Author: UkuriaOC, CryptoVizArt, Glassnode; Compiler: Deng Tong, Golden Finance

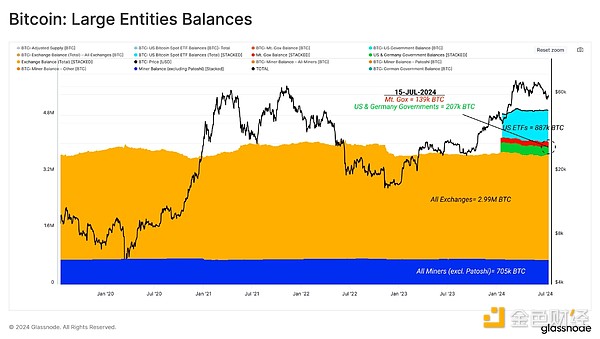

Large entities currently hold approximately 4.9 million BTC, equivalent to 25% of the circulating supply. Among these entities, centralized exchanges and ETF custodians account for the largest share.

After the German government completely exhausted the BTC sell-side market, the sell-side market appears to have eased in the short term, while demand has also re-emerged to support the market.

Market profitability remains very strong, and most of the token supply remains on a favorable cost basis, below the current spot price.

Assessing Large Entities

The landscape of Bitcoin holders is always evolving, which requires the analytical framework to evolve over time. Historically, miners and exchanges have been the largest and most dominant Bitcoin holders.

Throughout history, large amounts of tokens have ended up in the custody of market-neutral entities, such as the Mt. Gox Trustee, which was tasked with custodying tokens recovered following the collapse and bankruptcy of the Mt. Gox exchange. Similarly, large amounts of tokens have been seized by government law enforcement and periodically sold in batches.

More recently, institutional-grade custodians and ETFs have also entered the market. 11 new US spot ETFs have now accumulated a cumulative +887K BTC, making their combined balance the second-largest Bitcoin pool we monitor.

The chart below shows the amount of BTC held by these large entities.

Centralized exchanges: 3 million BTC(yellow)

US ETF balances: 887,000 BTC(gray)

Miners including Patoshi: 705,000 BTC(blue)

Government entities: 207,000 BTC(green)

Mt Gox Trustee: 139,000 BTC(red)

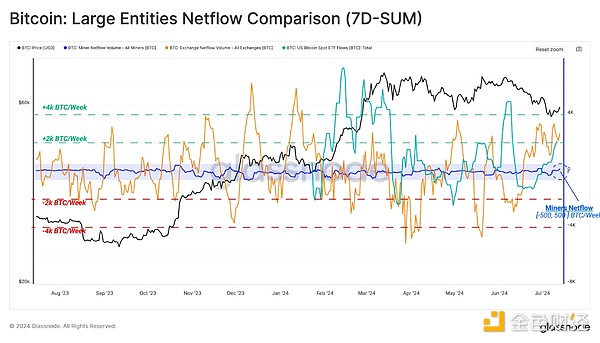

Miners have historically been the main source of sell-side pressure, but their supply relevance does decline with each halving event. Net miner flows over the past 12 months show that total balance changes are typically around ±500 BTC per week.

In the chart below, we compare miner net flows (blue) to net deposits/withdrawals from centralized exchanges (red) and net flows from ETF on-chain wallets (green). We can see that the latter two entities typically see larger ±4K BTC swings, suggesting that flows through these entities may have 4-8x more market influence than miners.

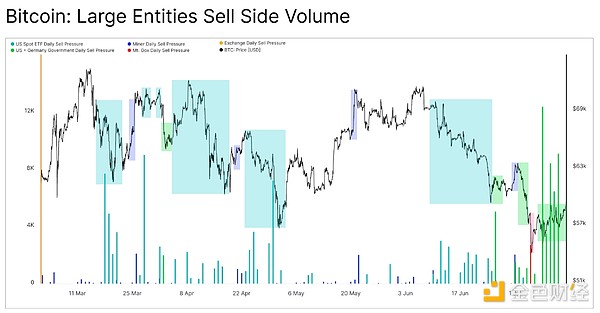

Taking this net flow dynamic as our baseline, we can measure the estimated intensity of sell-side pressure from large entities by isolating only net outflows. From this, three key observations can be made:

Increased sell-side pressure from miners tends to occur during price volatility.

ETF outflows dominated after the market hit new highs in March, which were mainly led by GBTC products.

The sell-side flows from the German government over the past few weeks have been significant. However, we can also see that most of the outflows occurred after the price dropped to $54,000, suggesting that the market was actually getting ahead of the news.

The chart below shows the cumulative net outflow activity from these large entities since the all-time high of $73,000. From this we can see that sell-side pressure from miners is relatively small relative to government sell-side, ETF outflows, and exchange deposits.

Centralized exchange deposits remain the largest and most persistent source of sell-side pressure. However, even capping out at these major trading venues, we can see that the recent sell-side from the German government is significant.

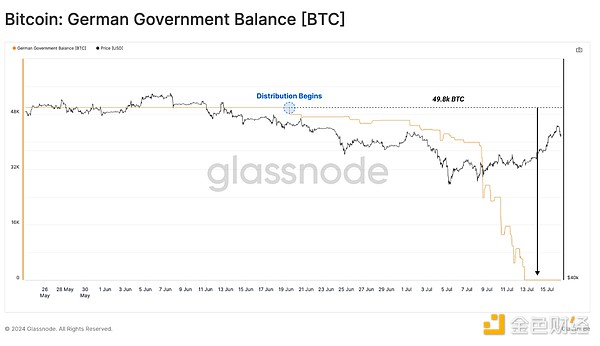

As we focus on the increasing selling pressure from the German government, we can see that their 48.8k BTC balance was depleted in just a few weeks. Most of the funds were outflowed in a very short period of time between July 7th and July 10th, with over 39.8k BTC flowing out of the marked wallets.

Interestingly, this sell-off occurred after the market bottomed out around $54,000, suggesting that the market got ahead of the news.

Stable vs. Speculative

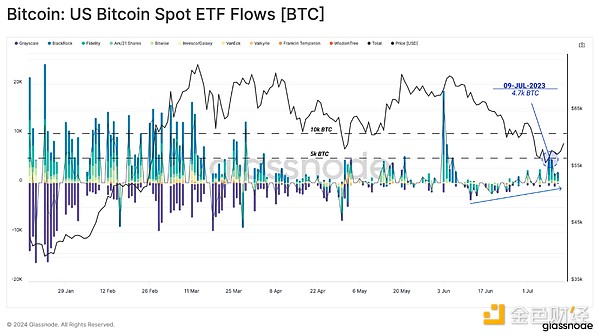

After an extended period of range-bound trading, the total net inflows for all ETFs have experienced sustained outflows. With prices falling to a low of $54,000, the average inflow cost basis for ETF holders has fallen below and now stands at $58,200.

In response, ETFs have seen their first significant positive gains since early June, with total inflows exceeding $1 billion last week alone.

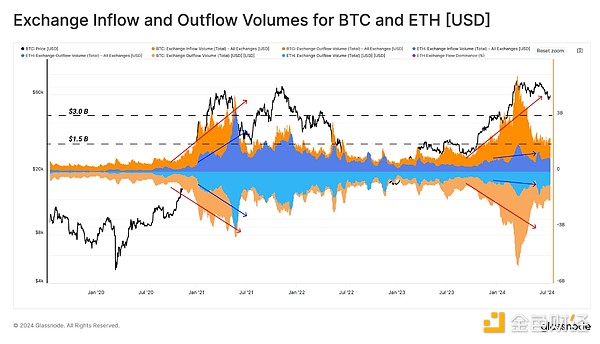

Deposit and withdrawal volumes to exchanges are often a strong indicator of investor interest and market liquidity. After hitting an all-time high in March, exchange traffic has declined significantly, while BTC trading volume (red) has since maintained a stable baseline of approximately $1.5 billion per day.

If we compare the inflow and outflow structure of Ethereum (blue), we see a clear reduction in interest in Ethereum relative to the 2021 bull cycle. At the peak of the 2021 bull cycle, ETH’s daily exchange flows were almost as large as BTC’s.

This suggests a relatively low level of speculative interest in 2024, consistent with ETH’s generally weaker performance relative to BTC since the 2022 cycle low.

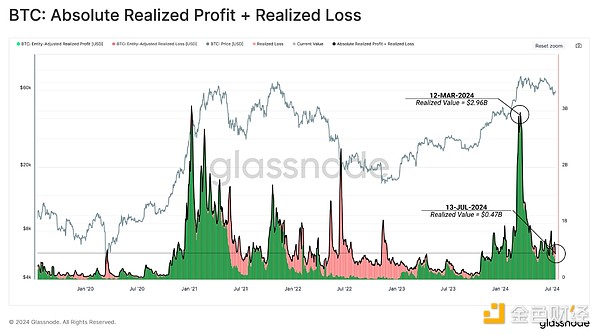

The size of realized profits and losses locked in by investors can also serve as a proxy for demand. Using this indicator, we can see a similar situation, with large demand supporting the rally, followed by a period of compression and consolidation.

This emphasizes the balance that is being established between supply and demand over the past 3 months. We can also see that despite the market's correction of more than -25% from its highs, there has been no significant increase in realized losses to date, suggesting limited panic.

Sell Net

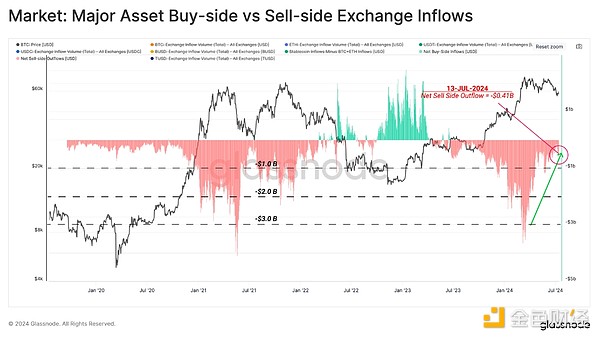

If we consider exchange inflows for BTC and ETH as sell pressure, we can compare it to inflows into stablecoins, representing a proxy for demand. With this metric, we are able to assess the overall balance between buyer or seller bias in the market.

We can think of this through the following framework:

Values close to zero indicate the presence of a neutral regime, where buyer inflows are comparable to seller pressure from both major assets.

A positive value indicates a net buy regime, where stablecoin buyers exceed sellers of the primary asset. (green)

A negative value indicates a net sell regime, where seller volume exceeds available new stablecoin capital to absorb it. (red)

We can see that the market has been in a net sell regime since mid-2023, but that this has been declining over the past few months.

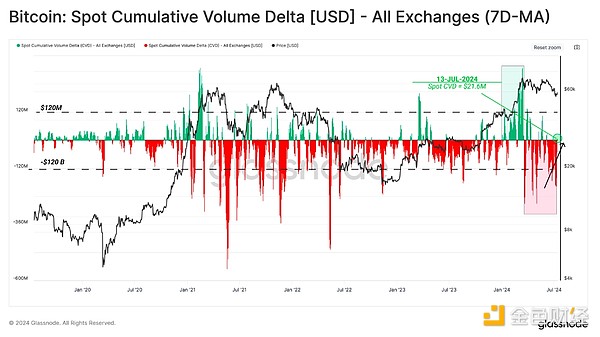

Using the spot cumulative volume delta (CVD) indicator, we can see similar dynamics. This tool measures the net difference between buy and sell volumes on centralized exchanges.

From this perspective, we can see that sellers have been significantly dominant since hitting all-time highs in March. However, as of last week, CVD had recorded its first net buyer indicator since July, indicating that the seller pressure facing the spot market has eased.

Investor Profitability Remains Strong

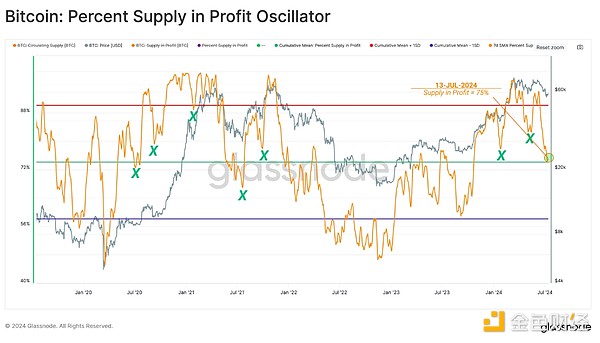

As the price of Bitcoin fell to a local low of $535,000, the proportion of money supply with unrealized losses surged to around 25% of the money supply. This caused the profit supply percentage indicator to fall back to its long-term average of 75%, which is its historical level during previous bull market corrections.

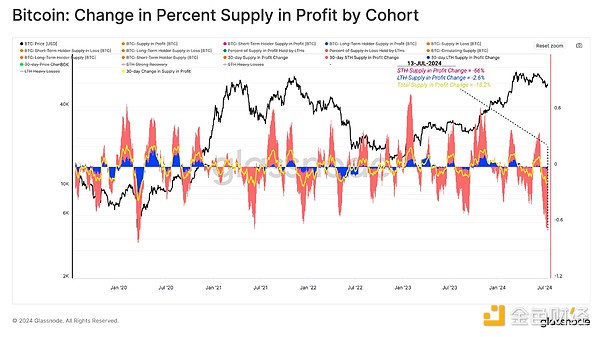

By separating the percentage of token supply held by long and short term holders, we can assess the impact of price contraction on both groups.

Over the past 30 days, profitability for the short term holder (STH) group has fallen sharply, with over -66% of supply turning into unrealized losses. This is one of the largest declines in STH profitability on record.

This suggests that a large number of "top buyers" have seen portfolio profitability challenged in recent weeks.

However, for the opposite group, long term holders, the proportion of their held supply that has taken profits has barely changed. This suggests that relatively few investors remained holding tokens at the peak of the 2021 bull run.

Overall, this suggests that the STH group remains the main group most likely to react to market fluctuations, with their average cost basis currently sitting at around 64.3k.

Summary

Examining the size of the primary sell-side forces, miners have historically been the primary source of sell-side pressure, however, we note that with each halving, their impact on the market has seen diminishing returns. Conversely, ETF flows and centralized exchanges have grown convincingly in their relevance to price action.

The Bitcoin market absorbed 48,000 BTC last month as the German government achieved full distribution of its balance sheet. The complete fading of German government sell-side pressure provided ample relief to the market, while initial signs of a renewed demand-side presence spurred positive price action.

Short-term holders endured a challenging month, with the recent correction leaving a significant portion of their token supply in the red. Conversely, sophisticated investors remained steadfast, with profitability barely declining, underscoring their impressive conviction and solid market positioning.

Alex

Alex

Alex

Alex Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph