Author: Xiaoren Source: X, @MetaHunter168

Not has been on the screen recently, dominating the list of gains every day. The project itself is just a TG robot clicking game, and even the project white paper seems a bit perfunctory, with only 9 pages of standard "white paper". But this does not affect the opportunity for more people to start paying attention to the TON public chain ecosystem.

Why do I think the TON public chain ecosystem will explode? Let me first say a few conclusions. 1. More project parties will join the TON public chain ecosystem to build it. Real money rewards: The TON Foundation has put out $150 million as an incentive plan to vigorously support start-up high-quality projects. Perfect infrastructure: Based on the Telegram social product with 1.3 billion users, with built-in native wallets and DEX trading markets, a closed-loop encryption ecosystem can be completed directly in the TG community. Coupled with the public chain's efficient sharding technology, flexible smart contract platform, powerful cross-chain interoperability, and rich development tools and application ecosystems. Natural user traffic pool: With the breakthrough of Notcoin, project parties will pay more attention to Telegram's huge user base. Compared with other social platforms, Telegram users are more active, and many are loyal users of cryptocurrencies.

2. VC institutions are more willing to invest: Compared with traditional high-valuation projects, TON public chain ecological projects have actual active users and cash flow income, rather than the false prosperity of the chain. VC institutions not only focus on the potential of the project, but also on its market acceptance and user base.

3. Exchanges are more willing to list coins: Why was NOT listed by the four major exchanges at the same time? Why did NOT have a significant price inversion after Binance and EURUSD opened? It is obviously to grab users! ! ! From the perspective of listing coins on exchanges, what projects do they like most? High financing? Technology? Strong team background? NO! These factors are not so sexy in front of traffic. The most fundamental starting point for an exchange to list a project is traffic. In the face of high-quality projects in the TON ecosystem, there are not only Web3 encrypted users, but also a large amount of precious Web2 traffic. High-quality projects will rush to be listed no matter which exchange they are in front of.

Looking back at the current status of the industry:

1. False prosperity of public chain data: The real users on some public chains may not even match the fan data of some big Vs on Twitter (except for brushing fans). This is the biggest pain point of the current public chain ecosystem. Take STRK as an example. The once star second-layer public chain, which was born with the golden key of luxurious capital and awesome project team, plummeted to only a few thousand daily active users after the coin issuance. If it were not for the ecological project launching a series of pledge activities after the STRK coin issuance, it is likely that the daily active data on the chain would be terrible.

2. Low circulation, high FDV leek plate prevalence: High FDV is not only easy to create market heat, but also likely to cover up actual risks. Especially in new projects with low circulation supply, retail investors often ignore the dilution risk brought by the unlocking plan. Similarly, the funds in the market are seriously sucked by the highly controlled projects, and the entire market is like a large group friend PVP. The project side only cares about cutting, whether it pulls up or not is not important. Retail investors have already been cut by high FDV projects.

Where will the breakthrough be? Answer: Where the traffic is, there is the breakthrough. We should not let the high-sounding technical terms cover up the most basic logical truth. Whether it is Web3 or Web2, traffic is king is the eternal truth.

Data explains everything:

1. Telegram social killer: TG has 800 million monthly active users, more than 1.3 billion registered users, and more than one million new users register every day. This data is 1.4 times that of Twitter, 61% of WeChat, and 86% of Facebook. The TON public chain and Telegram have an inseparable strategic relationship.

2. Active on-chain data: According to statistics from the tonstat data website, the number of daily transactions on the TON public chain is as high as more than 6 million, the number of daily on-chain activated wallets is as high as 170,000, and the number of monthly active wallets is more than 4 million. This data is almost all relatively real user data, which instantly kills the false prosperity of many other on-chain protocols.

3. Rapidly growing TVL data: As of press time, the total locked value (TVL) of TON's chain is more than 370 million US dollars. The monthly growth rate is 85%. The public chain ranking will soon be among the top 20. Inventory of the sub-sectors of the TON public chain ecosystem: In the TON public chain ecosystem, there are 13 staking projects, 43 wallets, 8 cross-chain bridges, 114 tools and bots, 98 NFTs, 21 social, 53 gambling, 16 DEX, 97 games, 10 developer tools, 12 e-commerce, and 10 Launchpads. Looking closely at these sub-sectors, we can see that the TON public chain already has a relatively rich ecological foundation.

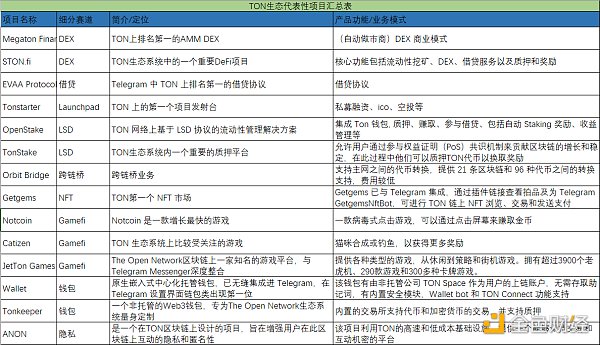

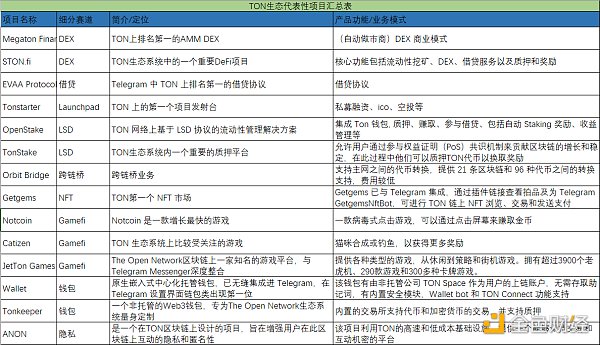

TON Ecological Segmentation Tracks with Representative Projects Summary Table)

The track that I think is most likely to come out - Gamefi

1. Low development cost: If you carefully study the TON public chain ecological game track, you will find that it is almost all small games. This entrepreneurial model has low cost, light assets, and is easy to copy. Compared with 3A-level encrypted games with long cycles and huge investment costs, project parties will prefer this feeling of light equipment.

2. Backed by Telegram's social killer: Telegram's unique advantage in the field of cryptocurrency lies in its privacy and open API, which allows developers to create various robots and applications. This openness makes Telegram an ideal platform for the promotion of encrypted game projects and user interaction. And Telegram has already mastered a huge traffic pool. As long as a crypto game project eats up 1-5% of the user market share, it will be very amazing data and benefits.

3. Fast user fission speed: With the Telegram traffic pool, the project party designs the game mechanism and combines the gameplay to do fission. Don't blindly copy and copy, the gameplay is innovative and novel. Do a good job of airdrop operation, and the 0-1 project growth and later growth flywheel can quickly fission and break the circle.

4. Telegram Mini App can naturally be combined with game products: This is a small program embedded in the Telegram application, which can be compared to the WeChat applet. Its rich extension functions can seamlessly support data storage, interactive games and transaction payments. The GameFi project can use these functions to provide a variety of gameplay and economic models, such as NFT markets, token transactions, game tasks, etc. After this set of processes, users do not need to download and install additional applications. At present, there are some bad experiences in terms of transaction speed and network stability, and the user experience is not good. There are also regulatory pressures and the degree of decentralization that have been criticized.

Thoughts and conclusions: Whether it is a project party, VC institution, exchange, or retail investor, grasping traffic is the kingly way. Where the traffic is, there are future opportunities. Whether it is Web2 or Web3, only by mastering traffic can we master the future. The story of TON public chain may just be the beginning.

JinseFinance

JinseFinance