Bitcoin Depot Makes Debut as First Crypto ATM Firm on Nasdaq

The firm's price initially surged to over $6.60 in early trading before settling at $3.34.

Beincrypto

Beincrypto

Author: JamesX Source: X, @0xJamesXXX

Why do I say that Web3 is not far from Mass Adoption?

Or the end of Web3 mass adoption is actually Web2.5.

And introduce several projects and product ideas that can really help web3 achieve mass adoption.

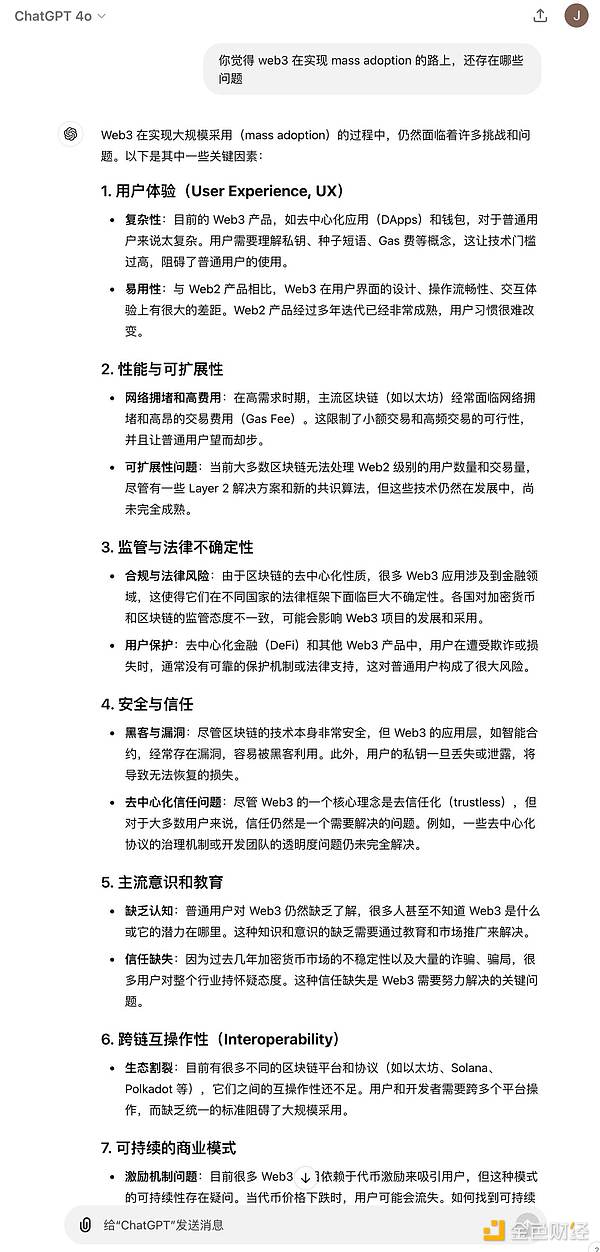

The picture below is the answer given by GPT after I asked him: "What problems does web3 still have on the road to achieving mass adoption?"

To be honest, there is nothing wrong with it, and it is basically stuck on the pain points of the industry. 3 and 5 are difficult to solve by product innovation and optimization within the industry, but the other problems are constantly being optimized and solved by teams within the industry.

Moreover, I have recently discovered several very impressive projects that have helped the web3 industry and are getting closer to the goal of mass adoption while using it and studying other research reports and data. So I will simply write this content to share with all industry practitioners.

"Connect wallet" and the experience of one wallet and one account have always been the core advantages that web3 industry practitioners feel are superior to the web2 industry.

However, this is also the biggest obstacle that prevents most users from starting to try to use the Web3 platform, because the learning threshold and risk of obtaining initial assets on the chain and using web3 wallets are too high.

Therefore, why don't we use the perspective of web2.5 to allow users to use various web3 platforms and register accounts without any web3 wallets, and at the same time, with the continuous optimization of AA wallet products, users can cross the door to the web3 world in a non-wallet/centralized exchange web3 application.

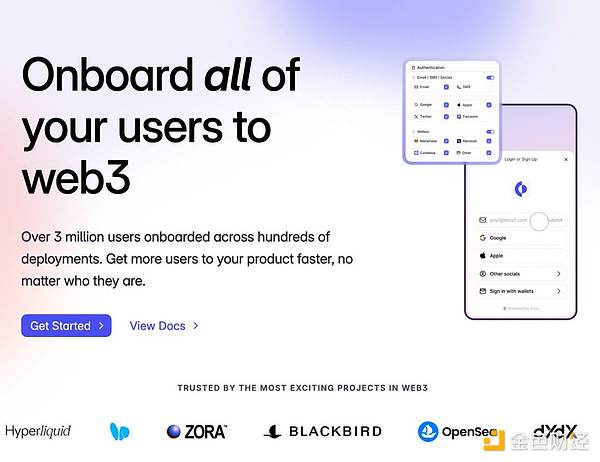

The most core product in this direction, @privy_io, supports almost all web2 and web3 account login systems, and currently has more than 3 million users.

If you are a user/practitioner who likes to try the latest web3 products, you must be amazed at how popular Privy's login/account/wallet components are in web3 products in recent months, and how smooth its experience is.

I even found some apps that have no need to interact with web3 assets at all. In order to attract high-net-worth web3 users who meet their user profiles, they are also using Privy's login component. It can be seen that web2 and web3 are not two relatively isolated industries. Once the user experience of the product is smooth enough, why do we need users to have a wallet to log in to the web3 platform?

I have a bold hypothesis for the future. There may even be a type of DeFi platform (or on-chain financial platform). Users do not need a web3 wallet at all. They can complete one-click operations from traditional payment accounts (paypal, apple pay, credit cards) to obtaining on-chain assets to depositing to the on-chain protocol. (Of course, this is inseparable from the progress of the payfi narrative that we will talk about later)

Now the various L2s of the ETH ecosystem, as well as the liquidity fragmentation problem with the Solana ecosystem, Move language ecosystem and even the BTC ecosystem with different technical architectures are a core pain point that plagues the user experience of all chains.

Recently, there is also a project that many people in the Chinese-speaking area are talking about. @dappos launched intend asset, an additional asset type that can be operated on multiple chains through asset pledge, which allows dappos to help the user ecosystem to a certain extent. It can solve the user pain points of having to pay high cross-chain costs and complex operation steps.

But I actually want to say that this is essentially a semi-centralized product model, and there is actually another role in the industry that can provide similar services, helping users to obtain an "intend asset" that can be transferred and used at any time on multiple chains by staking assets. This industry role is actually CEX.

Because: 1. The user experience of users depositing assets to Dappos for custody is not much different from the experience of you depositing assets to CEX. 2. CEX exchanges, especially the top CEXs, are actually the largest participants in cross-chain liquidity management/services. 3. CEXs have a natural desire not to let user assets be mentioned on the chain, so staking assets to CEXs and letting them help you provide an "intend asset" for you to use in the on-chain environment can help CEX keep more user assets on its own platform. 4. In the current industry context, the top CEXs have better compliance and fund management security endorsements. (CEXs that may go bankrupt and run away and those that will issue p assets are not included)

However, due to the psychological shadow left by the previous FTX bankruptcy, whether there will be a model of providing large-scale services to users in the role of CEX in this narrative direction remains to be discussed by the industry, and everyone is welcome to leave a message below for discussion. (I have foreseen that some people will think this idea is stupid)

Disclaimer: I am not saying that various cross-chain/ecological interoperability protocols & cross-chain bridges are useless, but the current experience, handling fees and security are indeed not friendly enough. I also look forward to more chain-native, decentralized, and trustless solutions in the future.

In another direction, the current multi-chain users have another major pain point, which is the multi-ecology + multi-chain wallet management system. Although all mainstream wallets are constantly providing native support for new public chain ecosystem wallets, such as OKX Wallet and Phantom, they already support multi-ecology wallet management for one account (including but not limited to EVM, BTC, Solana ecosystem, etc.), but when users transfer or receive money, they still need to open the wallet and click on the address bar at the top to find the corresponding different address strings and copy them.

Although there are various address abstraction services such as .BNB .ARB, etc. in the EVM ecosystem, and the Solana ecosystem also has its own .SOL service, users actually hope to use one product service to complete the multi-address management experience across ecosystems.

Debank provides a Web3 ID minting service, but the registration fee of nearly 100U has already discouraged me (and it requires depositing assets on Debank L2 before registering and paying the fee, which is indeed a bad user experience.

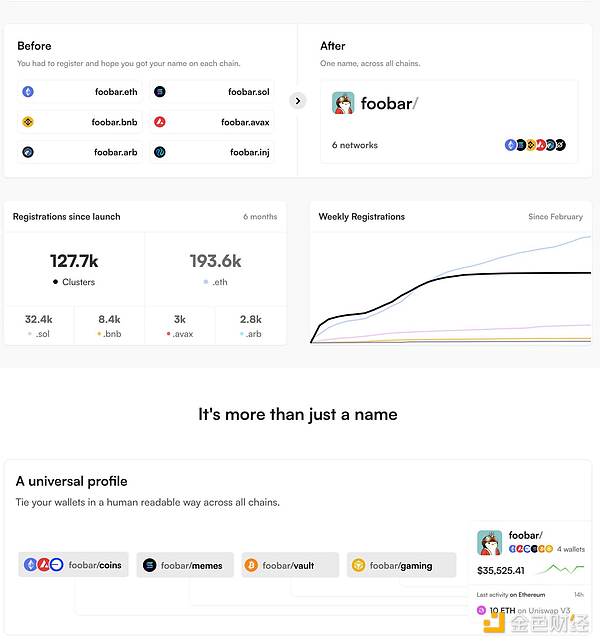

It was not until I saw another project, @clustersxyz, recently that I felt enlightened.

Cluster is an All-Chain Name Service product based on Layerzero. Its product logic is also very simple. Users need to register an account name such as "jamesx/ " and bind a main wallet. After that, they can generate a multi-chain wallet management account with one click. Later, if you want to transfer money to my sol account, for example, just enter "jamesx/sol" and the integrated application will parse it into the solana address under my account.

Currently, a "xxxx/" account will generate the corresponding addresses of 8 mainstream web3 public chain ecosystems, including /evm /sol /btc /ripple /aptos/doge/ tron/cosmos, by default.

As long as there are enough protocols integrating the address resolution of clusters accounts, this experience can be said to be very convenient (and the registration fee is currently as low as 0.01E, about 30 US dollars. Compared with the cost of registering .xxx accounts one by one and the lack of a unified management product, the cost and experience are very competitive.)

It is worth noting that: the Founder of Clusters is actually @delegatedotxyz Founder, already has sufficient industry experience and resources to help Clusters popularize faster in the industry (with Layerzero's support behind it).

So my expectation for the future is: when receiving payments, I can use any jamesx/xxx as the payment account (even the email address may become the payment address of cryptocurrency after privy's deeper product integration), and when I manage assets on multiple chains, cross-chain can be as convenient as the experience of directly transferring funds between different accounts in CEX exchanges.

Web3 Social is a topic that cannot be avoided in the end of Web3's move towards mass adoption, including the recently popular Ton/Telegram ecosystem and the Farcaster ecosystem that announced a $1 billion valuation financing this year, both of which are highly expected by the industry.

Many people think that the core essence of web3 social lies in "decentralization", "anti-censorship", "permanent storage and immutability on the chain", etc., but I don't think so.

Let's talk about the two most essential differences between web3 social and web2 social that I think many users or practitioners have not figured out.

Difference 1 (also the core difference that many practitioners have already gotten): Web3 Social essentially has the underlying conditions for creating a new type of asset.

This is actually easy for everyone to understand, because the current web3 social projects will rely on the public chain ecosystem. Once there is a public chain, issuing various assets will become extremely convenient. At first, there were NFT Gated social applications. Users needed to buy NFTs to use the corresponding social applications. Later, there were Token Gated social software. Users had to hold the corresponding tokens/NFTs to enter the corresponding communication groups. These were all assets first, and then social based on assets.

Later, everyone figured it out. I can create more value by issuing an additional asset. There are fan keys from http://Friend.tech, and there are Degen Tips token airdrops from the Farcaster ecosystem. There are also various recent projects of issuing coins from the Telegram ecosystem. They all create a new logical asset type for users of social platforms and issue them. This logic has indeed created a considerable wealth creation and breaking circle effect, allowing users to have higher expectations for Web3 Social (expectations of making money).

This is indeed something that web2 social platforms cannot do at all. For example, I cannot directly airdrop assets that can be traded in the secondary market to users of the Snowball APP, otherwise the result will definitely be even more exaggerated.

Difference 2 (a difference that most practitioners have not yet gotten): the accessibility of social data and the fundamental subversion of the logic of social application development.

In the traditional social media track, each application is actually a data island, so each social application needs its own independent account + data service system. Most platforms do not open external data acquisition interfaces. For those with external data API services such as Twitter, the data acquisition cost is also very high, so the third-party platforms that you see for Twitter account management/data services generally charge a membership fee that is not cheap to cover the data acquisition cost and make a profit.

Telegram is actually one of them, and it has opened certain data APIs to miniapp developers. However, since TG itself is an instant messaging application, data such as address books or chat messages are private data, and ordinary users will not want to open permissions to developers. Therefore, the Ton ecological reference based on TG that everyone sees can also obtain some simple user information dimensions to determine how many tokens to airdrop to you.

Telegram miniapp development documentation: https://docs.telegram-mini-apps.com/packages/telegram-apps-sdk/init-data/user

But for Farcaster, this category itself is the underlying technical architecture of Web3 social that benchmarks Twitter's open social platform logic. For developers, it is equivalent to a Twitter where all user data can be freely obtained. For example, all the public content published by your account and all the social interaction data of likes, comments and forwarding can be obtained by any developer of the Farcaster ecosystem and used as a basis to build their own social applications.

The simplest logic is that you can see that in addition to the official client Warpcast, there is also the Takocast client made by the @TakoProtocol team, the recaster client independently developed by @0xHaole, and more than a dozen client applications with completely different focuses that I have experienced.

Each one has a different interactive experience, each has a feed stream with a different recommendation algorithm, and each has its own unique features that integrate other on-chain applications. However, every user can use the same account to browse all the content in the Farcaster ecosystem through any client (although some platform algorithms will actively block some).

The logic of this application development is subversive. In the field of traditional social applications, it is completely impossible to achieve except for the situation where there are several social project teams under the same company (such as Facebook, Instagram and Threads).

To give a more direct example, assuming that the underlying layer of Twitter is built on a web3 social protocol similar to Farcaster, I can completely develop an algorithm that only recommends "Twitter Old Porn Version" that only touches the edge/pornographic content. In this client, the recommendation algorithm will only let you see content that meets this label, and the application team does not need to do "content creator" growth at the beginning, because it can directly filter and recommend the existing content data on Twitter.

This is the essence of web3 social that subverts traditional social applications the most, the developmental acquisition of user data and the convenience of ecological applications. This is why I say that BTC/ETH has built an open, anti-centralized financial operating system for the world, and protocols such as Farcaster have built an open underlying technical architecture for social, content, and identity for the world. The application ecosystem derived from it will definitely not be less than the current DeFi or the so-called "Crypto" industry.

Moreover, these logics do not rely on any tokens, and users can use them directly. Additional tokens or new asset types will only be a point of attraction for this ecosystem in the early stage.

For example, I can even make social applications without relying on your social data. I can completely make e-commerce applications, automatically recommending products and various service consumption scenarios for you based on your social data, social graph data, and even on-chain asset data.

(Of course, regarding the privacy of user data and other concerns, I believe that in the process of industry development, there will be continuous regulations and technical standards to be improved to meet the needs of more users.)

The two core logics of Web3 finance

a. Crypto assets are recognized and accepted by the mainstream market as value storage and investment targets. I won't talk about this in detail, this is also the bottom narrative of the entire Crypto industry.

b. On-chain assets are used as settlement tools/payment tools to subvert the traditional off-chain payment system

This reminds everyone to pay attention to PYUSD, which is rarely used by Chinese people. The incremental data of the US dollar stable currency issued by Paypal, the leading company in the North American payment system, I remember that it should have exceeded the level of $1 billion.

Friends with experience in living in North America also understand that once PayPal makes an effort, it will soon be able to fully roll out the payment and settlement channels of PYUSD.

And once PayFi is designed to meet offline payment needs, it must have very strong local compliance requirements (refer to the domestic digital RMB), so those who can do this business must have very strong traditional financial industry or local resources, which means it is not suitable for small developer teams (unless your business capital flow is relatively gray).

Some people will ask, is there more room for development in DeFi's financial management? I personally think that the narrative space is not large. You can see it by looking at the semi-centralized Ethena and MakerDAO's upgraded SKY. It still requires a certain centralized financial team to intervene. In the continuous growth of the industry, there will definitely be stricter compliance and regulatory requirements. On-chain DeFi is more suitable for satisfying some relatively simple and direct profit logic, such as simple lending functions (and it is over-collateralized lending).

It’s just that after companies like Paypel help users better complete the experience of depositing USD to U on the chain, the business and data of the DeFi track should have a relatively rapid growth in the short term, which can also solve the problem of high deposit threshold for users in the entire web3 industry.

Therefore, the popularization and promotion of web3 finance in the future is also a definite trend, but it is not so related to DeFi, and it is more about "On-chain Finance" supported by traditional financial companies.

So the above is my expectation for the future Mass Adoption of Web3, and I will briefly summarize it:

1. A more web2-like user login/account experience.

2. More convenient asset transfer (cross-chain) and more optimized address management experience across chains/ecologies.

3. A new social application development ecosystem spawned by the developmental web3 social underlying technology architecture.

4. Daily on-chain financial payment/settlement experience (payfi) driven by more traditional financial forces.

But looking back, do you think it is better to call them web3 or web2.5?

The firm's price initially surged to over $6.60 in early trading before settling at $3.34.

Beincrypto

Beincrypto Coinlive

Coinlive SBF believes that CZ must be happy with how it turned out for FTX.

Beincrypto

BeincryptoFew and Far, the next-generation NFT marketplace built on NEAR Protocol, has been awarded a grant by the NEAR Foundation .

Others

Others(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.) I have very few original ideas when it comes to global macroeconomic conditions. I…

Cryptohayes

CryptohayesBitbase is a cryptocurrency store and ATM company which has now decided to launch its ATM operations in Venezuela this ...

Bitcoinist

BitcoinistI regret reading the article late

链向资讯

链向资讯First, you need a cryptocurrency wallet and an accessible Bitcoin ATM nearby.

Cointelegraph

CointelegraphA crypto wallet and an accessible Bitcoin ATM are prerequisites for using Bitcoin teller machines.

Cointelegraph

CointelegraphThe evident reduction in the installation of crypto ATMs could result from the regulators' hesitance to adopt the Bitcoin ecosystem.

Cointelegraph

Cointelegraph