Author: Karim Halabi, Outlier Ventures token design and token economics team; Translation: 0xxz@金财经

We may all be familiar with Uber, which is a network for buying and selling car services. The companies that develop and maintain this network play a vital role. To fulfill this role, this centralized entity is able to extract significant rents from the network.

Does this make sense? Of course it is; without this entity's efforts and investment, the network would not be as popular as it is. What if there was a way to scale the network without a middle man extracting rent? Leaving more value to be captured by network participants. This is where encrypted networks come into play.

Getting Started with Encrypted Networks

Essentially, cryptoeconomic networks are two-way markets... just like Uber. L1 is the market for block space, and the decentralized digital resource network (also known as dePIN: decentralized physical infrastructure network) is the market for resources such as computing or storage.

There may also be a two-sided market in the application layer - the data alliance is the data market and DEX is the liquidity market.

What is the difference between a unilateral market and a two-sided market? In the former market, you can be a consumer of value or a producer of value, but not both. An example is AWS, where you are either a consumer (consumer) or Amazon (producer) of computing and storage resources. These different types of marketplaces are also called "pipelines and platforms."

In a two-sided market, any participant can play either role. In a decentralized computing market, anyone can join the network as a value producer (node operator; computing provider) or value consumer (paying nodes for computing access) without permission.

Cryptotechnology makes it easier to create two-sided markets for digital resources and allows them to exist in a decentralized (or more distributed) way. Doing so demonstrates that these marketplaces can achieve superior unit economics and operate in a censorship-resistant manner.

Crypto networks are self-organized two-sided markets with their own economic policies.

What are the daily two-sided markets?

eBay is a very visual example - it is an online marketplace where anyone can list an item for sale and anyone else can buy it. It's two-sided because you can both list and buy. You can do both at the same time if you want.

YouTube is another marketplace we use every day. Anyone can contribute content and anyone else can consume the value. Youtube of course charges a fee to provide this platform - it makes money by selling this attention to those seeking advertising space. Some of that revenue is shared with top creators, but it's usually not enough to stop them from exploring other avenues for making money.

The difference between these markets and crypto networks is the need for a centralized body to coordinate all the stakeholders in these networks. They play a vital role, for which they charge high fees. Furthermore, history shows that having a monarch with absolute power is not always a good thing (although in some cases it is relatively better!)

However, if we had a way to coordinate people in the absence of a monarch Woolen cloth? This is what cryptocurrencies bring to the world. Crypto networks align the incentives of different stakeholders so that they can coalesce around the incentive (to make more money).

What would an encrypted version of Uber look like?

This is a thought experiment designed to help us think about and understand how crypto networks operate from a high-level economics perspective, and how they align incentives without a central authority calling the shots and taking from the network Great value.

First, let’s define the roles in the network:

Driver

Now, how to become a driver? Well, of course you need a car. Then, how can we ensure they can be trusted to drive strangers around? What if they don’t have a driver’s license? What if their car isn’t roadworthy?

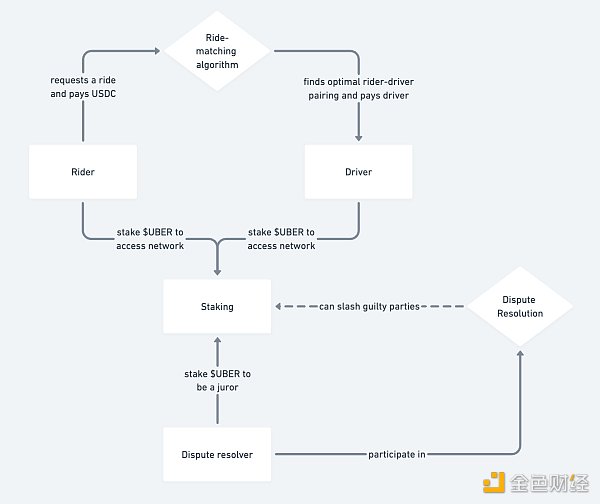

Typically, crypto networks like to have value producers post some funds as collateral to ensure their good behavior. In this example, drivers must stake some tokens, such as $100 in UBER tokens, which may be slashed if they are found to be bad drivers.

But how do we find out they are bad drivers? Perhaps the sufficient mechanism here could be that more than 20% of passengers rate them 4 stars or below, or that they receive 5 1 stars out of 20 passenger reviews.

In a digital environment, it is much easier to punish stakeholders because you can make it easy for others to verify the interaction, whereas on a physical level it is more challenging.

Passenger

Anyone can become a rider. To ensure their own courtesy and good behavior, we can also let them stake some UBER tokens. However, we don't need to set the bar as high as drivers need to because the risk of having a bad driver drive a bad car is higher.

When downloading the crypto-Uber app, riders must invest $10 in UBER tokens to initiate a ride, paying the full amount directly to the driver in USDC.

Since there is no middleman here to collect large amounts of rent, drivers may earn more, or passengers may pay less. Or both at the same time!

Here’s another question; what happens when a dispute breaks out between a passenger and a driver? When a “he said she said” situation arises, who resolves these disputes and what happens?

Dispute Resolution

Dispute resolution mechanisms exist in all markets, but if we want things to work in a "decentralized" way, that is another matter. Without a centralized party serving as the arbiter of truth – how do we incentivize network participants to play this role?

We can draw inspiration from the mechanism used by the Kleros Court, where a group of token stakers are randomly selected to serve as jurors to resolve a specific dispute.

Each juror receives information about the case and votes for one side. After all jurors have voted, the results are announced. Therefore, the winner of a dispute between a passenger and a driver is the party with the majority of votes (the number of jurors must be an odd number).

The tokens of the minority juror (the loser) will be forfeited, and these confiscated tokens will be awarded to the majority voters. This creates a mechanism that incentivizes jurors to vote for what they think other jurors will vote for. This creates a Schelling point at which dispute resolvers can reach subjective consensus.

Any one of the passengers or the driver can be found guilty, and after the result is reached, he is punished accordingly and tokens are awarded to the offended party.

What about governance?

If there is no centralized authority, who makes decisions in the network? Who decides whether and how to adjust the matching algorithm? Or how many tokens must be staked to participate in the network? Or even monetary policy for Token UBER?

Of course it’s Uber DAO! How does it work?

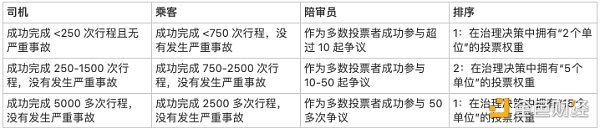

Many DAOs employ a "1 token = 1 vote" system, but in practice this has not proven to be very useful and most of the time just leads to an oligopoly. Instead, we could grant governance to stakeholders who are active users of the network, rather than to stakeholders who have significant funding but are otherwise less aligned.

One way to achieve this is to grant certain "badges" (NFTs) to premium users. For example:

As given above The figures given are arbitrary and in practice more refined criteria must be used. Also note that one party can play multiple roles in the network! And holding multiple badges at the same time increases their voting rights (passengers can also become jurors, for example).

Additionally, these credentials may influence ride matching algorithms and remove the preference for trusted, reliable stakeholders.

Value Capture

As crypto super apps become more downloaded and the number of users increases, more and more people must buy and stake the token coins, thereby removing them from circulation. Therefore, the more the network grows and the more success it achieves, the more value the UBER token gains.

This achieves two main goals:

If people believe that the network is solving real problems and the value will grow, then encourage them to join the network as early as possible

Coordinate the incentives of participating stakeholders and ensure that they act in a positive-sum manner so that the value of UBER tokens grows and is not inappropriately behavior and lose these tokens

Conclusion

The benefits here are mainly capturing greater value for network participants (assuming the economy is well designed) and User ownership of the network.

But there are also disadvantages:

User experience is worse since drivers/passengers need to purchase and stake tokens

p>

Network participants suffer actual loss of money due to slashing

Decentralization can be a disadvantage, especially when the network attempts to When extended

Immature abstraction services for removing the complexity of handling these networks

This article is intended as A thought experiment to highlight what a cryptographic network is.

They are self-organizing systems in which stakeholders do not have to know or trust each other to achieve goal alignment. To explore how it works, we apply these cryptoeconomic principles to a two-sided market like Uber and theorize what it would look like if it operated in a decentralized manner.

Kikyo

Kikyo

Kikyo

Kikyo Xu Lin

Xu Lin Catherine

Catherine Davin

Davin Beincrypto

Beincrypto Coindesk

Coindesk Beincrypto

Beincrypto Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Nulltx

Nulltx