Author: Lucas Kiely, Chief Investment Officer of Yield App, Cointelegraph; Compiled by: Songxue, Golden Finance

Amid the Bitcoin exchange-traded fund (ETF) craze, crazy price predictions are circulating everywhere. Even if the SEC approves these ETFs, many expect a "sell the news" event to cause Bitcoin prices to drop 30% below current levels.

However, I don't think this will happen. In fact, there is a compelling argument that predictsBitcoin will rise another 10% from current levels, breaking through the $50,000 mark before easing back slightly in the short term.

Having worked in the traditional asset management industry for decades, I know that when BlackRock publicly states something, the market should pay attention. BlackRock had until January 10 to appear confident that the plan would be approved.

Indeed,the applicants have revealed key details about their products, most notably the fees they plan to charge for their ETFs. And in the ETF world, these fees are very reasonable. BlackRock intends to charge just 0.2% in fees for the first 12 months or until the fund reaches $5 billion in assets, after which it will increase fees to 0.3%. Invesco will waive fees completely for the first six months, or until it reaches a $5 billion milestone, and then charge a 0.59% fee. ARK Invest and VanEck set fees at 0.25%, with ARK waiving fees in the first six months or until the product reaches $1 billion. To put that into perspective, the largest Bitcoin futures ETF, the ProShares Bitcoin Strategy ETF, charges 0.95%.

Bitcoin ETF fee comparison. Source: Bloomberg

These disclosures make it clear thatproviders are ready and focused on asset acquisitions. Indeed, this level of competition is reminiscent of the famous fee war between providers of broad market index ETFs (particularly the S&P 500 ETF) that raged on into the early 2010s. With so much momentum and expectations, the chances of getting turned down late in the game are slim.

More importantly,The ambitious asset acquisition goals indicate that the launch of Bitcoin will bring billions of dollars in revenue to Bitcoin in a short period of time. ETF providers have conducted research and spoken to multiple clients over the past few months, so their estimates are likely the most reliable. Soif BlackRock, Invesco and ARK achieve their goals, the three of them alone could bring $11 billion in revenue to Bitcoin within 12 months.

It is entirely possible that we will see more money pouring into Bitcoin through these investment vehicles. After all, it signals recognition that Bitcoin is a legal, regulated investment asset on par with gold, which has a market capitalization more than 10 times that of Bitcoin. As a result, we expect billions of dollars to flow into ETFs, along with increased interest from more crypto-savvy investors who will access Bitcoin through exchanges. Top players like Coinbase will benefit from this increased interest, and the broader cryptocurrency market will benefit from Bitcoin's price action.

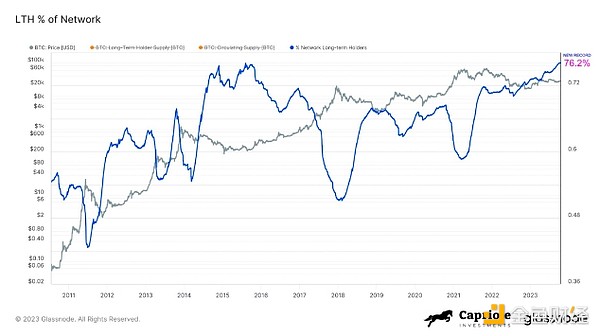

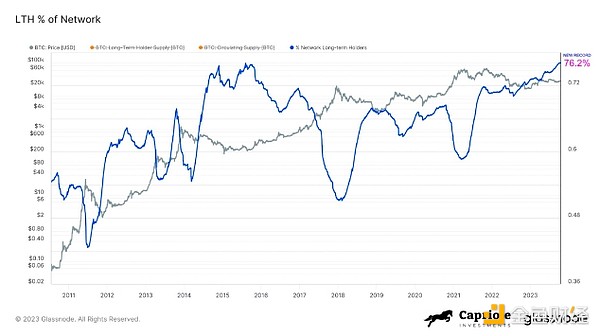

Given the tailwinds from ETF approval, I don’t expect the strong selling pressure that some are predicting. We only have to look at the current dynamics of Bitcoin investing to see that a 30% sell-off makes no sense. As of October, the proportion of Bitcoin long-term holders was 76%, an all-time high. They are not currently for sale. This is what they’ve been waiting for, with most expecting an all-time high of $100,000 or more. For them, now is simply the wrong time to sell.

Percent of long-term Bitcoin holders. Source: Glassnode

As a result, the only selling pressure will come from short-term traders whose orders have set execution prices. However, as we have seen time and time again over the past few months, these are often short-lived and merely the precursor to a price rebound. This won't be driven solely by ETFs either, as this year of course also marks the Bitcoin halving. In the past, Bitcoin has always surged to new all-time highs following these events, and there is reason to expect this year to be no different.

With all this in mind, we could easily seeBitcoin’s price surge by 25% to 30% in 2024, from current levels of $46,000 to around $60,000.

Of course, this is not to say that this rebound is without threats. With the approval of ETFs, regulatory pressure on the cryptocurrency ecosystem will only intensify, which could put downward pressure on prices. The global macroeconomic backdrop will also play a role, whether this is a positive or a negative remains to be seen. Overall, however, 2024 is a year of fear-mongering around Bitcoin. After all, this is the year Bitcoin finally went mainstream.

JinseFinance

JinseFinance