In the early hours of this morning, the "highly anticipated" Optimism officially opened the airdrop of its native token OP (for details, please refer to "Optimism officially issued coins, what are the airdrop rules?") to apply for.

As the first coin-issuing project among the "Layer 2 Four Heavenly Kings", the market has always given very high expectations for Optimism. According to the valuation comparison with other Layer 1 projects, OP has been shouted to $10 by some KOLs beforecirculationEven the high price of 20 US dollars, the off-site price was called 3-5 US dollars.

However, the story did not play out according to the script set by the market sentiment - the price of OP has been falling all the way since it was in circulation. As of the time of publication, it was temporarily quoted at 1.93 USDT on Ouyi OKX.

So, how did the story unfold? Based on the development of the evening's events, we think this is a rather bad marketing strategy failure. Specifically, there are three failures.

One is the scientists who took the lead. SinceOptimism has publicly tested the token contract a few days ago , before the front-end of the airdrop application is officially opened, many scientists have bypassed the front-end and directly interacted with the contract. Arrive the airdrop and sell when the price is expected to be higher.

The second is insufficient preparation for access pressure. Due to the opening of the airdrop application, Optimism ushered in a peak of access traffic in a short period of time. The high load caused serious delays in the Optimism main network and remote procedure call (RPC), causing most ordinary Users are still unable to successfully complete the application through the front end, and can only watch the currency price drop step by step, and emotionally become "early claim, early run, early release".

In addition, Optimism, as Layer 2 itself, focuses on the concept of expansion, so the negative impact caused by the delay of the main network will only be more serious than imagined, and some frustrated users even questioned "what's the use of your Layer 2". However, it should be noted that the delay here is more due to RPC overload, and has little to do with actual network performance.

The third is the failure of the legendary "50 million USD liquidity pool". In the previous test, Optimism invested 50 million USDC in the OP's liquidity pool, because there were still 20 million USDC in the pool at that time. OP, the market once interpreted that the opening price of OP would be $2.5.

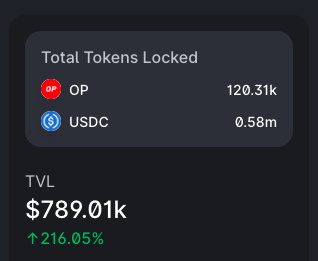

Then, after the test, Optimism withdrew the 50 million USDC. After the OP was officially circulated, it did not add any more liquidity for market making. As of 10:30, the size of the OP/USDC liquidity pool in Uniswap was "only" 78 Ten thousand U.S. dollars. Although Optimism has never promised to take out the 50 million USDC, this move will inevitably disappoint the market's expectations and dampen investor confidence.

Affected by the multiple "accidents" mentioned above, the market's expectations for OP have also been declining all the way, and even gradually began to move towards FUD, which finally made this carnival that should belong to Optimism go in a completely different direction.

Of course, this is just a story within a few hours after the OP is in circulation. Since Binance and others have not yet opened OP transactions, it is still unknown how the OP market price will go in the future. Taking a step back, under the current environment , whether the overvaluation of OP by a small number of people in the early stage is reasonable is also open to question. However, judging from today's opening situation, it is difficult to give Optimism a passing grade.

Alex

Alex