By Ian King, Bloomberg; Compiled by Deng Tong, Golden Finance

Nvidia Corp.’s latest earnings on Wednesday failed to meet investor expectations, with disappointing forecasts for its much-anticipated Blackwell chip and news of production problems.

The company’s quarterly report — the most anticipated part of the tech sector’s earnings season — met or beat analysts’ expectations on nearly every metric. But Nvidia investors have become accustomed to blowout quarterly results, and the latest numbers fell short of expectations.

In addition, Nvidia’s next cash cow, the new Blackwell processor family, is proving more challenging to manufacture than expected.The product is the next generation of the company’s dominant artificial intelligence processors, and concerns about delays sent shares down as much as 8.4% in late trading. The stock has more than doubled this year through Wednesday’s close and is up 239% for 2023.

“This is beyond outsized and unsustainable expectations,” Bloomberg Intelligence analysts Kunjan Sobhani and Oscar Hernandez Tejada said in a note.

The company said third-quarter revenue was about $32.5 billion. While analysts on average had forecast $31.9 billion, the highest estimate was $37.9 billion.

The disappointing outlook could dampen the artificial intelligence boom that has transformed Nvidia into the world’s second-largest company by market value. The chipmaker is a major beneficiary of the race to upgrade data centers to handle artificial intelligence software, and its sales forecast has become a barometer of that spending spree.

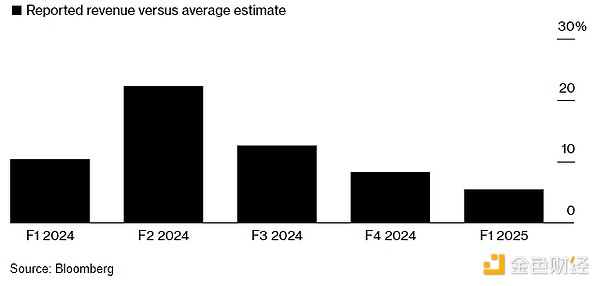

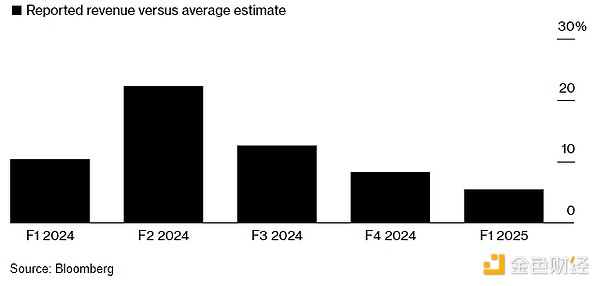

Ahead of the launch, there were concerns about problems with Nvidia’s new Blackwell design. The company acknowledged production issues and said it was making improvements to improve manufacturing yields — the number of functional chips that a factory churns out. Meanwhile, the company said it expects “billions” of dollars in revenue from the product in the fourth quarter. Chief Executive Officer Jensen Huang later said in an interview that supply will be plentiful after manufacturing gains momentum. “We’re going to have a lot of supply and we’re going to be able to ramp up production,” he said. Nvidia just came off a string of events that beat Wall Street expectations, even as analysts continue to raise their forecasts. But the upside has been falling. Much of Nvidia’s growth is also coming from a small group of customers. About 40% of Nvidia’s revenue comes from large data center operators — companies like Alphabet Inc.’s Google and Meta Platforms Inc. — that are pouring tens of billions of dollars into AI infrastructure. While Meta and other companies have increased capital spending budgets this earnings season, there are concerns that more infrastructure is being built than is currently needed. That could lead to a bubble. But Nvidia’s Huang insists this is just the beginning of a new era in technology and the economy.

Expectations are high for Nvidia. This year, Nvidia is the best-performing stock in the S&P 500, outperforming all other semiconductor companies. Nvidia’s market value, at more than $3 trillion, is roughly the same as the next 10 largest chip companies combined.

Nvidia’s strong quarters: Chip maker beats analysts’ expectations

Nvidia was best known for selling video game cards, but now it’s best known for so-called AI accelerators. The chips are derived from its graphics processors, which are used to develop artificial intelligence software by feeding it information.

This process is called training, and it makes AI models better at recognizing and responding to real-world inputs. Nvidia's components are also used in systems that run software, a stage called inference, and help power services like OpenAI's ChatGPT.

Last quarter's results beat Wall Street expectations, and the Santa Clara, California-based company's board approved an additional $50 billion in stock buybacks.

Nvidia's revenue more than doubled to $30 billion in the fiscal second quarter ended July 28.

Nvidia is ahead of other chipmakers because its technology is well suited to the needs of artificial intelligence. But rivals are trying to catch up. Advanced Micro Devices Inc. is now its closest rival, while Intel Corp., once the world's largest chipmaker, is further behind. Their combined revenue in that market is only about 5% of Nvidia's total.

Nvidia's data center unit, by far its biggest source of sales, generated $26.3 billion in revenue last quarter. Gaming chips provided $2.9 billion. Analysts had set targets for $25.1 billion for the data center unit and $2.79 billion for the gaming unit.

The Blackwell chip is expected to launch in the coming months and bring a new round of growth. Analysts downplayed concerns about delays, noting that demand for the company's current generation of products remains huge. That could help Nvidia deal with any delays without taking a major financial hit.

Describing the challenges facing the Blackwell chip, Nvidia said it had to change a mask production step to improve yields. A mask is a template used to burn circuit patterns into the material deposited on silicon wafers.

Nvidia said production of the Blackwell chip will increase in the fourth quarter and continue into the next fiscal year.

On a conference call after the earnings release, analysts sought more details about how much revenue the new Blackwell chips would bring in and when. Huang and Chief Financial Officer Colette Kress stuck to their promises of billions of dollars in revenue in the fourth quarter and declined to elaborate further.

As the call progressed, the stock continued to fall without answers.

Huang, as always, made high-level predictions about the future of computing, arguing that the world’s data centers will need $1 trillion worth of equipment to replace outdated equipment. That replacement process, he said, has only just begun.

AI is taking over computer searches and helping companies speed up business processes, he said, and countries will need AI to protect their data.

“It affects how computing is done at every layer,” Huang said.

Wilfred

Wilfred