Author: Mu Mu; Vernacular Blockchain

On February 29, Bitcoin quickly rose to above $64,000 after rising for several consecutive days, far away from the historical high of 69,000. The dollar is just a stone’s throw away. However, due to exchange rate changes, if calculated in CNY terms, the price of one Bitcoin has exceeded 450,000 yuan, which has already exceeded a record high. However, that night, while the crypto market was still collectively boiling, the traditional financial giant JPMorgan Chase poured cold water on it at an inappropriate time: "Analysts predict that the price of Bitcoin will fall to $42,000 after the halving."

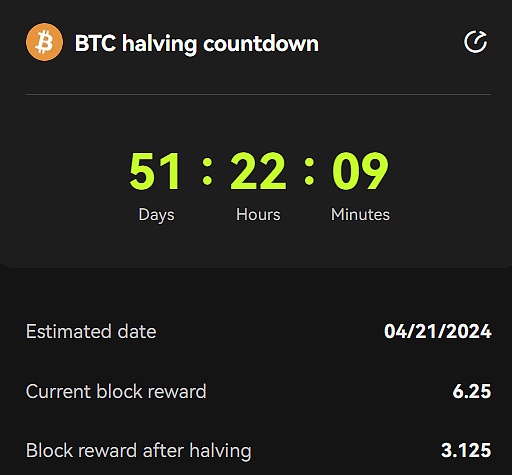

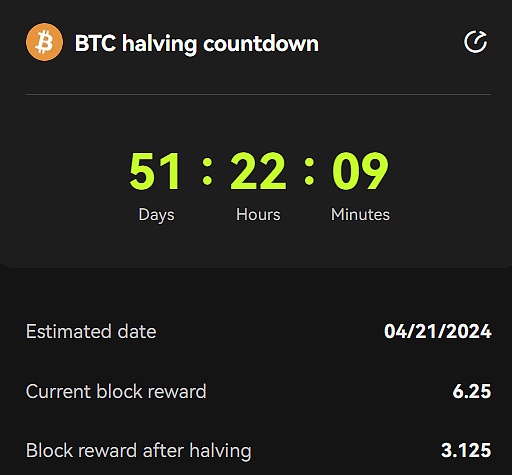

Recently, many major events have occurred in the encryption market that affect the price of Bitcoin, such as the continued explosion of the Bitcoin ecosystem, the approval of spot ETFs, etc. The following major events that have attracted much attention are 1 The halving occurred more than a month later. As a landmark event in cyclical theory, Bitcoin halvings in history seem to always cause waves in the market.

Since there are many “analyses” before each round of Bitcoin halving that say this halving is very different, is this year’s halving a good thing or a bad thing? Will it bring about a bigger bull market next?

Image source: oklink halving countdown

Image source: oklink halving countdown

01 Is the "halving cycle theory" a desperate situation?

The halving cycle theory is supported by the historical bull and bear time 4 The annual halving cycle is correct, but some people are trying to dig into the details with a magnifying glass and find flaws in various cycle theories to try to break the "Bitcoin halving cycle theory" to convince everyone that the cycle theory is unreliable. .

Bitcoin halving schedule over the years:

In January 2009, starting from the genesis block, the system’s initial default block was 50 BTC

In November 2012, Halving height 210000 Reward 25 BTC after halving

July 2016, halving height 420000 Reward 12.5 BTC after halving

May 2020, halving height 630000 Reward 6.25 BTC after halving

2024 In May (estimated), the halving height is 840,000, and the reward after the halving is 3.125 BTC

Selective recognition, everyone’s butt is crooked, since they are all predictions, then most people may only choose to believe it. A point of view that is favorable to you. After analyzing and analyzing the long speech, people in the encryption community may simply say "it's too long to read" and then reply with one sentence: The analysis makes sense, don't analyze it next time.

Whether the discussion and analysis of periodic theory has a positive impact or a negative impact ultimately depends on which one you are more willing to listen to and believe.

02 Half halving vs meme

With expectations, everything feels right. No matter what news is interpreted as positive, the market reacts accordingly.

The famous "Ding Crab Effect" has always existed in certain stock markets. Every time a TV series starring Zheng Shaoqiu is released, investors will be frightened. The Ding Crab effect is actually a certain manifestation of the herd effect. Most people may choose to follow the crowd because they are afraid of going against the mainstream view.

Compared with the Ding Crab effect, Bitcoin’s “halving effect” seems to have more logical and theoretical support. As a key part of the rules designed by Satoshi Nakamoto for the Bitcoin system, it has been repeated time and again. And the verification of San will undoubtedly continue to bring confidence and expectations to everyone.

In the crypto market, you will naturally get used to bizarre things after seeing them too much. Currently, many pure air memes are wildly sought after, not to mention the halving with strong consensus. The market has become accustomed to it. Such is the anticipation of a special event every four years. We would also like to think that the current halving has already become a meme. As long as it is mentioned that the halving is coming, everyone’s subconscious confidence will instantly return...

In fact, the crypto community and capital The market needs such a fuse to ignite FOMO emotions. After each round of halving, it will actively provide a lot of bull market logic and various analyses. Whatever happens will be interpreted as positive, and even constant self-hypnosis...auto-suggestion.

Taking a step back, even if periodic theory is just a kind of superstitious metaphysics, if more people believe in it, it will easily become a consensus and become a subconscious judgment similar to a "biological clock", forming a trend. .

Just as people have analyzed the major positive spot ETFs that have been passed for more than half a year, they did not rise but fell instead. The market is often not influenced by rationality. People are more willing to believe that "all the good news will be bad" and so on. law".

03 Bitcoin halving, good or bad?

Judging from the market after previous rounds of halving, the crypto bull market is not entirely due to the halving itself, but mainly from the explosion of the concept of digital gold and blockchain smart contracts. , DeFi application landing and other different logics are supporting the previous rounds of bull markets. The future itself is full of variables. When Bitcoin halved in previous years, it did not mean that good news would come immediately. On the contrary, in many cases, the market still fell before and after the halving. The Bitcoin halving can only be said to be an important trigger for the big market, but it cannot be regarded as a factor that directly brings about the bull market.

Whether Bitcoin can bring big market trends as usual after the halving, at least these variables need to be comprehensively considered:

- < p>Variable 1: Reduced miner rewards and rising production costs

This is also what was mentioned at the beginning. JP Morgan analysts predicted that after the halving, it would plummet to 42000 reasons. To put it simply, after the halving, the Bitcoin block reward will be directly reduced from 6.25 to 3.125. In the absence of a breakthrough upgrade of the computing power chip, the cost of miners producing Bitcoin will indeed rise significantly, according to JPMorgan Chase analysis The analyst believes that the rise in production costs will have a negative impact on its prices.

In fact, in every halving cycle, some people jump out and say that the halving will cause a large number of miners to increase their costs and withdraw their computing power. This will affect the stability of the Bitcoin network and even bring about the seriousness of "sudden death" However, the results of the first few halving cycles have been that it has become more joyful.

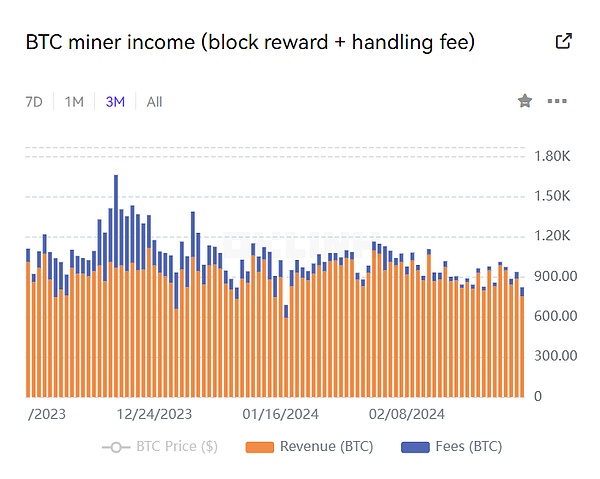

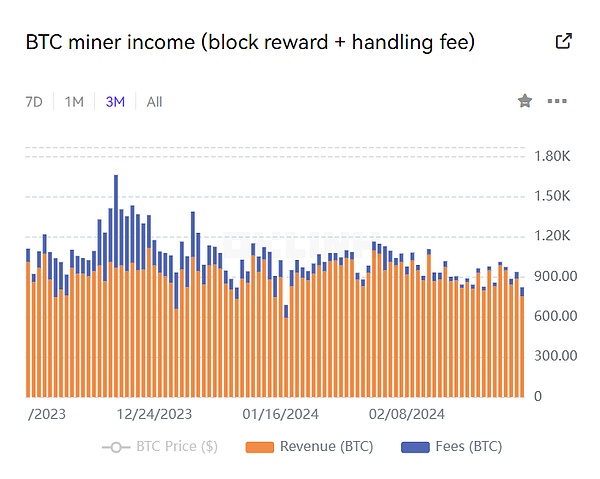

Although many people, including this J.P. Morgan analyst, may have ignored the fee income brought by miners and the Bitcoin ecosystem, according to on-chain data, in the past three months, The proportion of fee income in miners' income is declining. It could be as high as 40% during the inscription boom, but now it is generally between 5% and 8%. If the Bitcoin ecosystem cannot continue to be hot and the price of Bitcoin itself cannot continue to rise, then the issue of miners' reduced income is indeed worth thinking about.

Picture source: oklink

Picture source: oklink

The bottom-up Bitcoin ecological development model is unexpected by many people, but no matter what, it has given another pair of new wings to the digital gold Bitcoin. People naturally When we spare no effort to dig deep into the value behind it, perhaps there is a bigger gold mine under the water. A picture from Stacks, the head project of the Bitcoin smart contract layer, posted on social networks shows this expectation very intuitively:

Spot ETFs only open an entrance, and funds must flow in to be useful. Therefore, the real benefit lies in the "water release" of the US dollar this year. Only then can the super power of ETFs be reflected. The value of the entrance. When expectations brought about by Bitcoin are weak, funds flowing into spot ETFs may also flow away at any time. If the U.S. stock market encounters a waterloo and stages a bottomless "stock market crash", will funds be the first to withdraw from Bitcoin spot ETFs?

From the perspective of another hedging function of Bitcoin, Bitcoin is no longer what it used to be. Also driven by spot ETFs, Bitcoin, which has become a global mainstream asset, will gradually reduce volatility and highlight its hedging properties as "digital gold."You must know that when the economy is in recession and the stock market is down, people usually choose some safe-haven assets such as "gold." " and its derivatives to hedge risks. Now there is an additional option. Will funds be diverted to Bitcoin ETFs?

Recently, analysis pointed out that the large inflow of funds obtained after the launch of the Bitcoin spot ETF seems to be at the expense of the outflow of funds from the gold ETF. In the first week of February, investors redeemed $858 million from gold ETFs, with outflows reaching $3.2 billion as of last week.

There is such a logic: when everyone believes that it is about to happen, the market will often go in the opposite direction, and most people will be harvested by capital.

In the past, the stock market had a law of "five failures, six failures, and seven turnarounds." This was a stock market legend in the Hong Kong stock market from the 1980s to the 1990s, that is: the stock market would start every May. The market will fall even further in June, but in July, the stock market will come back to life.

Because this "prophecy" or "law" took effect every time, in the mid-to-late 1990s, some people began to "prevent" and "countermeasure" this phenomenon in various ways. After some operations, the ups and downs cycle continues to appear earlier and even loses its reference value.

When the Bitcoin block reward is halved in each round of the ladder, the halving amount is also significantly reduced, which means that the steps and intensity are getting smaller and smaller. This mechanism helps The network and price will be stable in the later period, but the subsequent halving may no longer have the potential and substantial influence of the previous halving. It will become more of a "anniversary". Next, we really have to watch Bitcoin. Ecological”.

The pace and intensity of the Bitcoin block reward halving in each round of the ladder

The pace and intensity of the Bitcoin block reward halving in each round of the ladder

Although some variables may not seem optimistic, and some variables are difficult to distinguish, we hope that they will tend to be good in the end. On the other hand, when a trend forms, everything will move along it.

04 Summary

Bitcoin halving may never have been the direct cause of the bull market; Everything is ready, all we need is the "east wind" in the east wind. The market has never been a place to judge right from wrong or to be rational. It is obviously not important whether the cycle theory is a desperate matter, because there is a strong demand and logic behind it.

In 2024, although the variables are mixed, there are many narrative combinations that capital can play, including the superposition of multiple logics such as halving + ETF inflow + Bitcoin ecology + U.S. dollar interest rate cut, and price growth. All problems will be solved. In this context, periodic theory may have to be "installed" again.

JinseFinance

JinseFinance