Source: Liu Jiaolian

Just when BTC (Bitcoin) was about to rise, breaking through the resistance line of the upper edge of the wedge (about $70,000) and occupying the position above $72k, the bears suddenly made a comeback and beat the bulls back to the wedge below $70,000. The bulls' breakout failed. The bears' confidence is roughly based on the following points: one is the approaching US tax season; the second is the Fed's tightening policy; the third is the sluggish inflow of ETFs and the expansion of outflows.

As for the question from some readers: Will there be a sharp drop before and after the halving (guess a 40% retracement is considered a sharp drop?), in fact, pure on-site speculation may not be enough to produce such a large amplitude, and external black swan events are rare (it sounds like they are looking forward to a black swan!).

The above figure shows the waterfall chart of the retracement in the second halving, the third halving and the current halving. As can be seen from the figure, the 2021 bull market cycle we have just experienced is actually a more "painful" cycle than the previous and the later ones - if we link the retracement amplitude with the degree of "pain".

In the last halving cycle, we actually experienced two black swan "plunge" shocks, one was "312" in 2020 (retracement of more than 60%), and the other was "519" in 2021 (retracement of more than 50%)! How "lucky"!

The retracement is an expression of the fragility of leverage. When selling causes prices to fall. The price drop causes leverage to be forced to close positions. The forced closing of leverage causes more selling. More selling causes price collapse. Such a feedback loop, chain reaction, causes price avalanche.

This halving cycle has been gentle so far. The maximum retracement is no more than 25%.

The common leverage ratios in the market are 2x, 3x, 5x, and 10x. To blow them up, you need to retrace more than 50%, 33%, 20%, and 10%, respectively. A 10% retracement and a 10x leverage blowup should be commonplace. A 20% retracement and a 5x leverage blowup should come from time to time to lighten the burden. A 33% retracement and a 3x leverage blowup should be seen occasionally, like the sword of Damocles hanging high. A 50% retracement and a 2x leverage blowup are rare, and it has been encountered twice in a halving cycle in 2020, which can be regarded as "historical".

The phoenix is flying on the Phoenix Terrace, and the phoenix leaves the terrace and the river flows by itself.

The flowers and plants of the Wu Palace buried the secluded paths, and the clothes and hats of the Jin Dynasty became ancient hills.

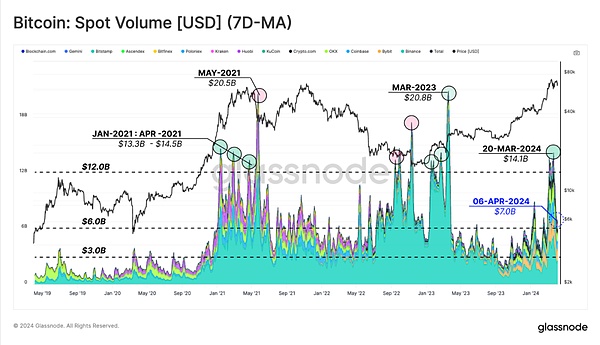

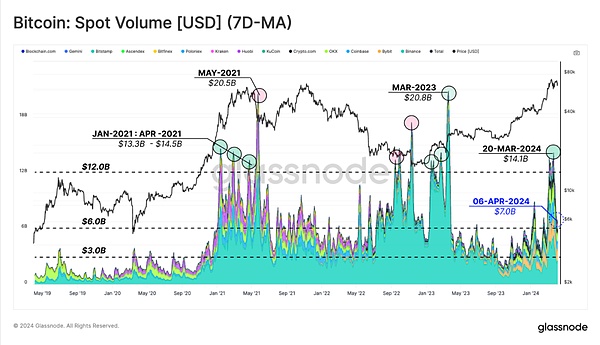

Looking back at the BTC spot volume and price chart since 2019 (as shown below), there is so much history to be learned.

From the volume and price chart, it can be seen at a glance that the trading volume will increase at the top of the bull market and the bottom of the bear market, and the trading volume will decrease during the bull market recession and the bear market recovery period.

Price is a leading indicator of trading volume. The price moves first, and the trading volume follows half a beat later.

At the beginning of the bull market, there was no volume increase. When the price rose to the point where most people began to react and rushed in to make a profit, the bull market basically reached its peak. So those who rushed in after realizing it took over at a high position and then got stuck.

The reason for the no volume increase is that the sellers were reluctant to sell at a low price and did not release too many chips. The buyers have accumulated sufficient food and grass, and suddenly actively buy. They don't need to buy too much, and they pull the price up.

Pulling up and increasing the volume means the top has been reached. It's not because people who see the wind rush in, but because the coin hoarders who are late to the party begin to be awakened, and they take advantage of the high price to "reduce their positions" and ship a large number of goods.

When the bull market just ended, there was a decline in volume. When the price fell to the point where most people cut their losses and left, the bear market basically bottomed out. Those who held on to the end finally couldn't bear it anymore. The slower they ran, the lower they cut, and the more they lost.

The reason for the decline in volume is that after the buyers took over at the top of the bull market, they used up their purchasing power at the high price, ran out of ammunition and food, and were unable to stop the sellers from selling. The seller only needs to sell a little bit to drive the price down a foot.

The decline in volume means the bottom has been reached. Because at the lowest price and the biggest loss, most people finally couldn't bear it and finally cut their losses. And their selling at this time, because the price is too low, the lethality is very limited.

From the color layered chart, you can see the rise and fall of each platform.

The largest area of turquoise tells us that Station B is obviously the one that benefits the most from the bull and bear market in 2021-2023. The disappearance of purple depicts the withdrawal and decline of Station H. A generation of ups and downs, the past is gone.

At the end of 2023, as the US iron fist hit the leading Station B hard, the previously tepid Station O, Station Bb, and the US-compliant Station C began to expand their color areas, and one grew while the other fell. It's really one after another.

Platforms are easy to fall, but BTC will last forever.

JinseFinance

JinseFinance