Author: Nancy Lubale, CoinTelegraph; Compiler: Deng Tong, Golden Finance

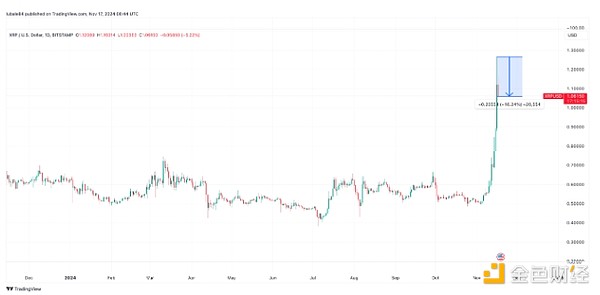

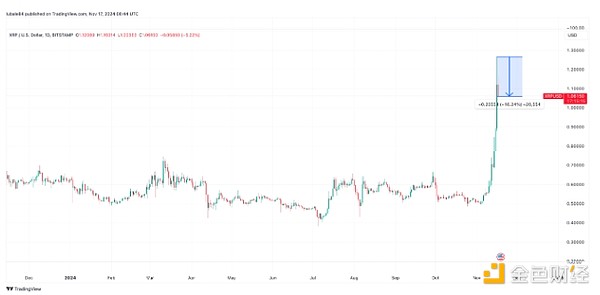

Recently, Ripple surged past the $1 mark to a three-year high of $1.26 on expectations of a favorable regulatory environment for cryptocurrencies and a possible resolution to Ripple's long-running legal dispute with the U.S. Securities and Exchange Commission (SEC).

However, XRP prices have since retreated sharply, raising questions about whether $1.26 is the top, at least for now.

XRP/USD daily chart. Source: TradingView

XRP Whales Take Profits

XRP Pulls Back on November 11 According to Whale Alert data, there were 17 transactions with large inflows worth tens of millions of dollars to Bitstamp and other exchanges.

This included a whale transferring 10 million XRP tokens worth $11.3 million to the Bitstamp cryptocurrency exchange. The transfer may have been part of an attempt by investors to cash in on gains after XRP’s sharp rise.

Source: Whale Alert

The timing of these large XRP transfers to exchanges is noteworthy as it coincides with a key shift in the distribution of XRP holdings.

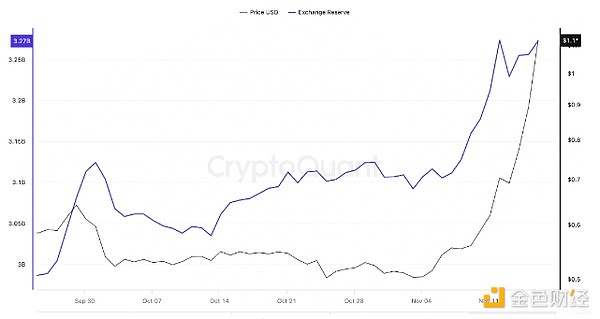

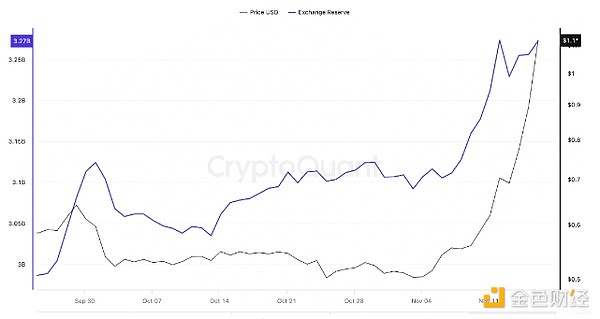

Specifically, exchanges have seen a significant increase in XRP supply, as evidenced by data from CryptoQuant. The chart below shows that between November 6 and November 16, XRP balances on exchanges grew by 3%.

Note that between November 13 and November 16, exchanges saw an increase of 44 million XRP in their reserves. Meanwhile, XRP is up 56% in the same time frame.

Exchange reserves of XRP. Source: CryptoQuant

This suggests that there may be a lot of profit-taking that has driven XRP down 13% since its November 16 high.

In addition, Santiment explained that retail traders have also been selling on “any small XRP rallies,” and the rebound to $1.26 was no different.

“Wallets holding less than 1 million XRP sold a total of 75.7 million tokens ($87.9 million) over the past week,” the on-chain data provider said in a Nov. 17 article.

Interestingly, tokens sold by retail traders were bought up by whale and mega-whale wallets holding between 1 million and 100 million tokens, a potential bullish sign for the future.

Santiment noted:

“In the past week alone, the group has accumulated a total of 453.3 million tokens (worth $526.3 million).”

XRP whale wallet holdings. Source: Santiment

Meanwhile, volatility caught long traders off guard when XRP deviated sharply from its multi-year high of $1.26.

Data from CoinGlass shows that on November 17, XRP derivatives markets saw over $12.6 million worth of liquidations, of which $9.1 million were long, and this is still ongoing at press time.

In the past four hours alone, over $3.9 million in leveraged long positions were liquidated.

XRP Liquidations. Source: CoinGlass

When long positions are liquidated, it usually involves selling the asset (voluntarily or by a broker), further driving the price down.

XRP Price ‘Overbought’ Across Multiple Timeframes

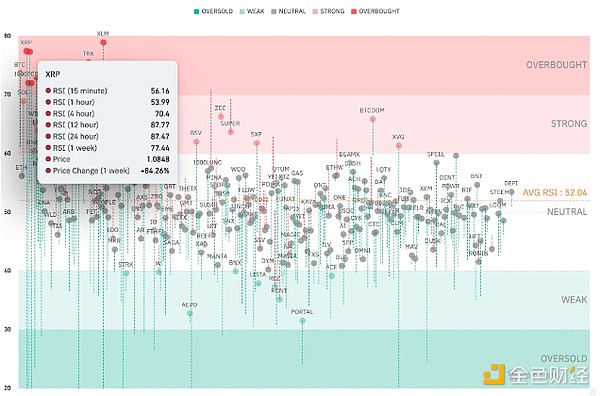

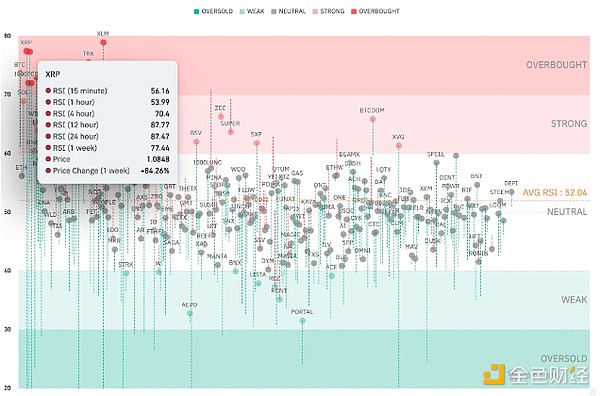

According to data from CoinGlass, XRP’s RSI heatmap currently shows overbought conditions on four out of six timeframes.

By contrast, Bitcoin’s RSI is overbought on three out of six timeframes.

Crypto market RSI heatmap. Source: CoinGlass

Overbought conditions typically describe recent movements in asset prices and reflect expectations that price trends may soon correct.

But while the popular indicator shows potential overheating risks, traders believe the XRP price rally is not over yet.

“It’s still early in the cycle for a coin like this,” independent trader Chris McCrypto said in a Nov. 16 article about XRP, adding that the coin could go as high as $15-$20.

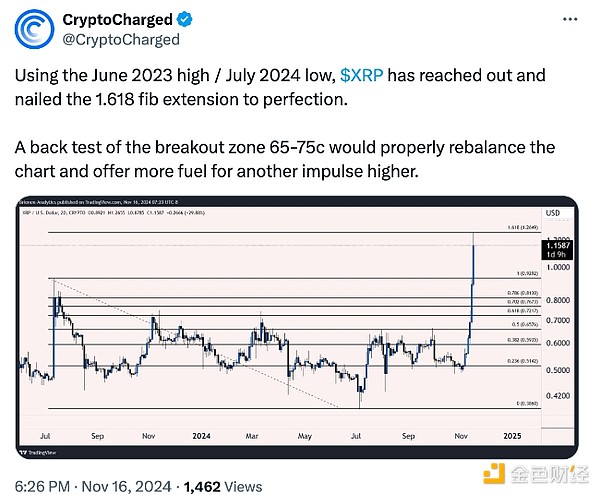

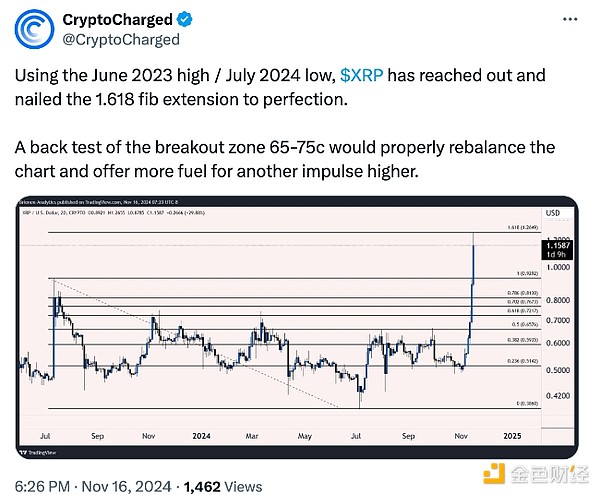

Meanwhile, anonymous analyst CryptoCharged believes that the ongoing pullback has set the price up “perfectly” for retesting key levels, adding that a drop to the $0.65 and $0.75 areas would reset the chart to move higher again.

Source: CryptoCharged

Joy

Joy