Author: Jack

Bitcoin is heading for $100,000, but the cryptocurrency trading community is very quiet. After Trump was elected, everyone was looking forward to the influx of liquidity. However, except for the meme hype activated by Binance, all altcoins were far behind BTC. Why? Why did altcoins fall when Bitcoin rose recently, and altcoins fell when Bitcoin fell?

The answer may be in the stock $MSTR.

MicroStrategy buying Bitcoin is not a new thing in the currency circle. Since the last cycle, it has become the BTC index in the US stock market. However, in September this year, MSTR attracted the attention of the market again. This time it was because MSTR actually started in advance before the rise in Bitcoin prices, and maintained a continuous premium to Bitcoin in the subsequent market.

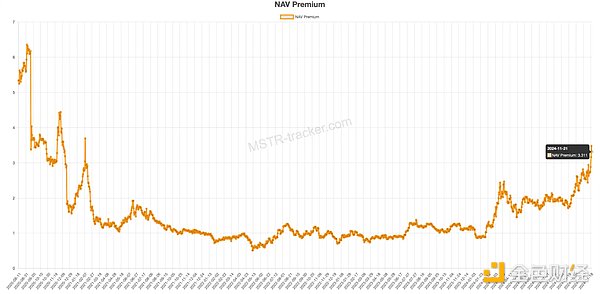

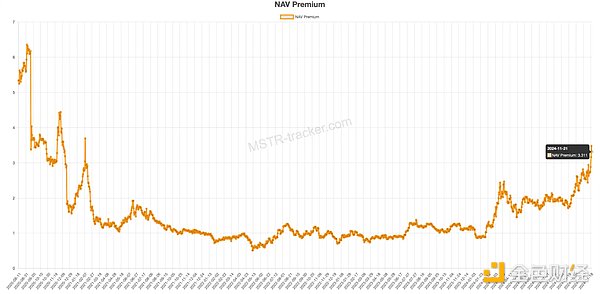

NAV premium coefficient (Net Asset Value Premium) is highly correlated with MicroStrategy's stock issuance activities. Soon after MSTR's issuance, the premium coefficient will go up. According to MSTR Tracker, the current NAV premium has reached about 3.3.

So many people began to discuss "why MSTR has a premium". In fact, MicroStrategy started a new coin buying strategy in a low-key manner in the middle and late last year, called "premium issuance".

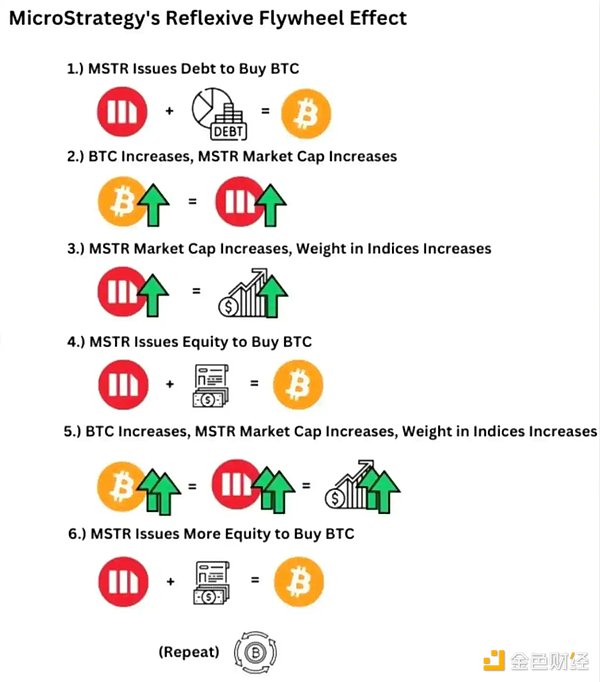

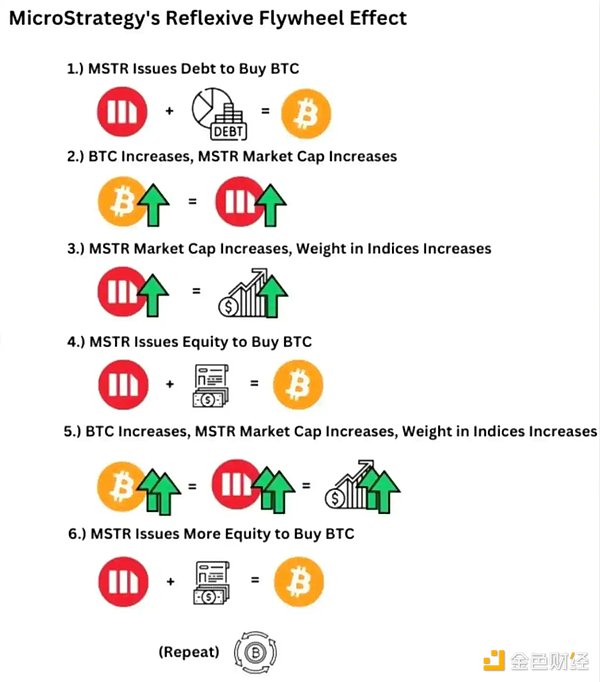

In simple terms, MicroStrategy has always raised funds to purchase BTC by issuing bonds, which means that each MSTR share represents a certain amount of BTC (which is also the reason why it is regarded as the BTC index of US stocks). However, the "premium issuance" model is simpler and more direct: when the price of Bitcoin rises and the company's market value rises, the exchange rate of MSTR to Bitcoin will have a premium.

At this time, the company issues additional MSTR shares and buys more Bitcoin than the corresponding amount of shares at a premium, so that the BTC corresponding to each MSTR share will further increase, which means that the company's market value and the value of MSTR will also increase, and then the cycle will repeat.

In a word, the more MSTR is issued, the more valuable it is.

What does this have to do with the Bitcoin bull market? In addition to the fact that MicroStrategy accounts for 5% of the total circulation, the current US stock market seems to be experiencing a Paradigm shift. MicroStrategy CEO Michael Saylor has been emphasizing this year: there will be more and more MSTRs in the US stock market, and he also called his model "infinite money glitch". At first, many people did not think so, but recently when US stock giants such as Microsoft also began to explore "Bitcoin finance", you can feel that the gears of fate have begun to turn.

In other words, if Saylor's vision continues to become a reality, more and more US stock companies will adopt the "premium issuance" of Bitcoin finance, and the price of Bitcoin will be further tied to the US stock market. And these huge amounts of liquidity will be entirely undertaken by BTC alone, and have nothing to do with other altcoins (this is one of the reasons why the inflow of Bitcoin ETF has surged recently, while Ethereum ETF has not made any waves).

It is foreseeable that if the crypto industry stops in narrative innovation and practical ability, Bitcoin will gradually drift away from Crypto. In this context, there are only two betas left in the bull market: one is Bitcoin, and the other is Solana, which undertakes the liquidity in the circle.

Catherine

Catherine