Author: Route 2 FI Source: @route2fi, substack Translation: Shan Ouba, Golden Finance

Does anyone else find human psychology interesting?

When the cryptocurrency market is falling, we spend a lot of time analyzing, trying to predict the exact bottom, and are generally very cautious. But when the market is rising, we feel confident and just buy in, with little to no analysis.

We keep clicking the green buy button like there is no tomorrow.

Why do we do this?

Fear and greed – these two emotions seem to drive most of our actions in the cryptocurrency market.

When fear takes over, everything is doomsday. The news on Twitter/X is full of warnings of further collapse and calls for surrender.

“This is the end, bye everyone, nice to meet you.”

But when greed is in the driver’s seat, euphoria takes over. Suddenly, everyone becomes an expert, confidently predicting new highs are just around the corner.

“If this coin goes up another 10,000%, I can retire. Go for it!”

So why is this happening?

Why are we so cautious at the bottom, but throw caution to the wind at the top?

A big part of it is loss aversion—the pain of losses is felt far more than the pleasure of gains.

Humans are social animals and the fear of missing out (FOMO) is very strong. It’s hard to stay out when everyone around you is getting rich quickly. The herd mentality takes over and we follow the herd into the market, often just when the market is at its peak. It’s hard to stay calm when you hear stories of random people getting rich overnight every day.

On the other hand, when prices fall and everyone flees, our instinct is to follow them. Holding on feels like fighting a losing battle. The prospect of future losses in our minds outweighs the potential gains.

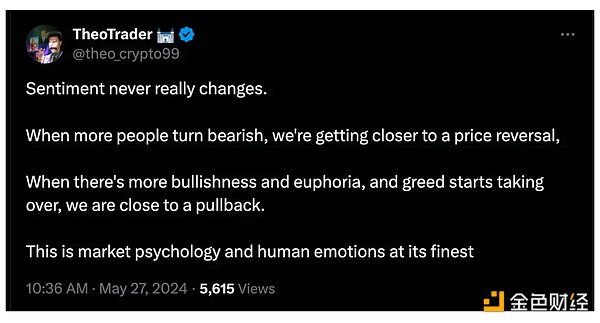

When cryptocurrencies hit bottom, you can feel it, it is a very unique feeling, especially on the day of the bottom, it is very obvious. Guessing the top is much harder, usually people start calling the top long before the actual top, and at the top people become extremely bullish, you hardly see any bearish voices, there is not a single bearish tweet in your tweets, it is all ecstasy.

Of course, this time may be different, but price action on the high timeframes is forming parabolas with very high tops (e.g. 2017) and most people call the top too early and are completely in disbelief until the real top arrives.

Yes, predicting bottoms and tops is a foolish business for most people.

When emotions reach extremes, opportunities are usually gone. By the time your Twitter/X is full of bullish or bearish news, it may be too late.

Ironically, the best opportunities often lie in swimming against the current.

Buy when others are overwhelmed by fear and sell when greed and euphoria are rampant. Yes, I know, it's easier said than done - it takes a strong mentality to swim against the tide.

But as one of the best investors says, Be fearful when others are greedy and be greedy when others are fearful.

So if emotion-based top and bottom predictions are often a losing strategy, what is a better approach?

It is not a trader's job to predict market bottoms and tops. That luxury is left to the experts and the average investor who has no real input. Think in terms of accumulation and distribution.

One way to do this is to focus on your own analysis and have a plan.

Don't try to figure out the perfect entry or exit, but think about accumulating gradually on dips and taking profits on rallies.

Have a strategy and stick with it, no matter what the herd is doing. Develop a theory based on fundamentals, technicals, or your assessment of the market cycle, and let that guide your decisions.

You don't know what other people's "prophecies" are based on. Maybe the bull on X who's calling for $100,000 in a week is a 16-year-old who doesn't even know the funding rate?

FOMO is a powerful force, and the temptation to abandon your plan to chase gains is strong. That's why discipline is important.

One big mistake I find myself making over and over is how I justify losing coins in my portfolio.

Holding them in the hope of getting my money back, even when I know the smartest thing to do is to cut my losses and invest my money in something else.

Human psychology at its best.

No one can seize every opportunity. I repeat: No one can seize every opportunity. There will always be coins that go up 100x that you didn’t buy, or coins that you sold too early.

This is the nature of markets. The key is to not let FOMO dictate your actions. Be disciplined, stick to your strategy, and believe that there will always be new opportunities.

By having a plan, staying disciplined, focusing on your own analysis rather than the actions of the herd, and keeping a long-term perspective, you can buy low and sell high, not the other way around.

It's not easy, but this is the mentality that will make the few profit and the many fail in the crazy world of crypto.

Ultimately, the goal is to keep emotions out of the equation as much as possible. Fear and greed may be inevitable human reactions, but we don't have to let them control our every move in the market.

Let’s break it down:

Professionalism means having a plan and sticking to it, even when emotions run high.

Consistency means applying your strategy every day, not just when it’s easy.

Discipline means resisting the urge to deviate from your plan when FOMO strikes or the market is gripped by fear.

Repetition is about spending time in front of a screen and working even when it feels tedious.

Perhaps most importantly, the ability to overcome repeated failures and disappointments is essential because no strategy is perfect and losing money is part of the game.

So why do most traders struggle with this? Why are they bearish at bottoms and bullish at tops even when they know better?

A big part of the reason is that it is difficult to truly internalize these basic but necessary principles. It is one thing to understand these concepts, but it is another to consistently apply them when it counts.

Warren Buffett's famous saying "Be greedy when others are fearful" rings true again.

But in practice, it is very difficult to buy when the market crashes and your portfolio is down 50%. Similarly, we know to be cautious when the market is ecstatic, but the temptation to make quick profits is very strong when everyone around seems to be getting rich easily.

Seeing headlines like "High School Student Makes $1 Million Overnight" several times a day, who can stay calm?

That's why it's so important to have a plan and stick to it.

If your plan is to accumulate on the dip, then you buy when prices fall and sentiment is low, no matter how you feel.

If your plan is to take profits when you reach your target, then you sell in stages on the way up, even if it feels like the rally could go on forever.

It may be ego-satisfying to catch exact bottoms and tops, but it's not a reliable way to build long-term wealth. A better approach is to focus on executing your plan over and over again, even if it means missing some of your best days.

A slow and steady approach often wins out in investing.

Remember that the herd is usually wrong in extreme cases.

Remember your plan, and the effort you put into making it.

Discipline is the key to long-term success, and every setback is an opportunity to learn and improve.

Stay rational, and I wish you good luck in your investment!

Alex

Alex

Alex

Alex Catherine

Catherine Anais

Anais Weatherly

Weatherly Alex

Alex Catherine

Catherine Miyuki

Miyuki Kikyo

Kikyo Weiliang

Weiliang Weatherly

Weatherly