Author: Yashu Gola, cointelegraph Translation: Shan Ouba, Golden Finance

According to technical and fundamental indicators, the price of Solana may usher in a sharp rise before March.

SOL price may break through "bull flag"

As of January 18, SOL’s Price is testing the upper trendline of the bull flag pattern.

A Bull Flag is a bullish continuation pattern characterized by price within a downward sloping channel (Flag) after a strong upward move (Flagpole) move. They usually resolve after price breaks above the channel's upper trendline and rises to flagpole height.

As a result, Solana is expected to break above the flag's upper trendline to $194 by March, representing an increase of approximately 80% from current price levels.

p>

Conversely, a pullback from the upper trendline could send the price of SOL down to the lower trendline near $80.

Nevertheless, the cryptocurrency could see some accumulation and sideways price action at the 50-day exponential moving average (50-day EMA; red wave) near $87 trend, this area has been a long-term support area. Staying within the flag range will keep the possibility of a breakout intact.

Solana ETF hot discussion

The Bitcoin spot ETF was approved on January 11th. This has sparked hopes in the industry that other cryptocurrencies, including Solana, will also receive spot ETFs in the future.

Franklin Templeton, a multi-trillion dollar asset management company, praised blockchain for its role in decentralized finance, infrastructure, and non-fungible generation. Advances in coin innovation and memecoin have further fueled the Solana ETF craze. The company already offers a spot Bitcoin ETF product of the same name, with the ticker (EZBC).

Anticipations for the spot Solana ETF could fuel a surge in SOL prices similar to the surge Bitcoin experienced before its ETF was approved.

Federal Reserve rate cut expectations

Expectations of a dovish Fed are likely to increase in the coming months Further pushing up Solana prices.

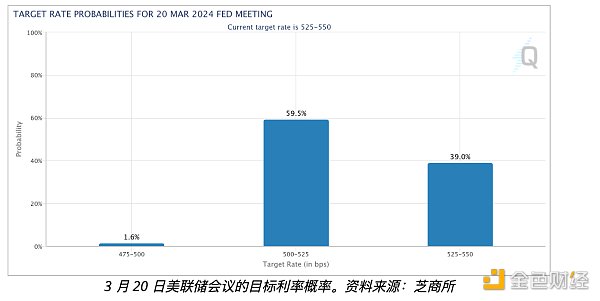

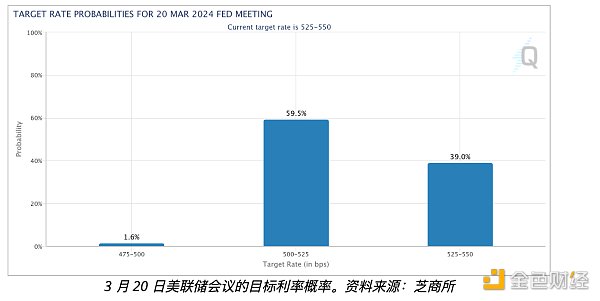

CME's Fed Futures Fund Rate Forecast puts a 59.5% chance of a 25 basis point cut in U.S. interest rates by March 2024.

p>

Lower interest rates could lead to a weaker dollar as yields on dollar-denominated assets decline. Cryptocurrencies like Solana are typically priced in U.S. dollars and may increase in value as the U.S. dollar weakens.

The technical setup for the U.S. Dollar Index (DXY) points to a sell-off period in the coming days. Notably, it has been forming a rising wedge pattern since December 2023, with a downside target between 101.50 and 102.25, depending on the breakout, as shown in the chart below.

p>

Consequently, Solana's continued negative correlation with the US dollar should also increase the likelihood of a sharp rise in SOL in March.

JinseFinance

JinseFinance