allowing for specialization among those interacting with them and fostering organic competition.

While I’ve heard about interest in SocialFi and the need to focus on building infrastructure, modularity was largely absent from conversations about capital flows in the first quarter of this year.

Vance Spencer believes that one part of the modular technology stack has received enough attention that it will reduce interest in similar projects. “If anything, I think there’s a non-zero chance that venture capital interest in modular will remain flat or decline slightly in the near term at least,” he explained.

That doesn’t mean there’s no interest, just that capital is unlikely to continue flowing into certain parts of the tech space as some players — like Celestia and EigenLayer (and even Avail after its funding round) — have become more established.

If you’re familiar with these projects, then you know they’re focused on data availability, which, as Vance Spencer said, is the first layer of the modular tech stack, and they’ve taken in millions of dollars in funding, with EigenLayer raising $100 million from Andreessen Horowitz in February.

Then, competitors Celestia and Avail raised millions more. Spencer told me that he has a hard time imagining new data availability projects getting more funding without some kind of differentiation, and maybe he has a point…

That leaves the other two parts of the overall tech stack: the settlement layer and the execution layer. Vance Spencer further stated:

"I think we may see more experimentation at these layers, but I think the adjustments will be smaller, such as different programming languages (see Movement Labs). Some of these types of projects will continue to be funded, but I think it's unlikely that we will see the same scale of projects as those at the DA layer."

There is a limited number of "crypto aqueducts" that need to be built simultaneously in the crypto market, especially when the products are not very differentiated. Modularity can stimulate competition and allow for more innovation, which is still very interesting even if venture capital funding is slowing down.

JinseFinance

JinseFinance