Author: Maksim Balabash; Compiler: Plain Language Blockchain

We are approaching the lowest point of the last crypto cycle, which occurred around November-December 2022. This makes me think that it is time to slow down, relax, and think about how the current crypto cycle might end. I have an interesting idea that I want to share with you.

Disclaimer: I am not a crypto expert or economist and have no idea about the price tomorrow or next year. We should all understand that most predictions are often inaccurate. When I mention "crypto", I mean the financial part of the broader concept of Web3, the decentralization of the Internet.

1. Why do cryptocurrencies have cycles and why do they persist?

Whether cryptocurrency is considered a commodity (which we seem to be increasingly inclined to) or a security (think back to 2017-2018), we buy it with cash. The availability of cash and people's willingness to exchange it for cryptocurrency are both affected by economic cycles.

Since cryptocurrency generally lacks intrinsic value (unlike stocks or bonds), its value is primarily determined by the price people are willing to pay. This makes cryptocurrency more susceptible to psychological factors, which are often exacerbated by narratives spread by the media.

The continued innovation of encryption and Web3 itself, as well as the evolution of regulation, introduce new variables and opportunities to the market. If more can be done, new incentives and narratives will continue to emerge, and more people will be willing to participate.

2. So, what is the crypto trinity?

The crypto trinity refers to the three interrelated variables of Token, flow and liquidity, which together describe the performance of the crypto market.

If we were to describe cryptocurrencies in a simple system, the workhorse is the token, the transport is the traffic, and the engine is liquidity.

Tokens incentivize their holders to shape narratives and direct traffic, which in turn attracts liquidity to the market, which in turn feeds back positively, continuing to drive the tokenization of everything (more and more market liquidity).

So, when for some reason 2/3 of the components of the system fail, favorable conditions emerge for a crash, trend reversal, or crypto winter. On the other hand, cryptocurrencies thrive best when 3/3 of the components of the system are functioning properly. This is what the crypto trinity means.

What indicators can we track to observe the dynamics? The simplest way is:

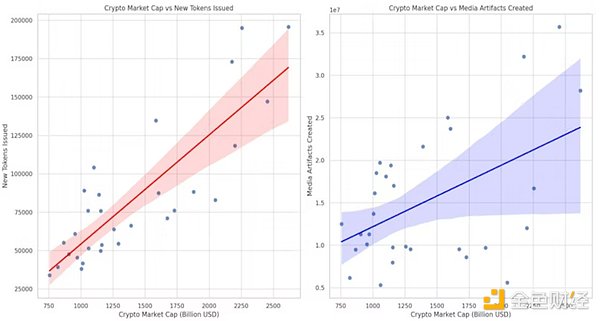

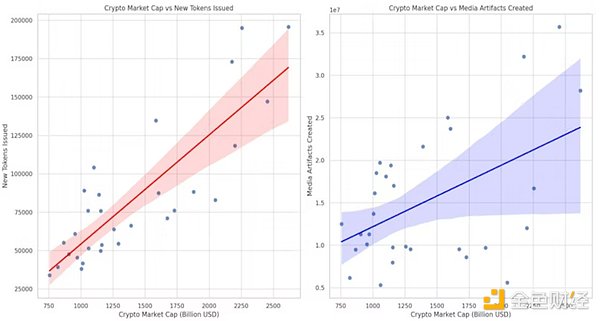

Get the total crypto market cap on TradingView.

Get the number of tokens created on GeckoTerminal.

Search "crypto" on Google and record the number of results we need for each month to get the number of media reports.

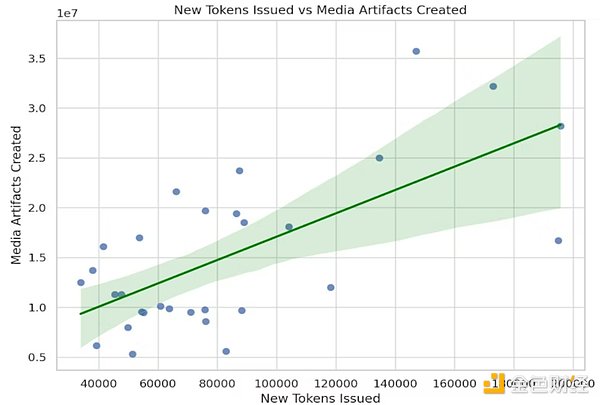

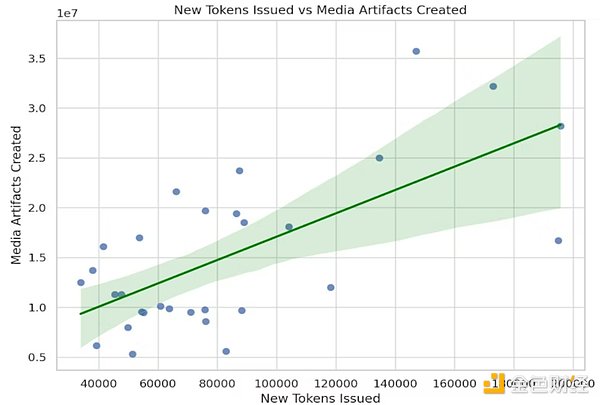

Of course, these data will not be completely pure, but it is enough for us to make a point: they are correlated.

The correlation between market value and newly issued tokens is very obvious. The correlation between market value and media reports is a little noisy, which I think is related to the simple way the data was collected.

There is a clear correlation between new tokens and media.

This is the data I collected. It would be very helpful if someone could organize this data into different periods and open source it so that everyone can use it.

3. What are the possible problems?

1) Token

There are many reasons why different projects create their own tokens, but there are three main reasons:

Provide some kind of utility to the community

Distribute value among community members

Provide a club logo for like-minded people

This is why tokens are an excellent community tool. I believe that communities have the potential to drive the process of tokenization.

I see several relatively reasonable bottlenecks, all of which are related to regulation (I am sure crypto and Web3 experts can come up with more, and even better ideas):

Government imposition of stricter regulation or outright crypto bans

Only whitelist a certain number of cryptocurrencies and leave the rest in a gray area to maintain legal leverage

Force major centralized services to adopt "proof of purity", scan users for "dirty" transactions (whatever "dirty" means), and potentially block their transactions or assets

Make it illegal for any cryptocurrency where at least 51% of the nodes are not in the country (although this sounds crazy, I'll leave it here anyway)

2) Traffic

This is why publicity works, technology plays a major role in modern society, and traffic is critical for market pricing.

Since the crypto market is still young, seeking better use cases, and mainly lacking in practicality, the role of traffic is even more important.

I see several plausible bottlenecks for crypto traffic:

If an alternative, more compelling narrative emerges (e.g. US elections in 2024)

If the narrative fails to generate enough optimism to drive people over the hurdle to buy

High-profile hacks and thefts could undermine the optimistic narrative

Government regulation of crypto influencers to protect users

Platform restrictions on crypto promotional content

3) Liquidity

Cash is king. No matter how you define cryptocurrency, you need cash to participate.

Whenever nearly costless borrowing is available, capital is actively injected into the financial system, or other conditions lead people to accumulate money that they don't urgently need to spend, we experience increases in consumption and/or financial market liquidity.

We all have our reasons for keeping cash in our pockets, but we can roughly guess at the factors that may prevent liquidity from pouring into the crypto market:

Global recession or financial crisis

Opportunities with a better risk/reward ratio

A ban on purchasing any cryptocurrency from unauthorized brokers to isolate decentralized crypto

Imposing a “wealth tax” on any decentralized crypto held (50% needs to be handed over to the government)

Institutional investors withdraw their investments due to concerns about volatility, regulatory issues or disappointing returns

4. What happens next?

It would be quite disappointing if the end result of blockchain was just "digital gold" or worse, Memecoin.

Blockchain has had its triumphs and failures, but the promise of removing central authority (consider the ratio of crypto held by retail investors vs. large holders), censorship resistance (consider the recent cases involving Telegram and X), and privacy (consider the Tornado Cash case) has not been fully realized.

Replacing Web2 leaders with Web3 applications and communities is a vast and relatively unexplored space. Many SaaS products could benefit from transitioning to Web3. And the technology is ready for new applications.

There is still a lot to explore and expand. I think it is time to start focusing on scaling the application layer (because the technology is no longer an issue).

5. Conclusion

The use cases for cryptocurrencies are very limited. However, as broader use cases (Web3) bring more practicality, this may have a positive impact on cryptocurrencies and make them more stable.

Until then, crypto cycles are mainly driven by idle cash in pockets, media advertising and traffic, and people who take advantage of other people's psychological biases.

I don't know how many more cycles we will see before the financial part evolves into the Web3 world. But I hope to see this change.

Alex

Alex