Author: Arthur Hayes, co-founder of BitMEX; Translator: Deng Tong, Golden Finance

I have just finished reading Red Mars, the first of Kim Stanley Robinson's trilogy. One of the characters in the book is Japanese scientist Hiroko Ai, who often says "nothing can be done" when referring to situations beyond the control of the Martian colonists.

This sentence came to my mind when I was thinking of a title for this "short article". This short article will focus on the Japanese banks that have fallen victim to the US monetary policy of the US. What did these banks do? In order to earn a decent return on their yen deposits, they engaged in the dollar-yen carry trade. They borrowed from elderly savers in Japan, looked around Japan, and found that all the "safe" government and corporate bonds had yields close to zero, so they concluded that lending to the US through the US Treasury (UST) market was a better use of capital, because the yields on these bonds could be many percentage points higher even when fully FX hedged.

But then, when inflation appeared in the United States, the Federal Reserve (Fed) had to act. The Fed is raising rates at the fastest pace since the 1980s. As a result, this is bad news for anyone holding UST. From 2021 to 2023, rising yields produced the worst bond run since the War of 1812. What to do!

March 2023 began with the first banking disaster in the United States that penetrated the bottom of the financial system. In less than two weeks, three major banks failed, resulting in the Fed providing full backstop for all UST held on the balance sheet of any US bank or US branch of a foreign bank. As expected, Bitcoin surged in the months following the bailout announcement.

Since the bailout was announced on March 12, 2023, Bitcoin has risen by more than 200%.

To consolidate the bailout of about $4 trillion (this is my estimate of the total amount of UST and mortgage-backed securities held on the balance sheets of US banks), in March this year, the Federal Reserve announced that the use of the discount window is no longer fatal. If any financial institution needs a quick injection of cash to fill the thorny holes in its balance sheet caused by negative assets "safe" government bonds, the said window should be used immediately. When the banking system inevitably has to be bailed out by devaluing its currency and violating the dignity of human labor, what do we say? What should be done!

The Fed is doing the right thing with US financial institutions, but what about the foreigners who also bought a lot of UST from 2020 to 2021 while global currencies soared? Which country's bank balance sheets are most likely to be blown up by the Fed? Of course, the Japanese banking system.

The latest news is that we learned why the Japanese bank, the fifth largest by deposit size, is selling $63 billion worth of foreign bonds, most of which are UST.

"Rising interest rates in the U.S. and Europe and falling bond prices have reduced the value of high-priced (low-yielding) foreign bonds that Norinchukin had bought in the past, leading to widening paper losses."

Norinchu "Nochu" was the first bank to capitulate and announce that it had to sell bonds, and all the others did the same, as I'll explain below. The Council on Foreign Relations gives us some idea of the huge amount of bonds that Japanese commercial banks may be selling.

According to the International Monetary Fund's (IMF) Coordinated Survey of Portfolio Investments, Japanese commercial banks hold about $850 billion in foreign bonds by 2022. That includes nearly $450 billion in U.S. bonds and about $75 billion in French debt - a figure that far exceeds their holdings of bonds issued by other large eurozone countries.

Why is this important? Because Yellen will not allow these bonds to be sold on the open market and spike UST yields. She will ask the Bank of Japan (BOJ) to buy these bonds from the Japanese banks it regulates. The BOJ will then use the Foreign and International Monetary Authorities (FIMA) repo facility established by the Federal Reserve in March 2020. The FIMA repo facility allows central bank members to pledge UST and receive newly printed dollar bills overnight.

The increase in FIMA repo agreements indicates an increase in dollar liquidity in global money markets. You all know what this means for Bitcoin and cryptocurrencies…which is why I thought it was important to alert readers to another secret avenue for money printing. It took reading a dry report from the Atlanta Fed titled “Offshore Dollars and U.S. Policy” for me to understand how Yellen could keep these bonds from hitting the open market.

Why now?

UST started to collapse in late 2021 as the Fed hinted that it would raise policy rates starting in March 2022. It's been more than two years; why would a Japanese bank be losing money after two years of pain? Another strange fact is the consensus of economists you should listen to: the US economy is on the brink of a recession. Therefore, the Fed is a few meetings away from cutting rates. A rate cut will push bond prices higher. Then again, why sell now if all the "smart" economists are telling you relief is coming?

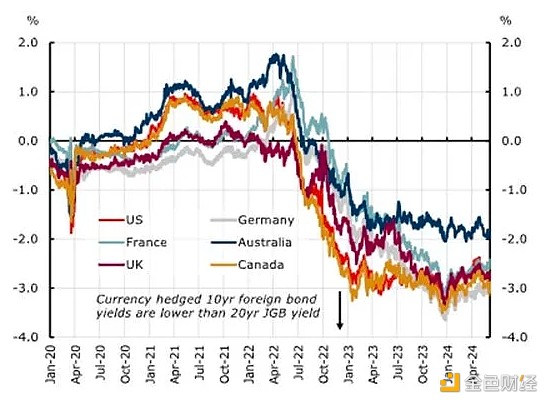

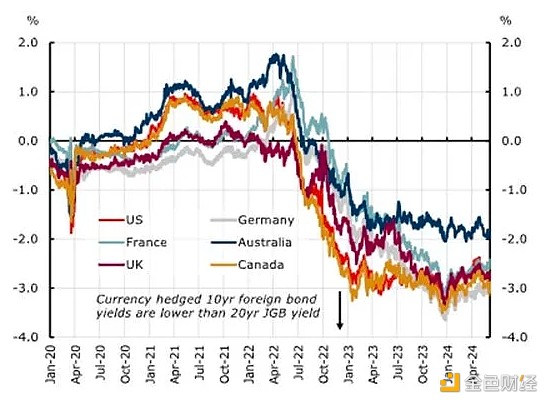

The reason is that the UST Nochu bought for FX hedging went from a slight positive carry to a huge negative carry. Prior to 2023, the difference between the USD and JPY exchange rates was ignored. Then the Fed went against the BOJ and raised rates, while the BOJ stuck at -0.1%. As the spread widened, the cost of hedging the USD exposure in UST outweighed the higher yield on offer.

Here's how it works. Nochu is a Japanese bank that has deposits of JPY. If it wants to buy UST, which has a higher yield, it must pay for that bond in USD. Nochu will sell JPY today and buy USD to buy that bond; this is done in the spot market. If that's all Nochu does, and the JPY appreciates between now and the maturity of the bond, then Nochu loses money when it sells the USD back into JPY. For example, you buy USD for 100 JPY today and sell it for 99 JPY tomorrow; the USD is weaker and the JPY is stronger. So Nochu will sell USD and buy JPY (usually three-month forwards) to hedge that risk. It will roll forward every three months until the bond matures.

Typically, 3m tensors are the most liquid. This is why banks like Nochu use rolling 3m forwards to hedge 10-year currency purchases.

With the Fed’s policy rate higher than the BoJ, the USDJPY spread widens and the forward points turn negative. For example, if spot USDJPY is 100, and USD yields 1% more than JPY next year, the USDJPY 1-year forward should trade around 99. This is because if I borrow 10,000 JPY at 0% to buy 100 USD today, and then deposit 100 USD to earn 1%, I will have 101 USD a year from now. What is the USDJPY 1-year forward price to offset the 1 USD interest income? ~99 USDJPY, which is the no-arbitrage principle. Now imagine that I did all of this to buy UST, which only yields 0.5% more than JGB of similar maturity. I am essentially paying a negative 0.5% carry to hold this position. If that were the case, Nochu or any other bank would not enter into this trade.

Back to the chart, as the spread widens, the 3m forward point becomes so negative that the UST bond FX hedged yen yields less than just buying yen-denominated JGBs. This is what you see starting in mid-2022, with the red line representing USD crossing below 0% on the X-axis. Remember, a Japanese bank buying JGBs in yen has no currency risk, so there is no reason to pay the hedging fee. The only reason to do this trade is when the FX hedge yields >0%.

Nochu is in a worse spot than FTX/Alameda Polycule participants. UST purchased in 2020-2021 are most likely down 20%-30% at mark-to-market. Additionally, FX hedging costs have gone from unacceptable to over 5%. Even if Nochu believes the Fed will cut rates, a 0.25% rate cut will not reduce the cost of hedging nor increase the price of the bonds to stop the bleeding. Therefore, they must dump UST.

Any scheme that allows Nochu to pledge UST in exchange for new dollars will not solve the negative cash flow problem. The only thing that would turn Nochu around from a cash flow perspective would be a significant reduction in the gap between the Fed and the Bank of Japan's policy rates. So, in this case, using any Fed scheme (such as the Standing Repo Facility that allows US branches of foreign banks to repurchase UST and MBS with newly printed dollars) will not help.

As I write this, I am racking my brain to think of any other financial shenanigans Nochu could pull that would allow it to avoid selling the bonds. But as I mentioned above, the existing schemes that help banks lie about unrealized losses are some kind of loans and swaps. As long as Nochu owns the bonds in some way, shape or form, the currency risk remains and must be hedged. Only by selling the bonds can Nochu unwind its FX hedge, which will be costly. That is why I believe Nochu's management will explore all other options, and selling the bonds is a last resort.

I will explain why Yellen is upset about this situation, but for now, let's turn off Chat GPT and use our imaginations. Is there a Japanese public institution that can buy bonds from these banks and store USD interest rate risk without worrying about bankruptcy?

Who?

It's the fucking Bank of Japan.

Bailout Mechanism

The Bank of Japan is one of the few central banks that can use the FIMA repo facility. This allows it to obscure UST price discovery in the following ways:

The BoJ has blandly "suggested" that any Japanese commercial bank that needs to exit should not sell UST on the open market, but instead dump those bonds directly onto the BoJ's balance sheet and receive the current last traded price without affecting the market.Imagine that you could dump all FTT tokens at market price because Caroline Elison can support a market of any size necessary. Obviously this wouldn't work well for FTX, but she's not a central bank with a printing press. Her printing press only printed $10 billion of customer funds at most. The BoJ's trading is unlimited.

Then, the BoJ exchanged the UST for dollar bills that the Fed printed out of thin air through the FIMA repo facility.

It’s that easy to sidestep the free market. Man, that’s freedom worth fighting for!

Let’s ask a few questions to understand the implications of the above policy.

Someone is definitely losing money here; the bond losses due to rising interest rates are still there.

The Bank of Japan is still materializing the bond losses because they sold the bonds to the BoJ at current market prices. The BoJ is now exposed to UST duration risk. If the price of these bonds falls, the BoJ will have unrealized losses. However, this is the same risk that the BoJ currently faces with its multi-trillion yen portfolio of Japanese government bonds. The Bank of Japan is a quasi-governmental entity that cannot go bankrupt and does not have to comply with capital adequacy ratios. It also does not have a risk management department that would forcefully reduce positions if its VaR rises due to large DV01 exposure.

As long as the FIMA repo exists, the Bank of Japan can roll over the repo every day and hold the UST until maturity.

How does the supply of dollars increase?

The repo requires the Fed to provide dollars to the Bank of Japan in exchange for UST. This loan is made daily. The Fed obtains these dollars by using the printing press.

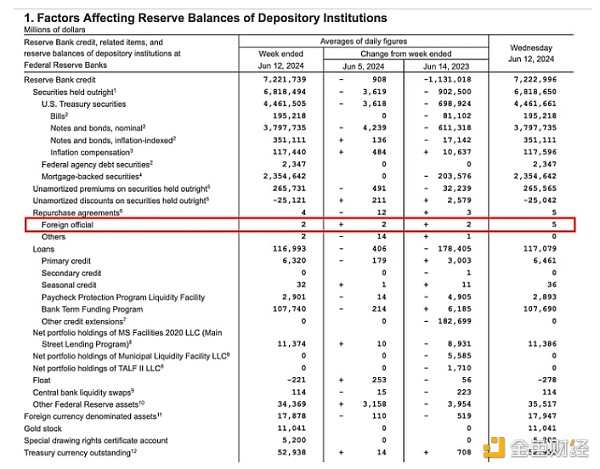

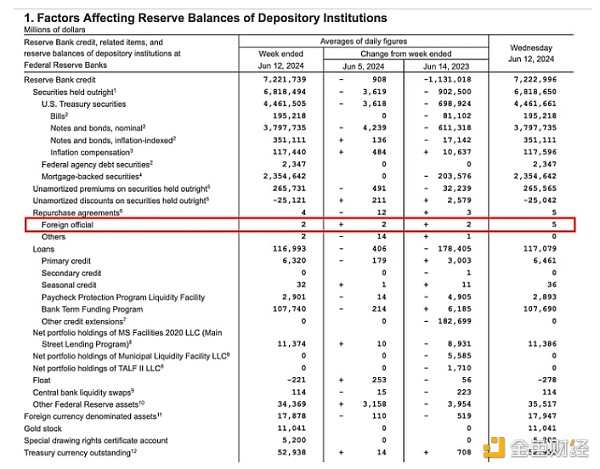

We can monitor the dollars injected into the system on a weekly basis. The line item is "Repo - Foreign Officials".

As you can see, the FIMA repository is very small at the moment. But the sell-off has not started yet, and I guess there will be some interesting phone calls between Yellen and BoJ Governor Ueda. If I'm right, the number will go up.

Why help others?

It is well known that Americans are not very sympathetic to foreigners, especially those who can't speak English and look interesting.

Faced with potential xenophobia, Yellen came to the rescue because without new dollars to absorb these shit bonds, all the big Japanese banks would follow Nochu's lead and sell off their UST portfolios to ease the pain. This would mean $450 billion worth of UST would be quickly released to the market. This cannot be allowed because yields would soar and make funding for the federal government extremely expensive.

In the Fed's own words, this is why the FIMA repo facility was created:

In March 2020, during the "rush for cash", central banks simultaneously sold US Treasuries.

And parked the proceeds in overnight repurchase agreements at the New York Fed. In response, the Fed offered in late March to agree to provide overnight advances to central banks using US dollars.

The New York Fed is holding US Treasuries as collateral at an interest rate above private repo rates.

Such advances will allow the central bank to raise cash without forcing an outright sale of securities.

The Treasury market is already tight.

Remember September-October 2023? During those two months, the UST yield curve steepened, causing the S&P 500 to fall 20%, and the yields on 10-year and 30-year USTs exceeded 5%. In response, Bud Gur Yellen switched most of the debt issued to short-term Treasuries to drain the cash in the Fed's reverse repo program. This stimulated the market, and starting on November 1, a race began for all risk assets, including cryptocurrencies.

I am very confident that in an election year, when her boss is facing a crushing defeat at the hands of the “Orange Man” felons, Yellen will do her “democratic” duty and ensure that yields remain low to avoid a financial market disaster. In this case, all Yellen needs is to call Ueda and instruct him not to allow the Bank of Japan to sell UST on the open market and that he should use the FIMA repo facility to absorb the supply.

Trading Strategies

Everyone is highly focused on when the Fed will finally start cutting rates. However, assuming the Fed cuts rates by 0.25% each at the next meeting, the USD/JPY spread is +5.5% or 550 basis points or 22 rate cuts. One, two, three or four rate cuts in the next twelve months will not materially lower the spread. Moreover, the Bank of Japan has shown no willingness to raise its policy rate. At best, the BoJ is likely to slow the pace of open market bond purchases. The reasons why Japanese commercial banks must sell off their FX-hedged UST portfolios have not been addressed.

That’s why I’m confident in a quick transition from Ethena collateralized USD (sUSDe) (yielding 20-30%) to crypto exposure. Given this news, the BoJ has no choice but to exit the UST market. As I mentioned, in an election year, the last thing the ruling Democratic Party needs is a big rise in UST yields that would affect the big financial concerns of their median voter. Namely mortgage rates, credit card rates, and auto loan rates. These will all go up if Treasury yields climb.

This situation is exactly why the FIMA repo facility was established. All that’s needed now is for Yellen to firmly insist that the BoJ use it.

Just when many were beginning to wonder where the next shock to USD liquidity would come from, the Japanese banking system dropped an origami crane consisting of neatly folded USD bills into the lap of crypto investors. This is just another prop for the crypto bull market. The USD supply must increase to maintain the current filthy USD-based financial system.

Dante

Dante