Written by: Deng Tong, Golden Finance

On August 11, Golden Finance reported that: According to the official blog of BitGo, BitGo and BiT Global are creating a joint venture to diversify WBTC's custody and cold storage businesses across multiple jurisdictions, and BitGo will become a minority shareholder in the new joint venture.

For a while, the topic of WBTC topped the headlines of major media in the crypto field. What exactly is WBTC? What is the specific content of BitGo's announcement? What kind of company is BiT Global? How valuable is the TCSP license? What does MakerDAO's move mean? What do industry insiders think? Golden Finance has written an article to discuss the above issues for readers.

1. What is WBTC?

WBTC, the full name is Wrapped BTC, also known as wrapped Bitcoin, is an ERC-20 token issued by BitGo on the Ethereum blockchain, pegged to Bitcoin (BTC). WBTC is one-to-one with Bitcoin. Before WBTC, the only way to use Bitcoin for financial transactions was through centralized entities, such as centralized exchanges (CEXs). WBTC was launched in January 2019 to make Bitcoin accessible to decentralized applications (DApps) on Ethereum. Today, WBTC is often exchanged on decentralized exchanges (DEXs) and used as collateral on lending and derivatives platforms.

WBTC was launched because BTC is not an interest-bearing asset. Holding BTC has no other benefits except the benefits brought by the increase in BTC prices, which is the same as gold. With the development of Defi, many lending and derivative trading projects have emerged. Many of these projects require ETH as a collateral asset, and the benefit of collateral is that there can be additional benefits, such as interest on loans. Liquidity mining, which became popular in 2019, has brought a lot of interest-bearing income to collateral operations, so the demand for BTC to enter Ethereum to participate in Defi projects to obtain interest-bearing income has emerged.

Since the launch of WBTC, the market has two concerns about WBTC:

The first is the risk of BitGo itself. Some people in the industry are worried that if BitGo uses the BTC reserves corresponding to WBTC for other purposes or loses them, BitGo will at most go bankrupt, and WBTC holders will suffer heavy losses.

The second is the Merchant. Some Merchants are highly credible, but some Merchants are much less credible than BitGo. If the Merchant first collects the Customer's BTC when buying WBTC for the Customer, then the Merchant may run away. (Merchant is a market maker, responsible for selling and recovering WBTC to ordinary users.)

Therefore, it can be summarized in one sentence: WBTC is the bridge from BTC to the Defi world.

2. BitGo's announcement

The incident can be traced back to August 9, when BitGo posted a tweet: BitGo is pleased to announce that through a unique partnership and joint venture with BiT Global, its WBTC business will shift to the world's first cross-jurisdictional and cross-institutional custody. The upgrade will take place within 60 days without interruption or disruption of service. WBTC customers will continue to benefit from the same quality of service that WBTC has provided to the community since 2019.

Jinse Finance translated the full version of the announcement released by BitGo as follows:

BitGo is pleased to announce that through a unique partnership and joint venture with BiT Global, its WBTC business will shift to the world's first cross-jurisdictional and cross-institutional custody. BitGo will become a minority shareholder in the new joint venture.

This move will enhance the security of WBTC operations by diversifying the custody jurisdictions and locations of the underlying Bitcoin, which is held in the United States. WBTC is the de facto standard for Bitcoin integration into DeFi applications on a growing number of blockchains, catering to the needs of its global users. Following the upgrade, WBTC operations will be geographically and jurisdictionally diversified, including in Hong Kong and Singapore.

BiT Global is a global custody platform headquartered in Hong Kong and operating under regulation, registered as a Trust and Company Service Provider (TCSP). This is a strategic partnership between BitGo, Justin Sun, and the Tron ecosystem, the leading blockchain that currently has the world’s largest circulating supply of USDT stablecoins totaling over $60 billion.

The joint venture will continue to use the same BitGo multi-signature technology and deep cold storage, with the only difference being the ability to distribute keys across multiple locations around the world. BitGo and BiT Global remain committed to maximum transparency and will continue to provide live proof of reserves through https://wbtc.network, one of the first continuously operating proof of reserves systems since 2019.

BitGo and BiT Global are pleased to announce this upgrade in advance, which will take place in 60 days, as both parties work together to facilitate a smooth migration of custody assets and merchants. WBTC customers will continue to benefit from the same great service that WBTC has provided to the community over the past five years, without any interruption to operations.

“It’s a pleasure for the BitGo team to work with the BiT Global team. We are proud not only of the increased trust this first-of-its-kind multi-jurisdiction service will bring, but also of the future growth it will unlock. The vast majority of WBTC usage is already in Asia, and BitGo has been actively expanding its regulated operations in South Korea and Singapore…With this collaboration, the future of WBTC has never been brighter,” said Mike Belshe, CEO of BitGo.

The content of BitGo's announcement can be roughly summarized into the following points:

WBTC business transfer, BitGo will be a shareholder in the future;

WBTC operation locations will be diversified;

BiT Global is related to Justin Sun;

The upgrade will be carried out in 60 days.

So, what does the original announcement "This is a strategic partnership between BitGo, Justin Sun and the Tron ecosystem" mean? What is the origin of BiT Global, is it reliable?

3. BiT Global, TCSP license, Justin Sun

First, let's take a look at what kind of company BiT Global is. The announcement states: "BiT Global is a global custody platform headquartered in Hong Kong, regulated and registered as a Trust and Company Service Provider (TCSP)." Apart from this, there is no more detailed information about BiT Global on the WBTC official website and BitGo's official announcement.

According to Tianyancha data, BiT Global was registered on August 9, 2023 and is located in the Hong Kong Special Administrative Region. Other information is less disclosed.

There is also little other information about BiT Global on the Internet.

Twitter @fishkiller author Feng Liu raised the question: "Does the TCSP license have gold content?" Later, he pointed out that "Anyway, the data I saw is: this license was launched in 2018, and as of September 2020, more than 7,300 licenses have been issued."

The author specifically looked up information about the TCSP license, and the following key points can be paid attention to:

According to the Anti-Money Laundering Ordinance, anyone who is operating or intends to operate a trust service business in Hong Kong must apply for a TCSP license. The TCSP license is issued by the Hong Kong Companies Registry and is generally valid for 3 years.

The applicant for the TCSP license can be an individual, a partnership, or a company. The main licensing conditions for the TCSP license are that the applicant, each of its partners (if the applicant is a partnership) or each of its directors (if the applicant is a company), and each ultimate owner are "fit and proper persons"... When determining whether a person is a "fit and proper person", the Hong Kong Companies Registry will consider any matters it deems relevant, including criminal records, whether there is a bankruptcy order or whether the company is in liquidation, etc.

From the above, it can be seen that as long as you operate trust services in Hong Kong, you must apply for a TCSP license, and the licensing conditions are not high. For a specific statement on this content, please click here for details.

As for the number of licenses issued, Feng Liu also gave detailed information: "Anyway, the data I saw is: this license was launched in 2018, and as of September 2020, more than 7,300 licenses have been issued."

Regarding the announcement that "this is a strategic partnership between BitGo, Justin Sun and the Tron ecosystem", risk management company Block Analitica Labs (BA Labs) warned of "elevated risk levels", claiming that the crypto projects involved in Justin Sun face operational and transparency issues.

In a MakerDAO forum post on August 11, BA Labs even proposed closing all new WBTC debts and blocking new borrowing with WBTC collateral in the upcoming executive vote.

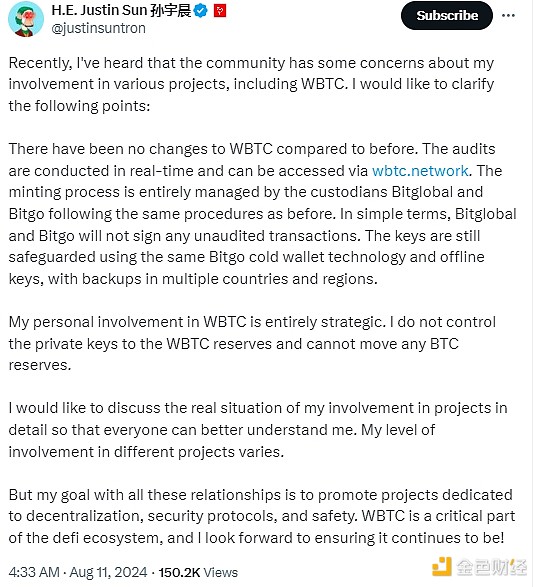

In response, Justin Sun responded on X:

Recently, I heard that the community has some concerns about my participation in various projects (including WBTC). I would like to clarify the following points:

WBTC has not changed compared to before. The audit is being conducted in real-time and can be accessed at http://wbtc.network. The minting process is managed entirely by custodians Bitglobal and Bitgo following the same procedures as before. In simple terms, Bitglobal and Bitgo will not sign any unaudited transactions. Keys are still secured using the same Bitgo cold wallet technology and offline keys, and backed up in multiple countries and regions.

My personal involvement with WBTC is purely strategic. I do not control the private keys to the WBTC reserves, nor can I move any BTC reserves.

I would like to discuss the true nature of my involvement in the project in detail so that everyone can get to know me better. The extent of my involvement in different projects varies.

But my goal with all of these relationships is to advance projects that are committed to decentralization, secure protocols, and security. WBTC is an important part of the DeFi ecosystem, and I look forward to ensuring it continues to be so!

Fourth, MakerDAO’s actions

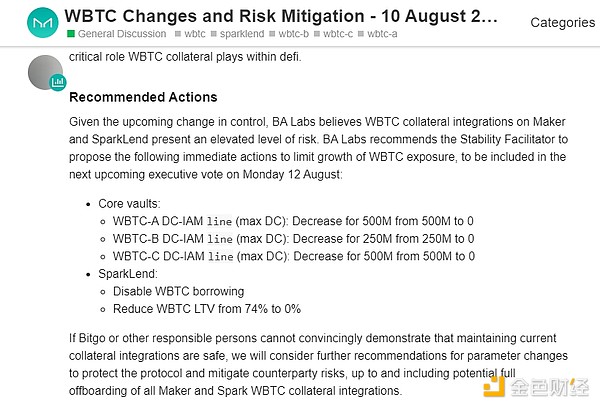

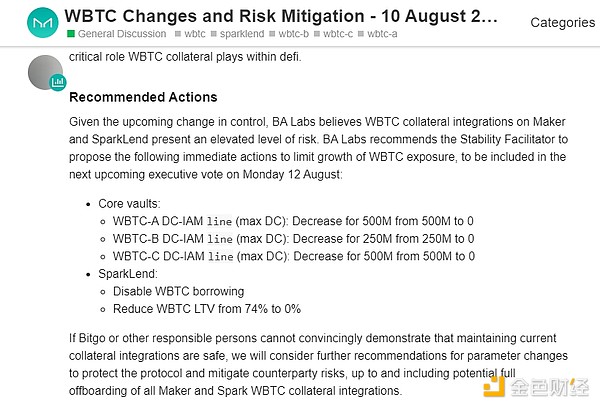

The MakerDAO governance platform shows that MakerDAO has launched a new proposal to close WBTC lending and reduce Spark’s WBTC lending ratio to 0, mainly due to the underlying asset risks after the WBTC custodian transfers authority.

According to the content released by the MakerDAO forum, the specific actions to deal with the potential risks of changes in custody rights include:

Core Treasury:

Reduce the WBTC-A DC-IAM quota (maximum guarantee amount) from 500M to 0;

Reduce the WBTC-B DC-IAM quota (maximum guarantee amount) from 250M to 0;

Reduce the WBTC-C DC-IAM quota (maximum guarantee amount) from 500M to 0.

SparkLend:

Prohibit borrowing of WBTC;

Reduce the loan collateral ratio of WBTC from 74% to 0%.

Why did MakerDAO have such a big reaction? Because the largest acceptor of WBTC is MakerDAO:

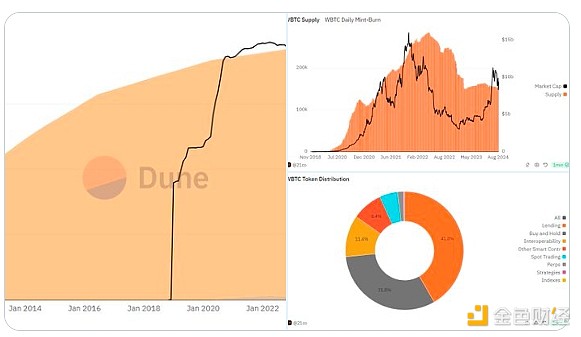

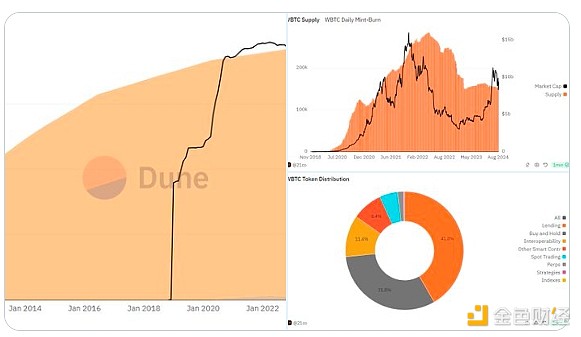

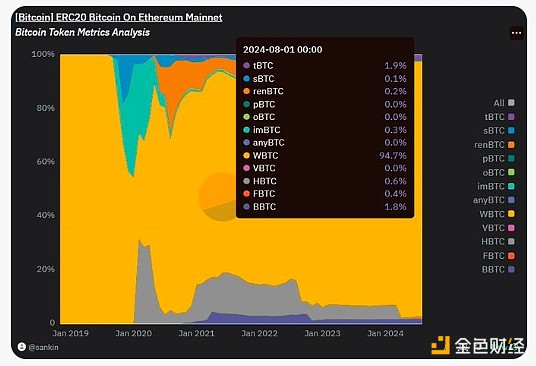

According to ai_9684xtpa monitoring, WBTC currently supports Ethereum/Base/Kave/Osmosis/Tron networks, of which Ethereum mainnet casting accounts for as high as 99.8%. As of today, 154,726 WBTC (worth US$9.45 billion) have been minted, accounting for 0.78% of the total market value of Bitcoin. According to Dune panel data, currently more than 41% of WBTC is used in the lending ecosystem, of which the largest usage scenario (acceptor) is MakerDAO, and nearly 32% is used for direct transactions.

MakerDAO’s move also illustrates its doubts about the security of WBTC: “If Bitgo or other responsible persons cannot convincingly demonstrate that it is safe to maintain the current collateral integration, we will consider further proposing parameter changes to protect the protocol and reduce counterparty risk until we completely disengage from all Maker and Spark WBTC collateral integrations.”

V. Industry insiders’ Views

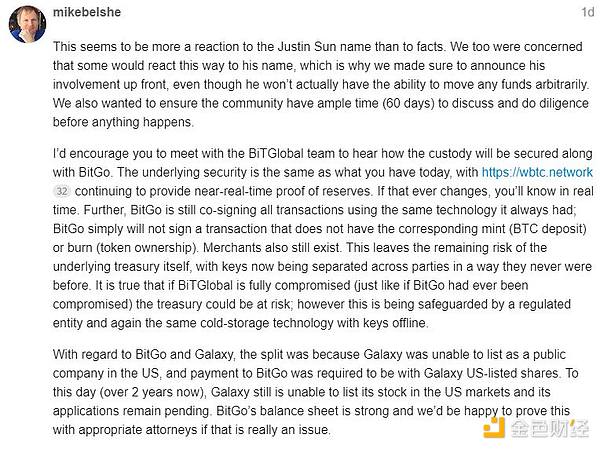

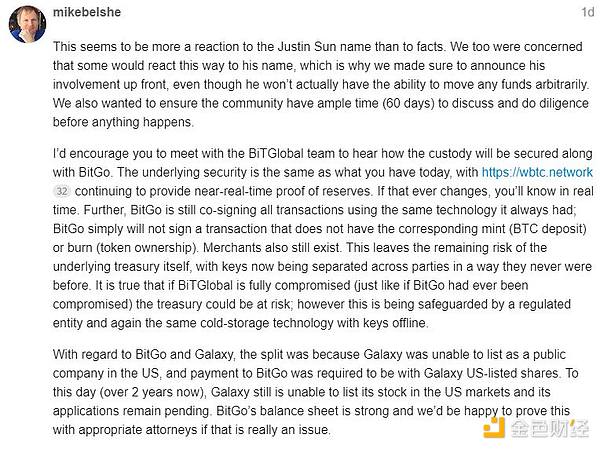

BitGo CEO Mike Belshe:

BitGo CEO Mike Belshe is trying to downplay people’s concerns, calling the controversy a “reaction to Sun Yuchen’s name, not to facts.”

Belshe said the underlying WBTC security protocols are not in danger and they will remain “the same as today.” "BitGo still uses its usual technology to co-sign all transactions; BitGo simply will not sign transactions without corresponding minted BTC deposits or destroyed token ownership." "Merchants also still exist. This leaves the risk of the underlying vault itself, and now the keys are dispersed to all parties in an unprecedented way."

Jupiter co-founder meow:

Jupiter co-founder meow published a "Letter to New and Old Custodians of WBTC" on social media, stating that "When we started the WBTC project a few years ago, we chose Bitgo as a partner because we believed that it was most critical for Bitcoin to be kept by a partner that is fully focused on custody work." "But the most important thing is that under no circumstances should the Bitcoin behind WBTC be used for any purpose. I am not going to make any judgments about Bitgo, they have indeed been an excellent custodian so far, and I believe they have the best intentions."

Meow believes that it is crucial for WBTC, the entire defi ecosystem, and bitgo/bitglobal to clarify some things immediately: "1. Who is the multi-signature holding BTC part of? 2. Will BTC be used for any purpose? 3. What are the benefits of this cooperation for both parties, and is it beneficial for TRON to adopt WBTC? 4. How does cross-jurisdiction help? 5. Is it possible to have a very respected independent party join the multi-signature group and act as a communicator and signer at the same time?

Chen Mo:

The doubts raised by the change of custody rights of $WBTC show that there is still a lack of very credible and decentralized cross-chain asset packaging solutions on the chain.

Currently the most trusted is Circle's $USDC native transmission CCTP, relying on centralized endorsement support, has performance comparable to that of CEX. Don't look at the chain abstraction and liquidity integration everywhere now. In fact, to establish security and trust, a consensus network that is no less than BTC and ETH is needed.

Waterdrip CEO Jademont:

- wBTC occupies an absolute market share on Ethereum-BTC;

- The current circulation of wBTC is 154,727 BTC. Although it only accounts for 0.78% of the circulation of BTC, it also makes wBTC one of the top 15 tokens in terms of market value;

- On May 13, 2022, the circulation of wBTC reached a peak of 285,004 BTC, and has been in a downward trend since then; from March 2023 to now, it has fluctuated between 150,000 and 170,000 BTC;

- 41.8% of wBTC is widely used for lending, and 31.8% is buy and hold.

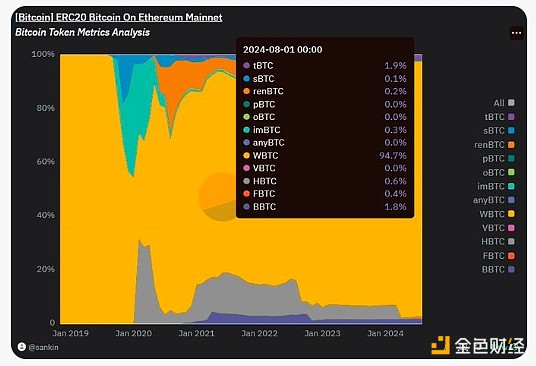

The @sankin_eth panel shows more intuitively the Ethereum-BTC market share occupied by wBTC, which is close to 95%;

The recently highly sought-after fBTC supported by Mantle is actually still very niche.

Twitter user @2040yyds:

Isn't the purpose of WBTC to be sold to the custody platform, and then to drive up and maintain the price of the coins it issues and holds?

Only a fool would take real BTC to exchange for paper Bitcoin.

Source: Golden Finance, BitGo official website, Maker DAO Forum, Bitcoin.com, CoinTelegraph, Lexology, Twitter

VI. Conclusion

Sun Yuchen's entry into WBTC has caused a stir. After BiT Global and Sun Yuchen took over WBTC, it remains to be seen whether the electronic paper gold WBTC can have a new development prospect, whether the custodian is honest in operation, and whether the BTC ecosystem will be affected.

JinseFinance

JinseFinance