Author: @EmanAbio; Plain Language Blockchain

The crypto market performed strongly in September, with the leading Bitcoin rising by more than 10%.At the same time, Sui, known as the "next Solana", saw its market value increase by 132.2%, ranking 13th and becoming the focus of recent attention.

With the halo of the former star project Libra, Sui's five co-founders are all former Facebook experts in different fields. Compared with Aptos, which is also the successor of Libra, the team seems to be stronger. About the team story and birth process of Sui, its co-founder Adeniyi Abiodun recently made a detailed sharing.

The following is the main text:

Imagine: Your wife is giving birth, and the first baby is about to be born, but you are spending all your savings and risking money on a startup project. Would you do this? I did, and this decision changed everything for me. This was the turning point in my life that eventually brought me together with some of the best minds in the industry to found Mysten Labs and build Sui. Let me tell you my story first, then Sui’s.

01 Background

In 2012, I was working in the financial industry. Life and work were very routine back then, and I could tell you every detail from waking up in the morning to leaving get off work. I knew what I was going to do, which bus I was going to take, who I was going to meet, who would be in front of me when I sat down, what I would write, how I would test, how I would review my code, and even what the traders would say about my new improvements before I went home. It was all too predictable.

For me, the certainty in life was boring. I was craving something uncertain, something to challenge myself, or at least something that would give me a sense of growth. It was at this time that I discovered Bitcoin.

I first read the Bitcoin whitepaper (pictured above) from a colleague and initially thought it was a bit of a scam and didn’t think there was much to see. It wasn’t until I looked at the code and re-read the paper that I thought, “Wow, this is incredible, this is great!” The concept of decentralized assets really struck a chord with me. It wasn’t just about mining, it was a bigger vision, Bitcoin showed me that robust assets could exist outside of the traditional financial system.

I first read the Bitcoin whitepaper (pictured above) from a colleague and initially thought it was a bit of a scam and didn’t think there was much to see. It wasn’t until I looked at the code and re-read the paper that I thought, “Wow, this is incredible, this is great!” The concept of decentralized assets really struck a chord with me. It wasn’t just about mining, it was a bigger vision, Bitcoin showed me that robust assets could exist outside of the traditional financial system.

So I started buying Bitcoins and mining them myself. I built my own mining farm at home, and over time I realized there was a demand in the market and started offering mining services to others, and then people started paying for it. Until one day my wife asked me to move the machines out of the house because there were no more empty rooms. The house was full of mining machines running non-stop. So I started renting space in data centers and ended up building my own mining company. Of course, all this happened naturally.

But eventually, I made the decision to go all in.

Imagine you’re in the hospital, your wife is in labor, and you have to admit that you just spent all your savings on Bitcoin mining machines. That was my reality, and that moment could have gone differently. I was nervous and anxious, but also hopeful. I knew it was risky, but I believed that cryptocurrencies could change our lives. My wife was, of course, mad, but I assured her that it was an investment in our future. I learned that it’s important to make calculated risk decisions and pursue your dreams, even if it means facing uncertainty and possible failure.

So, I used the money to buy mining machines, put them in data centers, and people paid to rent my machine time, and I charged them a fee for the bitcoins they mined. Most of my orders came from the United States, and my largest supplier was also in Texas. So considering how much I was spending on suppliers and how much I was making from the United States, it made sense to go there to grow my business.

So I got on a plane to the United States. It was supposed to be a temporary six-month move to work with suppliers while waiting for the mining machine to go into production, but it ended up being a permanent settlement. Of course, this wasn't the first time I had to move to a new place suddenly and adapt to new surroundings and new people.

02 Nigerian kid with an Aberdeen accent

Let's go back to the beginning of it all.

I was born in Nigeria and lived there until I was eight years old. At that time, my father was studying for a PhD in economics, so our family moved to Aberdeen in the east of Scotland, where he was studying for his PhD (my brother later followed the same path). As a result, I have a strong Aberdeen accent - which is strange, you know, a child from Nigeria speaking with a Scottish accent, it's really strange.

After my father completed his PhD, we moved again, this time to England. He started working, but soon made a bold decision - he quit his job and became a full-time pastor to serve God. It made me realize that everything is possible, and you don't have to be limited to the choices you have made before.

As for my mom, she was a natural entrepreneur, always investing in business and real estate. To be honest, she was probably the best negotiator I’ve ever met. When she went to the market, she would negotiate to the point of embarrassment and always get what she wanted. She never took no for an answer… I may have inherited some of that from her, but definitely not as much as she did.

It wasn’t always easy – moving, adapting to new environments, and seeing my parents take the leap. But looking back, I wouldn’t change a thing. My parents were a huge inspiration to me throughout it all: How boring it is to live in predictability.

As you can see, when I was a kid, I kept moving around and eventually studied at Queen Mary University. But to be honest, I had no interest in studying at all, and only wanted to play games and have fun. It wasn’t until I needed to take an exam that I realized how little I had learned.

As you can see, when I was a kid, I kept moving around and eventually studied at Queen Mary University. But to be honest, I had no interest in studying at all, and only wanted to play games and have fun. It wasn’t until I needed to take an exam that I realized how little I had learned.

I noticed that my old friends had no future, some went to jail, some got involved in all kinds of shady things. I thought, this is not the life I want, especially since my parents are African, I am doomed.

So I decided to change, studied hard, and finally barely got into Queen Mary University. After I enrolled, I took a one-year introductory course to think about my future direction. I was interested in astrophysics, but gradually I realized that I needed to do something more practical. Theory is good, but I prefer things that can be practical.

So I gave up astrophysics and switched to electronic engineering and computer science. Here, my passion for computers, programming, and software development really began to grow.

After graduation, I developed software and hardware for a startup to remotely monitor oil and gas production. Later I switched to finance and started building trading systems and risk management systems. While working at JP Morgan and HSBC, building these systems was fun, but gradually it became boring.

As I said, it was all too predictable. I could tell you what to do from the moment you wake up in the morning to the moment you leave. And I couldn’t see my long-term value and where I could make a big impact. I didn’t want 1% improvement, I wanted 100x change, achievements that I could talk about over and over again and be proud of.

So, moving to the US for the Bitcoin mining company was a blessing for me because I realized that the technology Bitcoin pioneered was more than just peer-to-peer cash, it had the power to change the way our world works. I began to see the bigger picture.

03 Finding Clarity Through Burnout

After spending some time in the Bitcoin mining space, I felt a little disappointed because it didn’t seem like we were making much progress with Bitcoin. Mining was just one of them, what else could we do?

Because I had a background in the corporate world, especially working for big banks, I began to feel that blockchain technology could be the key to solving enterprise problems. So, I decided to bring blockchain technology to the enterprise. These experiences led me to work at Oracle and VMware, a software company focused on cloud computing. Joining VMware was a new challenge for me. They were developing a blockchain-based enterprise solution, but progress was slow and there were almost no other products, only algorithms.

We needed to build new products, launch them to the market, sell them to enterprises and customers, and try to catch up with companies that were established earlier than us, such as IBM and Oracle. This put me under a lot of pressure.

I knew that things were changing fast in the crypto industry and I had to launch products quickly because I knew that failure didn't feel good. I didn't want to fail because I didn't give it my all. I couldn't accept that the reason for failure was that I didn't work hard enough.

04 Lessons on Competitiveness and Burnout

To make matters worse, I have always been a very competitive person. Whether I was playing football, basketball or playing video games, I always wanted to win. For me, a real win is a big win. I don't want to beat you 1-0 in FIFA. I have to win 6-0. The margin of victory must be obvious to be satisfying, right?

So I took on a lot of responsibility in a short period of time because there was just too much work. I found myself doing marketing, engineering, product, and all that, with a lot of travel and meetings, which was a lot for one person, but I was very motivated.

I kept telling myself and the team, "We have to be the best because we're behind and we have to get this product out as soon as possible." I worked 20 hours a day, seven days a week. I was working on my way to the office and on my way home, and I was working with people in different time zones. I felt unstoppable.

But I soon realized that the real problem wasn't the technology, which we could fix, but the ownership problem. Each company wanted to own the infrastructure they needed, which made it difficult to build good partnerships. Every company wanted a piece of the pie, and no one wanted to work together for a common goal. So I experienced my first burnout, which felt like I was hit by a truck. I was completely burned out in six months.

This experience taught me that failure can't be viewed as a short-term thing. We need to focus on the long term, and this is what we have always followed in the Sui team. We are not just looking for quick wins, but building a truly decentralized Internet.

This is not just a 1% improvement, but a 100x improvement. I hope this is something I can tell again and again and be proud of. But it also requires a team that also pursues 100x results, and it all started with Facebook's Libra project.

05 Meet the 100x Team

After experiencing professional burnout at VMware, I came to Facebook.

At Facebook, I started working on a project called Libra, which is very ambitious. Facebook has formed a consortium with the goal of building a global digital currency and payment system. What attracted me to Facebook was that they could achieve teamwork that we could not achieve in our previous jobs: at Facebook, everyone can work together around a common goal.

While the “launch problem” I saw with Oracle and VMware still exists, I feel like Facebook has solved it with the Libra and Diem alliance, and their commitment to building this infrastructure for the world.

Our goal is to make transferring money online as easy as sending an email. We see this as a public good that can really help the world. Honestly, after what I’ve been through, working at Facebook feels a lot easier, and the environment is completely different.

Our goal is to make transferring money online as easy as sending an email. We see this as a public good that can really help the world. Honestly, after what I’ve been through, working at Facebook feels a lot easier, and the environment is completely different.

Sponsored Business Content

Facebook has assembled one of the best research teams I’ve ever seen. The team includes professors from Stanford, outstanding computer scientists, and smart people from all over the world.

I’ve had great experiences working with both David Marcus and Kevin Weil, and everyone is very passionate about achieving our goals, and the team atmosphere is great.

However, even with all these great people, we still face great challenges. The biggest problem is that many people are skeptical about Facebook launching a new financial system due to their past problems with public trust and data privacy.

Think about it, if you woke up tomorrow and found that 2 billion people had accounts in the "Bank of Facebook," it would be the largest bank in the world. That would be scary for any country.

The public generally thought, "I don't trust Facebook because it's a monopoly."That's the problem we were trying to solve: How do you build trust on top of distrust? As a result, Libra didn't work. In retrospect, we probably underestimated the pressure from Congress on Facebook. However, I really think Zuck and David Marcus should be praised for daring to try something that others didn't dare to do.

At the end of the day, Facebook's failure gave other companies like PayPal, Visa, Circle, and others an opportunity. Their investment in Libra and subsequent cancellation of the project actually opened the door for others, and I think they should be praised for that.

It was really sad to see this great team fail because of external factors. It was the best team I've ever worked for, and I had no idea what to do next.

06 A great team without a plan

Sui's five co-founders

I would also like to say that Libra's failure also contained the seeds of success for me personally.Without that failure, I would not have had the opportunity to work with those great people who eventually came together to create Mysten Labs and subsequently launched Sui.Looking back on my time at Facebook, one thing that stands out to me is how shocked I was by Evan and his team. Evan is an outstanding leader and a great visionary.

Evan

Evan

Evan is one of the main innovators of LLVM, the technology that powers most iPhones and countless other devices we use every day. It was a game-changer in the tech world, and his work earned him the prestigious ACM Computer Science Award, which is also given to many top computer scientists.

He leads the R&D team at Facebook, and his team members are like mad scientists, creating all kinds of things we use every day. So when the opportunity to work with Evan and his team came up, I jumped at it immediately, and the experience also led to friendships with my future Mysten Labs co-founders.

Evan and I got together because there seemed to be no end to the delays in the launch of Libra/Diem. He asked, “If we were to start a company, who would you want to work with?” He asked the same question to the other founding team members. The answers were unanimous, which was obviously destined to happen. Sam Blackshear is one of Facebook’s top engineers, and the Move programming language is his idea. This guy is a genius.

Left: Sam Blackshear; Center: Evan; Right: Adeniyi Abiodun

Left: Sam Blackshear; Center: Evan; Right: Adeniyi Abiodun

Next up is consensus expert George Danezis.

Facebook actually acquired his company Chainspace to help build Libra, which is enough to prove his ability.

Facebook actually acquired his company Chainspace to help build Libra, which is enough to prove his ability.

Finally, it was Kostas ‘Kryptos’ Chalkias, and what he came up with was truly astounding.

At Facebook, he was the go-to person for all things crypto, and he developed many of the cryptographic algorithms used in WhatsApp, one of the most widely used apps in the world.

At Facebook, he was the go-to person for all things crypto, and he developed many of the cryptographic algorithms used in WhatsApp, one of the most widely used apps in the world.

We had a conference call together, and the names mentioned were exactly the same. So we said, “Let’s just do it!” There was no debate about roles and responsibilities. To be honest, we didn’t even know what we were going to build yet, but we knew one thing: we wanted to work together. That’s how Mysten Labs was born, and it was a great start.

07 Global Coordination Layer for Smart Assets

Libra’s vision is to make sending money as easy as sending an email, relying on a consortium of companies to control the infrastructure. When we founded Mysten Labs, we realized that vision was too narrow. We wanted to build something bigger, open, and decentralized.

We weren’t looking for quick wins either. As I’ve said before, this isn’t about 1% improvement, this is about 100x improvement, something I can talk about over and over again and be proud of.

The world is going digital, and every asset is becoming digital by default.Today, the internet does a great job of transferring data, but falls short when it comes to transferring value or intent. If I want to send you money, we’re faced with a mess of protocols, none of which actually controls the money.

So what infrastructure does the internet need to create a world where assets can be seamlessly built, coordinated, and combined?

If we’re going to have billions of assets, and everyone has their own, how can the intent of those assets be coordinated in a unified way so that everyone else can participate?

We got it, and that’s our mission.

So, from the ashes of Libra, Sui’s vision gradually emerged - a global coordination layer for digital assets. It was an ambitious goal.

But the key is: we knew we were up to the challenge.

But the key is: we knew we were up to the challenge.

We weren’t just a bunch of tech guys playing around with crypto. We were a team of people who had built systems and applications that scaled to billions of users. We had the necessary technology and real-world experience to build a product that could truly work on a global scale.

To me, it all fit perfectly: a big vision, a team I completely trusted, and the opportunity to have a profound impact on the future of the Internet.

I believed we had the talent to make it happen.

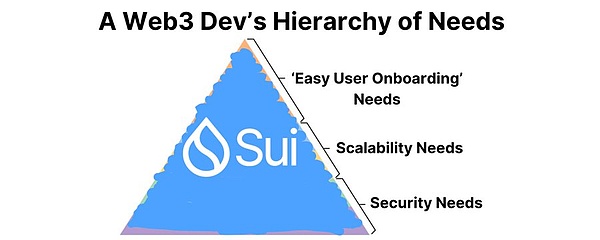

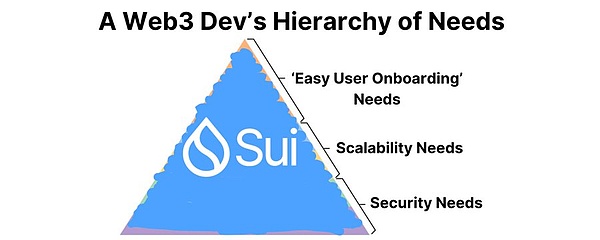

As we built, the strength of our team became more apparent. From the fastest consensus protocol to the object-oriented approach to the best developer experience in the industry, Sui was taking shape.

We also understand that the complete vision is more than just a global coordination layer. We need a storage layer and network infrastructure. We are working with Walrus to build a global storage layer. Next, we will build a global network layer, and we are building the entire technology system step by step.

We also understand that the complete vision is more than just a global coordination layer. We need a storage layer and network infrastructure. We are working with Walrus to build a global storage layer. Next, we will build a global network layer, and we are building the entire technology system step by step.

I can confidently say that there is no L1 blockchain that can compare to the vision or technology we are pursuing at Mysten Labs. Moreover, no other company has the talent of our team. This is why I believe we can win. As I said before, I hate to lose. I am not good at accepting failure, and this is a race that I firmly believe we can win.

You may ask, Why do I spend so much time telling my story instead of talking directly about the exciting content of Mysten Labs. I think it is important to understand my background so that you can see the fuller picture. It may seem smooth sailing on the surface, but it is not. Like the crypto world, my journey has been full of twists and turns — volatile, uncertain, risky, and perhaps a little reckless at times. If you’ve made it this far, thank you for your patience. If you’re more interested in Sui’s vision, see you in the next article where we’ll dive deeper.

Anais

Anais

I first read the Bitcoin whitepaper (pictured above) from a colleague and initially thought it was a bit of a scam and didn’t think there was much to see. It wasn’t until I looked at the code and re-read the paper that I thought, “Wow, this is incredible, this is great!” The concept of decentralized assets really struck a chord with me. It wasn’t just about mining, it was a bigger vision, Bitcoin showed me that robust assets could exist outside of the traditional financial system.

I first read the Bitcoin whitepaper (pictured above) from a colleague and initially thought it was a bit of a scam and didn’t think there was much to see. It wasn’t until I looked at the code and re-read the paper that I thought, “Wow, this is incredible, this is great!” The concept of decentralized assets really struck a chord with me. It wasn’t just about mining, it was a bigger vision, Bitcoin showed me that robust assets could exist outside of the traditional financial system.  As you can see, when I was a kid, I kept moving around and eventually studied at Queen Mary University. But to be honest, I had no interest in studying at all, and only wanted to play games and have fun. It wasn’t until I needed to take an exam that I realized how little I had learned.

As you can see, when I was a kid, I kept moving around and eventually studied at Queen Mary University. But to be honest, I had no interest in studying at all, and only wanted to play games and have fun. It wasn’t until I needed to take an exam that I realized how little I had learned.  Our goal is to make transferring money online as easy as sending an email. We see this as a public good that can really help the world. Honestly, after what I’ve been through, working at Facebook feels a lot easier, and the environment is completely different.

Our goal is to make transferring money online as easy as sending an email. We see this as a public good that can really help the world. Honestly, after what I’ve been through, working at Facebook feels a lot easier, and the environment is completely different.

Facebook actually acquired his company Chainspace to help build Libra, which is enough to prove his ability.

Facebook actually acquired his company Chainspace to help build Libra, which is enough to prove his ability.  At Facebook, he was the go-to person for all things crypto, and he developed many of the cryptographic algorithms used in WhatsApp, one of the most widely used apps in the world.

At Facebook, he was the go-to person for all things crypto, and he developed many of the cryptographic algorithms used in WhatsApp, one of the most widely used apps in the world.  But the key is: we knew we were up to the challenge.

But the key is: we knew we were up to the challenge.  We also understand that the complete vision is more than just a global coordination layer. We need a storage layer and network infrastructure. We are working with Walrus to build a global storage layer. Next, we will build a global network layer, and we are building the entire technology system step by step.

We also understand that the complete vision is more than just a global coordination layer. We need a storage layer and network infrastructure. We are working with Walrus to build a global storage layer. Next, we will build a global network layer, and we are building the entire technology system step by step.