FMG sorted out the recent coin lists of the three major exchanges (Binance, OKX, Bybit), and referred to the exchange coin listing information made by "Sha Po Lang". If the project takes listing on CEX as the ultimate goal and benefit, which sectors of tokens have the most advantages?

1. The Infra category is loved by major exchanges

Recently, $nerio has gained more than 20 times since its listing on Binance. At the same time, Binance has continuously launched multiple TON-related project tokens, which has attracted widespread attention from the market. The enthusiasm of other exchanges for the TON ecosystem is also in sharp contrast to their indifference to other tracks.

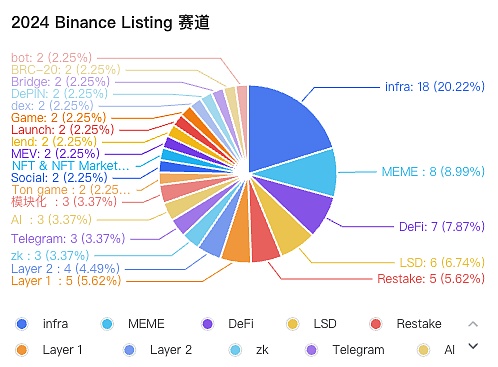

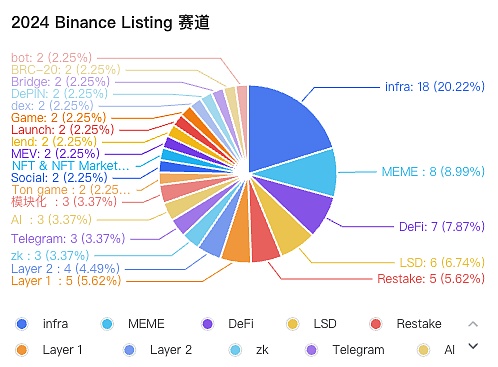

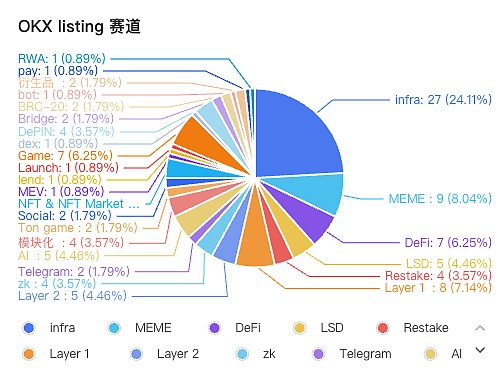

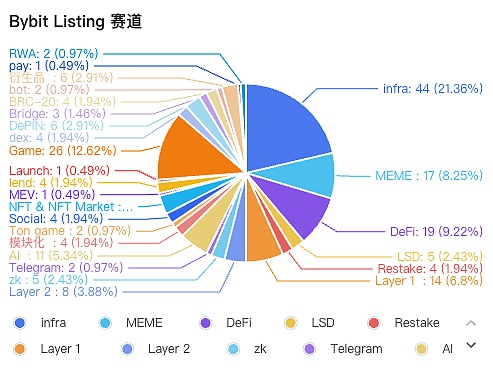

On Binance, Infra accounts for 20.22%, followed by MEME and DeFi.

On OKX, Infra's share further expanded to 24.11%, followed by MEME, DeFi and Layer 1;

Among the 119 projects counted by Bybit, 44 projects were marked as Infra, followed by MEME, DeFi and Layer 1.

Summary

The Game track, which was popular last year, has generally been cold this year.

In addition, the reason why large exchanges are willing to choose tracks such as Infra, MEME, and DeFi as the main tokens is that Infra, DeFi, and Layer 1 are generally used as terminal taps for different secondary tracks and popular projects. For example, the popularity of local dog projects such as BOME will transfer value to SOL; the popularity of NOT and CATI will also drive the price of TON up. However, the product cycle of this type is generally long. Most products generally take 1-2 years from getting investment to listing on exchanges.

In contrast, there is the trend of MEME. Seizing more hot spots and users has become the main reason for exchanges to choose to list coins in a timely manner.

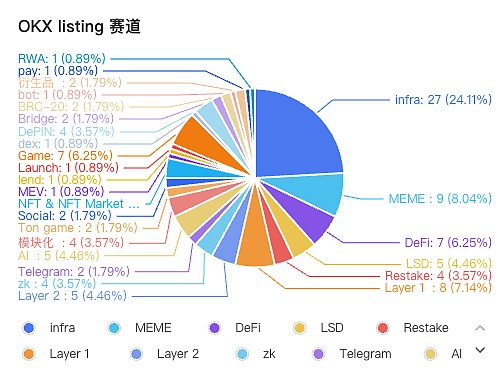

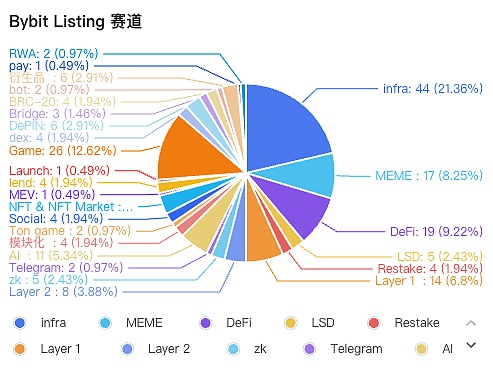

2. The exit scales represented by the three major exchanges are different

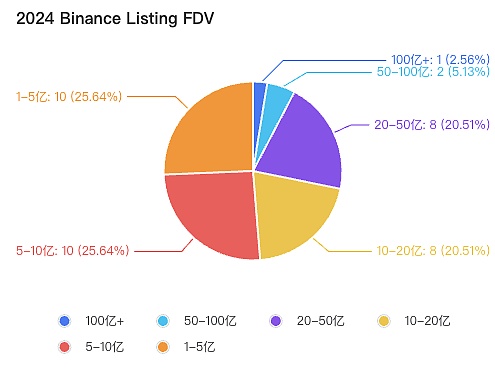

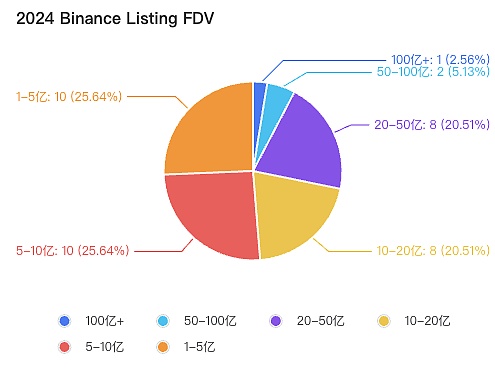

Binance counts 40 projects, with an average FDV of around $2.4 billion and a median of $870 million;

Among them, projects with FDVs of $100 million to $500 million and $500 million to $1 billion account for the largest proportion, at 25.64% respectively;

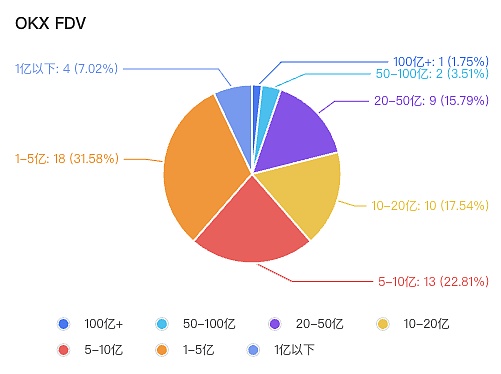

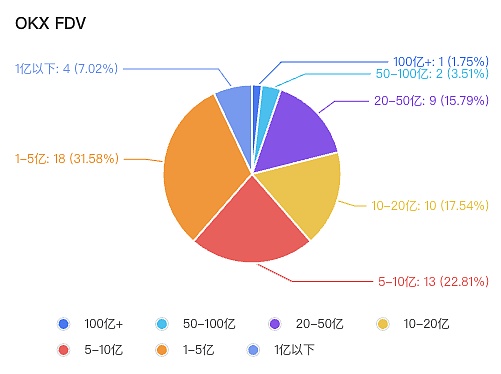

OKX counts 57 projects, with an average FDV of around $1.8 billion and a median of $730 million;

Among them, projects with FDVs of $100 million to $500 million account for the largest proportion, at 31.58%, and projects with FDVs of $500 million to $1 billion account for the second largest proportion, at 22.81%;

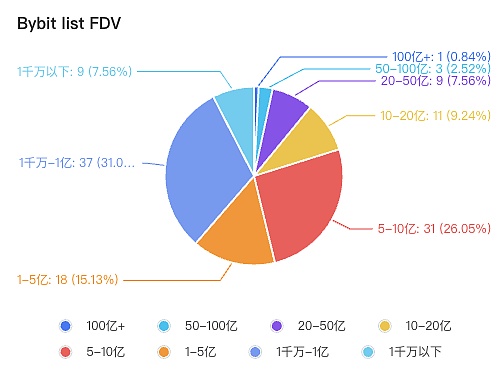

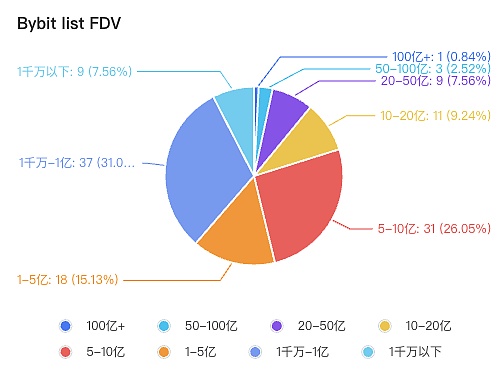

Bybit counts 119 projects, with an average FDV of about 1 billion USD and a median of 72 million USD;

Among them, projects with FDVs between 10 million and 100 million account for the largest proportion of 31%, followed by projects with FDVs between 500 million and 1 billion, accounting for 26.05%;

Sponsored Business Content

Conclusion

From the above performance, Binance and OKX are similar in performance and are in the first echelon of exchanges. Projects that can be listed on Binance and OKX also mean that they are likely to achieve a FDV of more than 1 billion USD. Although Bybit's current listing criteria are showing a trend of narrowing, it is still relatively loose compared to Binance and OKX. It is currently the main target of various project parties.

3. Influence of institutions on listing

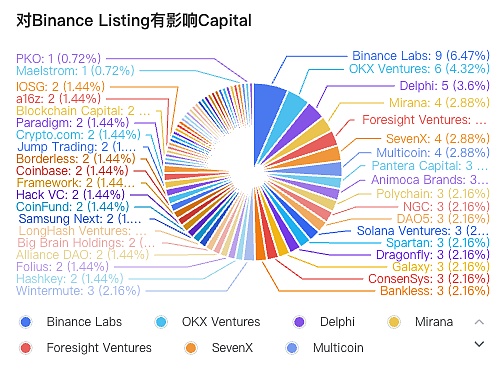

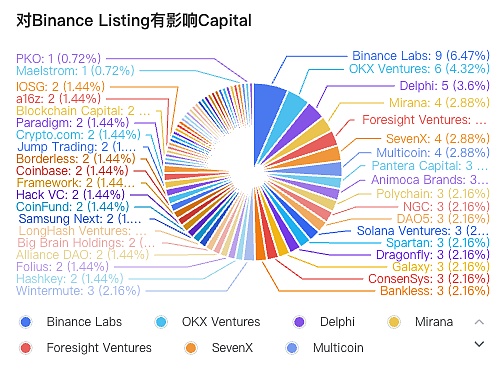

Among the projects listed on Binance, the institution that appeared most frequently was Binance Labs, appearing 9 times in 40 projects; followed by OKX Ventures, appearing 6 times; in addition, Delphi, appearing 5 times; Mirana, Forsight Ventures, SevenX, and Multicoin appeared 4 times.

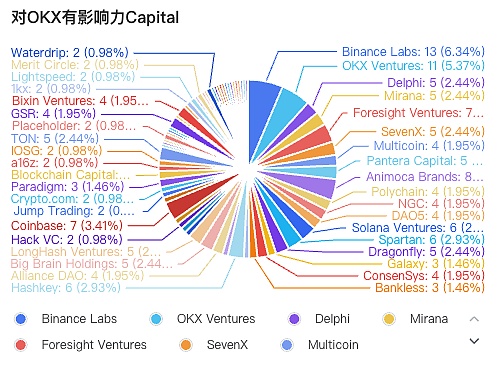

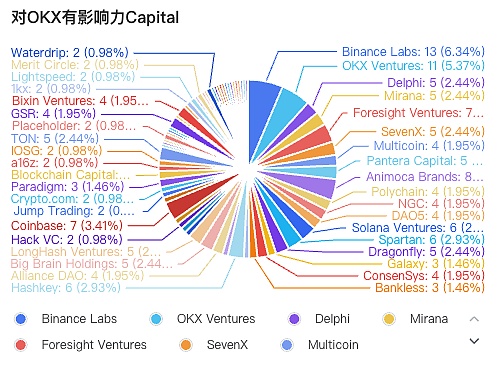

Among the projects listed on OKX, Binance Labs appeared the most, appearing 13 times, OKX Ventures appeared 11 times, Animoca appeared 8 times, Forsight Ventures and Coinbase appeared 7 times, Solana Ventures and Spartan appeared 6 times.

Summary

Exchanges generally favor Infra, but as the founder of IOSG said, projects with a valuation of around 100m and that have not yet completed TGE have given up their plans to list on Binance due to the high difficulty. Infra, which is valued at $300m to $500m, is still struggling to raise funds. In the context of large infrastructure still being overvalued and difficult to raise funds, a series of small games in the Ton ecosystem are increasingly favored by exchanges.

Starting with Notion, Doge, Catizen, and Hamster have been listed on first-tier exchanges one after another. And the initial FDV performed well, with NOT reaching a maximum of nearly $3 billion and CATI also rising to more than $1 billion. These data all demonstrate the high-quality potential of the Ton ecosystem. Starting with the game, the user's initial Web3 conversion is completed. After that, such as DuckChain, as Ton L2; UTONIC Protocol as the Ton ecosystem re-staking platform, RedStone as an oracle, DeDust as Dex... The Ton ecosystem is gradually becoming complete.

For the future of Ton

Here, we can boldly guess and focus on two ideas of Ton ecology:

1. Traffic distribution and reuse platform built based on Telegram;

Since TG naturally aggregates 900 million traffic, and the idea of interactive profit is further instilled into the minds of TG users through Notcoin, advertising flow and task distribution for B-side will become a trend in the future with users as the display form. The representative project is PEPE Miner Bot, which is a task distribution and reward acquisition platform based on Telegram. Users can get PEPE tokens by joining the Bot, and get more PEPE token rewards after completing other tasks. At present, the project has more than 700,000 subscriptions and huge traffic.

2. CeDeFi business built on Telegram native software.

Since Telegram comes with elements of Web2 and Web3, it is logical and feasible to build a combination of CeFi and DeFi in this ecosystem. A representative case is Blum, a hybrid exchange that combines CeFi and DeFi, providing universal token access through gamification in Telegram applets. Blum can access CEX and DEX tokens on one platform, supports more than 30 chains, and provides additional features including AI navigation, P2P trading, derivatives trading, etc. The project has already received investment from Binance Labs.

The data in this article comes from: Rootdata, SPL, Coinmarketmap

JinseFinance

JinseFinance