Author: Terry; Source: Vernacular Blockchain

If we ask which public chain ecosystem has been the most eye-catching since last year, I believe Solana must be the choice with the highest consensus: Whether it is price/market value, ecological narrative, Meme, or DeFi, NFT, DePIN and other tracks, all directions are thriving, leaving new public chains such as Avalanche and NEAR far behind, and becoming an almost discontinuous existence among smart contract public chains except Ethereum.

In the final analysis, in 6 months, from US$20 to US$200, the market value returned to US$80 billion. In addition to the impact of the FTX bankruptcy incident that quickly advanced to the end,As a model for post-disaster reconstruction, some new variables behind Solana are also particularly worthy of attention.

Especially since the beginning of this year, new generation Meme top streamers such as SILLY, DRAGON, WIF, BOME, and SLERF have begun to show a visible trend of shifting from Ethereum to Solana, which is enough to show that Solana has indeed taken a completely different step in terms of on-chain ecology and community traffic.

01 The on-chain ecology has recovered significantly

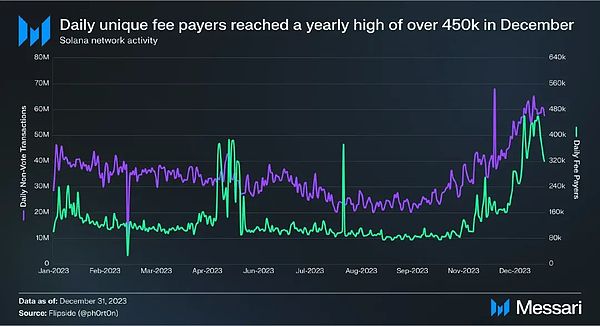

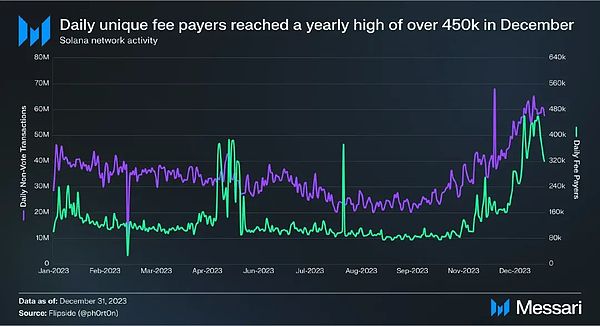

In fact, the first wave of growth on the Solana chain came from the promotion of the Solana Foundation Breakpoint Annual Conference in 2023-Before October 2023, the number of daily paying users, which measures the activity of the Solana ecosystem, has been hovering between 80,000 and 100,000.

The Breakpoint conference stimulated the first phase of growth from the end of October to November 2023, and the subsequent JTO Airdrop and Coinbase's launch of BONK further promoted the growth of this data, causing it to soar more than 5 times to 500,000 people.

Meme has always been the observation dimension that best reflects the wealth effect of the public chain. It can be said that since the beginning of this year, the new Solana+Meme combination has swept the entire crypto market.

Whether it is BOME, which has completed the entire life cycle of most crypto projects in three days, or SLERF, which became popular due to accidental destruction during the pre-sale, or IQ50 launched by veteran artists following their startups,they have quickly set off a legendary model of "leaving addresses and sending money to raise funds" on the Solana chain through the early wealth-making effect of hundreds of times.

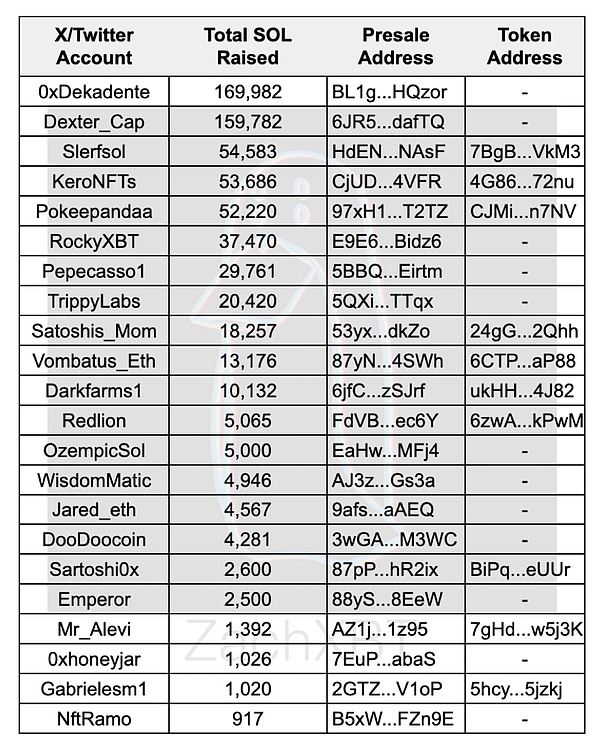

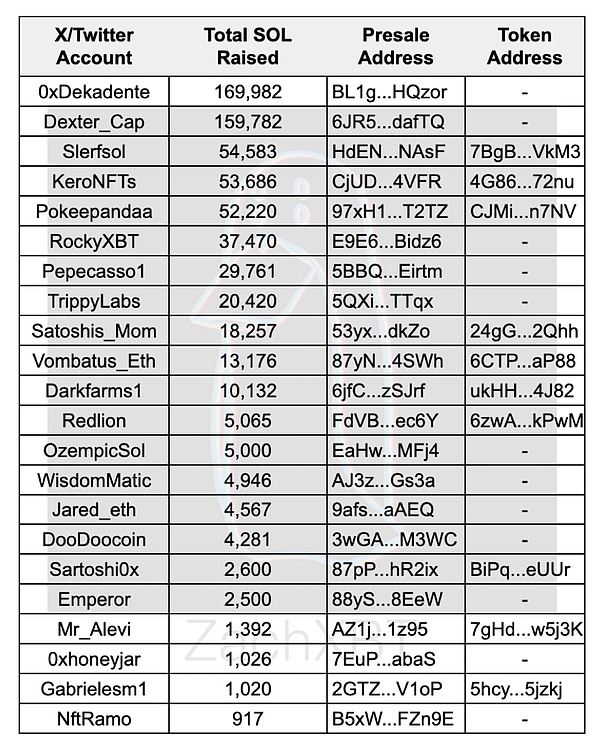

Even ZachXBT statistics show that only 27 pre-sales on the Solana chain have raised a total of more than 655,000 SOL (with a market price of more than 130 million US dollars),which has also brought unprecedented traffic and attention to Solana.

Part of the SOL fundraising information on the Solana chain, source: ZachXBT

I believe everyone has had this experience. At one time, there were countless passwords in the major WeChat and Telegram groups, and without asking about the project details, they could quickly attract a group of users to participate in the payment. For a time, people seemed to be back in the wave of crazily playing wealth passwords in Inscription last year.

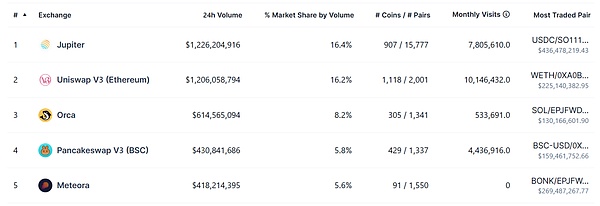

Accompanying this, since mid-March, the top three DEXs in terms of trading volume within 24 hours on the Solana chain - Raydium, Jupiter and Orca, have accounted for more than 50% of the total DEX trading volume on the entire network. Among them, Raydium's trading volume exceeded US$2 billion, which is twice the trading volume of Uniswap V3 on Ethereum during the same period (US$1.1 billion).

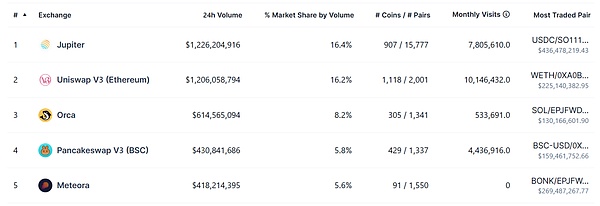

As of April 4, Coingecko statistics show that the top three DEXs in terms of trading volume on the entire network are Jupiter, Uniswap V3 and Orca, and Jupiter and Orca accounted for nearly a quarter of the total trading volume on the entire network in the past 24 hours.

DEX transaction rankings across the entire network, source: CoinGecko

Overall, Solana, which has inherited the Meme craze and spawned a large number of subsequent hot spots, has once again established its own label recognition as a high-performance chain for the poor to get rich. Under the wave inspired by this Meme wealth-making myth, the Solana ecosystem is showing a general upward trend.

At present, whether it is DeFi, NFT or the popular DePIN track, many ecological sub-projects worthy of attention have emerged. It is very likely that in 2024, phenomenal projects that will break through large-scale adoption will emerge. SOL has even exceeded 200 USDT, setting a new high since December 2021.

02 Technical Dimension

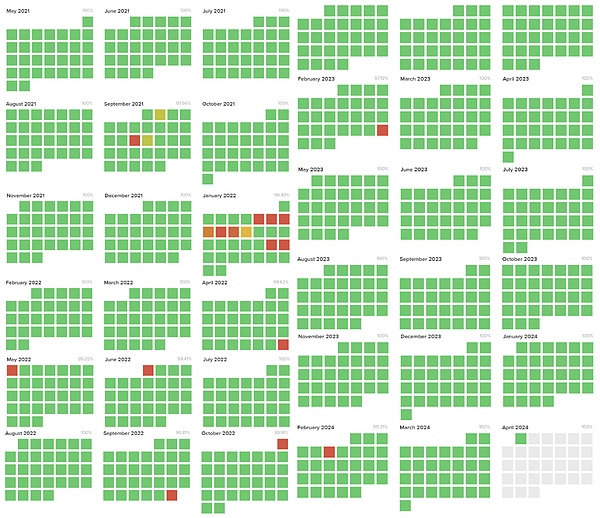

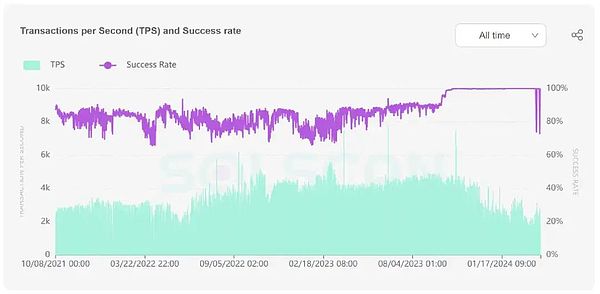

At the same time, what is less discussed is that under the impact of the surge in transaction volume and active addresses on the chain, Solana has so far been able to smoothly receive this overwhelming traffic, and no network downtime has occurred so far.

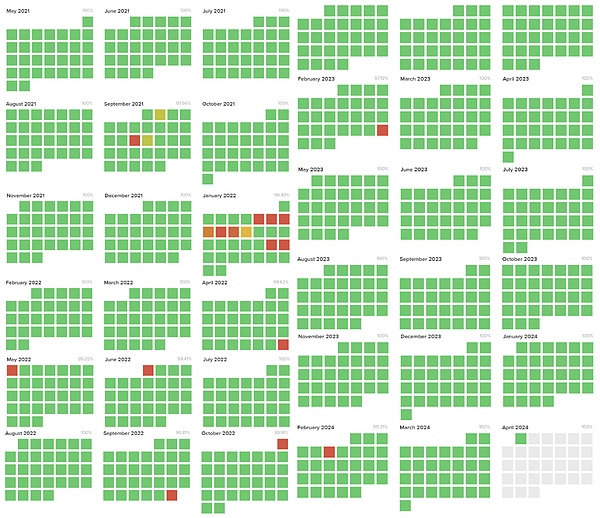

It should be noted that from January 2022 to February 2023, Solana experienced outages in 7 of the 13 months, and the longest outage lasted more than 24 hours.

As can be seen in the figure below, since the new outage on February 25, 2023, until the most recent failure on January 6, 2024 (repaired in a few hours), the Solana network has set the longest continuous record of no network outages, with a total duration of more than 330 days.

Solana network interruption status record, the red part is the fault, source: Justin_Bons (X)

Behind this, the Solana Foundation has launched a number of technical updates since last year, which greatly improved the availability and scalability of the Solana system.

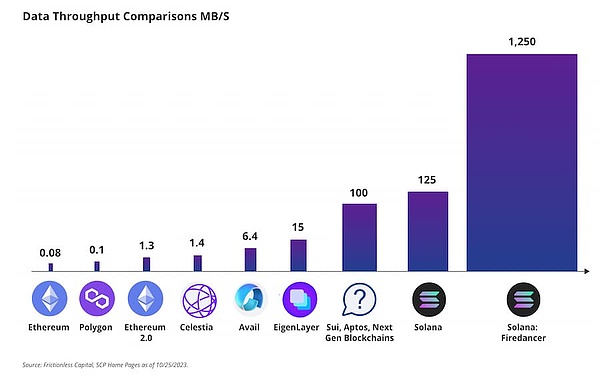

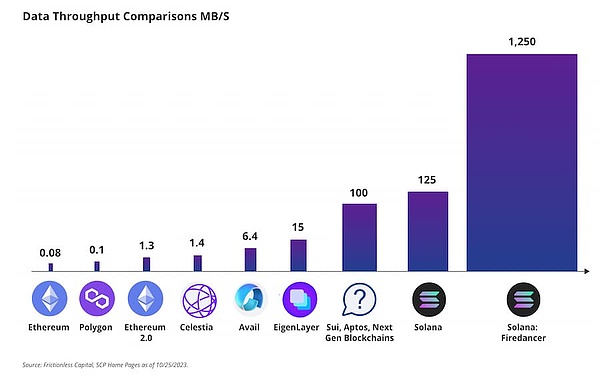

The first is the "Firedancer" test network launched at the end of last year. It can reach 1 million TPS during internal testing and is expected to reach 100,000 TPS during actual operation. It is expected to increase Solana's throughput by 10 times, which is enough to meet the needs of high-frequency trading applications.

At the same time, this technical update is implemented on the Solana main chain. From a technical point of view, this will also make Solana another blockchain with multiple completely independent validator clients outside of Ethereum.

The current market head network throughput is MB/S, source: Frictionless Capital

Another technical innovation, State Compression, significantly reduces the cost of NFTs-it only costs $100 for users to mint 100,000 NFTs on Solana, while it may cost $500,000 on Ethereum, which means that NFTs can be transformed from an application into an infrastructure for more on-chain use cases.

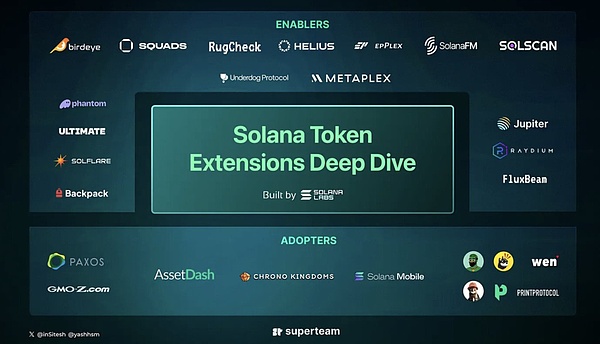

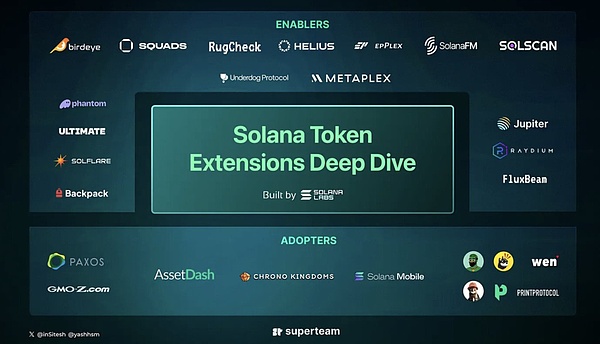

In addition, in January 2024, the Solana Foundation released a new SPL Token standard Token Extension, which includes 19 different Token standards, allowing developers to build custom Token functions.

This also opens up the Solana network to unlock more complex on-chain use cases - allowing developers to build custom Token functions,such as private transactions, transfer Hooks, non-transferable Tokens, interest-bearing assets, metadata, and more.

State Compression interface, source official website

For example, developers can build a DeFi borrowing application that only allows wallet addresses with a Nomis score higher than 500 to use (this is achieved through transfer Hooks); and users can deposit JitoSOL on the platform and receive an annualized return and points of 7.5% (this is achieved through interest-bearing Tokens).

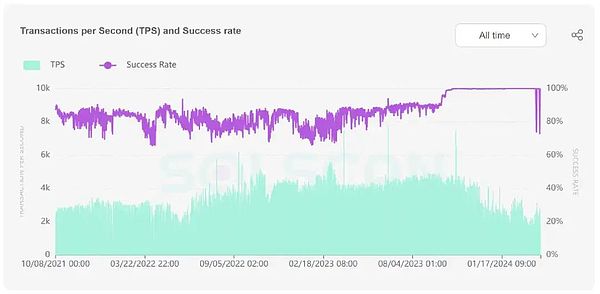

In fact, SOL's "real TPS" has hit a record high since the fourth quarter of 2023, and this is also one of the most stable periods for Solana's network.

Solana network's TPS and transaction stability rate, source: https://solscan.io

03 Support from Wall Street

In addition to ecological and technological progress, the resources brought by Lily Liu, chairman of the Solana Foundation, are also a key factor that cannot be ignored. Coupled with the strong support of the powerful investment institutions behind Sonana, the fundamentals of Solana have changed.

Among them, Lily graduated from Stanford and Harvard University in her early years. In the early stage of her career, she worked at Morgan Stanley, McKinsey and KKR. At the same time, she has been deeply immersed in the crypto industry for ten years - from CEX (Bitcoin China) to mining (21 Inc), and from platform (Coinbase) to joining the public chain (Solana).

So to some extent, Lily connects Sonala to a wider range of over-the-counter funds and traditional resources, which is also a competitive advantage that is difficult to replicate in other public chains.

Especially linking the old gun members of the crypto circle and the traditional elites in Silicon Valley, it also gives more people a reason to re-examine Solana, and the explicit and implicit variables brought to Solana cannot be ignored - "Her joining will make many people re-examine Solana and ask themselves if they were too arrogant before."

Since December last year, Coinbase has launched JTO, BONK, HONEY, MOBILE and other Solana ecosystem tokens one after another, which is a typical example. This also means that the new/old protocols and sub-projects of the Sonala ecosystem may gradually benefit from the spillover effect of such financial resources.

At the same time, it is precisely with the funds and resources brought by Wall Street as a backing that the Solana Foundation under Lily's leadership has invested heavily in hackathons and developer ecology, which should also be a unique label. At present, the Solana hackathon is not only very well-known in the industry, but also has produced many star projects such as STEPN.

Like last year during the bear market, Solana dared to launch a hackathon event with a prize pool of up to one million US dollars, which shows the importance it attaches to independent developers, which is also an important guarantee of its vitality on the chain.

04 Summary

The crypto world is full of narratives, but the market's demand for narratives is everlasting, which means that if we divide it by month/year, there are actually traces of the logic behind any major market trend.

Starting from October 2023, Solana has indeed ushered in a completely different pace in terms of on-chain ecology, technological updates, and capital attention. Some of the hidden clues in the early stage will undoubtedly gradually emerge in 2024, which is worth looking forward to.

JinseFinance

JinseFinance