Binance to Launch XAI Gaming Coin Through Launchpool

Binance to list new gaming altcoin XAI on January 9th, allowing users to stake and earn through its Launchpool platform.

Alex

Alex

Source: Zhong Zhengsheng Economic Analysis

On November 7, 2024, the US Federal Reserve cut interest rates by 25BP, in line with market expectations. After the meeting statement and Powell's speech, the market felt dovish: the 10-year US Treasury yield fell by 9BP during the day, closing at 4.33%; the S&P 500 and Nasdaq indexes closed up 0.74% and 1.51% respectively; the US dollar index fell by about 0.8% during the day; the current price of gold re-entered the $2,700/ounce mark.

Meeting Statement: Insist on a 25BP interest rate cut. The Federal Reserve's November 2024 interest rate meeting statement lowered the federal funds target rate by 25BP to a range of 4.50-4.75%. In the economic and policy description section, the Fed generally maintained an assessment similar to that of the September interest rate meeting; as employment and inflation have rebounded since the September meeting, the Fed emphasized the progress "since the beginning of the year" to rationalize this rate cut. Powell's speech: Find reasons for rate cuts and avoid discussing the election. The main issue discussed at this press conference was why the Fed chose to continue cutting interest rates in the face of recent strong economic, employment and inflation data. Powell expressed multiple logics in different answers: First, the current monetary policy is still restrictive. The Fed started to cut interest rates in September, and this rate cut should be regarded as "another action"; second, the Fed does not want or need to see a further cooling of the job market; third, the Fed believes that inflation in some links such as rent mainly reflects the "catch-up" effect, that is, it reflects past inflationary pressures rather than the present, so it tends to believe that inflation will continue to move towards 2%. On the other hand, many questions mentioned the possible impact of the US election results. Powell tried his best to avoid talking too much about politics and finance, emphasizing that the election will not affect monetary policy in the short term, but also emphasized that the US fiscal situation is on an unsustainable path. In addition, Powell said that he would not resign or be fired because of Trump's election. Policy logic: Why insist on cutting interest rates? Combining Powell's speech this time, as well as the economic and market situation in the United States, we believe that the Fed's insistence on cutting interest rates by 25BP this time can be understood from three aspects: First, although the employment and inflation data released after the September meeting have strengthened, they have not offset the progress of cooling in the previous period; Second, the Fed hopes to maintain policy inertia as much as possible; Third, the recent spontaneous rise in market interest rates has further given the Fed room to cut interest rates. Market outlook: The downward trend of interest rates is still the general direction. In the short term, due to the resilience of the US economy and inflation, and the market's great concern about the upward pressure of inflation caused by Trump's new policies, US Treasury bond interest rates may remain at a relatively high level; US stock investors may tend to believe that the US economy can "digest" high interest rates, and then maintain a relatively strong risk appetite; under high interest rates and a strong economy, the dollar still has its appeal, and the US dollar exchange rate may also receive good support. However, looking forward to the next six months to a year, the direction of policy and market interest rates is still downward. Moreover, once the economic and inflation data cool down again in the next few months, the market's view on the future interest rate path may also be adjusted in time. First, the impact of Trump's new policy on the economy and inflation will not be immediate; second, the Fed still has ample room to return to the neutral interest rate from the restrictive interest rate; finally, the risk of overshooting in the US Treasury bond interest rate in the short term is relatively high.

The Fed will continue to cut interest rates by 25BP at its November 2024 interest rate meeting, which is in line with market expectations. Faced with relatively strong economic, employment and inflation data since the September meeting, why did the Fed insist on cutting interest rates? Powell said in his speech that this rate cut should be seen as "another action" after the September rate cut; the current monetary policy is still restrictive, and the Fed does not want or need to see a further cooling of the job market, and is confident that inflation will continue to move towards 2%. We understand that the Fed insists on cutting interest rates, not only to maintain confidence in the progress of employment and inflation cooling, but also to maintain policy inertia and curb spontaneous upward market interest rates. Looking ahead to the next six months to a year, the direction of policy and market interest rates is still downward. Moreover, once the economic and inflation data cool down again in the next few months, the market's view on the future interest rate path may be adjusted in time.

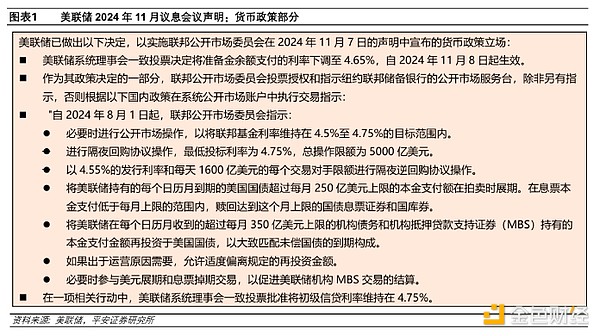

The Federal Reserve's November 2024 interest rate meeting statement lowered the federal funds target rate by 25BP to a range of 4.50-4.75%. At the same time, the Fed lowered other policy interest rates accordingly: 1) the deposit reserve rate was lowered to 4.65%; 2) the overnight repurchase rate was lowered to 4.75%; 3) the overnight reverse repurchase rate was lowered to 4.55%; 4) the primary credit rate was maintained at 4.75%. In terms of balance sheet reduction, the Fed maintained the pace of passive reduction of US$25 billion in Treasury bonds and US$35 billion in MBS per month.

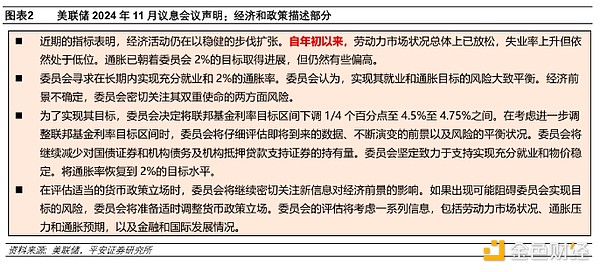

In the economic and policy description section, there are only two changes in the November meeting statement compared with September:1) In the description of employment, "employment growth slowed and the unemployment rate rose but remained low" was changed to "labor market conditions have generally eased since the beginning of the year, and the unemployment rate has risen but remains low"; 2) In the description of inflation, the word "further" in "inflation has moved further toward the Committee's 2% target, but is still high" was deleted. These changes suggest that the Fed wants to maintain a similar assessment to the September meeting; as employment and inflation have rebounded since the September meeting, the Fed further emphasized the progress "since the beginning of the year" to rationalize this rate cut.

Powell's speech was not smooth and hesitant as a whole, which may also reflect the difficulties and contradictions of monetary policy choices. The main issue discussed at this press conference is why the Fed still chose to continue cutting interest rates in the face of recent strong economic, employment and inflation data. Powell expressed multiple logics in different answers: First, the current monetary policy is still restrictive. The Fed started to cut interest rates in September, and this rate cut should be regarded as "another step"; Second, the Fed does not want and does not need to see a further cooling of the job market; Third, the Fed believes that inflation in some links such as rent mainly reflects the "catch up" effect, that is, it reflects past inflation pressure rather than the current one, so it tends to believe that inflation will continue to move towards 2%. On the other hand, many questions mentioned the possible impact of the results of the US election. Powell tried his best to avoid talking too much about politics and finance, emphasizing that the election will not affect monetary policy in the short term, but also emphasized that the US fiscal policy is on an unsustainable path. In addition, Powell said that he would not resign or be fired because of Trump's election.

After Powell's speech, the market further traded easing:The 10-year US Treasury yield fell further, with a cumulative drop of 9BP during the day, closing at 4.33%; the S&P 500 and Nasdaq indexes expanded their gains, and finally closed up 0.74% and 1.51% respectively; the US dollar index fell slightly, falling about 0.8% to 104.3 during the day; the spot price of gold rose further, rising about 1.8% during the day, and re-standing on the $2,700/ounce mark.

Specifically:

1) About the economic and inflation situation. In his opening remarks, Powell said that the economy is expanding steadily and consumption is strong; if there are no storms and strikes, the number of recruits will be "slightly higher", the labor market is not a source of inflationary pressure, and the labor market conditions are looser than before the epidemic; core inflation remains at a high level, while inflation expectations remain stable.

2) About this interest rate cut decision. A reporter asked why the Fed still cut interest rates in the face of positive economic data. Powell said that strong economic data is a good thing; the current policy is still restrictive, although the degree of restriction is uncertain; the job market does not need additional cooling to achieve inflation targets; the Fed started cutting interest rates in September, and today's decision is another step. Later, another reporter asked why the Fed did not pause the rate cuts based on the resilience of the job market and the stickiness of core inflation? Powell said that the core inflation level in the past 2-3 months was about 2.3% (lower than the latest 2.6%); the Fed fully understands the volatility of inflation, just as core inflation was very low in the second half of last year. In addition, he discussed several components of inflation in detail, believing that non-residential services have basically returned to pre-epidemic levels; residential service inflation is currently high, but it mainly reflects the "catch up" effect, that is, reflecting past inflation pressures rather than the present; insurance prices are high, but it may also be a similar catch-up logic. He then concluded that he was confident that inflation would continue to move towards 2%, although it was not time to declare victory yet.

3) About the decision in December and next year. In his opening remarks, Powell emphasized the "two-way risks" in the future. He said that if the economy remains strong and the inflation rate cannot move towards 2% sustainably, the Fed can reduce policy restrictions more slowly; if the labor market unexpectedly weakens or inflation falls faster than expected, it can act faster. When asked whether the current expectations and the September dot plot are still consistent, Powell said that overall, the Fed feels good about economic activity; the latest inflation is not terrible, but it is a little higher than expected; by December, the Fed will get more data, there will be another employment report and two inflation reports and many other data, and then a decision will be made in December. He emphasized that the Fed is trying to find a balance between acting too fast and acting too slow. When asked about the room for interest rate cuts in 2025, Powell emphasized that there was no prediction this time and avoided talking about personal views.

4) About the neutral interest rate and two-way risks. After a question about the neutral interest rate, Powell said that there was nothing that made him feel that he should rush to the neutral interest rate. A reporter asked, what are the specific uncertainties in the future? The first risk Powell mentioned was "moving too quickly", and then losing the good opportunity to control inflation at 2%; then he emphasized the other risk, that is, moving too slowly. In addition, he emphasized that the Fed strives to stay in the "middle", and as the policy interest rate moves closer to the neutral interest rate, the level of the neutral interest rate will be more uncertain, so it may be more cautious.

5) About the election and finance. The first reporter's question involved the election, and many questions involved how the election results and the new government's tax cuts and other policies will affect the Fed's decision-making. Powell remained cautious in front of most questions and tried to avoid excessive comments on politics and finance. However, he also mentioned some key information. For example, he explained how the Fed's "model" considers fiscal policy, emphasizing that in the short term, elections will not have an impact on monetary policy; in principle, any government policy or policy enacted by Congress is likely to have an economic impact over time; along with countless other factors, forecasts of these economic impacts will be incorporated into our economic model and will be taken into account; but it is not clear what the specific policies and possible impacts are, and it is difficult for the Fed to quantify them using the model. In addition, when discussing fiscal and economic and financial stability, Powell emphasized that the US fiscal situation is on an unsustainable path, and the debt level is not inappropriate relative to the economy; in a very large deficit, you are at full employment, and this situation is expected to continue; so it is important to deal with this problem, and it will eventually pose a threat to the economy.

6) Regarding whether Powell will continue to serve. A reporter asked if Powell would leave if Trump asked him to resign? Powell said: NO. Later, another reporter asked if the president had the power to fire or demote the Fed chairman? Powell said that such an action "is not allowed by law."

Combined with Powell's speech and the US economic and market situation, we believe that the Fed's insistence on cutting interest rates by 25BP this time can be understood from three aspects:

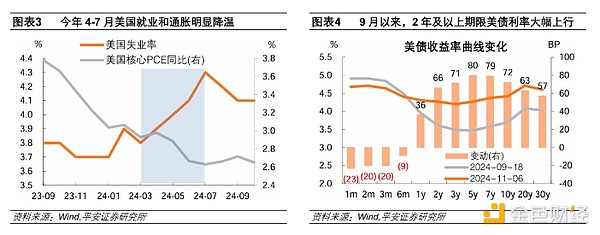

First, although the employment and inflation data announced after the September meeting have strengthened, they have not offset the progress of cooling in the previous period.The Fed's "compensatory" interest rate cut of 50BP in September is not groundless, but the result of the continued cooling of the employment market and inflation from April to July this year. Moreover, the "excess savings" of US residents turned negative for the first time in May this year, which basically coincides with the "turning point" of employment and inflation. Therefore, although the US economic data rebounded in September, it may not reverse the cooling trend of employment and inflation in the past six months. Overreacting to single-month data has never been a wise move.

Second, the Fed subjectively hopes to maintain policy inertia as much as possible.As the saying goes, "there is no turning back after starting work", the Fed's sharp interest rate cut in September, and then the economic and inflation data immediately rebounded, has been criticized for over-reliance on data and lack of foresight. Powell said in his speech that this rate cut can be regarded as "another action".

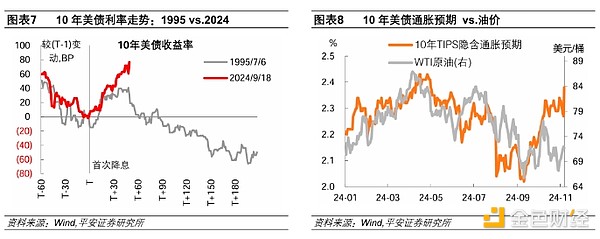

Third, the recent spontaneous rise in market interest rates has further given the Fed room to cut interest rates. Since the meeting on September 18, against the backdrop of stronger economic data and the "Trump deal" (raising medium-term economic and inflation expectations), the interest rates of US Treasury bonds with maturities of 2 years and above have risen sharply. As of November 6, the yield on 10-year US Treasury bonds has risen sharply by more than 70BP, reaching its highest level since early July this year. The spontaneous rise in market interest rates may put downward pressure on the economy and inflation in the future, and it is also a manifestation of the Fed's weakening ability to regulate market interest rates. Therefore, the Fed's insistence on cutting interest rates this time may also be based on the consideration of curbing the rapid rise in market interest rates.

In the short term, as the US economy and inflation remain resilient, coupled with the market's great concern about the upward pressure of inflation caused by Trump's new policies, US Treasury bond interest rates may remain at a relatively high level; US stock investors may tend to believe that the US economy can "digest" high interest rates and then maintain a relatively strong risk appetite; under high interest rates and a strong economy, the dollar still has its appeal, and the US dollar exchange rate may also receive good support.

However, looking ahead to the next six months to a year, the direction of policy and market interest rates is still downward. Moreover, if economic and inflation data cool down again in the coming months, the market's view on the future interest rate path may be adjusted in a timely manner.

First, the impact of Trump's new policy on the economy and inflation will not be immediate. The core provisions of Trump's 2017 tax reform bill will not expire until December 31, 2025. Although the expectation of tax policy adjustments may have a certain impact on current residents' consumption behavior, it should not be overestimated; in terms of tariffs, it will take some time for the policy to be finally implemented and take effect, and the impact on inflation remains to be seen.

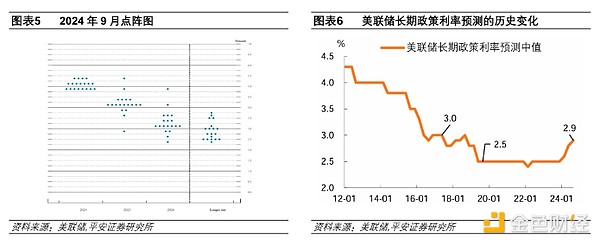

Second, the Fed still has ample room to return to a neutral interest rate from a restrictive interest rate. The Fed's long-term policy interest rate forecast will basically remain at 2.5% from June 2019 to December 2023, and roughly around 3% from 2016 to 2018; as of September 2024, the Fed's latest forecast is 2.9%, which has risen from before the epidemic. Even so, the current policy interest rate level (4.50-4.75%) is still significantly higher than the long-term policy interest rate, which means that the Fed has ample room for this round of rate cuts. In addition, there is currently a lack of substantial evidence that the potential growth rate or long-term neutral interest rate in the United States will be significantly revised upward. After 2008, the United States and major developed economies fell into a pattern of low growth, low inflation, and low interest rates ("three lows"), and the reasons behind it are extremely complex. Some of these reasons, such as long-term insufficient demand, international trade development, slow technological progress and innovation development, may change in the post-epidemic era due to changes in fiscal logic, greater attention to economic security, and the development of new technologies such as AI. However, there does not seem to be a clear turnaround in issues such as population aging, global excess savings, and the fact that it will take time for AI to be applied in the economy and society.

Finally, the risk of short-term overshoot of US Treasury bond interest rates is relatively high. On the one hand, the trend of US Treasury bond interest rates is stronger than that in 1995. The increase in US Treasury bond interest rates in the past 10 years since the first interest rate cut in this round has exceeded 70BP, which is significantly higher than the 40BP in 1995; but it is worth noting that the US Treasury bond interest rates in 1995 started to decline about one and a half months after the first interest rate cut. On the other hand, the recent US Treasury bond inflation expectations have clearly exceeded their correlation with oil prices in most periods this year. This may reflect investors' concerns about the US inflation outlook after Trump's election, but there is a suspicion of excessive concern.

Binance to list new gaming altcoin XAI on January 9th, allowing users to stake and earn through its Launchpool platform.

Alex

AlexThe SEC's upcoming vote on Bitcoin Spot ETFs signals a possible regulatory shift, potentially heralding a new era of cryptocurrency investment.

Kikyo

KikyoLogan Paul offers refunds for CryptoZoo NFTs amid legal battles and project's termination.

Alex

AlexCardano shows promising signs with bullish patterns, but short-term caution persists amid sell pressure.

Brian

BrianFed's Barkin discusses economic trends, advocating for normalized interest rates amidst uncertain inflation and a stabilizing labor market.

Brian

BrianKevin O’Leary remains optimistic about institutional crypto interest, viewing it as independent of the SEC's decision on spot bitcoin ETFs, despite regulatory challenges.

Alex

AlexAnalyst Nicholas Merten predicts Bitcoin's dominance over Ethereum, citing stagnation and lack of innovation in the ETH ecosystem.

Brian

BrianWall Street's foray into Bitcoin ETFs, led by firms like Goldman Sachs and JP Morgan, poses risks that contradict Bitcoin's foundational principles.

Brian

BrianBetter Markets CEO criticizes SEC's potential approval of Bitcoin ETF, citing fraud risks and possible investor harm

Kikyo

KikyoAn unknown entity transferred 26.91 BTC to Satoshi Nakamoto's address, stirring intrigue and speculation in the crypto community.

Brian

Brian